Special purpose acquisition companies (or SPACs) are back! They are not new, but become trendy during overvalued financial markets are frothy, e.g., before the last crisis and now.

Over the last few years, SPACs have raised record amounts. Everyone including hedge fund billionaire Bill Ackman, sports executive Billy Beane of Moneyball fame, former Citigroup dealmaker, Michael Klein, and ex-Blackstone rainmaker Chinh Chus are launching a SPAC, or three. Some of these high-profile investors believe SPACs have shed the dodgy reputation and seek to raise cash in blank check companies, believing they have the unique eye to find under-appreciated businesses that they can bring to the public markets.

This year 28 SPACs have had IPOs, raising $8.9 billion, and at this rate should reach $16.5 billion for the end of the year. If so, it will beat last year’s $13.6 billion and is far ahead of the 2011–2015 average of $1.7 billion.

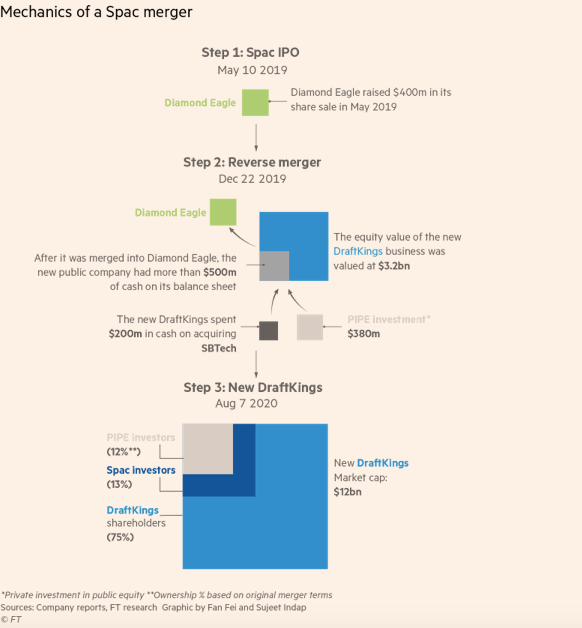

SPACs have a simple business model:

- Raise funds from the public markets.

- Find a target company with which to merge.

- On the announcement of the merger, shareholders can either accept stock in the new company or redeem their shares at the original price of the offering.

Thus, the SPAC is a deconstructed IPO with a very short roadshow. However, as the target is negotiating with a few SPACs to attract the highest bidder, there is an argument that most SPACs overpay for the target reducing shareholder returns. To the SPAC investor, it’s a subpar money market fund with a Kinder Surprise Egg-style option attached: invest, and for the cost of tying up your capital for a while, you have the opportunity to get… something.

SPAC advocates have three arguments for SPACs over IPOs.

They are cheaper than traditional IPOs. Also, they avoid the “IPO pop.” However, as Matt Levine noted,

“Compared to an IPO, the SPAC is much less risky for the company: You sign a deal with one person (the SPAC sponsor) for a fixed amount of money (what’s in the SPAC pool ) at a negotiated price, and then you sign and announce the deal, and it probably gets done. With an IPO, you announce the deal before negotiating the size or price, and you don’t know if anyone will go for it until after you’ve announced it and started marketing it. Things could go wrong in embarrassing public fashion.

***

The SPAC structure is less risky for the company than an IPO, which means that it’s riskier for the SPAC (than just buying shares in a regular IPO would be), which means that the SPAC should be compensated by getting an even bigger discount than regular IPO investors.”

Thus while cheaper, it comes at greater cost to investors.

SPACs are quicker.

SPACs advocates argue that the traditional IPO process is too slow and prevents people from taking advantage of opportunities as they arise. A company undertaking an IPO would spend months working with the Securities and Exchange Commission to finalize a prospectus that detailed its financial information and operations. SPACs dramatically shorten that process. However, as a recent article put it, “The SPAC is the Vegas wedding chapel of liquidity events; it seems like an urgently good idea at the time, but it doesn’t always turn out that way.” However, as we consider the craving for speed, it is worth reflecting that the regulations are there to ensure high standards of “IPOs” as WeWork demonstrated. As a result, the IPOs minimizes a financial meltdown for many rather than the original backers.

A Rebellion Against the Investment Bankers

Founders, companies, and investors are rebelling against the investment banks and their high fees and see SPACs as a way to minimize them. However, if no cash needs to be raised by the target company, a direct listing offers a low-cost alternative that provides the original investors with liquidity and a market.

However, SPACs also have a dodgy reputation.

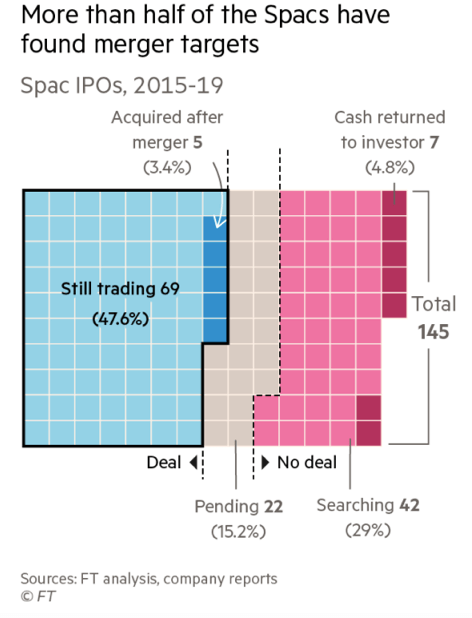

An analysis of 145 SPACs organized between 2015 and 2019 by the Financial Times shows that two-thirds are trading below $10 per share, the standard IPO issue price. About a third have not found a target, and less than half are still trading. This poor performance is not just limited to novice investors, the private equity firm, TPG, has three SPACs, none of which are trading above $10.20.

The poor performance record of these SPACs may be a reminder that when Wall Street is pushing a new product, financiers inevitably find a way to shift the risk on to ordinary investors.

However, while SPACs have improved some, most ordinary investors forget that these vehicles hold out the prospect of great riches for Wall Street’s finest, and their advisers. Otherwise, they wouldn’t do them. As Warren Buffett so aptly put it, “If you’ve been playing poker for half an hour and you still don’t know who the patsy is, you’re the patsy.”

Recent Posts

Align and Thrive: The Importance of Organizational Alignment and Agility

Discover the importance of organizational alignment and agility in this blog post. Learn how establishing a strong CORE and building a strategy around it can lead to sustainable growth and success. Find out how alignment and agility empower your organization to thrive in an ever-changing business landscape.

How to Achieve Smart Time Management: 10 Tips for Busy Professionals

When you are a busy professional running your own business, it can often feel like there aren’t enough hours in the day to accomplish everything. Being strategic with your time is the best (and possibly the only) way to achieve all of your daily tasks. If you are...

5 Strategic Leadership Skills Every Manager Needs

So often, people view leadership as a talent: you’re either born with this quality or you’re not. However, this is not always the case! In reality, good leadership is made up of skills, and anyone can learn how to improve. Some people may pick up leadership attributes...

How the Sellability Score is Calculated: The Ultimate Guide

Do you have questions about how to calculate your business’s sellability score? Whether you’re looking to sell your business in the near future or years from now, understanding your sellability score will help you thrive. The sellability score identifies the...

The Top 5 Benefits of the Entrepreneurial Operating System

As an entrepreneur running your own business, you know there are bumps in the road and struggles that both you and your business will face over time. However, with the right people and tools at your disposal, you can anticipate what’s coming, plan for it, and continue...

5 Ways to Use Email Automation to Boost Traffic

Every single business in the world wants to evolve and grow. This will happen using a variety of techniques and strategies. In 2022, digital marketing is more than a household name, and most companies will adopt at least a few ideas when long-term planning and coming...

6 Questions To Ask A Potential Business Coach Before Hiring Them

Many entrepreneurs consider executive business coaching when they start struggling on their professional path. A small business coach is an experienced professional mentor who educates, supports, and motivates entrepreneurs. They will listen to your concerns, assess...

3 Ways Proper Long Term Strategic Planning Helps Your Business

Dreams turn into goals when they have a foundation of long-term strategic planning supporting them. They become reality when the ensuing strategic implementation plan is executed properly. With Kaizen Solutions as their strategic planning consultant, small and...

What is a Peer Group, and How Can it Improve Your Career?

If you are a CEO or key executive who has come to a crossroads or crisis in your career, you'll gain valuable insights and solutions from a peer group connection more than anywhere else. But what is a peer group, and how can that statement be made with so much...

Profit and Revenue are Lousy Core Values

As I mentioned last week, I am down with COVID and tired, so spending more time reading rather than working. I read Bill Browder's Freezing Order this weekend, and I highly recommend it. However, at the end of the book, Browder says that oligarchs, autocrats, and...