Discover the importance of organizational alignment and agility in this blog post. Learn how establishing a strong CORE and building a strategy around it can lead to sustainable growth and success. Find out how alignment and agility empower your organization to thrive in an ever-changing business landscape.

College Woes

While Harvard receiving bailout funds made the news, be thankful, you are not a university protest. Higher education in the U.S. is about to experience the most significant disruption ever, and the effects will change the industry forever.

As Scott Galloway has said, “University brands are the premier luxury brands globally, built over centuries, with margins and the illusion of scarcity that renders Hermès vulgar.” Well, for many of the lower-end brands, their stores will close and possibly not reopen. Colleges are facing several threats that will result in the closing or merging of up to 20 – 25% of the countries colleges.

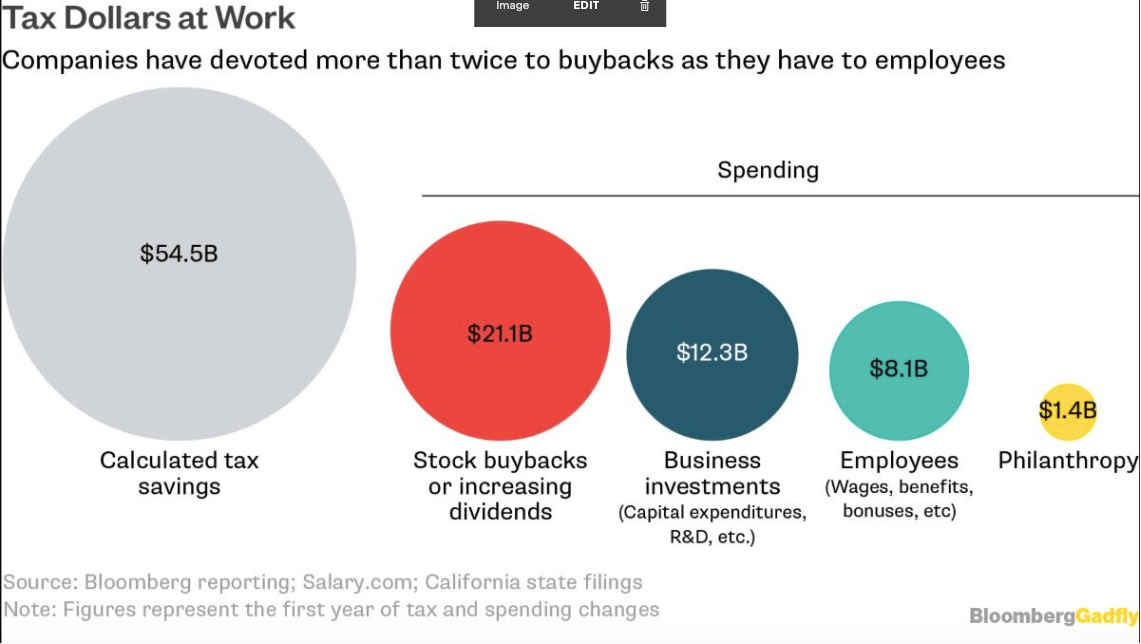

Financial Stress

COVID has arrived and threw a spanner in “the works,” bringing budgetary hits to schools. Many colleges were not financially secure before COVID came. Forbes analyzed all 933 private, not-for-profit colleges in the U.S. with enrollments higher than 500, grading them on balance sheet strength and operational soundness, plus specific other indicators. You can see the results here.

Of the 933 colleges analyzed, 675 or 72.3% received a grade of C or D. These colleges are called “tuition-dependent schools,” meaning they survive year-after-year, often losing money or eating into their dwindling endowments. Things are not likely to improve, and more college defaults are looming. According to a study by Nathan Grawe, the population of high school graduates will drop by 9% between 2025 and 2031. In most of New England and some Mid-Atlantic states, the decline will exceed 15%. Falling demand is only part of the issue, according to a study by Kevin P. Coyne and Robert Witt, “Public colleges have 6.4% excess capacity, growing at about half a percentage point a year. But the private colleges have 12.4% excess capacity, growing at about triple the rate of public colleges. The smaller half of private, not-for-profit colleges, those with enrollments below 1,125, have an overcapacity of 28% and growing rapidly.”

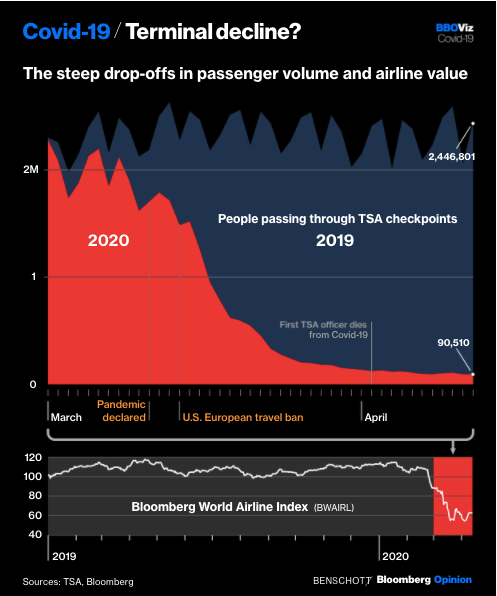

Ignoring the future trends, COVID is already creating havoc. The University of Michigan estimates it may lose up to $1 billion and the University of Kentucky, it’s $70 million by year-end. Hundreds of schools, including those with billion-dollar endowments, i.e., Duke University, Virginia Tech, and Brown, have announced hiring freezes. Other institutions have cut pay and have laid off staff and contractors. The Vermont State Colleges System may close three of its campuses and lay off hundreds as it faces a potential 20 percent drop in enrollment and millions of dollars in losses related to COVID.

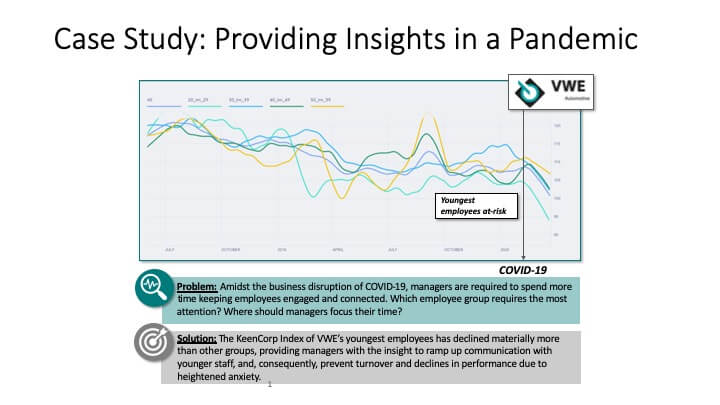

Foreign Students

The COVID outbreak has shown universities’ over-reliance on a multi-billion dollar international student market that underpins the finances of many leading institutions. China accounts for about one in six international students, and the Chinese spend an estimated $30 billion a year on overseas tuition alone. If you add in living expenses, the figure is even more significant. With college campuses closed in the U.S., U.K., Europe, and Australia, many Chinese students may not return and will look to attending or finishing college at Chinese institutions.

Nearly a million international students attend U.S. colleges, adding about $45 billion to the U.S. economy in 2018. These students are paying up to three times more than in-state students at public universities. They are thus “effectively subsidizing tuition costs for domestic students and functioning as a bailout for universities,” according to SelfScore. In 2015, public universities earned more than $9 billion in tuition and fees from international students.

If these students stay away because of travel restrictions, colleges closed, and other COVID issues, there it is unlikely that U.S. students can plug this hole. As a result, more financial strain on many schools and expected closings or mergers.

Auxiliary Operations

Schools, on average, earn roughly 10% of their income from auxiliary operations, including food and lodging. While students were forced to leave campuses, schools still owed them the right to use dorm rooms and be provided food under any purchased food plans. Harvard College, Princeton University and the Massachusetts Institute of Technology are among a handful of schools that plan to prorate room and board costs as the coronavirus has forced them to send students home. Other schools will offer refunds, and they will probably approach 2% of annual school revenues.

Declining Enrollments

Recruiting next year’s freshman class is posing a host of issues. First, admitted students cannot tour campuses. Thus students planning on attending will have to make the acceptance decisions based on online tours and presentations if they have not visited the school before. Second, no one knows if schools will be open in the fall and if they are, will they stay that way if a second wave hits. As a result, some commentators are suggesting that students should consider a Gap Year and wait for things to settle before starting college. Finally, for those who are determined to start school in the fall, if school classes are going to be virtual, are they willing to pay thousands more for a private school over a state school which is cheaper and may allow them to live at home? As a result, most people are predicting declining enrollments in the fall —the only issue is how much, possibly double-digit in some cases. As mentioned above, over 70% of schools are tuition-dependent; thus, a double-digit fall in revenue could drive many into bankruptcy.

Sports

The cancellation of NCAA men’s basketball means that the $600 million the NCAA was going to distribute to Division 1 members school, was reduced to $225 million. Such a significant decrease in income has left athletic departments everywhere scrambling. The fallout has some schools like Old Dominion University canceling its wrestling program, a move it expects will save $1 million in expenses, and Iowa State is cutting departments and suspending coaches’ bonuses and incentives.

Now the looming dread is what happens if the shutdown affects the big moneymaker: football. Jamie Pollard of Iowa State said, “We’re probably in a phase right now that we’re in a long hard winter, but if we can’t play football this fall, I mean, it’s ice age time.” Pollard penned a letter to Iowa fans laying out what they are doing in response to COVID.

According to a Forbes report two years ago, college football’s 25 most valuable teams generated a combined $2.5 billion a year in revenue. A large portion of those earnings goes toward supporting non-revenue sports like softball and swimming, and, to cash-hungry opponents. Last year when Alabama State lost to Florida State, Alabama State got what it wanted, a reported $425,000. Since it was a “Guarantee game,” one where a significant power beats minor football power and pays them a considerable amount to do so. Guaranteed games are critical for the smaller schools as they support the university. Failure to have Guarantee games can detrimentally affect a university. A scenario being considered for this football season, depending on the status of the outbreak, is playing a shortened season with just conference games.

Even for the major schools, cancellation of the football season would be hugely detrimental. At stake is at least $4.1 billion in fiscal-year revenue for the athletics departments at just the 50-plus public schools in the Power Five conferences — an average of more than $78 million per school, according to a USA TODAY Sports analysis.

Take Clemson, for example. Clemson’s “control budget” assumes the virus outlook improves so much that football games are allowed to proceed as planned this fall. Under that scenario, there is a 10% drop each in donations, ticket sales, and marketing revenue. All told, it would be a $7.5 million hit. The school’s more drastic scenarios include a 20% reduction in those primary revenue sources, so a drop of around $15 million. The school will look at the more significant loss scenarios if football can’t happen.

The University of Minnesota this month released its projections for its athletic department, which is roughly the same size as Clemson’s. Minnesota’s estimates were a $10 million hit in the “best case,” $30 million in the “moderate” scenario, and $75 million in the “severe.”

Thus, colleges are going to try their damnedest to have a season of 12 games, regardless of when. While a canceled season would have some cost savings, the revenue losses would be immense. Income from tickets; postseason games; game-appearance guarantees; and various game-day sales would be lost. There would also be a significant impact on payments connected to the right to buy tickets or obtain preferred seating, TV, radio, and digital rights and the value of marketing and sponsorship deals.

Concerning college-sports advertising and school-level sponsorships, everyone is preparing something between two scenarios:

-

The good. An optimistic approach to what still may be able to come to fruition with football and other fall and winter sports. If football takes place, opportunities to sell advertising for companies looking to make up for the lost Q2 will exist.

-

The bad. A canceled football season cancellation would mean a full canceled year of sponsorship activities. Advertising dollars that move out of college sports and would be reallocated in other places and may not return.

Related is the financial effect of football games on schools’ local areas. Public schools use these figures to demonstrate their economic impact to taxpayers and legislators, and it adds up to billions more. On average, an Alabama home football game has a “visitor expenditure impact” of about $19.6 million in the Tuscaloosa area.

Summer Activities

Many schools rent out facilities during the summer when most of the students are away. Writers’ workshops, corporate training events, weddings, and summer school programs rent parts of campuses, and this offseason revenue can account for up to 10 percent of annual income. With COVID, these are all canceled for this summer. Also, COVID canceled many summer abroad programs, which are a huge moneymaker for colleges as they cost way less than the colleges charge the students to attend.

Fundraising

The cancellation of fall sports will be a massive blow for college fundraising activities. However, of concern is other fundraising activities that colleges plan, i.e., parent’s weekend, alumni reunions around the country, and other promotional events. If people cannot get together, it is hard to get them to open their wallets. With many schools facing financial pressure, fundraising pressure will be enormous on alumni. While Sweet Briar managed to survive and raise significant funds from alumni to do so this time, it may be different for many schools. The falling stock market will hamper some contributions, while job losses will undoubtedly make a severe dent.

Public Schools

While the top universities have large endowments that will cushion the blow, public universities are going to be much harder hit. State budgets are turning red daily as they face decreased revenue from sales and income taxes, and increased payments for unemployment and healthcare. As a result, they will be in no position to bail out college. The only solution for many public schools will be with layoffs or closure. Vermont is already considering such steps, but expect many others to follow suit.

As I said, higher education as we know it is gone for most people, and one day we can explain what college was like to our grandkids and why Animal House was real.

Copyright (c) 2020, Marc A. Borrelli

Recent Posts

Align and Thrive: The Importance of Organizational Alignment and Agility

How to Achieve Smart Time Management: 10 Tips for Busy Professionals

When you are a busy professional running your own business, it can often feel like there aren’t enough hours in the day to accomplish everything. Being strategic with your time is the best (and possibly the only) way to achieve all of your daily tasks. If you are...

5 Strategic Leadership Skills Every Manager Needs

So often, people view leadership as a talent: you’re either born with this quality or you’re not. However, this is not always the case! In reality, good leadership is made up of skills, and anyone can learn how to improve. Some people may pick up leadership attributes...

How the Sellability Score is Calculated: The Ultimate Guide

Do you have questions about how to calculate your business’s sellability score? Whether you’re looking to sell your business in the near future or years from now, understanding your sellability score will help you thrive. The sellability score identifies the...

The Top 5 Benefits of the Entrepreneurial Operating System

As an entrepreneur running your own business, you know there are bumps in the road and struggles that both you and your business will face over time. However, with the right people and tools at your disposal, you can anticipate what’s coming, plan for it, and continue...

5 Ways to Use Email Automation to Boost Traffic

Every single business in the world wants to evolve and grow. This will happen using a variety of techniques and strategies. In 2022, digital marketing is more than a household name, and most companies will adopt at least a few ideas when long-term planning and coming...

6 Questions To Ask A Potential Business Coach Before Hiring Them

Many entrepreneurs consider executive business coaching when they start struggling on their professional path. A small business coach is an experienced professional mentor who educates, supports, and motivates entrepreneurs. They will listen to your concerns, assess...

3 Ways Proper Long Term Strategic Planning Helps Your Business

Dreams turn into goals when they have a foundation of long-term strategic planning supporting them. They become reality when the ensuing strategic implementation plan is executed properly. With Kaizen Solutions as their strategic planning consultant, small and...

What is a Peer Group, and How Can it Improve Your Career?

If you are a CEO or key executive who has come to a crossroads or crisis in your career, you'll gain valuable insights and solutions from a peer group connection more than anywhere else. But what is a peer group, and how can that statement be made with so much...

Profit and Revenue are Lousy Core Values

As I mentioned last week, I am down with COVID and tired, so spending more time reading rather than working. I read Bill Browder's Freezing Order this weekend, and I highly recommend it. However, at the end of the book, Browder says that oligarchs, autocrats, and...