Discover the importance of organizational alignment and agility in this blog post. Learn how establishing a strong CORE and building a strategy around it can lead to sustainable growth and success. Find out how alignment and agility empower your organization to thrive in an ever-changing business landscape.

Is This the Time to Start a Business?

As we progress through the recession, many commentators are saying that recessions are a great time to start a business. To validate their argument, they point to some of the great companies that got their start during a recession, e.g.

- Netflix, 1997

- Airbnb, 2008

- Trader Joe’s, 1958

- Microsoft, 1975

- Sports Illustrated, 1954

- MTV, 1981

- GE, 1890

- IBM, 1896

- Warby Parker, 2010

- Revlon, 1932

- Disney, 1929

Many arguments are justifying why starting a business during a recession is a great time. A summary is:

- Surviving = Winning. During a recession, just surviving is hard. If you survive during such times with limited capital and profits, you will be well-positioned to survive during good times. Companies that survive during times of scarce resources are more efficient.

- Learning from Mistakes. We rarely learn from successes, only from failures. During a recession, things are harder, and there are chances there will be more setbacks. This environment will improve an organization’s problem-solving skills and agility.

- Builds a Tribe with Folklore. Surviving during times of great adversity builds excellent team cohesion. That is why groups have initiation rituals, to bond the members. Those hardships become the folklore of the organization, enabling it to share its culture with newcomers post-recession better.

- Considerable amount of available talent. In recessions, swelling unemployment provides a talent pool is brimming with great potential that one can get for lower prices than during good times.

- Get noticed. During good times, everyone is succeeding, so gaining attention is hard. However, in a recession, marketing and advertising fall, and success stories are rare. Thus it provides a chance to get noticed and get a leadership position.

- People are more interested in “Life-Saving Products.” During good times, selling a product or service that will save a few points of cost, or grow a few points or revenue is not always easy. Margins are good, and management is too distracted to pay attention. However, in a recession, things are tough, and management will look to any lifeline to survive. Thus if you can save costs or boost revenue, customers are more likely to buy.

- Investors Have Shut Up Shop. During a recession, finding VC or institutional capital is hard, so companies must fund expansion from their resources. As a result, they are more focused on generating cash and being resilient, which ensures survival. Those companies that cannot make money in good times, e.g., WeWork, will never survive in a downturn.

- Better able to capture gains when the market returns. Due to the focus on cash generation and resistance, when markets return, these organizations are well suited to achieve the growth and more ahead of others.

- War Time CEOs. As Ben Horowitz points out, at times like this, you are “War Time” CEO. Thus survival is paramount, and you cannot run out of cash. Therefore CEOs will be more thoughtful to avoid costly mistakes, e.g., such as bad hires, pursuing multiple, disparate markets simultaneously, crafting one-sided partnerships to gain media exposure, and making inefficient marketing commitments.

- Everything is on Sale. Not only talent, but everything is on sale. Rents are down, and used equipment is available. The costs of everything are low, enabling higher margins than competitors.

While all the above reasons make logical sense, and there are those companies that launched during recessions that emerge as market leaders, overall do companies that begin during recessions have a higher chance of survival than those that start during regular times?

I don’t know and cannot find research on the matter. However, I am often concerned with being given a single data point and told that it proves a point or trend. A classic example is that anyone can be the next Jeff Bezos, Mark Zuckerberg, or Bill Gates. Yes, anyone can be; however, the probability of someone being like them is incredibly small, probably less than one in a million.

- VC funding continues to hit all-time highs;

- Private Equity buyouts hit all-time highs;

- The availability of gig workers, SaaS products, and Cloud servers should increase the ease of starting companies; and

- over 300 colleges offer entrepreneurship courses

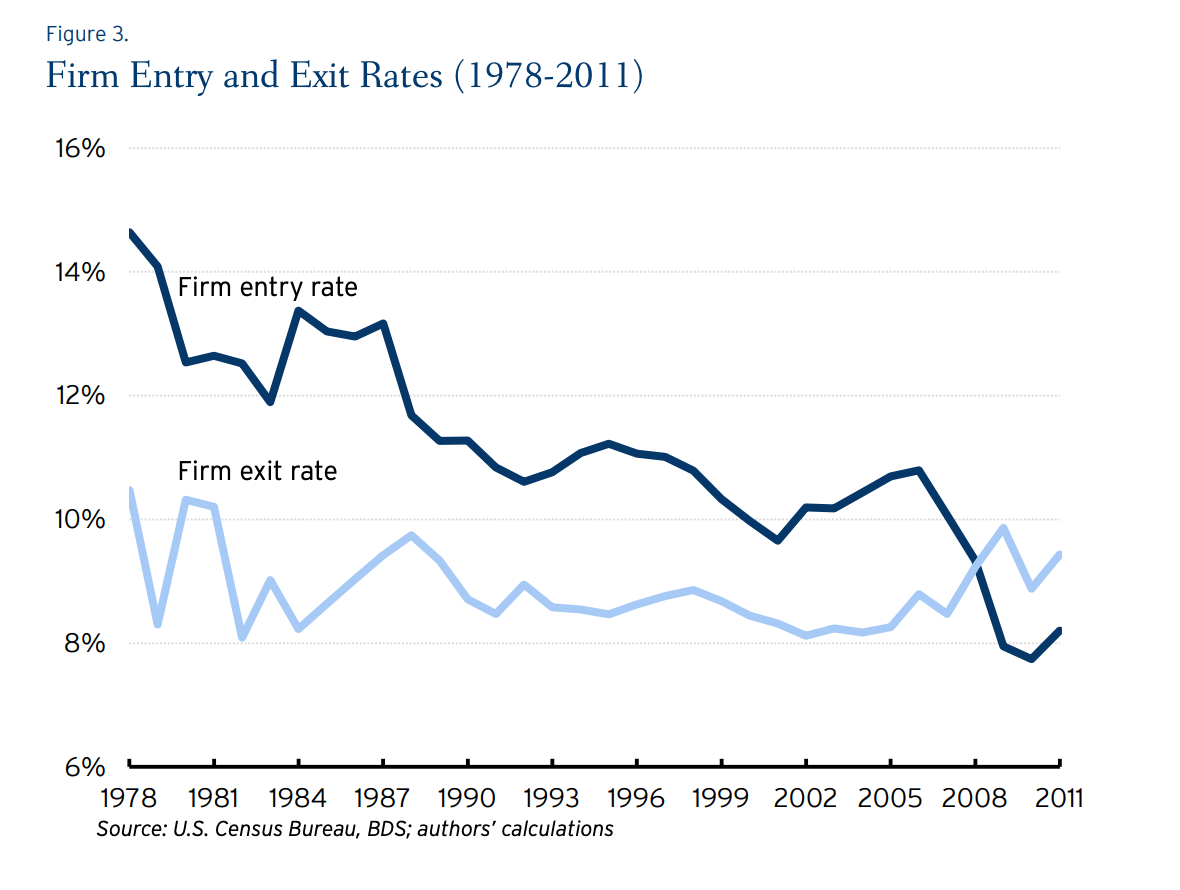

New corporate formation continues to fall and is below its level during the Carter Presidency. While the chart below only goes through 2011, the trends have not improved.

Recent Posts

Align and Thrive: The Importance of Organizational Alignment and Agility

How to Achieve Smart Time Management: 10 Tips for Busy Professionals

When you are a busy professional running your own business, it can often feel like there aren’t enough hours in the day to accomplish everything. Being strategic with your time is the best (and possibly the only) way to achieve all of your daily tasks. If you are...

5 Strategic Leadership Skills Every Manager Needs

So often, people view leadership as a talent: you’re either born with this quality or you’re not. However, this is not always the case! In reality, good leadership is made up of skills, and anyone can learn how to improve. Some people may pick up leadership attributes...

How the Sellability Score is Calculated: The Ultimate Guide

Do you have questions about how to calculate your business’s sellability score? Whether you’re looking to sell your business in the near future or years from now, understanding your sellability score will help you thrive. The sellability score identifies the...

The Top 5 Benefits of the Entrepreneurial Operating System

As an entrepreneur running your own business, you know there are bumps in the road and struggles that both you and your business will face over time. However, with the right people and tools at your disposal, you can anticipate what’s coming, plan for it, and continue...

5 Ways to Use Email Automation to Boost Traffic

Every single business in the world wants to evolve and grow. This will happen using a variety of techniques and strategies. In 2022, digital marketing is more than a household name, and most companies will adopt at least a few ideas when long-term planning and coming...

6 Questions To Ask A Potential Business Coach Before Hiring Them

Many entrepreneurs consider executive business coaching when they start struggling on their professional path. A small business coach is an experienced professional mentor who educates, supports, and motivates entrepreneurs. They will listen to your concerns, assess...

3 Ways Proper Long Term Strategic Planning Helps Your Business

Dreams turn into goals when they have a foundation of long-term strategic planning supporting them. They become reality when the ensuing strategic implementation plan is executed properly. With Kaizen Solutions as their strategic planning consultant, small and...

What is a Peer Group, and How Can it Improve Your Career?

If you are a CEO or key executive who has come to a crossroads or crisis in your career, you'll gain valuable insights and solutions from a peer group connection more than anywhere else. But what is a peer group, and how can that statement be made with so much...

Profit and Revenue are Lousy Core Values

As I mentioned last week, I am down with COVID and tired, so spending more time reading rather than working. I read Bill Browder's Freezing Order this weekend, and I highly recommend it. However, at the end of the book, Browder says that oligarchs, autocrats, and...