Special purpose acquisition companies (or SPACs) are back! They are not new, but become trendy during overvalued financial markets are frothy, e.g., before the last crisis and now.

Over the last few years, SPACs have raised record amounts. Everyone including hedge fund billionaire Bill Ackman, sports executive Billy Beane of Moneyball fame, former Citigroup dealmaker, Michael Klein, and ex-Blackstone rainmaker Chinh Chus are launching a SPAC, or three. Some of these high-profile investors believe SPACs have shed the dodgy reputation and seek to raise cash in blank check companies, believing they have the unique eye to find under-appreciated businesses that they can bring to the public markets.

This year 28 SPACs have had IPOs, raising $8.9 billion, and at this rate should reach $16.5 billion for the end of the year. If so, it will beat last year’s $13.6 billion and is far ahead of the 2011–2015 average of $1.7 billion.

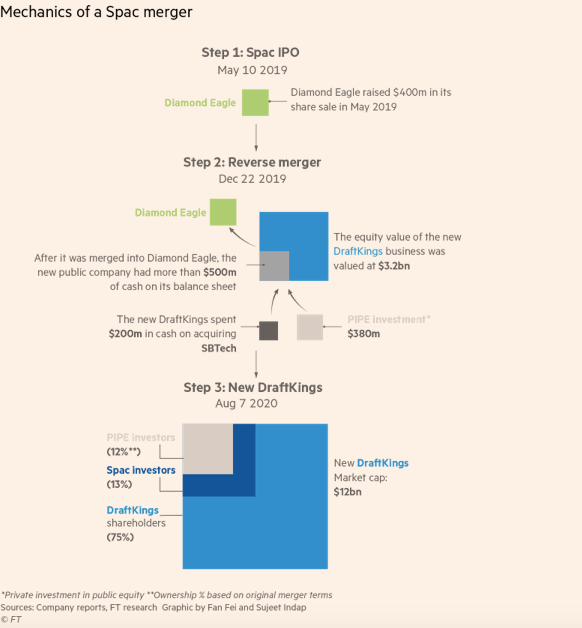

SPACs have a simple business model:

- Raise funds from the public markets.

- Find a target company with which to merge.

- On the announcement of the merger, shareholders can either accept stock in the new company or redeem their shares at the original price of the offering.

Thus, the SPAC is a deconstructed IPO with a very short roadshow. However, as the target is negotiating with a few SPACs to attract the highest bidder, there is an argument that most SPACs overpay for the target reducing shareholder returns. To the SPAC investor, it’s a subpar money market fund with a Kinder Surprise Egg-style option attached: invest, and for the cost of tying up your capital for a while, you have the opportunity to get… something.

SPAC advocates have three arguments for SPACs over IPOs.

They are cheaper than traditional IPOs. Also, they avoid the “IPO pop.” However, as Matt Levine noted,

“Compared to an IPO, the SPAC is much less risky for the company: You sign a deal with one person (the SPAC sponsor) for a fixed amount of money (what’s in the SPAC pool ) at a negotiated price, and then you sign and announce the deal, and it probably gets done. With an IPO, you announce the deal before negotiating the size or price, and you don’t know if anyone will go for it until after you’ve announced it and started marketing it. Things could go wrong in embarrassing public fashion.

***

The SPAC structure is less risky for the company than an IPO, which means that it’s riskier for the SPAC (than just buying shares in a regular IPO would be), which means that the SPAC should be compensated by getting an even bigger discount than regular IPO investors.”

Thus while cheaper, it comes at greater cost to investors.

SPACs are quicker.

SPACs advocates argue that the traditional IPO process is too slow and prevents people from taking advantage of opportunities as they arise. A company undertaking an IPO would spend months working with the Securities and Exchange Commission to finalize a prospectus that detailed its financial information and operations. SPACs dramatically shorten that process. However, as a recent article put it, “The SPAC is the Vegas wedding chapel of liquidity events; it seems like an urgently good idea at the time, but it doesn’t always turn out that way.” However, as we consider the craving for speed, it is worth reflecting that the regulations are there to ensure high standards of “IPOs” as WeWork demonstrated. As a result, the IPOs minimizes a financial meltdown for many rather than the original backers.

A Rebellion Against the Investment Bankers

Founders, companies, and investors are rebelling against the investment banks and their high fees and see SPACs as a way to minimize them. However, if no cash needs to be raised by the target company, a direct listing offers a low-cost alternative that provides the original investors with liquidity and a market.

However, SPACs also have a dodgy reputation.

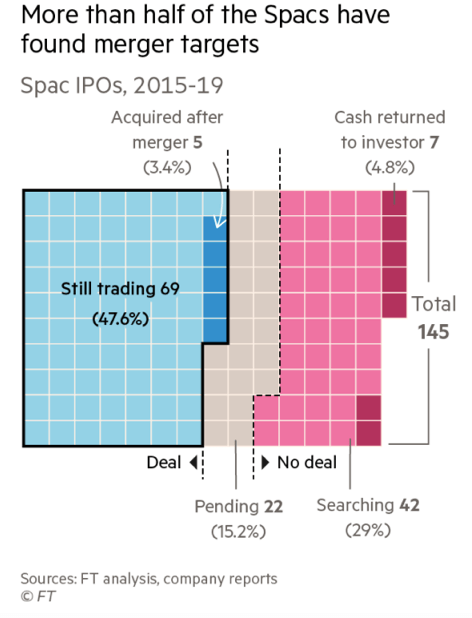

An analysis of 145 SPACs organized between 2015 and 2019 by the Financial Times shows that two-thirds are trading below $10 per share, the standard IPO issue price. About a third have not found a target, and less than half are still trading. This poor performance is not just limited to novice investors, the private equity firm, TPG, has three SPACs, none of which are trading above $10.20.

The poor performance record of these SPACs may be a reminder that when Wall Street is pushing a new product, financiers inevitably find a way to shift the risk on to ordinary investors.

However, while SPACs have improved some, most ordinary investors forget that these vehicles hold out the prospect of great riches for Wall Street’s finest, and their advisers. Otherwise, they wouldn’t do them. As Warren Buffett so aptly put it, “If you’ve been playing poker for half an hour and you still don’t know who the patsy is, you’re the patsy.”

Recent Posts

Boosting Common Sense Decision-Making in Your Organization

Discover how to enhance decision-making in your organization by focusing on three crucial areas: solving the right problem, gathering all the available information, and understanding the intent. Learn to empower your team, foster a purpose-driven culture, and improve organizational clarity for better decision-making.

Do You Understand Your Costs to Ensure Profitability?

You can only determine profitability when you know your costs. I’ve discussed before that you should price according to value, not hours. However, you still need to know your costs to understand the minimum pricing and how it is performing. Do you consider each jobs’ profitability when you price new jobs? Do you know what you should be charging to ensure you hit your profit targets? These discussions about a company’s profitability, and what measure drives profit, are critical for your organization.

Sunk Costs Are Just That, Sunk!

If you were starting your business today, what would you do differently? This thought-provoking question is a valuable exercise, especially when it brings up the idea of “sunk costs” and how they limit us. A sunk cost is a payment or investment that has already been made. Since it is unrecoverable no matter what, a sunk cost shouldn’t be factored into any future decisions. However, we’re all familiar with the sunk cost fallacy: behavior driven by a past expenditure that isn’t recoupable, regardless of future actions.

Do You REALLY Know Your Business Model?

Bringing clarity to your organization is a common theme on The Disruption! blog. Defining your business model is a worthwhile exercise for any leadership team. But how do you even begin to bring clarity into your operations? If you’re looking for a place to start, Josh Kaufman’s “Five Parts of Every Business” offers an excellent framework. Kaufman defines five parts of every business model that all flow into the next, breaking it down into Value Creation, Marketing, Sales, Value Delivery, and Finance.

Ideation! Harder Than It Sounds

Bringing in new ideas, thoughts, understanding, and logic is key as your organization faces the challenges of a changing environment. But when you do an ideation session in your organization… how does it go? For so many organizations, many times, after a few ideas have been thrown out and rejected, the thought process slows down very quickly, and a form of hopelessness takes over. How does your organization have better ideation? I’ve come across a new approach with a few teams lately.

Recruit, Recruit, Recruit!

An uptick in business has begun this quarter, and companies are rushing to hire to meet this surge in demand. What amazes me is how many are so unprepared to hire. Continual recruiting is key to the survival of a company. It isn’t the same thing as hiring—continuous recruiting is building a pipeline of people that you would hire if you needed to fill a position, or “A players” you would hire if they were available.

We All Need Clarity

If your organization is focused on obscurity over clarity, whether intentionally or not, your “A” player employees are vulnerable. There is a looming talent crunch. As we start to emerge from COVID, demand is increasing, and many are scrambling to fill positions to meet that demand. Headhunters and recruiters are soon going to be calling your key “A” employees. Have you been giving them a reason to stay?

Not Another **** Meeting

As Leonard Bernstein put it so well, “To achieve great things, two things are needed: a plan and not quite enough time.” Your meetings can be shorter, more fruitful, and engaging, with better outcomes for the organization, employees, and managers. It’s time to examine your meeting rhythms and how you set meeting agendas. This week, I break down daily, weekly, monthly, quarterly, annual, and individual meeting rhythms, with sample agendas for each.

Is Your Company Scalable?

Let’s start here: Why should your company be scalable at all? If your business is scalable, you have business freedom–freedom with time, money, and options. Many business leaders get stuck in the “owner’s trap”, where you need to do everything yourself. Sound familiar? If you want a scalable business that gives you freedom, you need to be intentional about what you sell, and how.

Are you ready for the Talent Crunch?

Companies are gearing up to hire. Unfortunately, many are competing within the same talent pool. Some experts are currently predicting a strong economic recovery starting in May or June. But as the economy booms, there is going to be fierce competition for talent. How will you fare in the looming talent crisis? Your organization should be creating a plan, now, so you can attract the talent you need in the year ahead.