Boeing’s 737 Max issues highlighted the company’s sacrifice of safety for financial performance, resulting in a tarnished reputation. The prioritization of profit over core values also damaged the FAA’s credibility and revealed a lack of accountability for top executives. This downfall serves as a reminder of the importance of maintaining core values and prioritizing them over short-term financial gains.

Where Exactly Are We Headed?

What is happening out there? Airbnb confidentially filed for its IPO last week. In the spring, the company laid off 2,000 employees and was negotiating over the terms of two fundraising deals totaling $2 billion in debt and equity.

However, total consumer spending on Airbnb in July was 22% higher than in the same period last year, according to Edison Trends. According to the company, it surpassed 1 million bookings on a single day that same month, led by an increase in stays at nearby destinations.

So, are we returning to normal? I would answer no, but there is hope. Normal is a long way away as people are still scared and want to social distance. However, given we can only take so much of staring at the same four walls, we are heading on vacation. Those vacations may not be the ones of pre-COVID days with cruises, trips abroad, or all-inclusive resort, but booking a house for just our family or close friends that we trust, works! Thus as the company reported, bookings are up for close to home destinations, basic economic substitution.

Along with other reports, consumer spending has increased during the pandemic, and I put that down to the fact that we are not spending as much on other things, e.g., commuting, sports, and meals out. However, will that spending last? Last week the Labor Department reported first-time jobless claims increased to 1.1 million, and it was the 22nd consecutive week claims exceeded those during the worst week of the Great Recession. On the positive side, the total number of Americans collecting unemployment fell from 15.5 million to 14.8 million, the lowest since early April. This data goes to show that the recovery will not be quick and a V-curve.

Where exactly are we headed, I am not sure. I hear lots of talk of continued layoffs ahead with about Wells Fargo and Boeing announcing more cuts as well as many smaller companies planning layoff. There is a sense of uncertainty over Q4 2020 and Q1 2021, and expect many are taking a wait and see approach. However, with school restarting, albeit in a confused manner, the Federal Unemployment Benefits in unchartered waters, and Congress in gridlock, there is a lot of confusion out there.

However, as an old Keynesian, the amount of stimulus that the government has poured into the economy is why we are experiencing a robust recovery to date. According to economic theory, in a world of excess capacity and mass unemployment, a combination of vast government borrowing with monetary expansion will not fuel inflation until most of the excess capacity is exhausted, which is where we are now. A Keynesian fiscal stimulus financed with negative real interest rates will boost private consumption and investment and should generate above-trend economic growth. Before the cry of “Crowding Out,” arises from many as I heard during the Great Recession, where all indications showed none. Currently, with central banks worldwide committing to financing this Keynesian stimulus with zero or negative interest rates for years ahead, there is no risk that public borrowing will crowd out private investment.

Thus, will this Keynesian stimulus lead to a healthier and longer growth economy? I would put that down to two factors.

- As always, public health. The sooner we adopt and proactive, data, and science-driven approach to the COVID crisis, the sooner we return to a functioning economy. Cases are rising again in Europe, which indicates that this is a marathon and not a sprint. I know for many, it already feels like a marathon, but the more apt analogy is the British in September 1939 saying, “It’ll all be over by Christmas!”

- The Stimulus. The actions by the Fed and the Congress, through the CARES Act, have injected substantial stimulus into the economy. However, as these have ended, we will have to observe to see what happens. As in the Great Recession, Congress stopped the stimulus too soon, for political reasons, which lead to a much weaker recovery than there should have been. Hopefully, this time, they will put the country first and give the economy what it needs to recover.

A lot of economists are arguing that the stock market is pricing in continuous stimuli for the economy, and if Congress fails to deliver the will, a market correction to accompany the economic contraction.

For those gnashing their teeth and anguishing over a Keynesian expansion, it is worth remembering that the 20 years of broadly Keynesian macroeconomic policy in place from 1946 until the late 1960s saw the most robust economic growth and productivity advances ever recorded. At the same time, we experienced generally moderate inflation and almost continuous bull markets in equities, property, and other real-value assets.

Recent Posts

The Downfall of Boeing: A Lesson in Core Values

Resolutions, Here We Go Again.

In reflecting on 2021 resolutions, the author scored themselves in three categories and sought to improve success in 2022 by addressing friction points. Drawing on advice from social psychologist Wendy Wood, the author identified areas to reduce or increase friction in their failed resolutions. By making these adjustments, the author aims to enhance their goal achievement and encourages others to consider friction when setting resolutions.

You need to take an extended vacation. No, seriously, you do.

COVID has taken a toll on all of us. If you have not taken an extended vacation in a while where you disconnect, you need to now. You and your business will benefit.

Becoming Famous in Your Niche: The Success Story of Linn Products Limited

In a previous discussion, I highlighted the importance of being famous for something. Being well-known in your niche can help you: Concentrate on your strengths Connect with your target audience Communicate your offerings more effectively Receive referrals Identify...

Understanding and Optimizing Your Cash Conversion Cycle

Understanding and optimizing the Cash Conversion Cycle is crucial for business growth, as it impacts cash flow and the ability to access external capital. This cycle consists of four components: Sales, Make/Production & Inventory, Delivery, and Billing and Payments. To improve the Cash Conversion Cycle, companies can eliminate mistakes, shorten cycle times, and revamp their business models.

Discovering Your Niche: Why You Need to Be Famous for Something

As an entrepreneur, it’s crucial to specialize in a specific area and become famous for something, allowing you to generate referrals and build your brand. Understanding the “job” you’re hired for helps you stand out in the marketplace and communicate your value proposition effectively. By providing value to your clients, you can adopt a value-based pricing approach, ensuring your business remains competitive and maintains a strong market presence.

Rethinking Your Pricing Model: Maximizing Margins and Providing Value

Rethink your pricing model by focusing on the value you provide and your customers’ Best Alternative To a Negotiated Agreement (BATNA). This approach can help you maximize margins while delivering better value to your clients. Assess your offerings and brainstorm with your team to identify pricing adjustment opportunities or eliminate commodity products or services.

Do you know your Profit per X to drive dramatic growth?

I recently facilitated a workshop with several CEOs where we worked on the dramatic business growth model components. One of the questions that I had asked them beforehand was, "What is Your Profit/X?" The results showed that there this concept is not clear to many....

The War for Talent: 5 Ways to Attract the Best Employees

In today’s War for Talent, attracting the best employees requires a focus on value creation, core customer, brand promise, and value delivery. Clearly articulate your company’s mission, identify your “core employee” based on shared values, and offer more than just a salary to stand out as an employer. Utilize employee satisfaction metrics and showcase your company’s commitment to its workforce on your website to make a strong impression on potential candidates.

Are you killing your firm’s WFH productivity?

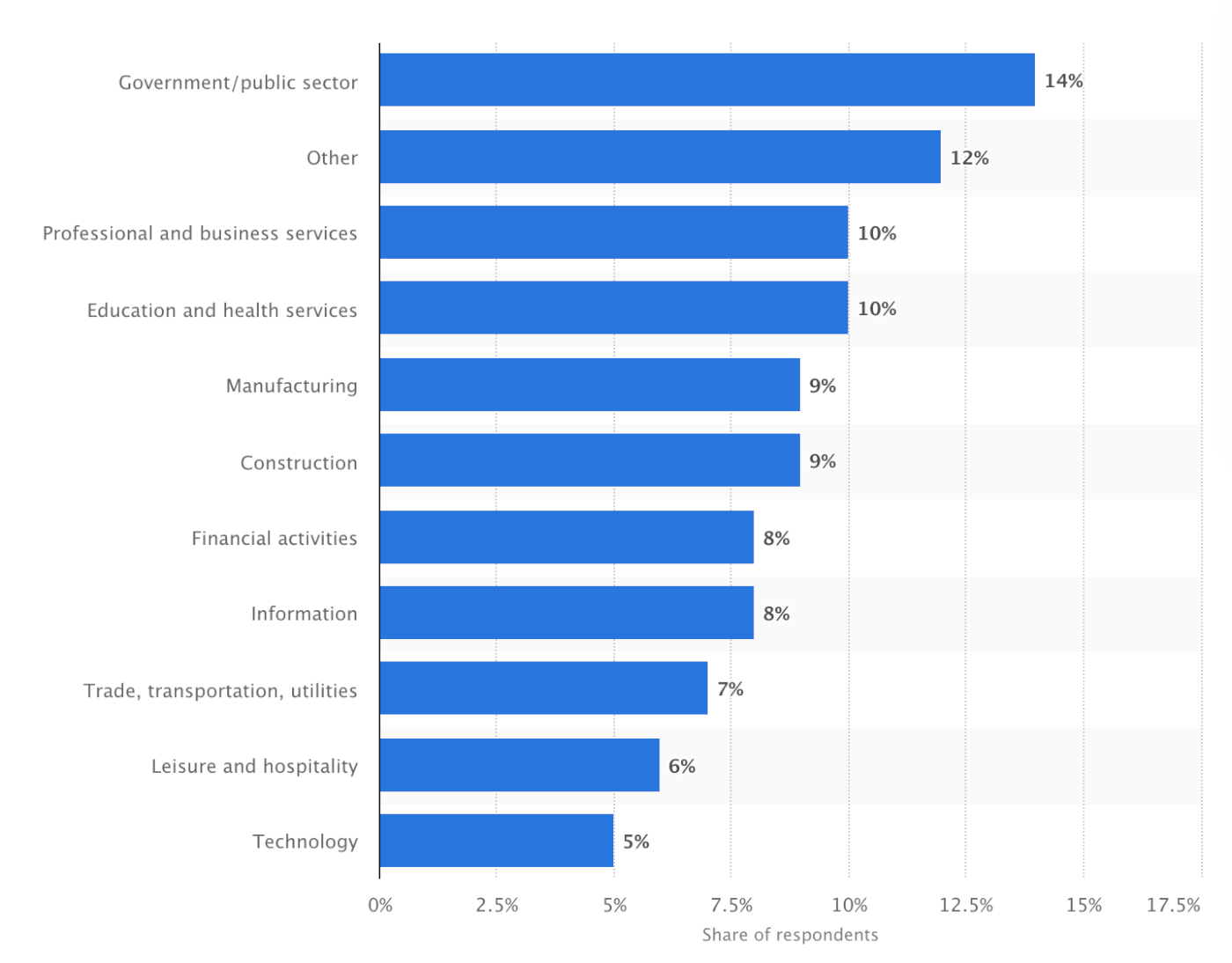

Productivity remained during WFH with COVID. However, further analysis found that hourly productivity fell and was compensated for by employees working more hours. What was the culprit – Meetings. Want to increase productivity, have fewer meetings.