Special purpose acquisition companies (or SPACs) are back! They are not new, but become trendy during overvalued financial markets are frothy, e.g., before the last crisis and now.

Over the last few years, SPACs have raised record amounts. Everyone including hedge fund billionaire Bill Ackman, sports executive Billy Beane of Moneyball fame, former Citigroup dealmaker, Michael Klein, and ex-Blackstone rainmaker Chinh Chus are launching a SPAC, or three. Some of these high-profile investors believe SPACs have shed the dodgy reputation and seek to raise cash in blank check companies, believing they have the unique eye to find under-appreciated businesses that they can bring to the public markets.

This year 28 SPACs have had IPOs, raising $8.9 billion, and at this rate should reach $16.5 billion for the end of the year. If so, it will beat last year’s $13.6 billion and is far ahead of the 2011–2015 average of $1.7 billion.

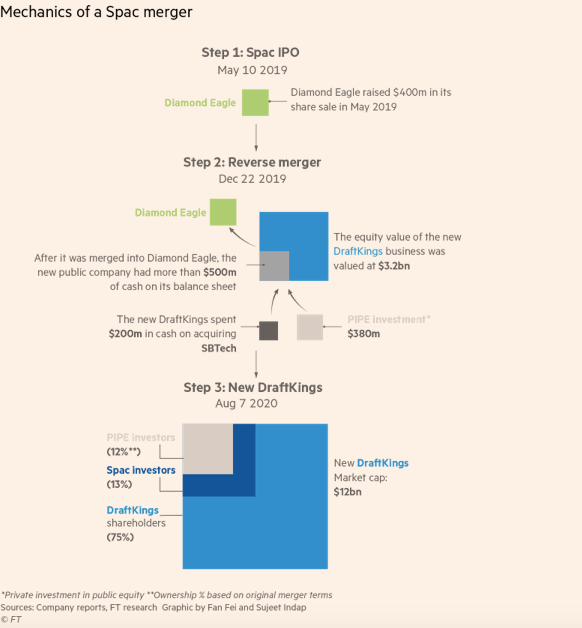

SPACs have a simple business model:

- Raise funds from the public markets.

- Find a target company with which to merge.

- On the announcement of the merger, shareholders can either accept stock in the new company or redeem their shares at the original price of the offering.

Thus, the SPAC is a deconstructed IPO with a very short roadshow. However, as the target is negotiating with a few SPACs to attract the highest bidder, there is an argument that most SPACs overpay for the target reducing shareholder returns. To the SPAC investor, it’s a subpar money market fund with a Kinder Surprise Egg-style option attached: invest, and for the cost of tying up your capital for a while, you have the opportunity to get… something.

SPAC advocates have three arguments for SPACs over IPOs.

They are cheaper than traditional IPOs. Also, they avoid the “IPO pop.” However, as Matt Levine noted,

“Compared to an IPO, the SPAC is much less risky for the company: You sign a deal with one person (the SPAC sponsor) for a fixed amount of money (what’s in the SPAC pool ) at a negotiated price, and then you sign and announce the deal, and it probably gets done. With an IPO, you announce the deal before negotiating the size or price, and you don’t know if anyone will go for it until after you’ve announced it and started marketing it. Things could go wrong in embarrassing public fashion.

***

The SPAC structure is less risky for the company than an IPO, which means that it’s riskier for the SPAC (than just buying shares in a regular IPO would be), which means that the SPAC should be compensated by getting an even bigger discount than regular IPO investors.”

Thus while cheaper, it comes at greater cost to investors.

SPACs are quicker.

SPACs advocates argue that the traditional IPO process is too slow and prevents people from taking advantage of opportunities as they arise. A company undertaking an IPO would spend months working with the Securities and Exchange Commission to finalize a prospectus that detailed its financial information and operations. SPACs dramatically shorten that process. However, as a recent article put it, “The SPAC is the Vegas wedding chapel of liquidity events; it seems like an urgently good idea at the time, but it doesn’t always turn out that way.” However, as we consider the craving for speed, it is worth reflecting that the regulations are there to ensure high standards of “IPOs” as WeWork demonstrated. As a result, the IPOs minimizes a financial meltdown for many rather than the original backers.

A Rebellion Against the Investment Bankers

Founders, companies, and investors are rebelling against the investment banks and their high fees and see SPACs as a way to minimize them. However, if no cash needs to be raised by the target company, a direct listing offers a low-cost alternative that provides the original investors with liquidity and a market.

However, SPACs also have a dodgy reputation.

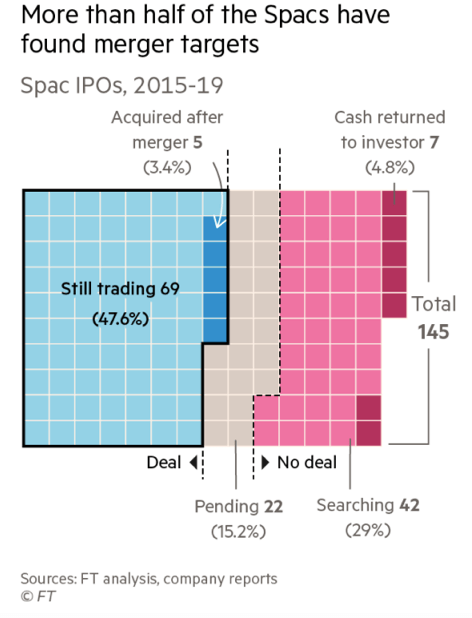

An analysis of 145 SPACs organized between 2015 and 2019 by the Financial Times shows that two-thirds are trading below $10 per share, the standard IPO issue price. About a third have not found a target, and less than half are still trading. This poor performance is not just limited to novice investors, the private equity firm, TPG, has three SPACs, none of which are trading above $10.20.

The poor performance record of these SPACs may be a reminder that when Wall Street is pushing a new product, financiers inevitably find a way to shift the risk on to ordinary investors.

However, while SPACs have improved some, most ordinary investors forget that these vehicles hold out the prospect of great riches for Wall Street’s finest, and their advisers. Otherwise, they wouldn’t do them. As Warren Buffett so aptly put it, “If you’ve been playing poker for half an hour and you still don’t know who the patsy is, you’re the patsy.”

Recent Posts

The Downfall of Boeing: A Lesson in Core Values

Boeing’s 737 Max issues highlighted the company’s sacrifice of safety for financial performance, resulting in a tarnished reputation. The prioritization of profit over core values also damaged the FAA’s credibility and revealed a lack of accountability for top executives. This downfall serves as a reminder of the importance of maintaining core values and prioritizing them over short-term financial gains.

Resolutions, Here We Go Again.

In reflecting on 2021 resolutions, the author scored themselves in three categories and sought to improve success in 2022 by addressing friction points. Drawing on advice from social psychologist Wendy Wood, the author identified areas to reduce or increase friction in their failed resolutions. By making these adjustments, the author aims to enhance their goal achievement and encourages others to consider friction when setting resolutions.

You need to take an extended vacation. No, seriously, you do.

COVID has taken a toll on all of us. If you have not taken an extended vacation in a while where you disconnect, you need to now. You and your business will benefit.

Becoming Famous in Your Niche: The Success Story of Linn Products Limited

In a previous discussion, I highlighted the importance of being famous for something. Being well-known in your niche can help you: Concentrate on your strengths Connect with your target audience Communicate your offerings more effectively Receive referrals Identify...

Understanding and Optimizing Your Cash Conversion Cycle

Understanding and optimizing the Cash Conversion Cycle is crucial for business growth, as it impacts cash flow and the ability to access external capital. This cycle consists of four components: Sales, Make/Production & Inventory, Delivery, and Billing and Payments. To improve the Cash Conversion Cycle, companies can eliminate mistakes, shorten cycle times, and revamp their business models.

Discovering Your Niche: Why You Need to Be Famous for Something

As an entrepreneur, it’s crucial to specialize in a specific area and become famous for something, allowing you to generate referrals and build your brand. Understanding the “job” you’re hired for helps you stand out in the marketplace and communicate your value proposition effectively. By providing value to your clients, you can adopt a value-based pricing approach, ensuring your business remains competitive and maintains a strong market presence.

Rethinking Your Pricing Model: Maximizing Margins and Providing Value

Rethink your pricing model by focusing on the value you provide and your customers’ Best Alternative To a Negotiated Agreement (BATNA). This approach can help you maximize margins while delivering better value to your clients. Assess your offerings and brainstorm with your team to identify pricing adjustment opportunities or eliminate commodity products or services.

Do you know your Profit per X to drive dramatic growth?

I recently facilitated a workshop with several CEOs where we worked on the dramatic business growth model components. One of the questions that I had asked them beforehand was, "What is Your Profit/X?" The results showed that there this concept is not clear to many....

The War for Talent: 5 Ways to Attract the Best Employees

In today’s War for Talent, attracting the best employees requires a focus on value creation, core customer, brand promise, and value delivery. Clearly articulate your company’s mission, identify your “core employee” based on shared values, and offer more than just a salary to stand out as an employer. Utilize employee satisfaction metrics and showcase your company’s commitment to its workforce on your website to make a strong impression on potential candidates.

Are you killing your firm’s WFH productivity?

Productivity remained during WFH with COVID. However, further analysis found that hourly productivity fell and was compensated for by employees working more hours. What was the culprit – Meetings. Want to increase productivity, have fewer meetings.