Boeing’s 737 Max issues highlighted the company’s sacrifice of safety for financial performance, resulting in a tarnished reputation. The prioritization of profit over core values also damaged the FAA’s credibility and revealed a lack of accountability for top executives. This downfall serves as a reminder of the importance of maintaining core values and prioritizing them over short-term financial gains.

When Should I Sell My Business?

Every business owner I have ever known, has sought to sell their business at the top of the market. I think this is part of the movement where many are in a constant quest to outdo others. While conceptually I understand this desire, these owners should heed the voices of some sages.

Daniel Kahneman’, “The average investor’s return is significantly lower than the market indices due primarily to market timing.”

Warren Buffett, “Trying to time the market is a fool’s game.”

Baron Rothschild, “You can have the top 20% and the bottom 20%; I will take the 80% in the middle.”

What it takes to Sell at the Top of the Market

If you are determined to sell at the top and are ready to step aside at any time, the only concern is timing. However, if you have other timing considerations, e.g., retire when my business is worth $X, step aside when I am 65, then things are far more complicated.

For the market to be at the top when you reach some predetermine criteria, you need to ensure that the entire economy collaborates with you. To do this, I expect you would need to have the ear of:

- the President,

- the majority of Congress,

- the Chair of the Federal Reserve, the Secretary of the Treasury,

- the President of the European Central Bank,

- the German Chancellor,

- the President of France,

- the President of Russia,

- the President of the People’s Republic of China,

- the heads of the People’s Bank of China, and

- the leaders of all the leading investment banks and hedge funds worldwide, to name a few.

Not only would you need their ear, but you would have to persuade them that collaborating with you is in their best interests as well. Furthermore, many of these people would want something in return for a favor, and most of the people I have spoken with would be able to afford the price Vladimir Putin would expect. Finally, I have found any scheme where only one person knows of it but requires many people to ensure its success is bound to fail.

As a result, I would say that trying to sell at the top is a fool’s errand and one that should be abandoned.

A Contrarian View

Some have argued that selling at the bottom of the market makes more sense. The rationale is that the business owner will reinvest those assets into other assets whenever they sell their company. Thus if you want to ensure continued wealth accumulation, one should do it at the bottom of the market rather than the top.

To examine this theory, I did a simple analysis. I reviewed four dates and the market conditions. I looked at the Russell 2000 Price Earnings Ratio for those dates and indexed them with the 2000 Price Earnings Ration as the base = 100. Assuming that enterprise value (EV) to EBITDA ratios followed the Russell 2000’s PER, the EV/EBITDA ratio in 2000 was 5x, and the company had an EBITDA of $1 million in each year before the sale, the results are as follows:

| Date | Market Conditions | Russell 2000 PER (Indexed) | EV / EBITDA Multiple | Proceeds ($k) |

| 12/31/2000 | After the Top of the market | 100.0 | 5.0 | $5,000 |

| 12/31/2005 | Near the top of the market | 58.6 | 2.9 | $2,929 |

| 12/31/2010 | Emerging from a recession | 52.6 | 2.6 | $2,631 |

| 12/31/2015 | Middle of a bull market | 74.7 | 3.7 | $3,734 |

I then made a few more simple assumptions:

- Transaction costs to be 30% comprising intermediary and legal fees of 10% and taxes of 20%.

- The proceeds are invested in two funds, VFIAX – Vanguard 500 Index Fund Admiral Shares and VBMFX – Vanguard Total Bond Market Index Fund Investor Shares as proxies for a general stock and bond market investment.

- The allocation is 70% into VFIAX and 30% into VBMFX.

- Any funds withdrawn and any distributions are ignored as they would be the same for both funds.

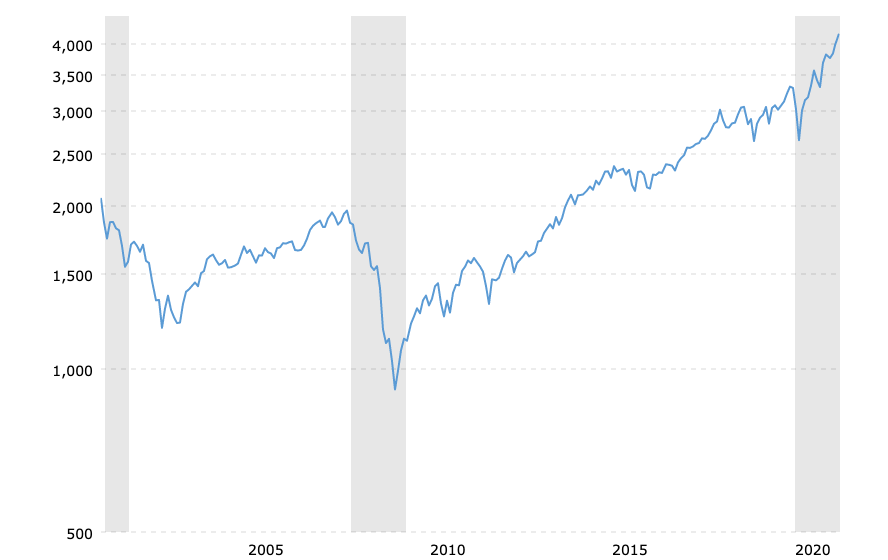

Below is a chart of the S&P 500 from December 31, 2000, to December 31, 2020 to show the market’s performance over the period.

Source: Yahoo Finance

Following the investments as described above after five, ten and fifteen years the returns were:

| Date | Initial Value ($k) | After 5 yrs ($k) | Return (%) | After 10 yrs ($k) | Return (%) | After 15 years ($k) | Return (%) |

| 12/31/2000 | 5,000 | 4,822 | -3.6 | 4,930 | -1.4 | 7,027 | 40.5 |

| 12/31/2005 | 2,929 | 2,993 | 2.2 | 4,292 | 46.5 | 5,414 | 84.8 |

| 12/31/2010 | 2,631 | 3,790 | 44.0 | 4,786 | 81.9 | ||

| 12/31/2015 | 3,734 | 4,643 | 24.3 |

So as it can be seen, while selling at the top, provided the greatest wealth after fifteen years, interesting the difference over 10 years was less than 3% between selling at the top and selling just after the bottom. The other points are somewhere in between. Therefore, selling at the top is not the conclusive answer we expected.

So what to do?

What I have always advised clients is to build a business that is attractive to buyers and can be sold. The key is to create your own redundancy, so that you can sell it, stay in a non-executive capacity and effectively “coupon clip,” or pass it on to your children or employees. You have many options and if someone comes along and offers you “silly” money, take it. But don’t worry about the “Top of the Market.”

If you want to know if your business is sellable, complete this questionnaire, and if you want help building a sellable business, contact me.

Copyright (c) 2021, Marc A. Borrelli

Recent Posts

The Downfall of Boeing: A Lesson in Core Values

Resolutions, Here We Go Again.

In reflecting on 2021 resolutions, the author scored themselves in three categories and sought to improve success in 2022 by addressing friction points. Drawing on advice from social psychologist Wendy Wood, the author identified areas to reduce or increase friction in their failed resolutions. By making these adjustments, the author aims to enhance their goal achievement and encourages others to consider friction when setting resolutions.

You need to take an extended vacation. No, seriously, you do.

COVID has taken a toll on all of us. If you have not taken an extended vacation in a while where you disconnect, you need to now. You and your business will benefit.

Becoming Famous in Your Niche: The Success Story of Linn Products Limited

In a previous discussion, I highlighted the importance of being famous for something. Being well-known in your niche can help you: Concentrate on your strengths Connect with your target audience Communicate your offerings more effectively Receive referrals Identify...

Understanding and Optimizing Your Cash Conversion Cycle

Understanding and optimizing the Cash Conversion Cycle is crucial for business growth, as it impacts cash flow and the ability to access external capital. This cycle consists of four components: Sales, Make/Production & Inventory, Delivery, and Billing and Payments. To improve the Cash Conversion Cycle, companies can eliminate mistakes, shorten cycle times, and revamp their business models.

Discovering Your Niche: Why You Need to Be Famous for Something

As an entrepreneur, it’s crucial to specialize in a specific area and become famous for something, allowing you to generate referrals and build your brand. Understanding the “job” you’re hired for helps you stand out in the marketplace and communicate your value proposition effectively. By providing value to your clients, you can adopt a value-based pricing approach, ensuring your business remains competitive and maintains a strong market presence.

Rethinking Your Pricing Model: Maximizing Margins and Providing Value

Rethink your pricing model by focusing on the value you provide and your customers’ Best Alternative To a Negotiated Agreement (BATNA). This approach can help you maximize margins while delivering better value to your clients. Assess your offerings and brainstorm with your team to identify pricing adjustment opportunities or eliminate commodity products or services.

Do you know your Profit per X to drive dramatic growth?

I recently facilitated a workshop with several CEOs where we worked on the dramatic business growth model components. One of the questions that I had asked them beforehand was, "What is Your Profit/X?" The results showed that there this concept is not clear to many....

The War for Talent: 5 Ways to Attract the Best Employees

In today’s War for Talent, attracting the best employees requires a focus on value creation, core customer, brand promise, and value delivery. Clearly articulate your company’s mission, identify your “core employee” based on shared values, and offer more than just a salary to stand out as an employer. Utilize employee satisfaction metrics and showcase your company’s commitment to its workforce on your website to make a strong impression on potential candidates.

Are you killing your firm’s WFH productivity?

Productivity remained during WFH with COVID. However, further analysis found that hourly productivity fell and was compensated for by employees working more hours. What was the culprit – Meetings. Want to increase productivity, have fewer meetings.