Discover how to enhance decision-making in your organization by focusing on three crucial areas: solving the right problem, gathering all the available information, and understanding the intent. Learn to empower your team, foster a purpose-driven culture, and improve organizational clarity for better decision-making.

Where Exactly Are We Headed?

What is happening out there? Airbnb confidentially filed for its IPO last week. In the spring, the company laid off 2,000 employees and was negotiating over the terms of two fundraising deals totaling $2 billion in debt and equity.

However, total consumer spending on Airbnb in July was 22% higher than in the same period last year, according to Edison Trends. According to the company, it surpassed 1 million bookings on a single day that same month, led by an increase in stays at nearby destinations.

So, are we returning to normal? I would answer no, but there is hope. Normal is a long way away as people are still scared and want to social distance. However, given we can only take so much of staring at the same four walls, we are heading on vacation. Those vacations may not be the ones of pre-COVID days with cruises, trips abroad, or all-inclusive resort, but booking a house for just our family or close friends that we trust, works! Thus as the company reported, bookings are up for close to home destinations, basic economic substitution.

Along with other reports, consumer spending has increased during the pandemic, and I put that down to the fact that we are not spending as much on other things, e.g., commuting, sports, and meals out. However, will that spending last? Last week the Labor Department reported first-time jobless claims increased to 1.1 million, and it was the 22nd consecutive week claims exceeded those during the worst week of the Great Recession. On the positive side, the total number of Americans collecting unemployment fell from 15.5 million to 14.8 million, the lowest since early April. This data goes to show that the recovery will not be quick and a V-curve.

Where exactly are we headed, I am not sure. I hear lots of talk of continued layoffs ahead with about Wells Fargo and Boeing announcing more cuts as well as many smaller companies planning layoff. There is a sense of uncertainty over Q4 2020 and Q1 2021, and expect many are taking a wait and see approach. However, with school restarting, albeit in a confused manner, the Federal Unemployment Benefits in unchartered waters, and Congress in gridlock, there is a lot of confusion out there.

However, as an old Keynesian, the amount of stimulus that the government has poured into the economy is why we are experiencing a robust recovery to date. According to economic theory, in a world of excess capacity and mass unemployment, a combination of vast government borrowing with monetary expansion will not fuel inflation until most of the excess capacity is exhausted, which is where we are now. A Keynesian fiscal stimulus financed with negative real interest rates will boost private consumption and investment and should generate above-trend economic growth. Before the cry of “Crowding Out,” arises from many as I heard during the Great Recession, where all indications showed none. Currently, with central banks worldwide committing to financing this Keynesian stimulus with zero or negative interest rates for years ahead, there is no risk that public borrowing will crowd out private investment.

Thus, will this Keynesian stimulus lead to a healthier and longer growth economy? I would put that down to two factors.

- As always, public health. The sooner we adopt and proactive, data, and science-driven approach to the COVID crisis, the sooner we return to a functioning economy. Cases are rising again in Europe, which indicates that this is a marathon and not a sprint. I know for many, it already feels like a marathon, but the more apt analogy is the British in September 1939 saying, “It’ll all be over by Christmas!”

- The Stimulus. The actions by the Fed and the Congress, through the CARES Act, have injected substantial stimulus into the economy. However, as these have ended, we will have to observe to see what happens. As in the Great Recession, Congress stopped the stimulus too soon, for political reasons, which lead to a much weaker recovery than there should have been. Hopefully, this time, they will put the country first and give the economy what it needs to recover.

A lot of economists are arguing that the stock market is pricing in continuous stimuli for the economy, and if Congress fails to deliver the will, a market correction to accompany the economic contraction.

For those gnashing their teeth and anguishing over a Keynesian expansion, it is worth remembering that the 20 years of broadly Keynesian macroeconomic policy in place from 1946 until the late 1960s saw the most robust economic growth and productivity advances ever recorded. At the same time, we experienced generally moderate inflation and almost continuous bull markets in equities, property, and other real-value assets.

Recent Posts

Boosting Common Sense Decision-Making in Your Organization

Do You Understand Your Costs to Ensure Profitability?

You can only determine profitability when you know your costs. I’ve discussed before that you should price according to value, not hours. However, you still need to know your costs to understand the minimum pricing and how it is performing. Do you consider each jobs’ profitability when you price new jobs? Do you know what you should be charging to ensure you hit your profit targets? These discussions about a company’s profitability, and what measure drives profit, are critical for your organization.

Sunk Costs Are Just That, Sunk!

If you were starting your business today, what would you do differently? This thought-provoking question is a valuable exercise, especially when it brings up the idea of “sunk costs” and how they limit us. A sunk cost is a payment or investment that has already been made. Since it is unrecoverable no matter what, a sunk cost shouldn’t be factored into any future decisions. However, we’re all familiar with the sunk cost fallacy: behavior driven by a past expenditure that isn’t recoupable, regardless of future actions.

Do You REALLY Know Your Business Model?

Bringing clarity to your organization is a common theme on The Disruption! blog. Defining your business model is a worthwhile exercise for any leadership team. But how do you even begin to bring clarity into your operations? If you’re looking for a place to start, Josh Kaufman’s “Five Parts of Every Business” offers an excellent framework. Kaufman defines five parts of every business model that all flow into the next, breaking it down into Value Creation, Marketing, Sales, Value Delivery, and Finance.

Ideation! Harder Than It Sounds

Bringing in new ideas, thoughts, understanding, and logic is key as your organization faces the challenges of a changing environment. But when you do an ideation session in your organization… how does it go? For so many organizations, many times, after a few ideas have been thrown out and rejected, the thought process slows down very quickly, and a form of hopelessness takes over. How does your organization have better ideation? I’ve come across a new approach with a few teams lately.

Recruit, Recruit, Recruit!

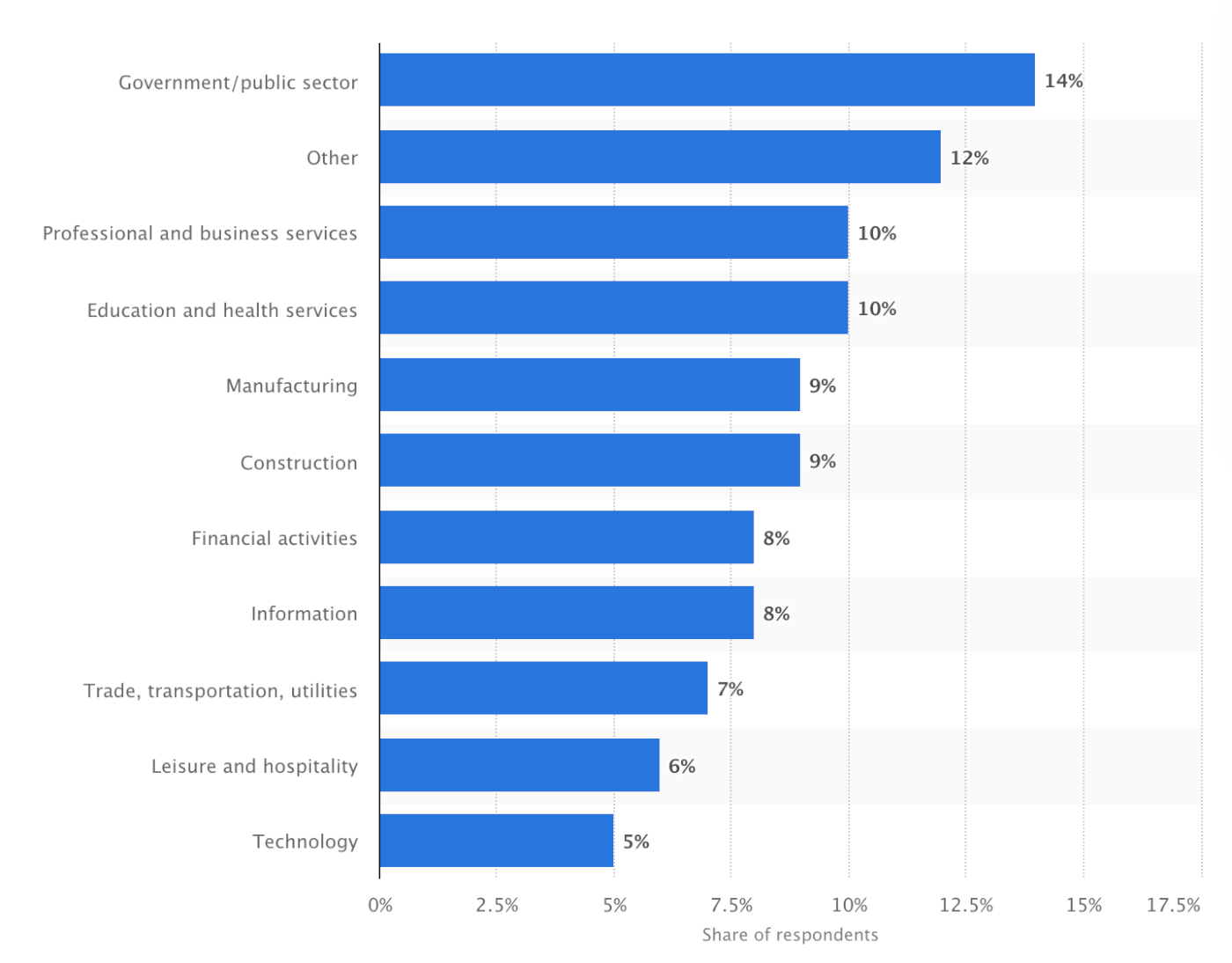

An uptick in business has begun this quarter, and companies are rushing to hire to meet this surge in demand. What amazes me is how many are so unprepared to hire. Continual recruiting is key to the survival of a company. It isn’t the same thing as hiring—continuous recruiting is building a pipeline of people that you would hire if you needed to fill a position, or “A players” you would hire if they were available.

We All Need Clarity

If your organization is focused on obscurity over clarity, whether intentionally or not, your “A” player employees are vulnerable. There is a looming talent crunch. As we start to emerge from COVID, demand is increasing, and many are scrambling to fill positions to meet that demand. Headhunters and recruiters are soon going to be calling your key “A” employees. Have you been giving them a reason to stay?

Not Another **** Meeting

As Leonard Bernstein put it so well, “To achieve great things, two things are needed: a plan and not quite enough time.” Your meetings can be shorter, more fruitful, and engaging, with better outcomes for the organization, employees, and managers. It’s time to examine your meeting rhythms and how you set meeting agendas. This week, I break down daily, weekly, monthly, quarterly, annual, and individual meeting rhythms, with sample agendas for each.

Is Your Company Scalable?

Let’s start here: Why should your company be scalable at all? If your business is scalable, you have business freedom–freedom with time, money, and options. Many business leaders get stuck in the “owner’s trap”, where you need to do everything yourself. Sound familiar? If you want a scalable business that gives you freedom, you need to be intentional about what you sell, and how.

Are you ready for the Talent Crunch?

Companies are gearing up to hire. Unfortunately, many are competing within the same talent pool. Some experts are currently predicting a strong economic recovery starting in May or June. But as the economy booms, there is going to be fierce competition for talent. How will you fare in the looming talent crisis? Your organization should be creating a plan, now, so you can attract the talent you need in the year ahead.