Boeing’s 737 Max issues highlighted the company’s sacrifice of safety for financial performance, resulting in a tarnished reputation. The prioritization of profit over core values also damaged the FAA’s credibility and revealed a lack of accountability for top executives. This downfall serves as a reminder of the importance of maintaining core values and prioritizing them over short-term financial gains.

COVID May Be Here for a While

I recently saw a comment from an old business colleague of mine on Facebook which effectively said that until we get back to selling face to face, the economy will not recover.

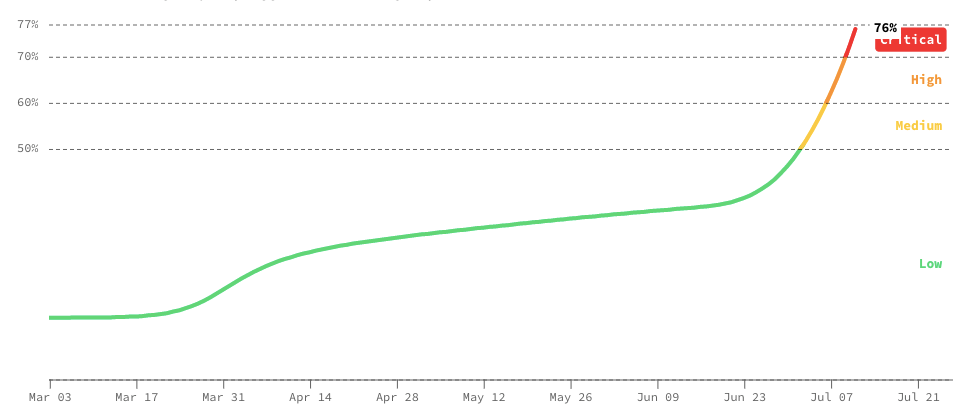

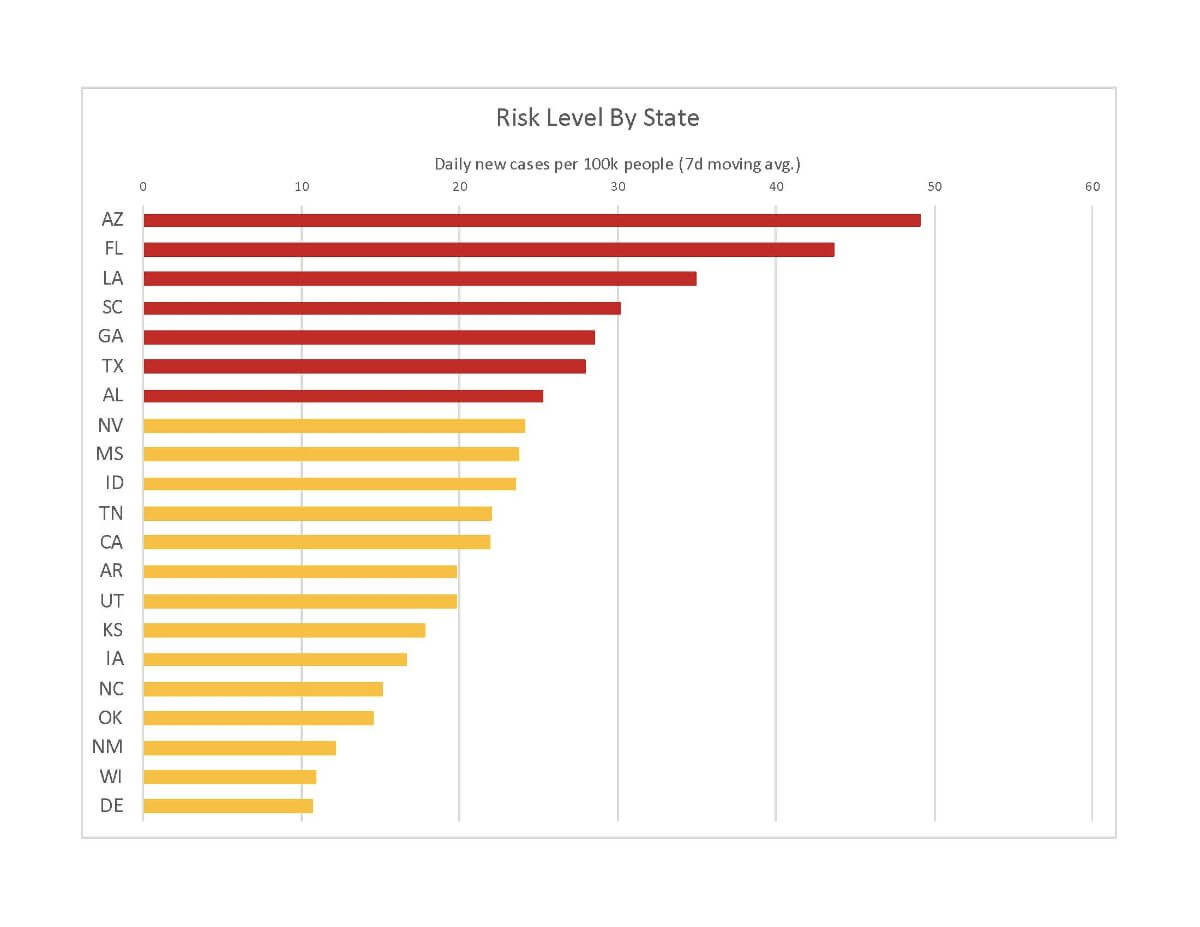

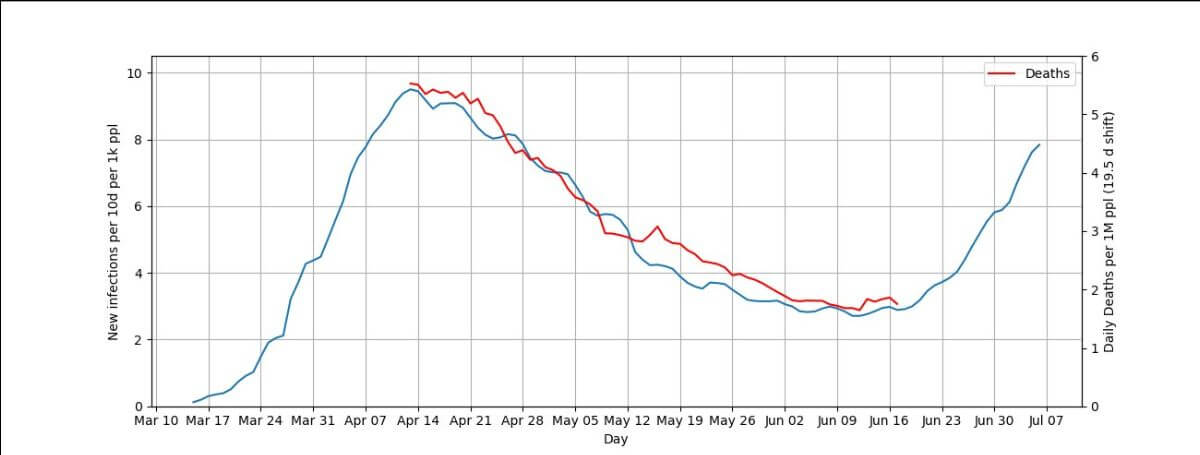

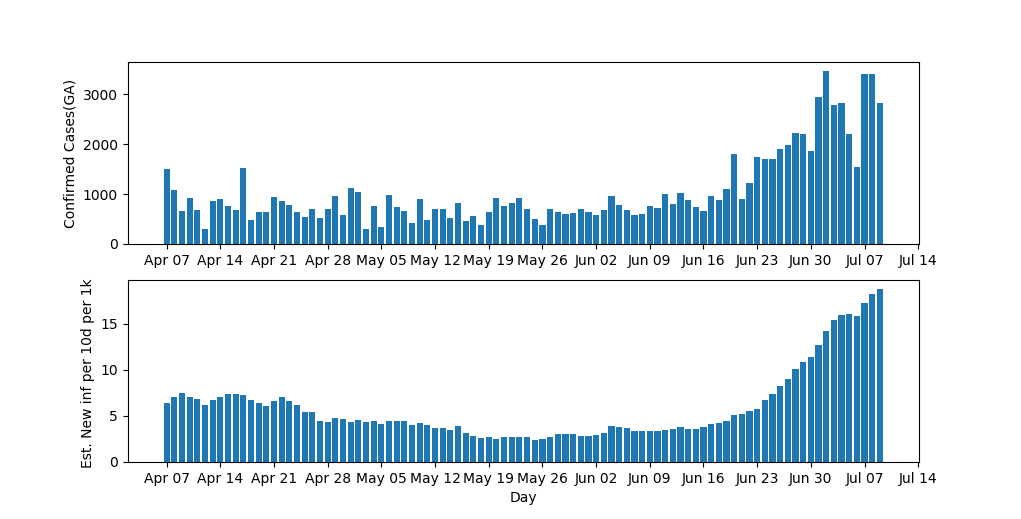

While that might be true, the failure to deal with COVID in the U.S. is leading to accelerating cases and deaths from COVID. While some steps to slow the virus are being instituted by various governments, the increasing caseload is bringing the disease closer to more and more people. As a result, more and more people are worried and not interacting with others more than absolutely necessary. This behavior is slowing down the potential recovery.

So the question is “How long will we live with this?“

I said for some time that we will be like this until this time next year. However, a recent article quoted Ezekiel (Zeke) Emanuel, vice provost for global initiatives and chair of the Department of Medical Ethics and Health Policy at the University of Pennsylvania, saying that a full return to normal isn’t likely to happen until November 2021. While Emanuel says he is an optimistic person, he believes that the November date is how long it will take for an effective vaccine distributed widely enough to stop the spread of COVID-19.

Further, he expects the toll in the U.S. to reach 250,000 by the end of 2020. However, he also believes that non-pharmacological interventions i.e., social distancing, wearing masks, avoiding crowds and enclosed spaces, and staying away from people who are coughing, sneezing, singing, or yelling are working. Besides, Emanuel thinks it is almost inevitable the U.S. is going to have a second wave that pops up in October or November of this year when we’re all going inside.

His advice is:

Companies

Until we reach a point where there is a vaccine or herd immunity, corporate employees should continue to work from home as much as possible because enclosed spaces and prolonged exposure to other people increase the likelihood of transmission. For frontline workers and others who cannot work remotely, including employees at retail stores, a detailed protocol must be implemented to protect both workers and customers – such as mandatory masks, plexiglass dividers, and regular sanitizing of hands and surfaces.

Stores

Stores have much to consider, e.g., can they put some of their merchandise outside to limit the number of shoppers inside? Can they open windows or doors to help air circulation?

Emanuel believes the use of face masks will be necessary, but he questioned the effectiveness of conducting temperature checks at the door. Instead, use symptom screening questions daily for employees, i.e., whether they are experiencing shortness of breath. Testing for COVID-19 more than once a week for asymptomatic employees is wasteful and creates a false sense of security. Instead, emphasizing good, routine personal hygiene – especially washing hands — and store cleaning is reassuring for both employees and customers. While more research is needed to determine whether clothing, shipping boxes, or store surfaces could transmit the virus, Emanuel said these are likely not the main modes of transmission.

Concerning a store closing its doors, the answer is dependant on so many factors; it is too abstract to say.

Public Transportation

No. Use your car, walk, or bike. Emanuel is an avid bike rider who rides his bike in the snow.

Air travel

Avoid it. Airplanes do have sound air filtration systems, but they cannot protect against sneezes or other exhalations from fellow passengers two rows away from you or in the aisle.

So what does this mean for most of us?

Whatever processes we have taken to manage in the current environment is going to be the way we operate for another 16 months. Thus we have look at these processes and rather hope for the “old” normal return, look at them through the lens of continuous improvement.

- How do we become more effective in operating in this environment?

- What can we expect from our sales team and can we meet any increase in demand?

- If we were designing a system from scratch and with the luxury of time, would we do it this way?

- How do we ensure that our employees remain healthy?

- How do we ensure that our employees’ mental health is ok?

- How are our customers and suppliers are doing? Should we be concerned?

It is key to take time during this period to think Upstream and work on these issues with your team. As I have said before, Darwin said that those who survive are best at adapting to their environments. If we don’t adapt we die.

During a pandemic that applies to not only our business but ourselves.

Finally, Emanuel said that he relies on Trust for America’s Health, a nonpartisan policy, research, and advocacy organization for comprehensive information on the pandemic. I am heading there next.

Recent Posts

The Downfall of Boeing: A Lesson in Core Values

Resolutions, Here We Go Again.

In reflecting on 2021 resolutions, the author scored themselves in three categories and sought to improve success in 2022 by addressing friction points. Drawing on advice from social psychologist Wendy Wood, the author identified areas to reduce or increase friction in their failed resolutions. By making these adjustments, the author aims to enhance their goal achievement and encourages others to consider friction when setting resolutions.

You need to take an extended vacation. No, seriously, you do.

COVID has taken a toll on all of us. If you have not taken an extended vacation in a while where you disconnect, you need to now. You and your business will benefit.

Becoming Famous in Your Niche: The Success Story of Linn Products Limited

In a previous discussion, I highlighted the importance of being famous for something. Being well-known in your niche can help you: Concentrate on your strengths Connect with your target audience Communicate your offerings more effectively Receive referrals Identify...

Understanding and Optimizing Your Cash Conversion Cycle

Understanding and optimizing the Cash Conversion Cycle is crucial for business growth, as it impacts cash flow and the ability to access external capital. This cycle consists of four components: Sales, Make/Production & Inventory, Delivery, and Billing and Payments. To improve the Cash Conversion Cycle, companies can eliminate mistakes, shorten cycle times, and revamp their business models.

Discovering Your Niche: Why You Need to Be Famous for Something

As an entrepreneur, it’s crucial to specialize in a specific area and become famous for something, allowing you to generate referrals and build your brand. Understanding the “job” you’re hired for helps you stand out in the marketplace and communicate your value proposition effectively. By providing value to your clients, you can adopt a value-based pricing approach, ensuring your business remains competitive and maintains a strong market presence.

Rethinking Your Pricing Model: Maximizing Margins and Providing Value

Rethink your pricing model by focusing on the value you provide and your customers’ Best Alternative To a Negotiated Agreement (BATNA). This approach can help you maximize margins while delivering better value to your clients. Assess your offerings and brainstorm with your team to identify pricing adjustment opportunities or eliminate commodity products or services.

Do you know your Profit per X to drive dramatic growth?

I recently facilitated a workshop with several CEOs where we worked on the dramatic business growth model components. One of the questions that I had asked them beforehand was, "What is Your Profit/X?" The results showed that there this concept is not clear to many....

The War for Talent: 5 Ways to Attract the Best Employees

In today’s War for Talent, attracting the best employees requires a focus on value creation, core customer, brand promise, and value delivery. Clearly articulate your company’s mission, identify your “core employee” based on shared values, and offer more than just a salary to stand out as an employer. Utilize employee satisfaction metrics and showcase your company’s commitment to its workforce on your website to make a strong impression on potential candidates.

Are you killing your firm’s WFH productivity?

Productivity remained during WFH with COVID. However, further analysis found that hourly productivity fell and was compensated for by employees working more hours. What was the culprit – Meetings. Want to increase productivity, have fewer meetings.