Special purpose acquisition companies (or SPACs) are back! They are not new, but become trendy during overvalued financial markets are frothy, e.g., before the last crisis and now.

Over the last few years, SPACs have raised record amounts. Everyone including hedge fund billionaire Bill Ackman, sports executive Billy Beane of Moneyball fame, former Citigroup dealmaker, Michael Klein, and ex-Blackstone rainmaker Chinh Chus are launching a SPAC, or three. Some of these high-profile investors believe SPACs have shed the dodgy reputation and seek to raise cash in blank check companies, believing they have the unique eye to find under-appreciated businesses that they can bring to the public markets.

This year 28 SPACs have had IPOs, raising $8.9 billion, and at this rate should reach $16.5 billion for the end of the year. If so, it will beat last year’s $13.6 billion and is far ahead of the 2011–2015 average of $1.7 billion.

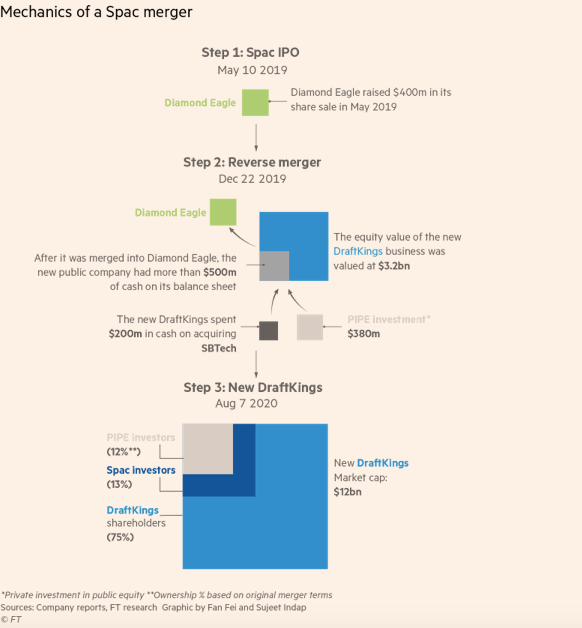

SPACs have a simple business model:

- Raise funds from the public markets.

- Find a target company with which to merge.

- On the announcement of the merger, shareholders can either accept stock in the new company or redeem their shares at the original price of the offering.

Thus, the SPAC is a deconstructed IPO with a very short roadshow. However, as the target is negotiating with a few SPACs to attract the highest bidder, there is an argument that most SPACs overpay for the target reducing shareholder returns. To the SPAC investor, it’s a subpar money market fund with a Kinder Surprise Egg-style option attached: invest, and for the cost of tying up your capital for a while, you have the opportunity to get… something.

SPAC advocates have three arguments for SPACs over IPOs.

They are cheaper than traditional IPOs. Also, they avoid the “IPO pop.” However, as Matt Levine noted,

“Compared to an IPO, the SPAC is much less risky for the company: You sign a deal with one person (the SPAC sponsor) for a fixed amount of money (what’s in the SPAC pool ) at a negotiated price, and then you sign and announce the deal, and it probably gets done. With an IPO, you announce the deal before negotiating the size or price, and you don’t know if anyone will go for it until after you’ve announced it and started marketing it. Things could go wrong in embarrassing public fashion.

***

The SPAC structure is less risky for the company than an IPO, which means that it’s riskier for the SPAC (than just buying shares in a regular IPO would be), which means that the SPAC should be compensated by getting an even bigger discount than regular IPO investors.”

Thus while cheaper, it comes at greater cost to investors.

SPACs are quicker.

SPACs advocates argue that the traditional IPO process is too slow and prevents people from taking advantage of opportunities as they arise. A company undertaking an IPO would spend months working with the Securities and Exchange Commission to finalize a prospectus that detailed its financial information and operations. SPACs dramatically shorten that process. However, as a recent article put it, “The SPAC is the Vegas wedding chapel of liquidity events; it seems like an urgently good idea at the time, but it doesn’t always turn out that way.” However, as we consider the craving for speed, it is worth reflecting that the regulations are there to ensure high standards of “IPOs” as WeWork demonstrated. As a result, the IPOs minimizes a financial meltdown for many rather than the original backers.

A Rebellion Against the Investment Bankers

Founders, companies, and investors are rebelling against the investment banks and their high fees and see SPACs as a way to minimize them. However, if no cash needs to be raised by the target company, a direct listing offers a low-cost alternative that provides the original investors with liquidity and a market.

However, SPACs also have a dodgy reputation.

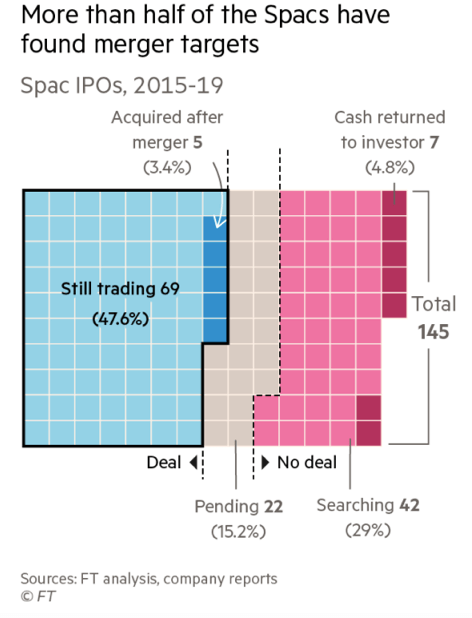

An analysis of 145 SPACs organized between 2015 and 2019 by the Financial Times shows that two-thirds are trading below $10 per share, the standard IPO issue price. About a third have not found a target, and less than half are still trading. This poor performance is not just limited to novice investors, the private equity firm, TPG, has three SPACs, none of which are trading above $10.20.

The poor performance record of these SPACs may be a reminder that when Wall Street is pushing a new product, financiers inevitably find a way to shift the risk on to ordinary investors.

However, while SPACs have improved some, most ordinary investors forget that these vehicles hold out the prospect of great riches for Wall Street’s finest, and their advisers. Otherwise, they wouldn’t do them. As Warren Buffett so aptly put it, “If you’ve been playing poker for half an hour and you still don’t know who the patsy is, you’re the patsy.”

Recent Posts

EOS is just that, an Operating System

The EOS Model® provides a useful foundation for businesses, but it falls short in addressing key aspects of creating an growth. By incorporating additional elements from the Gravitas 7 Attributes of Agile Growth® model, businesses can create a more comprehensive system that promotes growth while maintaining smooth operations. Focusing on Leadership, Strategy, Execution, Customer, Profit, Systems, and Talent, the 7 Attributes of Agile Growth® offer a more encompassing approach to achieving success.

What has COVID done to Company Culture?

COVID has affected everyone. However, companies need to examine if they have lived their core values during COVID, how they are reinforcing them in a WFH environment, and especially with the onboarding of new hires.

Profit ≠ Cash Flow

Knowing how much cash you generate is essential for planning for growth. Too many companies don’t know and when they grow they find they are continually running out of cash. Understand your cash flow generation and how to improve it through improvements in your Cash Conversion Cycle and using the Power of One.

What Are Your Critical and Counter Critical Numbers?

The key to achieving long term goals is to define short term goals that lead you there. Focusing those short term goals around a key metric is essential. However, ensure that the metric will not lead other areas astray by having an appropriate counter critical metric act as a counter balance.

Rethinking ‘Family’ Culture in Business: Fostering Performance and Success

Explore the importance of company culture and the potential pitfalls of adopting a “Family” culture in organizations. Learn how to foster a high-performance culture while maintaining key family values and discover success factors for family businesses. Rethink the “Family” culture concept and create a thriving environment for your organization.

Do You Truly Know Your Core Customer?

Knowing the profit of your core customers is key to building a growth model. Many companies have identified core customers that are generating a sub-optimal profit and so they cannot realize the profits they seek. Identifying the correct core customer allows you to generate profits and often operate in “Blue Ocean.”

The Spectacular Rise and Fall of the European Super League

The European Super League (ESL) collapsed within 48 hours of its announcement due to hubris, a lack of value creation, and fan backlash. The founders’ arrogance led them to disregard European football’s deep-rooted traditions and culture. At the same time, the focus on wealthy club owners instead of merit undermined the essence of the competition. The fierce backlash from fans, who felt betrayed by their clubs, demonstrated the importance of prioritizing supporters’ interests in football.

When Should I Sell My Business?

Many business owners want to sell at the top of the market. However, market timing is tough. Is this the best strategy? Probably not.

Does Your Financial Model Drive Growth?

Working with many companies looking to grow, I am always surprised how many have not built a financial model that drives growth. I have mentioned before a financial model that drives growth? Here I am basing on Jim Collin's Profit/X, which he laid out in Good to...

COVID = Caught Inside

As we emerge from COVID, the current employment environment makes me think of a surfing concept: “Being Caught Inside When a Big Set Comes Through.” Basically, the phrase refers to when you paddle like crazy to escape the crash of one wave, only to find that the next wave in the set is even bigger—and you’re exhausted. 2020 was the first wave, leaving us tired and low. But looking forward, there are major challenges looming on the horizon as business picks up in 2021. You are already asking a lot of your employees, who are working flat out and dealing with stress until you are able to hire more. But everyone is looking for employees right now, and hiring and retention for your organization is growing more difficult.