Discover the importance of organizational alignment and agility in this blog post. Learn how establishing a strong CORE and building a strategy around it can lead to sustainable growth and success. Find out how alignment and agility empower your organization to thrive in an ever-changing business landscape.

The Spectacular Rise and Fall of the European Super League

A Dramatic Introduction and Swift Collapse

Last week, the world of football experienced the dramatic birth and collapse of the European Super League (ESL). Living in Atlanta, the defeat reminded me of the Falcon’s 2017 Superbowl and Greg Norman’s 1986 Masters. On Sunday evening, the formation of the ESL was announced, consisting of 12 “founding clubs” from England, Spain, and Italy. Three other unnamed clubs were soon to join, along with another five teams that would qualify annually for the 20-team competition. However, within 48 hours, the ESL was dead.

Financial Motivations and American Influences

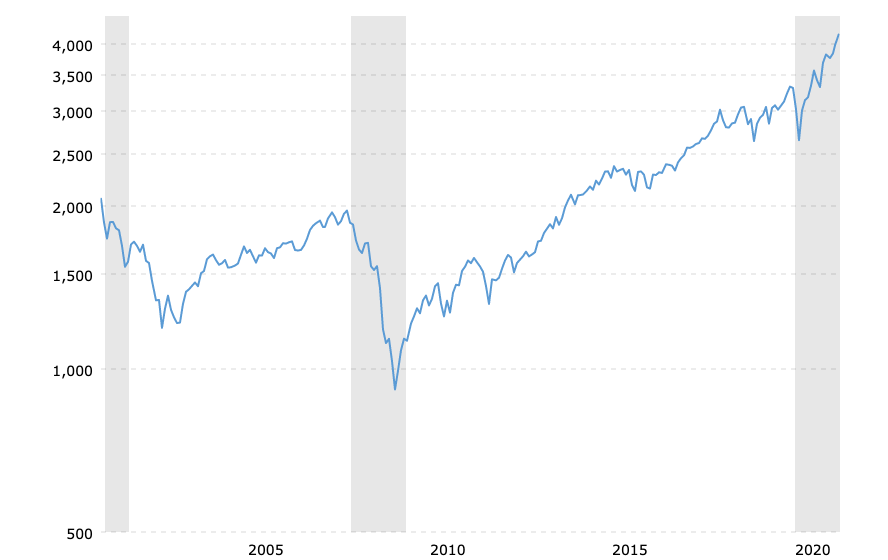

The ESL was introduced with a promise to “deliver excitement and drama never seen before in football,” and it surely delivered, albeit not in the way they had intended. The main motivation behind the formation of the ESL was money. The fifteen founding clubs were guaranteed a place every year, bypassing the need for qualification and relegation and enabling them to secure a larger share of revenues with less risk. Broadcasting rights were expected to generate €4bn annually, nearly double the €2.4bn brought in by the Champions League in the 2018-19 season.

The American sports industry is known for its effective money-producing cartels. Professional sports leagues in the United States act as monopoly-like structures that distribute wealth evenly among a self-selected group. These leagues ensure that teams remain in the league regardless of their performance, challenging the American ideal of meritocracy. The European model, on the other hand, is more capitalistic, with club owners taking risks and investing in the potential for rewards. The ESL sought to impose an American-style cartel on European football to reduce risk and transfer more money to the club owners, similar to the recent restructuring of Formula 1 under Liberty Media’s ownership. As Martin Baumann put it, “We can sell just about anything to the Europeans. Why not our hyper-capitalistic cartel-based pro sports system?”

Hubris, Value Creation, and Fan Backlash

Hubris

The collapse of the ESL can be attributed to hubris. The founders neglected the sport’s business model and Ben Horowitz’s sage advice, “Take care of the People, the Products, and the Profits— IN THAT ORDER.” Their arrogance led them to believe that they could easily impose the American sports system on European clubs without considering the cultural differences and deep-rooted traditions. This hubris resulted in the creation of a league that generated widespread contempt, proving that the incompetence of a few powerful individuals should never be underestimated.

Value Creation

The league’s criteria were not based on being the best in Europe but rather on the wealth of the owners, leading to a lack of value creation. The ESL claimed to be an exhibition of elite football, but without the need for qualification, teams would not have had to try very hard, reducing the value of the competition. Furthermore, the selection of clubs based on their owners’ wealth undermined the very essence of what it means to be the best in Europe. For example, Arsenal, a once-powerful club, is currently struggling in the Premier League and would not have been considered one of Europe’s top teams based on their on-field performance. The ESL destroyed any pretense of value creation by focusing on wealth instead of merit.

Fan Backlash

The European model places emphasis on the fans, the players, and the managers, with club success being the primary focus. The ESL completely disregarded this fundamental aspect of European football, leading to fierce backlash from fans who felt betrayed by their clubs. Protests erupted at stadiums and training grounds, with fans burning effigies of club owners and demanding change. Fans were also united in their disdain for the ESL, with a YouGov poll finding that 79% of British football fans opposed the league, and 68% of them “strongly.” This overwhelming response from fans made it clear that any league that does not prioritize the interests of its supporters is destined for failure.

Its founding members’ swift abandonment of the ESL left the American owners no choice but to follow suit.

The Aftermath and Potential Regulation

The outcome of the ESL debacle led to apologies from club owners and even JP Morgan, who underwrote the league’s formation. However, the real threat now lies in regulation. The British government has launched a review into how football is run, and there is pressure for British clubs to adopt the German community-ownership model, where fans own 51 percent of the club.

As the dust settles, it is clear that football is anything but boring.

Copyright (c) 2021 Marc A. Borrelli

Recent Posts

Align and Thrive: The Importance of Organizational Alignment and Agility

How to Achieve Smart Time Management: 10 Tips for Busy Professionals

When you are a busy professional running your own business, it can often feel like there aren’t enough hours in the day to accomplish everything. Being strategic with your time is the best (and possibly the only) way to achieve all of your daily tasks. If you are...

5 Strategic Leadership Skills Every Manager Needs

So often, people view leadership as a talent: you’re either born with this quality or you’re not. However, this is not always the case! In reality, good leadership is made up of skills, and anyone can learn how to improve. Some people may pick up leadership attributes...

How the Sellability Score is Calculated: The Ultimate Guide

Do you have questions about how to calculate your business’s sellability score? Whether you’re looking to sell your business in the near future or years from now, understanding your sellability score will help you thrive. The sellability score identifies the...

The Top 5 Benefits of the Entrepreneurial Operating System

As an entrepreneur running your own business, you know there are bumps in the road and struggles that both you and your business will face over time. However, with the right people and tools at your disposal, you can anticipate what’s coming, plan for it, and continue...

5 Ways to Use Email Automation to Boost Traffic

Every single business in the world wants to evolve and grow. This will happen using a variety of techniques and strategies. In 2022, digital marketing is more than a household name, and most companies will adopt at least a few ideas when long-term planning and coming...

6 Questions To Ask A Potential Business Coach Before Hiring Them

Many entrepreneurs consider executive business coaching when they start struggling on their professional path. A small business coach is an experienced professional mentor who educates, supports, and motivates entrepreneurs. They will listen to your concerns, assess...

3 Ways Proper Long Term Strategic Planning Helps Your Business

Dreams turn into goals when they have a foundation of long-term strategic planning supporting them. They become reality when the ensuing strategic implementation plan is executed properly. With Kaizen Solutions as their strategic planning consultant, small and...

What is a Peer Group, and How Can it Improve Your Career?

If you are a CEO or key executive who has come to a crossroads or crisis in your career, you'll gain valuable insights and solutions from a peer group connection more than anywhere else. But what is a peer group, and how can that statement be made with so much...

Profit and Revenue are Lousy Core Values

As I mentioned last week, I am down with COVID and tired, so spending more time reading rather than working. I read Bill Browder's Freezing Order this weekend, and I highly recommend it. However, at the end of the book, Browder says that oligarchs, autocrats, and...