Every business owner I have ever known, has sought to sell their business at the top of the market. I think this is part of the movement where many are in a constant quest to outdo others. While conceptually I understand this desire, these owners should heed the voices of some sages.

Daniel Kahneman’, “The average investor’s return is significantly lower than the market indices due primarily to market timing.”

Warren Buffett, “Trying to time the market is a fool’s game.”

Baron Rothschild, “You can have the top 20% and the bottom 20%; I will take the 80% in the middle.”

What it takes to Sell at the Top of the Market

If you are determined to sell at the top and are ready to step aside at any time, the only concern is timing. However, if you have other timing considerations, e.g., retire when my business is worth $X, step aside when I am 65, then things are far more complicated.

For the market to be at the top when you reach some predetermine criteria, you need to ensure that the entire economy collaborates with you. To do this, I expect you would need to have the ear of:

- the President,

- the majority of Congress,

- the Chair of the Federal Reserve, the Secretary of the Treasury,

- the President of the European Central Bank,

- the German Chancellor,

- the President of France,

- the President of Russia,

- the President of the People’s Republic of China,

- the heads of the People’s Bank of China, and

- the leaders of all the leading investment banks and hedge funds worldwide, to name a few.

Not only would you need their ear, but you would have to persuade them that collaborating with you is in their best interests as well. Furthermore, many of these people would want something in return for a favor, and most of the people I have spoken with would be able to afford the price Vladimir Putin would expect. Finally, I have found any scheme where only one person knows of it but requires many people to ensure its success is bound to fail.

As a result, I would say that trying to sell at the top is a fool’s errand and one that should be abandoned.

A Contrarian View

Some have argued that selling at the bottom of the market makes more sense. The rationale is that the business owner will reinvest those assets into other assets whenever they sell their company. Thus if you want to ensure continued wealth accumulation, one should do it at the bottom of the market rather than the top.

To examine this theory, I did a simple analysis. I reviewed four dates and the market conditions. I looked at the Russell 2000 Price Earnings Ratio for those dates and indexed them with the 2000 Price Earnings Ration as the base = 100. Assuming that enterprise value (EV) to EBITDA ratios followed the Russell 2000’s PER, the EV/EBITDA ratio in 2000 was 5x, and the company had an EBITDA of $1 million in each year before the sale, the results are as follows:

| Date | Market Conditions | Russell 2000 PER (Indexed) | EV / EBITDA Multiple | Proceeds ($k) |

| 12/31/2000 | After the Top of the market | 100.0 | 5.0 | $5,000 |

| 12/31/2005 | Near the top of the market | 58.6 | 2.9 | $2,929 |

| 12/31/2010 | Emerging from a recession | 52.6 | 2.6 | $2,631 |

| 12/31/2015 | Middle of a bull market | 74.7 | 3.7 | $3,734 |

I then made a few more simple assumptions:

- Transaction costs to be 30% comprising intermediary and legal fees of 10% and taxes of 20%.

- The proceeds are invested in two funds, VFIAX – Vanguard 500 Index Fund Admiral Shares and VBMFX – Vanguard Total Bond Market Index Fund Investor Shares as proxies for a general stock and bond market investment.

- The allocation is 70% into VFIAX and 30% into VBMFX.

- Any funds withdrawn and any distributions are ignored as they would be the same for both funds.

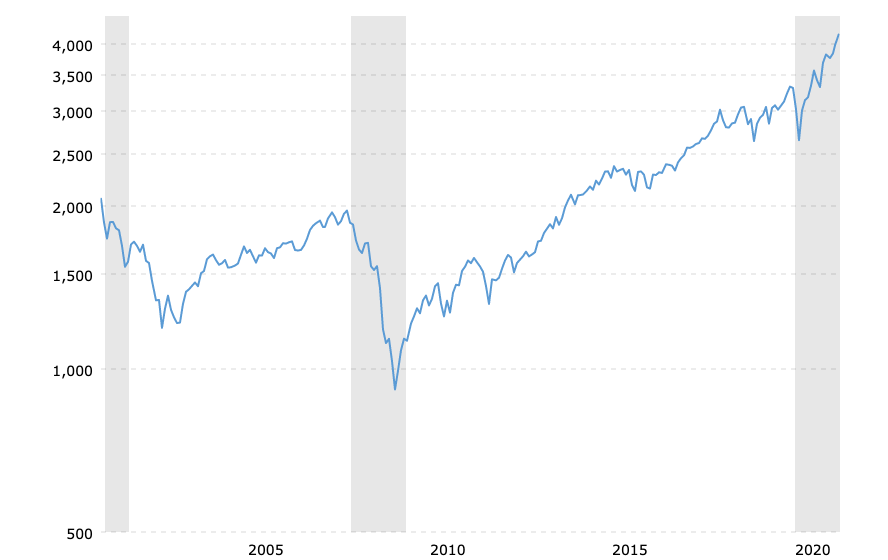

Below is a chart of the S&P 500 from December 31, 2000, to December 31, 2020 to show the market’s performance over the period.

Source: Yahoo Finance

Following the investments as described above after five, ten and fifteen years the returns were:

| Date | Initial Value ($k) | After 5 yrs ($k) | Return (%) | After 10 yrs ($k) | Return (%) | After 15 years ($k) | Return (%) |

| 12/31/2000 | 5,000 | 4,822 | -3.6 | 4,930 | -1.4 | 7,027 | 40.5 |

| 12/31/2005 | 2,929 | 2,993 | 2.2 | 4,292 | 46.5 | 5,414 | 84.8 |

| 12/31/2010 | 2,631 | 3,790 | 44.0 | 4,786 | 81.9 | ||

| 12/31/2015 | 3,734 | 4,643 | 24.3 |

So as it can be seen, while selling at the top, provided the greatest wealth after fifteen years, interesting the difference over 10 years was less than 3% between selling at the top and selling just after the bottom. The other points are somewhere in between. Therefore, selling at the top is not the conclusive answer we expected.

So what to do?

What I have always advised clients is to build a business that is attractive to buyers and can be sold. The key is to create your own redundancy, so that you can sell it, stay in a non-executive capacity and effectively “coupon clip,” or pass it on to your children or employees. You have many options and if someone comes along and offers you “silly” money, take it. But don’t worry about the “Top of the Market.”

If you want to know if your business is sellable, complete this questionnaire, and if you want help building a sellable business, contact me.

Copyright (c) 2021, Marc A. Borrelli

Recent Posts

Align and Thrive: The Importance of Organizational Alignment and Agility

Discover the importance of organizational alignment and agility in this blog post. Learn how establishing a strong CORE and building a strategy around it can lead to sustainable growth and success. Find out how alignment and agility empower your organization to thrive in an ever-changing business landscape.

How to Achieve Smart Time Management: 10 Tips for Busy Professionals

When you are a busy professional running your own business, it can often feel like there aren’t enough hours in the day to accomplish everything. Being strategic with your time is the best (and possibly the only) way to achieve all of your daily tasks. If you are...

5 Strategic Leadership Skills Every Manager Needs

So often, people view leadership as a talent: you’re either born with this quality or you’re not. However, this is not always the case! In reality, good leadership is made up of skills, and anyone can learn how to improve. Some people may pick up leadership attributes...

How the Sellability Score is Calculated: The Ultimate Guide

Do you have questions about how to calculate your business’s sellability score? Whether you’re looking to sell your business in the near future or years from now, understanding your sellability score will help you thrive. The sellability score identifies the...

The Top 5 Benefits of the Entrepreneurial Operating System

As an entrepreneur running your own business, you know there are bumps in the road and struggles that both you and your business will face over time. However, with the right people and tools at your disposal, you can anticipate what’s coming, plan for it, and continue...

5 Ways to Use Email Automation to Boost Traffic

Every single business in the world wants to evolve and grow. This will happen using a variety of techniques and strategies. In 2022, digital marketing is more than a household name, and most companies will adopt at least a few ideas when long-term planning and coming...

6 Questions To Ask A Potential Business Coach Before Hiring Them

Many entrepreneurs consider executive business coaching when they start struggling on their professional path. A small business coach is an experienced professional mentor who educates, supports, and motivates entrepreneurs. They will listen to your concerns, assess...

3 Ways Proper Long Term Strategic Planning Helps Your Business

Dreams turn into goals when they have a foundation of long-term strategic planning supporting them. They become reality when the ensuing strategic implementation plan is executed properly. With Kaizen Solutions as their strategic planning consultant, small and...

What is a Peer Group, and How Can it Improve Your Career?

If you are a CEO or key executive who has come to a crossroads or crisis in your career, you'll gain valuable insights and solutions from a peer group connection more than anywhere else. But what is a peer group, and how can that statement be made with so much...

Profit and Revenue are Lousy Core Values

As I mentioned last week, I am down with COVID and tired, so spending more time reading rather than working. I read Bill Browder's Freezing Order this weekend, and I highly recommend it. However, at the end of the book, Browder says that oligarchs, autocrats, and...

[url=https://bmtadalafil.online/]tadalafil online prescription[/url]

[url=http://bmtadalafil.online/]tadalafil generic price in india[/url]

[url=http://azithromycinmds.online/]zithromax cost canada[/url]

[url=https://medicinesaf.online/]pharmacy[/url]

[url=https://tadalafilstd.com/]tadalafil over the counter uk[/url]

cheap lisinopril no prescription

[url=https://asynthroid.com/]synthroid 88 mcg[/url]

[url=https://lisinoprilgp.online/]lisinopril online without prescription[/url]

[url=https://happyfamilystorerx.online/]safe reliable canadian pharmacy[/url]

[url=http://metformindi.online/]metformin online[/url]

[url=https://drugstorepp.online/]reputable online pharmacy reddit[/url]

[url=https://pharmgf.online/]canada pharmacy not requiring prescription[/url]

[url=http://metforminn.com/]metformin over the counter canada[/url]

[url=http://synthroidx.online/]synthroid 100 mg price[/url]

[url=http://prednisoneiv.online/]generic prednisone 20mg[/url]

[url=http://metformin.store/]metformin 1 000mg[/url]

[url=http://vatrex.online/]order valtrex online uk[/url]

[url=http://happyfamilystorerx.online/]online pharmacy non prescription drugs[/url]

[url=https://synthroidam.online/]synthroid 20 mcg[/url]

[url=https://happyfamilystorerx.online/]online pharmacy no prescription needed[/url]

[url=http://azithromycinmds.online/]drug azithromycin 500 mg[/url]

[url=http://prednisoneo.online/]prednisone 40 mg tablet[/url]

[url=https://metforminbi.online/]metformin pharmacy[/url]

[url=http://prednisonekx.online/]buy generic prednisone online[/url]

[url=http://olisinopril.com/]lisinopril 12.5 mg 10 mg[/url]

[url=http://happyfamilymedicalstore.online/]online otc pharmacy[/url]

[url=https://ametformin.com/]metformin 500 mg for sale[/url]

[url=http://synthroidam.online/]cost of synthroid brand name[/url]

[url=https://prednisonecsr.com/]prednisone 13 mg[/url]

[url=http://synthroidam.online/]generic synthroid online[/url]

[url=https://bestmedsx.online/]canadapharmacyonline legit[/url]

[url=https://lisinoprilgp.com/]zestoretic price[/url]

[url=http://bmtadalafil.online/]buy tadalafil 20mg price[/url]

[url=https://pharmgf.online/]canadian pharmacy prices[/url]

[url=http://synthroidam.online/]buy synthroid 150 mcg online[/url]

[url=https://happyfamilystorerx.online/]reputable indian pharmacies[/url]

[url=http://valtrexv.com/]buy valtrex 1000 mg[/url]

[url=http://synthroidotp.online/]synthroid 112 mcg coupon[/url]

[url=http://lisinoprilos.online/]lisinopril 10 mg tablet price[/url]

[url=http://valtrexarb.online/]buy valtrex india[/url]

[url=http://prednisoneo.online/]prednisone 2.5 mg[/url]

[url=http://metformindi.com/]best metformin brand[/url]

[url=http://synthroidx.com/]can i buy synthroid over the counter[/url]

[url=http://valtrexmedication.com/]valtrex without a prescription[/url]

[url=https://asynthroid.com/]synthroid generic prices[/url]

[url=http://oazithromycin.com/]azithromycin online no prescription[/url]

[url=http://tadalafilgf.com/]cheap cialis paypal[/url]

[url=https://valtrexmedication.com/]valtrax on line[/url]

[url=https://tadalafilgf.com/]buying cialis in mexico[/url]

[url=http://bestprednisone.online/]prednisone purchase online[/url]

WONDERFUL Post.thanks for share..extra wait .. …

[url=https://synthroidx.com/]cost of synthroid 200 mcg[/url]

Great web site you have here.. It’s hard to find high-quality writing like yours these days. I truly appreciate people like you! Take care!!

[url=https://azithromycinhq.com/]azithromycin brand name india[/url]

[url=http://prednisonexg.online/]how much is prednisone cost[/url]

[url=http://predniso.online/]prednisone online purchase[/url]

[url=https://metformin.store/]metformin 1000 coupon[/url]

[url=https://isynthroid.online/]synthroid 0.05mg cost[/url]

[url=https://tadalafilgf.com/]generic cialis 2018[/url]

[url=https://synthroidotp.online/]cost of brand name synthroid[/url]

[url=https://prednisonekx.online/]average cost of prednisone[/url]

[url=https://lisinoprilos.online/]lisinopril 10 mg prices[/url]

[url=https://azithromycinmds.online/]buy azithromycin 250 mg[/url]

[url=http://synthroidotp.online/]synthroid 100 mcg tablet[/url]

[url=http://metformin.store/]cheap metaformin[/url]

[url=http://happyfamilystorerx.online/]list of online pharmacies[/url]

[url=https://happyfamilystorerx.online/]legit non prescription pharmacies[/url]

[url=http://prednisonexg.online/]buy prednisone 5mg canada[/url]

[url=http://metformin.store/]buy metformin 1000[/url]

[url=https://metforemin.online/]metformin 500 mg discount[/url]

[url=http://ametformin.com/]can i buy metformin from canada[/url]

[url=http://prednisonecsr.com/]prednisone 300 mg[/url]

[url=http://tadalafi.online/]tadalafil 30mg capsules[/url]

[url=https://happyfamilymedicalstore.online/]my canadian pharmacy rx[/url]

[url=http://olisinopril.online/]lisinopril 20 mg daily[/url]

[url=https://tadalafi.online/]brand cialis online us pharmacy[/url]

[url=http://happyfamilystorerx.online/]happy family pharmacy[/url]

[url=https://tadalafilu.online/]cheap 10 mg tadalafil[/url]

[url=http://tadalafilgf.com/]generic cialis price[/url]

Balmorex Pro is a natural and amazing pain relief formula that decreases joint pain and provides nerve compression relief.

[url=http://valtrexmedication.online/]how to get valtrex in uk[/url]

[url=https://bestmedsx.online/]pill pharmacy[/url]

[url=http://synthroidsl.online/]synthroid 112 mcg coupon[/url]

[url=https://tadalafilstd.online/]canadian pharmacy cialis 60 mg[/url]

[url=http://metformindi.com/]metformin 1000 mg no prescription[/url]

[url=http://olisinopril.online/]can i order lisinopril online[/url]

[url=https://tadalafi.online/]tadalafil soft[/url]

[url=https://ismetformin.online/]cheap meds metformin[/url]

[url=http://azithromycinhq.com/]buy azithromycin 1g[/url]

[url=https://olisinopril.online/]prinivil drug[/url]

[url=http://metformin.store/]metformin 850mg[/url]

[url=https://tadalafilgf.com/]tadalafil 20 mg best price[/url]

[url=https://ametformin.com/]metformin on line[/url]

[url=http://bestmedsx.online/]internet pharmacy manitoba[/url]

[url=http://bestmedsx.online/]escrow pharmacy canada[/url]

What is ZenCortex? ZenCortex is a cutting-edge dietary supplement meticulously crafted to provide essential nutrients that support and enhance healthy hearing

[url=https://bestmedsx.com/]mexican pharmacy online[/url]

Puravive is a weight management supplement formulated with a blend of eight exotic nutrients and plant-based ingredients aimed at promoting fat burning.

[url=http://metforminbi.online/]metformin order online canada[/url]

[url=https://prednisonecsr.com/]cheap prednisone online[/url]

[url=https://oazithromycin.online/]zithromax azithromycin[/url]

[url=http://diflucand.com/]can you buy diflucan over the counter in mexico[/url]

[url=https://zithromaxl.online/]medicine azithromycin 250 mg[/url]

[url=https://advaird.online/]advair generic brand[/url]

[url=https://baclofenx.online/]baclofen buy online uk[/url]

[url=https://vermoxin.online/]vermox 100 mg otc[/url]

[url=https://zithromaxl.online/]buy generic zithromax[/url]

[url=https://albuterolp.online/]albuterol 200[/url]

[url=https://eflomax.online/]can i buy flomax over the counter[/url]

[url=http://lasixav.online/]furosemide 20mg[/url]

[url=https://modafinilmip.online/]modafinil medicine[/url]

[url=http://acyclovirmc.online/]acyclovir 1mg[/url]

[url=http://vermoxin.online/]vermox usa[/url]

Крупный учебный и научно-исследовательский центр Республики Беларусь. Высшее образование в сфере гуманитарных и естественных наук на 12 факультетах по 35 специальностям первой ступени образования и 22 специальностям второй, 69 специализациям.

[url=https://glucophage.online/]metformin 1mg[/url]

[url=http://bactrim.company/]how to get bactrim[/url]

[url=http://azithromycinmds.online/]medicine azithromycin 250 mg[/url]

[url=https://strattera.company/]buy strattera india[/url]

[url=https://oazithromycin.online/]azithromycin over the counter us[/url]

[url=http://amoxicillinir.online/]amoxicillin clavulanate[/url]

[url=https://amoxil.company/]amoxicillin capsules from india[/url]

[url=https://effexor.directory/]effexor cost canada[/url]

I admire your piece of work, thankyou for all the useful blog posts.

[url=http://lyricamd.com/]lyrica 150 mg capsule[/url]

[url=https://finasterideff.online/]generic propecia australia[/url]

[url=https://declomid.online/]how to buy clomid online[/url]

[url=https://drdoxycycline.online/]how to get doxycycline online[/url]

It’s a shame you don’t have a donate button! I’d certainly donate to this superb blog! I guess for now i’ll settle for bookmarking and adding your RSS feed to my Google account. I look forward to fresh updates and will share this site with my Facebook group. Talk soon!

[url=http://accutaneiso.com/]cheapest accutane prices[/url]

[url=http://diflucanr.online/]diflucan otc in canada[/url]

[url=https://modafinilon.online/]buy provigil online australia[/url]

[url=https://odiflucan.online/]where can i get diflucan over the counter[/url]

[url=https://xlyrica.online/]buy lyrica 150mg[/url]

[url=https://drdoxycycline.online/]doxycycline costs uk[/url]

[url=https://bacclofen.online/]baclofen where to buy[/url]

[url=https://rettretinoin.online/]retin a 0.025 cream price[/url]

[url=http://mcadvair.online/]advair[/url]

[url=https://enolvadex.com/]nolvadex india[/url]

[url=https://odiflucan.com/]diflucan online nz[/url]

[url=https://doxycyclineo.com/]doxycycline 500mg price[/url]

[url=https://ciproffl.online/]where to buy ciprofloxacin[/url]

[url=https://abamoxicillin.com/]amoxicillin medication[/url]

[url=http://albuterolp.com/]order ventolin[/url]

[url=https://enolvadex.online/]buying nolvadex[/url]

[url=https://azithromycinps.online/]azithromycin online prescription[/url]

[url=http://bactrim.company/]where to buy bactrim[/url]

[url=https://lasixor.com/]lasix 40 mg price[/url]

[url=http://glucophage.online/]134 metformin 500 mg[/url]

Hi there, I found your website via Google while looking for a related topic, your website came up, it looks great. I’ve bookmarked it in my google bookmarks.

[url=http://lasixtbs.com/]can you buy furosemide otc pharmacy[/url]

[url=http://rettretinoin.online/]tretinoin 0.05 cream india[/url]

[url=https://acyclovirmc.online/]generic aciclovir[/url]

[url=https://rettretinoin.online/]generic tretinoin canada[/url]

[url=https://acyclovirlp.online/]zovirax tablets over the counter uk[/url]

[url=https://strattera.company/]purchase strattera online[/url]

[url=http://accutaneo.com/]accutane how to get[/url]

[url=https://tretinoineff.online/]retin a 1[/url]

[url=http://drdoxycycline.online/]doxycycline over the counter india[/url]

[url=http://mcadvair.online/]advair diskus price canada[/url]

[url=https://xmodafinil.com/]modafinil pharmacy price[/url]

[url=http://ibaclofen.com/]baclofen brand name[/url]

[url=http://finasterideff.com/]generic propecia from india[/url]

[url=http://modafinile.com/]buy modafinil online cheap[/url]

[url=https://lyricamd.online/]lyrica best price[/url]

[url=https://dezithromax.online/]buy azithromycin online without prescription[/url]

Great line up. We will be linking to this great article on our site. Keep up the good writing.

[url=http://doxycyclinepr.com/]doxycycline 40 mg[/url]

[url=http://clomidsale.com/]clomid prices[/url]

[url=http://eflomax.com/]price of flomax[/url]

[url=http://baclofenx.online/]baclofen 50 mg tablet[/url]

[url=https://azithromycinhq.com/]buy azithromycin 250 mg[/url]

[url=https://nolvadexin.online/]tamoxifen 10 mg tablet[/url]

[url=https://bacclofen.online/]baclofen prescription medicine[/url]

[url=https://albuterolp.online/]albuterol 83[/url]

canadian mail order pharmacy

[url=http://lasixtbs.com/]fureosinomide[/url]

largest canadian pharmacy

geinoutime.com

“폐하, 은혜에 감사드립니다.” Shen Wen은 눈물을 흘리며 울었습니다.

[url=https://oazithromycin.online/]zithromax 250 coupon[/url]

Hi there, this weekend is good in favor of me, since this point in time i am reading this wonderful informative piece of writing here at my home.

I?¦ll immediately snatch your rss feed as I can’t find your e-mail subscription hyperlink or e-newsletter service. Do you have any? Kindly allow me know so that I may subscribe. Thanks.

[url=http://vermox.company/]vermox india[/url]

[url=https://diflucanr.online/]buy duflican[/url]

[url=https://flomaxms.online/]cheapest flomax uk[/url]

[url=https://finasterideff.online/]propecia 1mg price[/url]

[url=http://avermox.com/]vermox pills for sale[/url]

[url=https://lasixtbs.online/]furosemide discount[/url]

[url=http://ibaclofen.com/]over the counter baclofen[/url]

[url=http://accutaneo.com/]roaccutane buy[/url]

[url=https://accutaneiso.com/]where can you buy accutane[/url]

[url=https://azithromycinhq.com/]azithromycin antibiotics[/url]

[url=https://lyricamd.com/]lyrica cheapest price[/url]

[url=https://tadalafilu.com/]brand cialis online usa[/url]

[url=https://adfinasterid.online/]generic finpecia[/url]

[url=http://diflucanr.online/]diflucan otc uk[/url]

[url=http://modafinile.com/]buy provigil uk[/url]

[url=https://baclofenx.online/]lioresal tablet[/url]

[url=https://avermox.com/]buy vermox online uk[/url]

[url=https://xlyrica.com/]lyrica tablet cost[/url]

[url=http://nolvadexin.online/]nolvadex-d[/url]

[url=http://doxycyclineo.online/]doxycycline tablets where to buy[/url]

[url=https://flomaxms.com/]flomax 0.4 mg price[/url]

[url=http://nolvadexin.online/]tamoxifen 50 mg[/url]

[url=http://doxycyclinepr.com/]doxycycline prescription price[/url]

[url=http://dezithromax.online/]zithromax purchase online[/url]

[url=https://amoxicillinir.online/]rx augmentin[/url]

シンドバッドアドベンチャーは榎本加奈子でどうですか(自动转)

このブログはいつも私の知識を広げてくれます。大変感謝しています。

[url=https://azithromycinmds.online/]zithromax 500mg[/url]

[url=https://rettretinoin.online/]best otc tretinoin[/url]

[url=http://nolvadexin.online/]tamoxifen brand name canada[/url]

geinoutime.com

사실 이것은 송나라의 강한 줄기와 약한 가지의 전략의 연속에 가깝습니다.

[url=https://ibaclofen.com/]baclofen 20 mg buy without prescription[/url]

Usually I don’t read post on blogs, but I would like to say that this write-up very pressured me to try and do it! Your writing style has been amazed me. Thank you, quite nice post.

[url=http://declomid.online/]can you buy clomid over the counter in uk[/url]

[url=http://accutaneiso.com/]buy accutane from canada[/url]

[url=https://dezithromax.online/]buy zithromax uk[/url]

[url=https://ifinasteride.com/]propecia generic uk[/url]

[url=https://adfinasterid.online/]how to get propecia in us[/url]

[url=http://accutaneiso.com/]accutane generic price[/url]

[url=https://lasixav.online/]lasix 20 mg cost[/url]

[url=https://azithromycinhq.com/]how to buy azithromycin 250 mg[/url]

[url=http://albuterolo.com/]combivent for sale[/url]

geinoutime.com

섬세하고 비싸다… 하지만 이 두 녀석은 여전히 망설임이 없다.

I truly love your blog.. Pleasant colors & theme. Did you create this web site yourself? Please reply back as I’m hoping to create my own blog and would like to learn where you got this from or exactly what the theme is called. Thank you!

[url=http://dexamethasoneff.online/]dexona 4mg tablet[/url]

[url=http://bacclofen.online/]baclofen 5 mg tab[/url]

[url=http://baclofenx.online/]baclofen cost[/url]

[url=http://iclomid.com/]clomid 50 mg for sale[/url]

[url=http://advaird.online/]buying advair in mexico[/url]

[url=http://tretinoineff.com/]buy retin a cream online canada[/url]

I will right away seize your rss as I can not in finding your email subscription link or newsletter service. Do you have any? Please allow me realize so that I may subscribe. Thanks.

[url=http://strattera.company/]atomoxetine strattera[/url]

What is Java Burn? Java Burn, an innovative weight loss supplement, is poised to transform our perception of fat loss.

[url=https://adexamethasonep.online/]dexamethasone tablet 1mg[/url]

what causes pain on top of big toe joint

pain in joints of hand an darms

stress and joint pains

me cfs and joint pain

joint pain and fever covid

joint pain nasal polyp muscle pain

what are joint pain differential diagnosis in young females

causes of shoulder joint pain

thumb ip joint pain and swelling

[url=http://acutanep.online/]cheapest accutane generic[/url]

running pain in big toe joint

hip joint pain lifting leg

pain in joint of foot

http://jointpain.top/ – inflammatory arthritis and joint pain

http://jointpain.top/ – 38 weeks sacral illiac joint pain

http://jointpain.top/ – allopurinol cause joint pain

[url=http://tadalafilu.com/]cheapest cialis usa[/url]

[url=http://ifinasteride.com/]price of propecia in south africa[/url]

[url=http://azithromycinmds.com/]where can i buy zithromax[/url]

[url=http://clomidsale.com/]clomid for women[/url]

[url=https://modafinile.online/]online modafinil prescription[/url]

[url=https://drdoxycycline.online/]doxycycline without prescription[/url]

[url=https://oazithromycin.com/]zithromax online usa[/url]

[url=http://tadalafilu.com/]buy real cialis online canada[/url]

I went over this web site and I believe you have a lot of great info, saved to my bookmarks (:.

[url=https://acyclovirmc.com/]acyclovir pills otc[/url]

[url=https://okmodafinil.com/]where can i buy modafinil[/url]

Hi would you mind sharing which blog platform you’re working with? I’m going to start my own blog in the near future but I’m having a tough time selecting between BlogEngine/Wordpress/B2evolution and Drupal. The reason I ask is because your layout seems different then most blogs and I’m looking for something completely unique. P.S Sorry for getting off-topic but I had to ask!

[url=http://bactrim.company/]purchase bactrim[/url]

[url=http://bactrim.company/]bactrim medication[/url]

[url=https://finasterideff.online/]cheap generic propecia[/url]

Hey I am so grateful I found your weblog, I really found you by error, while I was browsing on Google for something else, Nonetheless I am here now and would just like to say thank you for a remarkable post and a all round enjoyable blog (I also love the theme/design), I don’t have time to browse it all at the minute but I have book-marked it and also included your RSS feeds, so when I have time I will be back to read a great deal more, Please do keep up the fantastic job.

[url=https://bacclofen.online/]baclofen pills[/url]

[url=http://finasterideff.com/]price of propecia in south africa[/url]

[url=http://odiflucan.com/]over the counter diflucan pill[/url]

[url=https://flomaxms.com/]buy flomax 4 mg[/url]

[url=http://modafinilon.online/]online modafinil pharmacy[/url]

I conceive this internet site holds some rattling great info for everyone : D.

You have brought up a very wonderful details , appreciate it for the post.

[url=http://adexamethasonep.online/]dexamethasone brand[/url]

Good post. I learn one thing tougher on different blogs everyday. It will at all times be stimulating to learn content material from other writers and follow a little something from their store. I’d favor to make use of some with the content material on my weblog whether you don’t mind. Natually I’ll give you a hyperlink on your internet blog. Thanks for sharing.

Perfectly written subject material, appreciate it for entropy. “Necessity is the mother of taking chances.” by Mark Twain.

[url=http://modafinilon.online/]modafinil 2019[/url]

[url=https://xmodafinil.com/]provigil online paypal[/url]

[url=https://prednisonecsr.online/]medication prednisone 20 mg[/url]

[url=https://ifinasteride.com/]propecia pills cost[/url]

[url=http://itretinoin.online/]buy retin a online canada[/url]

[url=http://diflucanr.com/]where can i buy diflucan 1[/url]

[url=https://flomaxms.com/]noroxin 400mg tablets[/url]

[url=https://effexor.directory/]effexor 450 mg[/url]

[url=https://baclofenx.com/]baclofen 10mg tablets cost[/url]

Hi there! I could have sworn I’ve been to this site before but after reading through some of the post I realized it’s new to me. Nonetheless, I’m definitely happy I found it and I’ll be bookmarking and checking back often!

geinoutime.com

“뭐라고?” 주후는 의아해하며 류진을 바라보았다.

Greetings! I know this is somewhat off topic but I was wondering which blog platform are you using for this site? I’m getting tired of WordPress because I’ve had issues with hackers and I’m looking at options for another platform. I would be great if you could point me in the direction of a good platform.

I haven’t checked in here for a while as I thought it was getting boring, but the last few posts are great quality so I guess I will add you back to my everyday bloglist. You deserve it my friend 🙂

сериал 2024

Do you mind if I quote a couple of your posts as long as I provide credit and sources back to your website? My blog site is in the very same area of interest as yours and my visitors would truly benefit from a lot of the information you present here. Please let me know if this alright with you. Regards!

[url=https://flomaxms.com/]flomax 0.4 mg price[/url]

[url=https://ifinasteride.com/]finasteride 5 mg daily[/url]

Dragon money [url=https://vk.com/dragon_money_promokod]vk.com/dragon_money_promokod[/url] — это платформа, где собраны лучшие азартные игры. Промокоды помогут вам получить дополнительные бонусы и улучшить игровой процесс. Ассортимент игр удовлетворит запросы даже самых требовательных геймеров. В этом сообществе доступно множество бездепозитных промокодов.

[url=http://itretinoin.com/]retin a usa[/url]

geinoutime.com

처음에 사람들은 이것이 Xishan Jianye의 방법일 뿐이라고 생각했습니다.

This site is really a walk-through for all of the info you wished about this and didn’t know who to ask. Glimpse right here, and also you’ll definitely discover it.

Штейнбах Х.Э. и популярные обзоры по психоанализу.

сериал

It’s impressive that you are getting ideas from this post as well as from our discussion made at this place.

Slightly off topic 🙂

It so happened that my sister found an interesting man here, and recently got married ^_^

(Moderator, don’t troll!!!)

Is there are handsome people here! 😉 I’m Maria, 28 years old.

I work as a model, successfull – I hope you do too! Although, if you are very good in bed, then you are out of the queue!)))

By the way, there was no sex for a long time, it is very difficult to find a decent one…

And no! I am not a prostitute! I prefer harmonious, warm and reliable relationships. I cook deliciously and not only 😉 I have a degree in marketing.

My photo:

[img]https://i.ibb.co/zhMSQpj/5489819-2-3.jpg[/img]

___

[i]Added[/i]

The photo is broken, sorry(((

Check out my blog where you’ll find lots of hot information about me:

https://new-kino24.ru

Or write to me in telegram @Lolla_sm1_best ( start chat with your photo!!!)

[url=http://metforminn.online/]metformin over the counter[/url]

Hi all!

I’ve come across a frustrating problem – there’s a noticeable vibration at speed, and I’ve determined it’s the driveshaft causing it. The vibration is worse around 80-90 km/h. After reading through some forums, it seems like it’s probably an imbalance problem.

I’m considering the best method to solve this:

Take it off and balance it with specialized equipment. It’s a reliable method, though it’s a bit of a hassle and expensive. Some say you can balance it directly on the car. They do it on a lift without removing the shaft using some equipment.

Has anyone used this method for balancing the driveshaft ? Please share your experiences and results. Thanks for your help!

Keep on writing, great job!

куплю диплом кандидата наук

https://www.zillow.com/profile/lutroduyda

купить свидетельство о браке

сериал смотреть

[url=https://tretinoineff.com/]retin a pharmacy prices[/url]

[url=http://adfinasterid.online/]where to get propecia[/url]

canada drugs online reviews

Купить Кокаин в Москве? Самый чистый Кокаин в Москве Купить

ССЫЛКА НА САЙТ- https://mephedrone.top

Москва Купить Мефедрон? Кристаллы МЕФ?

Где в Москве Купить Мефедрон? САЙТ – https://mephedrone.top/

сериал бесплатно

prednisone mexican pharmacy

[url=https://nolvadexin.online/]buy tamoxifen online uk[/url]

Ready to experience the excitement of video poker? Join our [url=https://usacasinohub.com/video-poker/]online poker sites canada[/url] and start playing today. Whether you’re a novice or a seasoned poker player, our video poker games offer something for everyone. Embrace the challenge, apply your strategy, and enjoy the thrill of winning.

Howdy excellent blog! Does running a blog like this take a lot of work? I have no expertise in computer programming but I was hoping to start my own blog soon. Anyway, if you have any suggestions or tips for new blog owners please share. I know this is off topic but I just needed to ask. Kudos!

Головоломка 2

купить официальный аттестат [url=https://diplom61.ru/]купить официальный аттестат[/url] .

Hello There. I found your blog using msn. This is a very well written article. I will make sure to bookmark it and return to read more of your useful information. Thanks for the post. I will definitely return.

Experience bliss

https://bit.ly/4bdMuAg

prescription drugs canadian

[url=http://ciproffl.online/]ciprofloxacin 500 mg tablet price[/url]

Have no financial skills? Let Robot make money for you. https://t.me/cryptaxbot/11

Get new tokens in the game now [url=https://notreward.pro]Hamster Kombat[/url]

daily distribution Notcoin to your wallets

Join our project notreward.pro and receive toncoin

[url=https://notreward.pro]Hamster kombat airdrop[/url]

you’ll have hard on all night —> http://zi.ma/3kmnv4/

[url=https://flomaxms.online/]flomax medicine price[/url]

[url=http://acutanep.online/]accutane cost in india[/url]

Great blog! Do you have any helpful hints for aspiring writers? I’m planning to start my own site soon but I’m a little lost on everything. Would you advise starting with a free platform like WordPress or go for a paid option? There are so many choices out there that I’m completely confused .. Any tips? Bless you!

[url=https://accutaneo.com/]buy accutane tablets[/url]

[url=https://xmodafinil.com/]where to buy provigil[/url]

[url=http://advaird.com/]advair from mexico[/url]

Rybelsus – Quick and Easy Weight Lass

According to randomised controlled trials, you start losing weight immediately after taking Rybelsus. After one month, the average weight loss on Rybelsus is around 2kg; after two months, it’s over 3kg.

What does Rybelsus do to your body?

Rybelsus (oral semaglutide) is a GLP-1 receptor agonist. It mimics a fullness hormone called GLP-1.

Rybelsus reduces appetite and hunger by interacting with the brain’s appetite control centre, the hypothalamus. This effect on the brain helps you eat fewer calories and starts almost immediately after taking the pill.

However, you might notice your hunger levels rising and falling in the first 4-5 weeks you take Rybelsus.

It can take around 4-5 weeks for Rybelsus to reach a level in the body we call a steady state. A steady state is when the drug’s levels in the body remain consistent rather than spiking and falling.

Interestingly, this initial weight loss is no different to other weight loss treatments or the impact of diet interventions on weight loss. The real effect of oral semaglutide is seen beyond three months.

Oral semaglutide is a long-acting medication that’s started at a lower dose to reduce the number and severity of side effects as it’s built up to a higher maintenance dose.

https://true-pill.top/rybelsus.html

[center][size=5][b]Balanset-1A Sale: Your Ideal Tool for Balancing and Vibration Analysis[/b][/size][/center]

[center][img]https://vibromera.eu/wp-content/uploads/2023/09/77-e1693745667801.jpg.webp[/img][/center]

[center][size=4][b]Device Description:[/b][/size][/center]

Balanset-1A is a dual-channel device for balancing and vibration analysis, ideal for balancing rotors such as crushers, fans, grain harvester choppers, shafts, centrifuges, turbines, and more.

[center][size=4][b]Features:[/b][/size][/center]

[size=3][b]Vibrometer Mode:[/b][/size]

Tachometer: Accurately measures rotation speed (RPM).

Phase: Determines the phase angle of vibration signals for precise analysis.

1x Vibration: Measures and analyzes the main frequency component.

FFT Spectrum: Provides a detailed view of the vibration signal frequency spectrum.

Overall Vibration: Measures and monitors overall vibration levels.

Measurement Log: Saves measurement data for analysis.

[size=3][b]Balancing Mode:[/b][/size]

Single-Plane Balancing: Balances rotors in a single plane to reduce vibration.

Two-Plane Balancing: Balances rotors in two planes for dynamic balancing.

Polar Diagram: Visualizes imbalance on a polar diagram for precise weight placement.

Last Session Recovery: Allows resuming the previous balancing session for convenience.

Tolerance Calculator (ISO 1940): Calculates allowable imbalance values according to ISO 1940 standards.

Grinding Wheel Balancing: Uses three correction weights to eliminate imbalance.

[size=3][b]Diagrams and Graphs:[/b][/size]

General Graphs: Visualization of overall vibration.

1x Graphs: Display of main frequency vibration patterns.

Harmonic Graphs: Show the impact of harmonic frequencies.

Spectral Graphs: Graphical representation of the frequency spectrum for in-depth analysis.

[size=3][b]Additional Features:[/b][/size]

Archiving: Storage and access to previous balancing sessions.

Reports: Generation of detailed reports on balancing results.

Rebalancing: Easily repeat the balancing process using saved data.

Serial Production Balancing: Suitable for balancing rotors in serial production.

Imperial and Metric System Options: Provides compatibility and convenience worldwide.

[center][size=4][b]Price:[/b][/size][/center]

€1751

[size=3][b]Package Includes:[/b][/size]

Measurement unit

Two vibration sensors

Optical sensor (laser tachometer) with magnetic stand

Weights

Software (laptop not included, available as an additional order)

Plastic carrying case

[center][url=https://vibromera.eu/?via=olesia][b]Buy Portable balancer and Vibration Analyzer[/b][/url][/center]

Order Balanset-1A today and ensure precise balancing of your rotors!

Интересно: [url=https://autoplenka.com/product/nabor-iz-dvuh-skraperov-iz-plastika-5-sm-nabor-smennyh-lezvij-100-sht/]данмакс пермь[/url] или [url=https://autoplenka.com]оклейка антигравийной пленкой[/url]

Может быть полезным: https://autoplenka.com/product/kant-rezinovyj-sinij/ или [url=https://autoplenka.com/shop/]какая антигравийная пленка[/url]

Ещё можно узнать: [url=http://yourdesires.ru/it/windows/940-kak-uznat-seriynyy-nomer-noutbuka.html]как найти серийный номер[/url]

You are my inhalation, I possess few web logs and infrequently run out from to post .

smartblip home gadgets https://smartblip.com best price

prescription price checker

Используйте промокоды в up-x и наслаждайтесь бонусами. Узнайте больше, посетив up-x промокоды, и начните выигрывать уже сегодня.

[b]https://e-porn.net[/b] free xxx tube videos webcams dating,

онлайн камеры, знакомства

smartblip home gadgets https://smartblip.com best price, free shipping,

hot offer!

https://e-porn.net free xxx videos, web cams, dating for sex, adult

movies, hot babes, porno

Professional seo https://dseo24.monster

Fantastic goods from you, man. I’ve bear in mind your stuff prior to and you’re simply too wonderful. I really like what you’ve obtained here, really like what you’re stating and the best way through which you assert it. You make it entertaining and you still take care of to stay it sensible. I can not wait to read far more from you. This is actually a wonderful site.

[url=https://rettretinoin.online/]tretinoin pharmacy[/url]

Make thousands of bucks. Financial robot will help you to do it! https://t.me/cryptaxbot/14

What does the Lottery Defeater Software offer? The Lottery Defeater Software is a unique predictive tool crafted to empower individuals seeking to boost their chances of winning the lottery.

Rich people are rich because they use this robot. https://t.me/cryptaxbot/14

buying from online mexican pharmacy

https://cmqpharma.com/# best online pharmacies in mexico

mexico drug stores pharmacies

Old man with young wife. Donald Trump Approves —> http://zi.ma/30ywvb/

mexican pharmaceuticals online: online mexican pharmacy – mexican online pharmacies prescription drugs

[url=http://mcadvair.online/]generic advair usa[/url]

마블 슬롯

다행히도 상처는 없지만 뜨거워도 아프지 않습니다.

[url=https://gklab.ru]Анализ промышленных выбросов[/url] или [url=https://gklab.ru]контроль шума на рабочих местах[/url]

[url=https://41ab.ru/inzhenerno-ekologicheskie-izyskaniya/gazogeoximicheskie-issledovaniya/]исследование геохимического состояния газов[/url]

https://gklab.ru/chemicals/metilperkaptan/

Ещё можно узнать: [url=http://yourdesires.ru/it/1593-kak-otkryt-xml-fajl-rosreestra-v-internet-explorer.html]как открыть файл росреестра xml[/url]

производственный контроль качества

Still not a millionaire? Fix it now! https://t.me/cryptaxbot/14

[url=http://tretinoineff.com/]tretinoin buy usa[/url]

[b]Здравствуйте[/b]!

Хочу поделиться своим опытом по заказу аттестата ПТУ. Думал, что это невозможно, и начал искать информацию в интернете по теме: купить диплом для иностранцев, купить диплом сварщика, купить диплом университета, купить диплом в махачкале, купить диплом в димитровграде. Постепенно углубляясь в тему, нашел отличный ресурс здесь: http://dalpaeng.blogspot.com/2015/02/iope-air-cushion-xp.html и остался очень доволен!

Теперь у меня есть диплом сварщика о среднем специальном образовании, и я обеспечен на всю жизнь!

Успехов в учебе!

[url=https://iclomid.com/]how to order clomid[/url]

Write more, thats all I have to say. Literally, it seems as though you relied on the video to make your point. You clearly know what youre talking about, why waste your intelligence on just posting videos to your site when you could be giving us something enlightening to read?

[url=https://doxycyclineo.online/]cost of doxycycline in canada[/url]

Looking for additional money? Try out the best financial instrument.] https://t.me/cryptaxbot/14?pekapera35Pek

The financial Robot is your future wealth and independence.] https://t.me/cryptaxbot/14?pekapera86Pek

Играйте в популярные [url=https://vulcanprestige6.com/]игровые автоматы[/url] без необходимости регистрации на нашем сайте и наслаждайтесь азартными играми в любое удобное время.

I am always invstigating online for articles that can assist me. Thanks!

Most successful people already use Robot. Do you? https://t.me/cryptaxbot/17?pekapera93Pek

판다스 포춘

그를 견습생으로 받아들이는 것은 단순한 농담입니다.

What’s Happening i am new to this, I stumbled upon this I’ve found It absolutely helpful and it has helped me out loads. I hope to contribute & aid other users like its helped me. Good job.

Still not a millionaire? The financial robot will make you him!] https://t.me/cryptaxbot/17?pekapera45Pek

[url=https://okmodafinil.com/]modafinil online pharmacy canada[/url]

Make yourself rich in future using this financial robot. https://t.me/cryptaxbot/17?pekapera68Pek

5 라이온스 메가웨이즈

당신이 그것을 피한다면 이것은 Hongzhi 황제의 스타일이 아닙니다.

Hello there, just became aware of your blog through Google,

and found that it is truly informative. I’m going to watch out for brussels.

I will appreciate if you continue this in future.

Numerous people will be benefited from your writing.

Cheers! Lista escape room

С нами строительство автомоёк под ключ превращается в приятный и легкий процесс, ведь мы заботимся о каждом аспекте вашего будущего предприятия.

[url=https://modafinile.online/]modafinil over the counter uk[/url]

[url=https://advaird.com/]advair diskus cheap[/url]

Even a child knows how to make $100 today.] https://t.me/cryptaxbot/17?pekapera34Pek

Строительство автомойки под ключ – это наша доменная зона. Мы создаем проекты, которые приносят прибыль и радуют клиентов.

[url=https://modafinile.com/]buy cheap modafinil[/url]

Blackjack is not just a game of luck; it’s a thrilling challenge that can be mastered with the right strategy. Imagine the excitement of hitting 21 and beating the dealer with confidence. Whether you’re a novice or an experienced player, learning [url=https://usacasinohub.com/blackjack/]online blackjack live dealer[/url] can transform your gaming experience and lead to significant wins. Don’t miss out on the opportunity to improve your skills and enjoy the rewards. Start playing blackjack today and take the first step towards becoming a pro!

[url=http://strattera.company/]strattera prices 100 mg[/url]

Start your online work using the financial Robot. https://t.me/cryptaxbot/17?pekapera21Pek

[url=https://dexamethasoneff.com/]dexamethasone online pharmacy[/url]

Currently it seems like BlogEngine is the top blogging platform available right now.

(from what I’ve read) Is that what you are using on your

blog?

“Франшиза автомойки” от нас подразумевает полную поддержку и совместные усилия. Мы тесно взаимодействуем с каждым из наших партнеров.

Have no money? Earn it online.] https://t.me/cryptaxbot/17?pekapera67Pek

Франшиза автомойки позволяет быстро начать свое дело с проверенной моделью бизнеса и полным пакетом услуг от партнера.

에그벳슬롯

Fang Jifan은 눈을 가늘게 뜨고 “보육원? 할 수 있니?”

medication from mexico pharmacy

https://cmqpharma.com/# mexico drug stores pharmacies

pharmacies in mexico that ship to usa

п»їbest mexican online pharmacies: mexican pharmacy – mexican border pharmacies shipping to usa

Roulette is more than just a game of chance; it’s a captivating experience that offers endless possibilities. Imagine the rush of placing your bet on red or black and watching the wheel spin in anticipation. Whether you’re a beginner or a seasoned player, roulette promises excitement and the chance to win big. Embrace the challenge, learn the strategies, and enjoy the thrill of this iconic casino game. Start your journey with [url=https://usacasinohub.com/roulette/]roulette payouts[/url] today and let the excitement of the wheel propel you towards unforgettable wins!

Step into the thrilling world of [url=https://usacasinohub.com/reviews/]casinos[/url], where every card you draw could be the key to victory! Whether you’re a seasoned player or a newcomer, our online casinos offer endless excitement and the chance to master your skills. Join us now and experience the ultimate casinos list adventure!

Great V I should certainly pronounce, impressed with your website. I had no trouble navigating through all the tabs as well as related information ended up being truly simple to do to access. I recently found what I hoped for before you know it at all. Reasonably unusual. Is likely to appreciate it for those who add forums or something, website theme . a tones way for your client to communicate. Excellent task..

mexico drug stores pharmacies

https://cmqpharma.online/# mexican border pharmacies shipping to usa

buying prescription drugs in mexico online

mexican drugstore online: cmq pharma mexican pharmacy – medication from mexico pharmacy

“Автомойка под ключ” – это не просто прибыльный бизнес. это возможность предложить клиентам исключительные услуги и построить связь с сообществом.

Hello! This is my first visit to your blog! We are a group of volunteers and starting a new initiative in a community in the same niche. Your blog provided us useful information to work on. You have done a marvellous job!

I truly appreciate this post. I have been looking all over for this! Thank goodness I found it on Bing. You’ve made my day! Thanks again

Hello everyone. Could you please recomend me some good

Peptide Therapy Clinic in Chicago?

I am glad to be one of many visitants on this outstanding website (:, regards for putting up.

[url=http://abamoxicillin.com/]purchase augmentin[/url]

https://gosznakdublikat.ru/

http://remontwasher.ru/

We’ve all made email marketing mistakes: You click send on an email and suddenly your stomach drops. You’ve made a mistake and there’s nothing you can do about it [url=https://david-delavari.space/blog/best-practices-for-integrating-social-media-with-your-marketing-automation-strategy]Best Practices for Integrating Social Media with Your Marketing Automation Strategy[/url]

http://nedvizhimostrussa.ru/

In a world where communication is key, having a reliable phone number is essential for both personal and business interactions. However, not everyone needs a permanent number, especially when privacy, convenience, and flexibility are at stake [url=https://fr.kompass.com/p/kompass-posts/ua103618/l-importance-d-avoir-un-numero-de-telephone-belge-pour-les-affaires/6ef54021-ce5a-418b-915d-3178160a23c4]https://fr.kompass.com/p/kompass-posts/ua103618/l-importance-d-avoir-un-numero-de-telephone-belge-pour-les-affaires/6ef54021-ce5a-418b-915d-3178160a23c4[/url]

[url=https://top1ab.ru/otbor-prob-vozduxa-rabochej-zony/]мониторинг качества воздуха на рабочем месте[/url] или [url=https://gklab.ru]контроль за состоянием воздуха[/url]

[url=https://gklab.ru]услуги контроля атмосферного воздуха в городе Уфа[/url]

https://gklab.ru/uslugi/ekologicheskoe-normirovanie/deklaracziya-o-sostave-i-svojstvah-stochnyh-vod/

Ещё можно узнать: [url=http://yourdesires.ru/it/windows/940-kak-uznat-seriynyy-nomer-noutbuka.html]серийный номер устройства ноутбука[/url]

измерение воздуха

https://redstoneestate.ru/

https://med-blesk.ru

https://nsdentalsolution.com

https://romashkaclinic.ru

https://psy-medcentr.ru

[url=https://bacclofen.online/]baclofen 10 mg discount[/url]

I really enjoy reading through on this website , it has got wonderful content. “A man of genius has been seldom ruined but by himself.” by Samuel Johnson.

https://novomed-cardio.ru

Специализация компании ООО «АвтоПрайм» предоставляет в аренду автовышки и другую спецтехнику для проведения самых различных высотных работ — прокладки линий электропередач, клининга, отделки фасадов, монтажа конструкций и многих других. Мы предлагаем в аренду на выгодных условиях [url=https://tk-autolider.ru/]спецтехника в аренду[/url]

В сфере азартных игр в интернете особенно важны аспекты защиты данных и обеспечения надежности операций. Это ключевые аспекты, на которых строятся доверие игроков и успешная работа платформ [url=http://rytof.ru/node/16458]http://rytof.ru/node/16458[/url]

https://akkred-med.ru

Looking for a thrilling gaming experience without spending a dime? Discover the excitement of a [url=https://getb8.us/]free slot machine games[/url], where you can enjoy your favorite games and win big without risking your hard-earned money!

Discover the thrill of winning big at our premier [url=https://flashroyal.us/casinos/]casino online gambling websites costa[/url], where every spin of the wheel promises excitement and opportunity. Immerse yourself in a world of luxury and glamour, where the lights are bright, and the stakes are high. Our casino offers an unparalleled gaming experience with a vast selection of classic and modern games tailored for all levels of players. Join us and feel the adrenaline rush as you take your chance at fortune in an atmosphere of elegance and sophistication.

Step into the thrilling world of [url=https://usacasinohub.com/reviews/]casino[/url], where every card you draw could be the key to victory! Whether you’re a seasoned player or a newcomer, our online casinos offer endless excitement and the chance to master your skills. Join us now and experience the ultimate casinos list adventure!

На этой странице представлены самые лучшие онлайн игровые автоматы на деньги, а также рекомендации по выбору надежных казино [url=https://onlinesloti.ru]Лучшие игровые автоматы[/url]

[url=https://finasterideff.com/]propecia order[/url]

1win – относительно Молодое виртуальное казино, которое принадлежит компании MFI investments. В перечень предлагаемых услуг входят: ставки на спорт, киберспорт, тв программы, а также подборка совершенных игровых автоматов и присоединение к игровым столам с картами [url=https://ife-online.kz/archives/248468?preview=true]https://ife-online.kz/archives/248468?preview=true[/url]

[url=http://acutanep.online/]accutane for sale australia[/url]

Thanks-a-mundo for the post.Really thank you! Awesome.

My website: anilingus.tv

[url=http://accutaneo.com/]generic accutane online pharmacy[/url]

Автомойка самообслуживания под ключ – это экономия времени клиентов и вашего вложения в персонал. Будущее за инновациями!

Москва работа, подработка, ежедневная оплата.

https://chat.whatsapp.com/GzH4KtsMu2aEChLTOiLMAM

Франшиза автомойки – отличное решение для начинающих бизнесменов. Мы предлагаем проверенную модель и постоянную поддержку.

Преимущество строительства автомойки под ключ заключается в оперативности запуска проекта и минимизации забот для заказчика, так как исполнитель берет на себя все этапы работ.

Мойка самообслуживания под ключ — это удобно и выгодно. Оборудование европейского качества обеспечит стабильную прибыль.

Практический опыт в SEO с 2008 г. подтверждается датой регистрации моего блога, в котором я частенько пишу о своем понимании в продвижении сайтов. Внедряю стратегию SEO, учитывая алгоритмы поисковиков и использую свои технические skills для достижения наилучших результатов [url=https://leadzavod.com/30-blogov-kotorye-dolzhen-chitat-kazhdyj-arbitrazhnik/]https://leadzavod.com/30-blogov-kotorye-dolzhen-chitat-kazhdyj-arbitrazhnik/[/url]

С нами строительство автомоёк под ключ превращается в приятный и легкий процесс, ведь мы заботимся о каждом аспекте вашего будущего предприятия.

Мойка самообслуживания под ключ обеспечивает комфорт для клиентов и стабильную прибыль для владельца. Присоединяйтесь к успешным предпринимателям!

For those who love the allure of designer purses but cringe at the exorbitant price, fake purses provide an appealing choice. This post explores the secrets of the fake purse market, highlighting its appeal to style aficionados and high-end devotees alike. From comprehending what imitation handbags are to suggestions for executing savvy buys, we’ll explore all you require to know to enjoy in elegance without breaking the wallet.

Replica handbags represent premium imitations of designer handbags, crafted to meticulously mimic their authentic versions. While these bags may never bear the official brand name, these imitations often mirror the same design, fabric, along with craftsmanship as with their much costly counterparts.

http://tiny.cc/seq3yz

Quality and Artistry

Contrary in popular belief, many fake handbags are created using meticulous focus to detail. Expert craftsmen use high-quality materials in order to ensure the fact that the replicas have a comparable appearance and feel as the authentic luxury items.

Availability and Variety

vast. access.Ethical Considerations

While knockoff purses offer a budget-friendly way to enjoy high-end fashion, it’s important to recognize recognize the consequences. The production and distribution of fake fake purses might breach on intellectual property rights, raising issues regarding the ethics of purchasing purchasing and possessing such products.Access to Luxury Designs

Reasons Choose Fake Purses?

Knockoff purses have a significant fan base within fashion enthusiasts lovers for many compelling reasons. Below, we explore examine why these such chic choices have grown grown so favored liked.

Cost-effectiveness

Among the most obvious advantages of replica knockoff bags is their affordability. Premium fakes may provide the same same stylistic enjoyment as genuine designer purses without incurring the high exorbitant price.

Imitation purses enable this feasible for fashion lovers toward appreciate the newest luxury creations, irrespective of budget restrictions. This availability allows additional people to participate in high couture and express one’s fashion.Experimentation Without Commitment

For whom enjoy experimenting experimenting with different different styles purses offer offer a way to try out various without without financial commitment. This flexibility is especially attractive appealing individuals that enjoy to switch up their their looks.To to Identify the High-Quality Replica Bagplica bags.

Navigating the replica bag industry may be tricky, however with proper correct knowledge, one will easily execute smart purchases. Here exist several tips for identifying high-quality reproduction bags

Material and Stitching

Pay close attention to the materials used and the quality of the stitching. High-quality replicas often use genuine leather or premium synthetic alternatives and exhibit clean, precise stitching.

Equipment & Information

Check the hardware, like closures, clasps, and emblems. High-quality imitations feature hardware that closely matches that of the authentic designer bags, with no rough edges or poorly finished aspects.

Although replica bags cannot lawfully utilize the exact logo of the authentic ones, a few could contain subtle markings that imitate the pattern elements of luxury brands. Search for these elements to judge the precision of the copy.Popular Replica Bag Brands

Specific brands are famous known for their high-quality replicas, giving clothing aficionados an wide array of chic trendy choices. Here, we feature some of the most sought-after imitation bag labels.

AAA Bags Purses is for creating some the top imitations on the market. Their products items feature exceptional focus to meticulousness and, making them popular with replica enthusiasts.

Purse Valley Bags Products sells a broad selection of copy purses, such as designs based on top prestigious brands. Focusing on excellence and quality and customer client happiness, they’ve built built a strong reputation in the replica purse community.

Designer Discreet focuses on making premium imitations that nearly mimic the authentic versions. Their lineup range contains handbags from famous fashion houses, providing clothing fans with ample plenty of selections.

An Art of Styling Replica Handbags

Imitation handbags can seamlessly integrate into any wardrobe, enabling you to compose elegant and fashionable outfits. Here are some tips for adding fake handbags into your wardrobe repertoire.Handling with Care

Matching against Timeless Outfits

A traditional ensemble, such as a black dress or a custom suit, can be improved with a well-chosen fake bag. Select classic designs that match your outfit and add a touch of elegance.

Mixing High with Street Style

Combine top-notch fake purses together with budget-friendly wear articles to create a harmonious and trendy appearance. This strategy permits you to showcase your taste whilst remaining budget-conscious.

Adorning with Assurance

When pairing fake handbags, assurance is key. Manage your replica bag with attention and dignity as you would a original branded article, and it will boost your overall look.

Maintaining the Fake Purse

Correct maintenance and maintenance are critical to ensure your replica purse being its best. Adhere to these advice to guarantee its lifespan.

Regular Maintenance

Clean your imitation bag regularly with a mild fabric and gentle cleaner. Refrain from strong chemicals that can harm the material or shade.

Keeping Tips

Keep your fake purse in a moderate, arid area, away from direct light. Employ dust covers or mild cloths to protect it from particles and scuffs.

Handle the replica purse with, avoiding abrasive surfaces as well as overloading. It will assist maintain the form and preventing potential harm.

Replica bags provide an affordable option for designer designer pieces without having to sacrificing fashion or durability. By using proper fashion styling and maintenance, they can effortlessly integrate into any fashion wardrobe, making them a favored option for fashion lovers. Regardless if you’re looking for the classic look & a fashionable statement piece, there are many reputable imitation purse labels that offer high-quality options which fit any preference. So go ahead and include some fashionable replicas to your collection – nobody can notice a difference.The Social Aspect of Replica Bags

Treat your own replica bag with proper care, avoiding overburdening it with with weighty objects. Doing so can assist preserve the form and avoid wearing and tear.

Replica bags are not concerning style; they also foster a sense regarding camaraderie among enthusiasts. In this article, we explore the social elements regarding having and discussing replica handbags.Online Communities

Many online groups and forums are devoted to the topic of copy bags, in which aficionados exchange advice, reviews, as well as tips. These sites provide valuable insight and assistance for those exploring the copy sector.In-Person Meetups

Some replica bag lovers organize in-person meetups in order to showcase their collections as well as discuss their passion for fashion. These gatherings provide opportunities to network with similar people and exchange thoughts.Influencers and Reviews

Influencers as well as influencers often evaluate fake bags, providing genuine feedback as well as comparisons with authentic designer pieces. Following these reviews can assist one in making well-informed decisions about one’s purchases.Legal and Ethical Considerations

Grasping the statutory as well as moral aspects concerning acquiring imitation purses is vital for making educated decisions. Here, we address some common issues.Intellectual Property Rights

Fake purses might violate on the creative property rights of high-end companies. Be conscious of the juridical repercussions and likely dangers connected to purchasing and possessing fakes.Ethical Shopping

Think about the ethical implications of supporting the knockoff bag industry. While it offers affordable options, it may also contribute to exploitative labor conditions and ecological issues.Making Informed Choices

Upcoming Patterns in Imitation Handbags

A replica bag industry is continuously constantly evolving, with new trends and innovations arising. In this article, we explore a few possible upcoming advancements.

Sustainable MaterialsConclusion

As sustainability grows as a increasing concern, the copy handbag industry may shift towards employing eco-friendly materials. This change could draw to green-minded customers and lower the industry’s environmental impact.

Cutting-edge Tech

Developments in tech, such as three-dimensional printing, may revolutionize the creation of imitation bags. These innovations could lead to even better copies that are hard to identify from the originals.

Evolving Consumer Attitudes

Consumer views on imitation bags might continue to change, with greater acceptance and recognition for better replicas. This shift may increase interest and affect field movements.

Replica bags offer a stylish and affordable alternative for fashion enthusiasts and luxury lovers. By understanding the intricacies of the replica bag market, you can make informed choices and enjoy the benefits of high-quality imitations. Whether you’re drawn to the affordability, variety, or the ability to experiment with different styles, replica bags provide a gateway to the world of luxury fashion.

Ready to explore the world of replica bags? Join our community of fashion enthusiasts and start your stylish journey today!

Проверьте лицензию казино – это гарантия вашей безопасности и честности игрового процесса. [*]Отзывы других игроков являются ценным источником информации о надежности и качестве обслуживания. [*]Техническая поддержка должна быть доступна круглосуточно, чтобы оперативно решать любые возникающие проблемы [url=http://peaklift.ru/communication/forum/messages/forum2/message235/239-interaktivnye-igry-i-loterei-na-1vin-kazino?result=new#message235]http://peaklift.ru/communication/forum/messages/forum2/message235/239-interaktivnye-igry-i-loterei-na-1vin-kazino?result=new#message235[/url]

“Строительство автомойки под ключ” включает все от проектирования до ввода в эксплуатацию. Ваш бизнес-проект будет безопасен и эффективен с нами!

Множество пользователей активно ищут удобные и доступные способы развлечения. Это привело к повышению популярности различных онлайн-сервисов [url=https://visualchemy.gallery/forum/viewtopic.php?pid=3403183#p3403183]https://visualchemy.gallery/forum/viewtopic.php?pid=3403183#p3403183[/url]

I love your blog.. very nice colors & theme. Did you create this website yourself? Plz reply back as I’m looking to create my own blog and would like to know wheere u got this from. thanks

[url=http://itretinoin.com/]retin-a microgel[/url]

На сайте [url=https://mostbet-wxf2.xyz/]Mostbet[/url] вы сможете войти в свой аккаунт и начать делать ставки на спорт, играть в казино и участвовать в лотереях, воспользовавшись удобным и безопасным сервисом.

Бесплатный промокод на скидку, первый и повторный заказ 2024. Промокод на доставку. Акции и скидки. Халява в телеграм [url=https://t.me/megamarket_promokod_skidka]промокод на первый заказ[/url]

Веном 3 2024 https://bit.ly/venom-3-venom-2024

Промоакции и бонусы для игроков 1win Игроки всегда ищут способы увеличить свои шансы на выигрыш. Бонусные предложения и привлекательные акции помогают сделать игру более захватывающей [url=https://aben75.cafe24.com/bbs/board.php?bo_table=free&wr_id=446803]https://aben75.cafe24.com/bbs/board.php?bo_table=free&wr_id=446803[/url]

become our affiliate

https://affiliates.whalehunter.cash/track/Kirill.18AffRef.18AffRef.MAIN.0.0.0.0.0.0.0.0

[b]www.NoxProxy.com | High Quality IPv6 Proxy | IPv6 proxy from Residential ISP or Mobile ISP[/b]

– Virgin IPv6 Proxy (Private, Dedicated)

– IPv6 Mobile or Residential Proxy

– IPv6 HTTP or Socks5 proxy

– High Speed IPv6 Proxy

– High Quality IPv6 Proxy

– Rotating IPv6 Proxy (Configurable)

– Static IPv6 Proxy (Configurable)

26 Geo Locations available:

Australia – Brisbane

Brazil – Palmas

Canada – Montreal

Colombia – Cali

Djibouti – Djibouti City

France – Lyon

Germany – Munich

Hong Kong – Hong Kong

Hungary – Budapest

India – Mumbai

Indonesia – Jakarta

Japan – Osaka

Malaysia – Kuala Lumpur

Netherlands – Amsterdam

Philippines – Quezon City

Poland – Warsaw

Portugal – Porto

Singapore – Singapore

South Africa – KwaZulu-Natal

Spain – Barcelona

Sweden – Gothenburg

Switzerland – Zurich

Taiwan – Taipei City

United Arab Emirates – Abu Dhabi

United Kingdom – Birmingham

United States – Huntsville

[url=https://www.noxproxy.com][b]www.NoxProxy.com[/b][/url]

[url=https://t.me/NoxProxyIPv4IPv6][b]Telegram[/b][/url]: @NoxProxyIPv4IPv6

Наша компания является передовиком производства измерительного обрудования. Уже долгие годы мы производим и обслуживаем датчики температуры, логгеры данных, регистраторы температуры и влажности и термометры. Наше оборудование помогает осуществлять контроль параметров микроклимата в аптеках, на складах, на производствах и в магазинах [url=http://mix-opt.ru/]Прибор-МСК[/url]

Наша команда уже более 20 лет проектирует, возводит и обслуживает бассейны в Тюмени, Челябинске и Екатеринбурге. Мы используем только современное и проверенное оборудование и материалы. Даем гарантию выполненных работ. Кроме этого, мы являемся официальными поставщиками химии для бассейнов лучших мировых марок [url=http://aqualand11.ru/]изготовление каркасных бассейнов[/url]

Продвижение сайта в поисковых системах Яндекс, Google. Гарантия выполненных работ. Бесплатный аудит сайта [url=https://seo-steam.ru/]Подробнее[/url]

Looking for a quick financial boost? Apply now for a [url=https://loansbigguide.com/loan-reviews/]instant payday loans[/url] and secure the funds you need with ease. Whether it’s for unexpected expenses, home improvements, or a special purchase, our fast approval process ensures you get the money swiftly. Don’t wait – take the first step towards financial freedom today!

Уже не удивительно, что кондиционеры становятся неотъемлемым элементом наших домов и офисов. Именно поэтому мы рады предложить вам широкий выбор кондиционеров от лучших мировых брендов по доступным ценам в нашем магазине Enter в Кишиневе [url=https://enter.online/ru/klimaticheskaja-tehnika/conditionery/mobilnye]мобильный кондиционер[/url]

В критические моменты жизни важно, чтобы похоронное бюро было надежным и профессиональным. Наша статья поможет вам разобраться в разнообразии ритуальных услуг в Алматы и выбрать агентство, которое предложит качественное обслуживание по разумной цене [url=https://teletype.in/@funeralservice/funeralprice2]ритуальны услуги цены в алматы[/url]

[url=https://samoylovaoxana.ru/tag/obuchenie-v-germanii/]обучение в Германии[/url] или [url=https://samoylovaoxana.ru/tag/leto/]лето[/url]

[url=https://samoylovaoxana.ru/turizm-i-otdyx/zimoj/]Зимой[/url]

https://samoylovaoxana.ru/tag/otdyh-v-aprele/

Ещё можно узнать: [url=http://yourdesires.ru/it/windows/940-kak-uznat-seriynyy-nomer-noutbuka.html]где посмотреть серийный номер ноутбука acer[/url]

Ночная жизнь

[url=http://okmodafinil.com/]modafinil india cost[/url]

[url=https://dexamethasoneff.com/]can you buy dexamethasone over the counter[/url]

Интересно: [url=https://alikson.ru/umnye-chasy-1008/tag-zhenskie-smart-chasy/]смарт часы для девушки[/url] или [url=https://iq-techno.ru]смартфоны с поддержкой 5G[/url]

Может быть полезным: https://alikson.ru/zhestkie-diski-i-ssd-1081/tag-ssd-diski-dlya-noutbuka/ или [url=https://elektronik-art.ru]лучшие планшеты 2024[/url]

[url=https://market-try.ru]интернет-магазин гаджетов[/url]

Ещё можно узнать: [url=http://yourdesires.ru/home-and-family/cookery/232-kak-prigotovit-shpikachki-v-domashnih-usloviyah.html]как правильно готовить шпикачки[/url]

LAX Long Term Parking: Find secure and affordable options near LAX Airport. Reviews & details to choose the best fit for your trip [url=https://lax-longtermparking.com/]lax long term parking fee[/url]

[url=https://ciproffl.online/]ciprofloxacin 500mg antibiotics[/url]

[url=https://pin-up-casino-sv.biz]online casino[/url]

Placera ditt spel hos pin up online – mest prestigeious bookmaker

Pin up casino

LGA Long Term Parking: Find secure & affordable options near LaGuardia Airport. Reviews & details to choose the best fit for your trip [url=https://lga-longtermparking.com/]https://lga-longtermparking.com/[/url]

[url=https://pin-up-casino-no.biz]pin up casino[/url]

Plasser innsatsen din hos pinup now – mest palitelig bookmaker

pinup no

Welcome to our [url=https://lecastella.info/]Gay Blog[/url], where we celebrate the diversity and beauty of the LGBTQ+ community. Explore articles, stories, and resources that embrace love, equality, and pride. Join us in fostering understanding, acceptance, and empowerment for all.

[url=http://strattera.company/]generic atomoxetine[/url]

An Charm concerning Luxury Style

Fashion fans plus high-end consumers frequently locate themselves captivated by a grace as well as renown concerning high-end fashion. From the intricate aspects regarding an Hermes Birkin up to a iconic style concerning one Chanel 2.55, these particular products signify greater than just dress—many people symbolize a specific position and exclusiveness. Nonetheless, definitely not everyone might pay for towards shell out with those premium items, which provides brought up to the increasing trend regarding imitation handbags. Regarding a lot of, these particular imitations give a approach towards take pleasure in a elegance of high-fashion layouts devoid of breaking a bank.

An rise inside popularity regarding fake purses has opened up a amazing fascinating dialogue about dress, values, as well as personal style. In this weblog post, we all can explore a various facets regarding this pattern, supplying style fans together with one detailed handbook to replica purses. Through an conclusion, you’ll have an knowledge for you to create advised decisions that will align together with the values as well as aesthetics.

Honorable as well as Legitimate Factors concerning Imitation Purses

When it relates to replica purses, one regarding a most pressing concerns can be the ethical and lawful effects. The manufacturing plus sale regarding counterfeit items usually are illegal within a lot of countries, while it breaches intellectual house rights. This specific definitely not only impacts an profits concerning luxury manufacturers but in addition raises inquiries concerning an problems below that these particular imitations tend to be made.

Coordinating & Including Imitation Handbags

Integrating fake handbags into your wardrobe may become both stylish also ethical. One way is to to combine premium replicas w/authentic genuine items & other sustainable green apparel pieces. Doing this does not only enhance elevates one’s complete appearance but also additionally promotes encourages a more sustainable style cycle.

When styling fake bags, consider your event setting & one’s ensemble. An elegant traditional fake handbag can add a hint of elegance to an official outfit, whereas an in-style pattern can render a relaxed style more fashionable. Don’t become hesitant to play with different patterns & accoutrements to create a distinctive plus personalized appearance.

Furthermore, taking care for your imitation handbags is key crucial to preserve their condition & longevity. Regular washing plus appropriate keeping may assist keep your purses appearing pristine & trendy for longer.

The importance Significance of Informed Customer Decisions

In the current modern fashion environment, educated customer decisions are more more significant than. While imitation handbags offer an affordable option to luxury designer pieces, it’s vital to reflect on the moral plus lawful repercussions. By being conscious of where and & how you you purchase replicas, you can can enjoy luxury style whilst staying staying true to one’s values values.

It’s additionally important to keep in mind that one’s individual fashion isn’t dictated by name tags or price labels. Whether or not you one opts to spend in real high-end items or explore explore the domain of imitation bags, the secret is to find discovering items that help you feel confident & fashionable.

Wrap-Up

Fake bags carved out a unique unique niche within the fashion universe, giving a cost-effective and reachable option to designer goods. Although they come come with their own its particular set of principled

Associated Fashion Topics

Discovering the universe of style doesn’t end with copy bags. Here are some extra associated themes that may intrigue you:

Green Style

Delve into the significance of eco-friendliness in the apparel industry. Learn about eco-friendly materials, principled production practices, and how to build a sustainable closet.

Classic and Pre-owned Style

Explore the appeal of retro and pre-owned garments. Learn how to source premium vintage pieces, the perks of second-hand fashion, and suggestions for including these items into your current collection.

Homemade Style and Upcycling

Become innovative with DIY fashion initiatives and recycling previous apparel. Get practical tips on altering your wardrobe by making your own accents or modifying present articles to grant them a new life.

Style on a Dime

Learn how to be trendy without surpassing the bank. Uncover tricks for securing excellent deals, shopping wisely during sales, and making the most of your style budget.

Compact Wardrobes