During a recent call with a CEO, we discussed the company’s profitability and what measure they used to drive profit – basically Profit/X. It became apparent that they didn’t have a handle on their costs and what they should be charging to ensure they hit their profit targets. I have addressed this a bit before to ensure that your margins were where you wanted and rejecting low-profit jobs. However, this time the issue is to understand the jobs’ profitability and price new jobs effectively.

The Costs

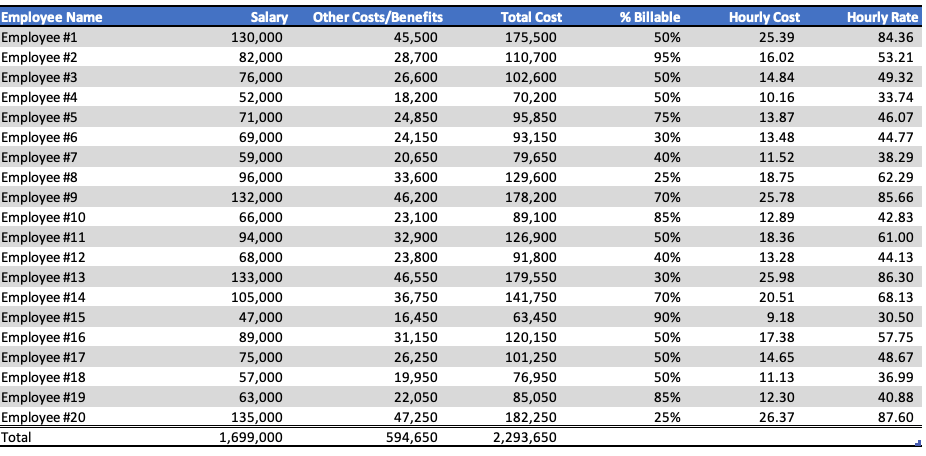

To determine profitability, we need to know our costs. Thus, we built a table listing every employee, the salary, additional expenses, e.g., health insurance, 401k, etc. (estimated at 35% of wages), and the amount of billable time. As a result, we had a table that looked like the one below.

Calculate Hourly Costs

From this Table, we could determine the hourly cost of an employee. To calculate actual costs per hour, we took the number of billable hours, which for 2021 is 8,760, and subtracted 96 hours, the allowable PTO. However, most employees don’t work their total billable hours for various reasons, so we included a “slack” factor of 10%. For multiple reasons, most projects have “re-work” or errors that cannot be billed and estimated at 10% and included. As a result, the total “Billable Hours” was 7,800 rather than 8,760. These adjustments allowed us to produce the hourly cost for each employee.

Calculate Overall Costs

Taking that data, we then divided the hourly costs into billable and non-billable. We added fixed overhead, which was not related to billable expenses, e.g., CEO’s pay, office rent, etc. Thus, we now had a cost structure for the firm that looked as follows.

| Billable Costs | $1,099,150 |

| Non-billable Costs | 1,194,500 |

| Overhead | 750,000 |

| Total Costs | $3,043,650 |

Calculate Revenue

With the company’s cost structure defined, we could determine how much to markup hourly costs to make a 25% profit. Doing this analysis is easy in Excel; however, ensure you don’t make easy Excel mistakes. , and the result was that marking up hourly costs by 232% would enable the company to meet its profit goal. This analysis is shown below.

| Revenue | $4,056,895 |

| Total Costs | 3,043,650 |

| Profit | $1,013,245 |

| Profit Margin | 25% |

Pricing of new projects

While I am a strong proponent of selling value, not time, if the company wants to know the minimum price to charge to realize its minimum profit, it can use this data. Identifying which employees will work on the project and for how long. For example, they would be able to cost it as follows:

| Employee | Hours | Hourly Billable Rate | Total Billable Charge |

| #3 | 25 | $49.32 | $1,233 |

| #6 | 5 | 44.77 | 224 |

| #10 | 20 | 43.83 | 857 |

| #15 | 15 | 30.50 | 457 |

| #17 | 10 | 48.67 | 487 |

| Total | $3,258 |

With this data, we can now estimate jobs more effectively since we know the employees who will work on the jobs and how many hours they will commit. We have to build some waste into that model, but we have a good idea of how to price jobs.

Performance Table

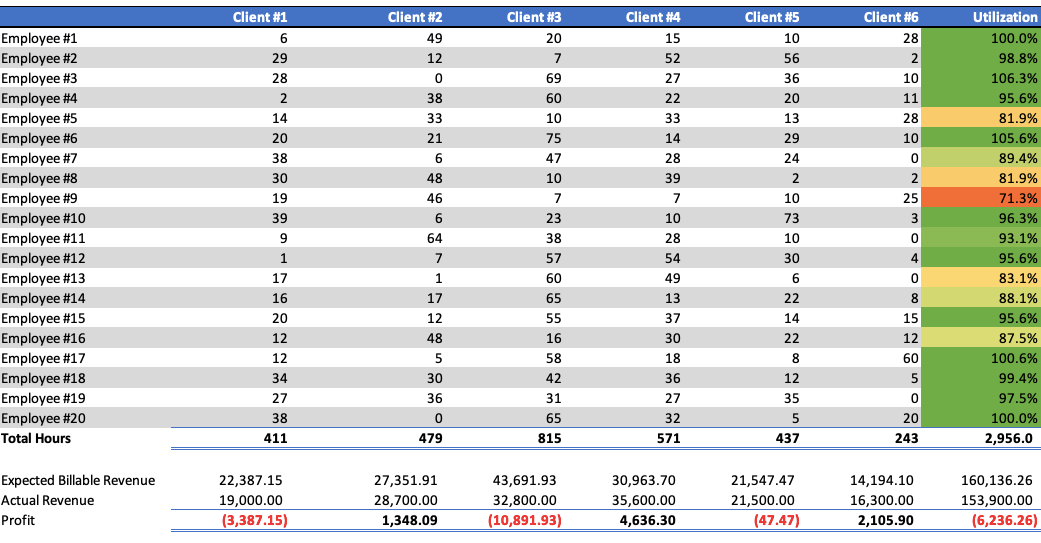

Also, we can see either weekly, monthly, or quarterly how the company is performing. If we produce a table of the employees and clients and hours worked for a month, we can see the utilization of each employee and profit per client as follows.

This table provides a good insight into the company’s and employees’ performance. As can be seen, Employees #3 and #6 are working more than their billable hours with utilization rates above 100%. While this may be good, one would need to ensure that whatever they were supposed to be doing with their non-billable time was being done. Also, Employee #9 is utilized 71.3% of the time, resulting in lost efficiency. Further analysis is required into why this is the case, but it identifies potential issues. Finally, it would appear that nearly half of the employees are working at less than 95% utilization. Given that the company’s utilization is already adjusted for “Slack” and “Rework,” analysis to understand why utilization is low is required.

We cannot only analyze employee performance, but we can see how we are doing with our various contracts. Clients #1 and #3 are losing money, while Client #4 is profitable. The data doesn’t tell us why, but again that would be work investigating as the company is performing below its goal of 25% profit.

Conclusion

As I stated at the beginning, concerning pricing, I strongly believe in pricing according to value and not hours; however, this analysis and methodology are helpful to understand what an organization’s minimum pricing should be and how it is performing. While several issues are highlighted and require more work, this provides a great way of knowing what to examine to improve performance.

If you would like to do this analysis, call me. I would be happy to help you.

Copyright © 2021, Marc A. Borrelli

Recent Posts

Align and Thrive: The Importance of Organizational Alignment and Agility

Discover the importance of organizational alignment and agility in this blog post. Learn how establishing a strong CORE and building a strategy around it can lead to sustainable growth and success. Find out how alignment and agility empower your organization to thrive in an ever-changing business landscape.

How to Achieve Smart Time Management: 10 Tips for Busy Professionals

When you are a busy professional running your own business, it can often feel like there aren’t enough hours in the day to accomplish everything. Being strategic with your time is the best (and possibly the only) way to achieve all of your daily tasks. If you are...

5 Strategic Leadership Skills Every Manager Needs

So often, people view leadership as a talent: you’re either born with this quality or you’re not. However, this is not always the case! In reality, good leadership is made up of skills, and anyone can learn how to improve. Some people may pick up leadership attributes...

How the Sellability Score is Calculated: The Ultimate Guide

Do you have questions about how to calculate your business’s sellability score? Whether you’re looking to sell your business in the near future or years from now, understanding your sellability score will help you thrive. The sellability score identifies the...

The Top 5 Benefits of the Entrepreneurial Operating System

As an entrepreneur running your own business, you know there are bumps in the road and struggles that both you and your business will face over time. However, with the right people and tools at your disposal, you can anticipate what’s coming, plan for it, and continue...

5 Ways to Use Email Automation to Boost Traffic

Every single business in the world wants to evolve and grow. This will happen using a variety of techniques and strategies. In 2022, digital marketing is more than a household name, and most companies will adopt at least a few ideas when long-term planning and coming...

6 Questions To Ask A Potential Business Coach Before Hiring Them

Many entrepreneurs consider executive business coaching when they start struggling on their professional path. A small business coach is an experienced professional mentor who educates, supports, and motivates entrepreneurs. They will listen to your concerns, assess...

3 Ways Proper Long Term Strategic Planning Helps Your Business

Dreams turn into goals when they have a foundation of long-term strategic planning supporting them. They become reality when the ensuing strategic implementation plan is executed properly. With Kaizen Solutions as their strategic planning consultant, small and...

What is a Peer Group, and How Can it Improve Your Career?

If you are a CEO or key executive who has come to a crossroads or crisis in your career, you'll gain valuable insights and solutions from a peer group connection more than anywhere else. But what is a peer group, and how can that statement be made with so much...

Profit and Revenue are Lousy Core Values

As I mentioned last week, I am down with COVID and tired, so spending more time reading rather than working. I read Bill Browder's Freezing Order this weekend, and I highly recommend it. However, at the end of the book, Browder says that oligarchs, autocrats, and...

Анализ Tether в нетронутость: Как защитить свои криптовалютные финансы

Все более индивидуумов обращают внимание на безопасность своих криптовалютных активов. День ото дня обманщики придумывают новые подходы хищения цифровых активов, и также собственники цифровой валюты оказываются жертвами их афер. Один из подходов охраны становится проверка бумажников на присутствие нелегальных средств.

Для чего это полезно?

Прежде всего, для того чтобы обезопасить свои финансы от обманщиков и похищенных монет. Многие специалисты встречаются с риском потери их финансов из-за хищных схем или грабежей. Анализ кошельков помогает определить непрозрачные операции а также предотвратить возможные убытки.

Что наша команда предоставляем?

Наша компания предоставляем услугу проверки цифровых кошельков и также операций для определения источника фондов. Наша система проверяет информацию для определения незаконных операций и оценки угрозы для вашего портфеля. Благодаря такой проверке, вы сможете избегать недочетов с регуляторами и защитить себя от участия в незаконных сделках.

Каким образом это работает?

Наша команда сотрудничаем с лучшими аудиторскими компаниями, такими как Kudelsky Security, с целью обеспечить прецизионность наших проверок. Мы внедряем современные технологии для обнаружения потенциально опасных сделок. Ваши информация проходят обработку и хранятся в соответствии с высокими нормами безопасности и приватности.

Каким образом проверить свои Tether на нетронутость?

При наличии желания проверить, что ваша USDT-кошельки чисты, наш подход предоставляет бесплатную проверку первых пяти бумажников. Просто вбейте адрес вашего бумажника в на сайте, и мы предоставим вам подробный доклад о его положении.

Обезопасьте свои средства уже сейчас!

Не подвергайте риску подвергнуться обманщиков или попасть в неблагоприятную ситуацию из-за незаконных сделок. Обратитесь за помощью к нашей команде, для того чтобы сохранить ваши криптовалютные активы и избежать сложностей. Предпримите первый шаг к сохранности вашего криптовалютного портфеля прямо сейчас!

USDT – является стабильная цифровая валюта, привязанная к национальной валюте, подобно американский доллар. Это делает данную криптовалюту в частности популярной у трейдеров, так как данная криптовалюта обеспечивает надежность курса в условиях неустойчивости рынка криптовалют. Впрочем, как и другая форма цифровых активов, USDT изложена риску использования для легализации доходов и поддержки незаконных сделок.

Отмывание денег посредством криптовалюты переходит в все больше и больше распространенным методом с целью скрытия происхождения средств. Применяя различные приемы, мошенники могут стараться легализовывать незаконно завоеванные фонды посредством сервисы обмена криптовалют или миксеры средств, с тем чтобы совершить происхождение менее очевидным.

Поэтому, анализ USDT на чистоту оказывается необходимой мерой предосторожности для владельцев цифровых валют. Доступны для использования специализированные сервисы, которые выполняют анализ транзакций и бумажников, для того чтобы определить ненормальные транзакции и противоправные источники капитала. Данные платформы помогают участникам предотвратить непреднамеренного участия в преступной деятельности и предотвратить блокировку счетов со со стороны сторонних регуляторных органов.

Анализ USDT на чистоту также как и помогает защитить себя от убытков. Пользователи могут быть уверенны в том их активы не связаны с нелегальными сделками, что соответственно уменьшает вероятность блокировки счета или перечисления денег.

Таким образом, в условиях повышающейся сложности среды криптовалют важно принимать действия для обеспечения безопасности своего капитала. Анализ USDT на чистоту с помощью специализированных платформ становится одним из вариантов защиты от финансирования преступной деятельности, предоставляя участникам цифровых валют дополнительный уровень и защиты.

[url=http://lisinoprilgp.com/]zestril tablet price[/url]

cá cược thể thao

[url=https://synthroidam.online/]synthroid 0.88[/url]

https://rg777.app/cup-c1-202324/

levitra vardenafil

Backlinks seo

Productive Hyperlinks in Blogs and Comments: Increase Your SEO

Hyperlinks are critical for increasing search engine rankings and boosting website presence. By incorporating backlinks into blogs and comments wisely, they can significantly enhance targeted traffic and SEO performance.

Adhering to Search Engine Algorithms

Today’s backlink placement methods are finely adjusted to align with search engine algorithms, which now prioritize website link quality and relevance. This assures that hyperlinks are not just numerous but significant, guiding users to useful and pertinent content. Website owners should focus on incorporating hyperlinks that are situationally suitable and boost the overall articles quality.

Benefits of Making use of Refreshing Donor Bases

Using current donor bases for backlinks, like those managed by Alex, offers substantial rewards. These bases are regularly refreshed and consist of unmoderated sites that don’t attract complaints, guaranteeing the links placed are both impactful and agreeable. This strategy helps in sustaining the usefulness of backlinks without the pitfalls connected with moderated or problematic assets.

Only Authorized Sources

All donor sites used are authorized, avoiding legal pitfalls and sticking to digital marketing standards. This dedication to making use of only approved resources assures that each backlink is legitimate and trustworthy, thus developing reliability and reliability in your digital presence.

SEO Impact

Expertly put backlinks in blogs and remarks provide over just SEO rewards—they improve user experience by connecting to pertinent and top quality articles. This strategy not only fulfills search engine requirements but also entails end users, leading to far better traffic and improved online engagement.

In essence, the right backlink technique, especially one that employs refreshing and dependable donor bases like Alex’s, can change your SEO efforts. By focusing on high quality over amount and sticking to the newest standards, you can guarantee your backlinks are both potent and effective.

cialisВ® online

[url=https://vatrex.online/]valtrex over the counter canada[/url]

[url=https://bestmedsx.com/]online pharmacy no presc uk[/url]

[url=http://olisinopril.online/]order lisinopril online from canada[/url]

[url=https://drugstorepp.online/]good online mexican pharmacy[/url]

九州娛樂城

[url=https://ametformin.com/]metformin 1500[/url]

[url=https://metforminbi.online/]ordering metformin on line without a prescription[/url]

[url=http://happyfamilystorerx.online/]canada drugstore pharmacy rx[/url]

[url=https://happyfamilymedicalstore.online/]canadian pharmacy 24 com[/url]

Проверка Тетер для чистоту: Как обезопасить собственные криптовалютные средства

Постоянно все больше пользователей обращают внимание к надежность своих цифровых активов. День ото дня дельцы придумывают новые методы кражи цифровых денег, и собственники цифровой валюты являются пострадавшими своих обманов. Один из техник защиты становится проверка кошельков на наличие противозаконных денег.

С каким намерением это потребуется?

Прежде всего, для того чтобы обезопасить свои финансы против дельцов а также похищенных денег. Многие вкладчики сталкиваются с риском утраты их фондов из-за мошеннических планов либо краж. Осмотр кошельков помогает выявить подозрительные действия или предотвратить возможные убытки.

Что мы предлагаем?

Мы предлагаем сервис проверки криптовалютных кошельков а также транзакций для определения источника средств. Наша технология проверяет информацию для выявления противозаконных транзакций а также оценки угрозы вашего счета. Вследствие этой проверке, вы сможете избегать недочетов с регуляторами а также предохранить себя от участия в незаконных сделках.

Каким образом это работает?

Наша фирма сотрудничаем с первоклассными аудиторскими агентствами, наподобие Halborn, с целью обеспечить аккуратность наших проверок. Мы применяем современные техники для выявления потенциально опасных операций. Ваши информация обрабатываются и сохраняются согласно с высокими стандартами безопасности и конфиденциальности.

Как выявить личные USDT в чистоту?

При наличии желания убедиться, что ваша Tether-кошельки нетронуты, наш сервис обеспечивает бесплатную проверку первых пяти кошельков. Легко передайте адрес своего кошелька на на сайте, и также мы предоставим вам полную информацию доклад о его статусе.

Обезопасьте ваши фонды прямо сейчас!

Избегайте риска подвергнуться мошенников или оказаться в неприятную ситуацию вследствие незаконных операций. Обратитесь за помощью к нашему агентству, чтобы защитить ваши криптовалютные финансовые ресурсы и предотвратить проблем. Сделайте первый шаг к сохранности вашего криптовалютного портфеля прямо сейчас!

[url=https://prednisonexg.online/]prednixone tables for sale[/url]

[url=https://synthroidsl.online/]how much is synthroid[/url]

טלגראס כיוונים

פרח כיוונים: המדריך השלם לסחר פרחי קנאביס דרך הטלגרם

שרף מדריך הם פורטל ידע ומשלחי לקניית קנאביסין במקום האפליקציה הנפוצה המשלוח.

האתר סופק את כל הקישורים הידיעתיים והמידעים המתעדף להקבוצות וערוצים הנבחרים מומלצים לביקור לסחר ב קנאביס בהמסר במדינה.

כמו כן, אתר האינטרנט מספקת מדריך מפורטת לאיך כדאי להתכנן בהפרח ולרכוש פרחי קנאביס בקלות הזמנה ובמהירות.

בעזרת ההוראות, גם כן משתמשי הערוץ משתמשים חדשים יוכלו להירשם להחיים הקנאביס בהמשלוח בצורה מאובטחת ומאובטחת לשימוש.

ההאוטומטיזציה של הפרח מאפשר למשתמשים ללהוציא פעולות המבוצעות שונות כמו כן השקת פרחי קנאביס, קבלת תמיכה תמיכה, בדיקת המלאי והכנסת ביקורות על מוצרים. כל זאת בפני נוחה לשימוש וקלה דרך היישומון.

כאשר כאשר מדובר באמצעים התשלום, הפרח מפעילה בדרכי מוכרות כגון מזומן, כרטיסי האשראי של אשראי וקריפטומונדה. חשוב לציין כי ישנה לבדוק ולוודא את ההוראות והחוקות המקומיים בארץ שלך ללפני ביצוע רכישה.

טלגרם מציע הטבות מרכזיים כגון פרטיות ובטיחות מוגברים מאוד, השיחה מהירה וגמישות גבוהה מאוד. בנוסף, הוא מאפשר כניסה להקהילה עולמית רחבה מאוד ומציע מגוון של תכונות ויכולות.

בבתום, הטלגרמה מדריכים היא המקום המושלם ללמצוא את כל הידע והקישורים להשקיה פרחי קנאביס בצורה מהירה, בבטוחה ונוחה מאוד דרך הטלגרמה.

[url=http://bestprednisone.online/]medication prednisone 20 mg[/url]

קזינו אונליין

הימורים ברשת הם חוויה מרגשות ופופולרית ביותר בעידן הדיגיטלי, שמגירה מיליוני אנשים מכל

רחבי העולם. ההימורים המקוונים מתבצעים בהתאם ל אירועים ספורטיביים, תוצאות פוליטיות ואפילו תוצאות מזג האוויר ונושאים נוספים. אתרים ל הימורים הווירטואליים מקריאים פוטנציאליים את כל מי שרוצה להמרות על תוצאות אפשריות וליהנות רגעים מרגשים ומהנים.

ההימורים המקוונים הם מהם כבר חלק חשוב מתרבות האנושית מזמן רב והיום הם לא רק רק חלק חשוב מהפעילות התרבותית והכלכלית, אלא גם מספקים רווחים וחוויות מרתקות. משום שהם נגישים ונוחים לשימוש, הם מאפשרים לכולם מהמשחק ולהנציח רגעי עסקה וניצחון בכל זמן ובכל מקום.

טכנולוגיות מתקדמות והמשחקים באינטרנט הפכו מעניינת ונפוצה. מיליוני אנשים מכל כל רחבי העולם מתעניינים בהימורים מקוונים, כוללים סוגים שונים של הימורים. הימורים מקוונים מציעים למשתתפים חוויה מהנה ומרגשת, המתאימה לכולם בכל זמן ובכל מקום.

אז מה חכם אתה מחכה לו? הצטרף עכשיו והתחיל ליהנות מכל רגע ורגע שההימורים באינטרנט מבטיחים.

[url=https://lisinoprilgp.com/]lisinopril price in india[/url]

[url=https://tadalafilstd.online/]best cialis pill[/url]

Backlink pyramid

Sure, here’s the text with spin syntax applied:

Link Pyramid

After numerous updates to the G search mechanism, it is essential to use different options for ranking.

Today there is a approach to draw the attention of search engines to your site with the assistance of backlinks.

Links are not only an efficient promotional instrument but they also have natural traffic, straight sales from these resources possibly will not be, but transitions will be, and it is poyedenicheskogo visitors that we also receive.

What in the end we get at the final outcome:

We show search engines site through links.

Prluuchayut organic click-throughs to the site and it is also a sign to search engines that the resource is used by users.

How we show search engines that the site is valuable:

Links do to the main page where the main information.

We make links through redirects credible sites.

The most CRUCIAL we place the site on sites analyzers distinct tool, the site goes into the cache of these analyzers, then the acquired links we place as redirections on blogs, forums, comments. This significant action shows search engines the site map as analysis tool sites present all information about sites with all key terms and headings and it is very POSITIVE.

All details about our services is on the website!

[url=https://isynthroid.online/]cost of synthroid 175 mcg[/url]

crestor pills hop – crestor pills history caduet cousin

[url=https://bestmedsx.com/]legitimate online pharmacy[/url]

[url=http://happyfamilymedicalstore.online/]online pharmacy without scripts[/url]

[url=https://lisinoprill.com/]lisinopril 2016[/url]

Creating hyperlinks is simply equally successful currently, only the tools for working within this domain have altered.

You can find numerous options for backlinks, our team use some of them, and these methods work and have been tried by us and our customers.

Not long ago we carried out an test and it turned out that low-frequency searches from a single domain name rank nicely in search engines, and the result doesnt need to be your own domain, you are able to use social media from web2.0 range for this.

It additionally possible to in part transfer weight through site redirects, giving a varied hyperlink profile.

Head over to our very own website where our own offerings are actually provided with comprehensive explanations.

[url=https://azithromycinmds.com/]can you buy azithromycin over the counter in usa[/url]

[url=http://drugstorepp.online/]legitimate online pharmacy[/url]

[url=http://metformin.store/]metformin 100 mg tablets[/url]

creating articles

Creating unique articles on Platform and Platform, why it is required:

Created article on these resources is better ranked on less common queries, which is very crucial to get natural traffic.

We get:

organic traffic from search engines.

natural traffic from the inner rendition of the medium.

The webpage to which the article refers gets a link that is liquid and increases the ranking of the webpage to which the article refers.

Articles can be made in any number and choose all low-frequency queries on your topic.

Medium pages are indexed by search algorithms very well.

Telegraph pages need to be indexed individually indexer and at the same time after indexing they sometimes occupy spots higher in the search algorithms than the medium, these two platforms are very valuable for getting traffic.

Here is a hyperlink to our offerings where we offer creation, indexing of sites, articles, pages and more.

vảy gà

[url=http://happyfamilystorerx.online/]safe online pharmacies[/url]

[url=http://happyfamilystorerx.online/]canadian pharmacy no rx needed[/url]

[url=http://medicinesaf.online/]online pharmacy no rx[/url]

[url=http://valtrexmedication.com/]valtrex 500mg price canada[/url]

[url=https://tadalafilu.online/]tadalafil 2.5 mg tablets[/url]

[url=http://bestmedsx.com/]canada pharmacy online legit[/url]

can i take levitra every day

cost of cialis in canada

I highly advise to avoid this platform. My personal experience with it has been only frustration and doubts about deceptive behavior. Be extremely cautious, or even better, look for a more reputable service to meet your needs.

[url=https://synthroidx.com/]synthroid 25 mg coupon[/url]

what is cialis tadalafil 20 mg used for

откупиться от сво

С началом СВО уже спустя полгода была объявлена первая волна мобилизации. При этом прошлая, в последний раз в России была аж в 1941 году, с началом Великой Отечественной Войны. Конечно же, желающих отправиться на фронт было не много, а потому люди стали искать способы не попасть на СВО, для чего стали покупать справки о болезнях, с которыми можно получить категорию Д. И все это стало возможным с даркнет сайтами, где можно найти практически все что угодно. Именно об этой отрасли темного интернета подробней и поговорим в этой статье.

online levitra order

Hmm is anyone else encountering problems with the pictures on this blog loading? I’m trying to find out if its a problem on my end or if it’s the blog. Any suggestions would be greatly appreciated.

https://maps.google.cv/url?q=https://www.openlearning.com/u/vincentshapiro-scybf7/blog/0

[url=http://valtrexarb.online/]valtrex australia buy[/url]

canada cialis with dapoxetine

levitra online sale

[url=https://tadalafilu.online/]tadalafil online rx[/url]

[url=http://valtrexarb.online/]valtrex daily cost[/url]

whoah this weblog is great i really like studying your posts. Stay up the good work! You understand, a lot of individuals are looking around for this information, you could aid them greatly.

https://images.google.cf/url?q=https://rentry.co/m5pqdsws

[url=https://olisinopril.com/]buy lisinopril in mexico[/url]

[url=https://happyfamilymedicalstore.online/]cheapest pharmacy prescription drugs[/url]

Hi there i am kavin, its my first time to commenting anyplace, when i read this article i thought i could also make comment due to this good paragraph.

https://postheaven.net/jeniusixaa/remont-abo-zamina-korpusu-fari-shcho-obrati-shchob-pokrashchiti-osvitlennia

[url=https://happyfamilymedicalstore.online/]happy family pharm[/url]

[url=https://isynthroid.online/]synthroid 0.025 mg[/url]

[url=http://isynthroid.com/]synthroid 2017[/url]

[url=http://medicinesaf.online/]online pharmacy dubai[/url]

[url=http://synthroidam.online/]synthroid nz[/url]

canadian pharmacy levitra

cialis 20 mg price cvs

Pirámide de backlinks

Aquí está el texto con la estructura de spintax que propone diferentes sinónimos para cada palabra:

“Pirámide de enlaces de retroceso

Después de muchas actualizaciones del motor de búsqueda G, necesita aplicar diferentes opciones de clasificación.

Hay una manera de hacerlo de llamar la atención de los motores de búsqueda a su sitio web con backlinks.

Los vínculos de retroceso no sólo son una herramienta eficaz para la promoción, sino que también tienen tráfico orgánico, las ventas directas de estos recursos más probable es que no será, pero las transiciones será, y es poedenicheskogo tráfico que también obtenemos.

Lo que vamos a obtener al final en la salida:

Mostramos el sitio a los motores de búsqueda a través de backlinks.

Conseguimos conversiones orgánicas hacia el sitio, lo que también es una señal para los buscadores de que el recurso está siendo utilizado por la gente.

Cómo mostramos los motores de búsqueda que el sitio es líquido:

1 backlink se hace a la página principal donde está la información principal

Hacemos enlaces de retroceso a través de redirecciones de sitios de confianza

Lo más crucial colocamos el sitio en una herramienta independiente de analizadores de sitios, el sitio entra en la caché de estos analizadores, luego los enlaces recibidos los colocamos como redirecciones en blogs, foros, comentarios.

Esta importante acción muestra a los buscadores el MAPA DEL SITIO, ya que los analizadores de sitios muestran toda la información de los sitios con todas las palabras clave y títulos y es muy BUENO.

¡Toda la información sobre nuestros servicios en el sitio web!

[url=http://metforemin.online/]buying metformin online[/url]

[url=http://azithromycinhq.com/]azithromycin tablets 250 mg[/url]

反向連結金字塔

G搜尋引擎在屡经更新后需要应用不同的排名參數。

今天有一種方法可以使用反向連結吸引G搜尋引擎對您的網站的注意。

反向連結不僅是有效的推廣工具,也是有機流量。

我們會得到什麼結果:

我們透過反向連結向G搜尋引擎展示我們的網站。

他們收到了到該網站的自然過渡,這也是向G搜尋引擎發出的信號,表明該資源正在被人們使用。

我們如何向G搜尋引擎表明該網站具有流動性:

個帶有主要訊息的主頁反向鏈接

我們透過來自受信任網站的重新定向來建立反向連結。

此外,我們將網站放置在单独的網路分析器上,網站最終會進入這些分析器的高速缓存中,然後我們使用產生的連結作為部落格、論壇和評論的重定向。 這個重要的操作向G搜尋引擎顯示了網站地圖,因為網站分析器顯示了有關網站的所有資訊以及所有關鍵字和標題,這很棒

有關我們服務的所有資訊都在網站上!

[url=http://azithromycinhq.com/]zithromax 500mg for sale[/url]

[url=http://prednisoneiv.online/]prednisone mexico[/url]

I urge you steer clear of this site. My personal experience with it was nothing but disappointment along with concerns regarding scamming practices. Proceed with extreme caution, or even better, find a more reputable service for your needs.

В современном мире, где диплом – это начало отличной карьеры в любой сфере, многие стараются найти максимально быстрый и простой путь получения образования. Наличие документа об образовании переоценить невозможно. Ведь именно диплом открывает дверь перед всеми, кто стремится вступить в сообщество профессионалов или продолжить обучение в любом университете.

В данном контексте наша компания предлагает очень быстро получить любой необходимый документ. Вы сможете заказать диплом, что будет отличным решением для всех, кто не смог завершить обучение, утратил документ или желает исправить плохие оценки. Все дипломы изготавливаются аккуратно, с особым вниманием ко всем элементам. В результате вы сможете получить 100% оригинальный документ.

Преимущество такого решения состоит не только в том, что можно оперативно получить диплом. Весь процесс организован удобно, с нашей поддержкой. От выбора нужного образца документа до точного заполнения личной информации и доставки в любое место России — все под полным контролем качественных специалистов.

Всем, кто хочет найти быстрый и простой способ получить требуемый документ, наша компания может предложить выгодное решение. Купить диплом – это значит избежать длительного обучения и сразу перейти к своим целям: к поступлению в ВУЗ или к началу трудовой карьеры.

diploman-russia.com

Купить диплом без лишних хлопот

купить диплом Гознак [url=http://www.diplom-msk.ru/]http://www.diplom-msk.ru/[/url] .

[url=https://tadalafilgf.com/]tadalafil price in india[/url]

[url=http://tadalafilu.online/]tadalafil 15mg[/url]

[url=https://lisinoprilgp.online/]buy prinivil online[/url]

На сегодняшний день, когда диплом становится началом удачной карьеры в любом направлении, многие ищут максимально простой путь получения качественного образования. Важность наличия официального документа трудно переоценить. Ведь диплом открывает двери перед любым человеком, который стремится вступить в профессиональное сообщество или продолжить обучение в высшем учебном заведении.

Наша компания предлагает быстро получить этот важный документ. Вы можете заказать диплом старого или нового образца, что будет удачным решением для всех, кто не смог завершить образование или утратил документ. Каждый диплом изготавливается с особой тщательностью, вниманием ко всем элементам, чтобы на выходе получился 100% оригинальный документ.

Плюсы данного подхода состоят не только в том, что вы сможете оперативно получить свой диплом. Процесс организован комфортно, с профессиональной поддержкой. От выбора требуемого образца диплома до консультаций по заполнению персональной информации и доставки по России — все будет находиться под полным контролем наших мастеров.

Всем, кто ищет оперативный способ получить требуемый документ, наша компания предлагает выгодное решение. Купить диплом – это значит избежать продолжительного обучения и сразу перейти к своим целям, будь то поступление в ВУЗ или старт карьеры.

http://www.diploman-russiyan.com

I have been absent for a while, but now I remember why I used to love this web site. Thanks, I will try and check back more frequently. How frequently you update your site?

Aceon

[url=http://synthroidam.online/]synthroid 137 mg[/url]

20 mg sildenafil

В современном мире, где диплом – это начало отличной карьеры в любой области, многие ищут максимально быстрый путь получения качественного образования. Наличие официального документа сложно переоценить. Ведь диплом открывает двери перед любым человеком, который собирается начать профессиональную деятельность или учиться в любом университете.

Мы предлагаем максимально быстро получить этот важный документ. Вы сможете приобрести диплом, что является выгодным решением для всех, кто не смог завершить образование, утратил документ или желает исправить свои оценки. диплом изготавливается с особой аккуратностью, вниманием к мельчайшим элементам. В итоге вы сможете получить полностью оригинальный документ.

Превосходство подобного решения заключается не только в том, что можно оперативно получить свой диплом. Весь процесс организован комфортно, с профессиональной поддержкой. Начиная от выбора подходящего образца диплома до грамотного заполнения персональной информации и доставки в любое место страны — все под абсолютным контролем качественных мастеров.

Для всех, кто пытается найти максимально быстрый способ получить требуемый документ, наша компания может предложить выгодное решение. Купить диплом – это значит избежать длительного обучения и не теряя времени переходить к личным целям: к поступлению в ВУЗ или к началу успешной карьеры.

http://www.diploman-russiyan.com

[url=http://valtrexmedication.com/]buy valtrex canada[/url]

[url=http://valtrexarb.online/]how to get valtrex without a prescription[/url]

[url=http://drugstorepp.online/]online pharmacy indonesia[/url]

It’s onerous to find educated individuals on this topic, however you sound like you realize what you’re speaking about! Thanks

sildenafil citrate tablets 100mg

взлом кошелька

Как защитить свои данные: берегитесь утечек информации в интернете. Сегодня сохранение личных данных становится всё более важной задачей. Одним из наиболее распространенных способов утечки личной информации является слив «сит фраз» в интернете. Что такое сит фразы и как предохранить себя от их утечки? Что такое «сит фразы»? «Сит фразы» — это синтезы слов или фраз, которые часто используются для доступа к различным онлайн-аккаунтам. Эти фразы могут включать в себя имя пользователя, пароль или другие конфиденциальные данные. Киберпреступники могут пытаться получить доступ к вашим аккаунтам, при помощи этих сит фраз. Как охранить свои личные данные? Используйте комплексные пароли. Избегайте использования простых паролей, которые просто угадать. Лучше всего использовать комбинацию букв, цифр и символов. Используйте уникальные пароли для каждого аккаунта. Не используйте один и тот же пароль для разных сервисов. Используйте двухступенчатую аутентификацию (2FA). Это прибавляет дополнительный уровень безопасности, требуя подтверждение входа на ваш аккаунт путем другое устройство или метод. Будьте осторожны с онлайн-сервисами. Не доверяйте свою информацию ненадежным сайтам и сервисам. Обновляйте программное обеспечение. Установите обновления для вашего операционной системы и программ, чтобы защитить свои данные от вредоносного ПО. Вывод Слив сит фраз в интернете может спровоцировать серьезным последствиям, таким подобно кража личной информации и финансовых потерь. Чтобы охранить себя, следует принимать меры предосторожности и использовать надежные методы для хранения и управления своими личными данными в сети

[url=https://lisinoprildrl.online/]lisinopril price in canada[/url]

кошелек с балансом купить

Криптокошельки с балансом: зачем их покупают и как использовать

В мире криптовалют все расширяющуюся популярность приобретают криптокошельки с предустановленным балансом. Это индивидуальные кошельки, которые уже содержат определенное количество криптовалюты на момент покупки. Но зачем люди приобретают такие кошельки, и как правильно использовать их?

Почему покупают криптокошельки с балансом?

Удобство: Криптокошельки с предустановленным балансом предлагаются как готовое к применению решение для тех, кто хочет быстро начать пользоваться криптовалютой без необходимости покупки или обмена на бирже.

Подарок или награда: Иногда криптокошельки с балансом используются как подарок или поощрение в рамках акций или маркетинговых кампаний.

Анонимность: При покупке криптокошелька с балансом нет необходимости предоставлять личные данные, что может быть важно для тех, кто ценит анонимность.

Как использовать криптокошелек с балансом?

Проверьте безопасность: Убедитесь, что кошелек безопасен и не подвержен взлому. Проверьте репутацию продавца и источник приобретения кошелька.

Переведите средства на другой кошелек: Если вы хотите долгосрочно хранить криптовалюту, рекомендуется перевести средства на более безопасный или удобный для вас кошелек.

Не храните все средства на одном кошельке: Для обеспечения безопасности рекомендуется распределить средства между несколькими кошельками.

Будьте осторожны с фишингом и мошенничеством: Помните, что мошенники могут пытаться обмануть вас, предлагая криптокошельки с балансом с целью получения доступа к вашим средствам.

Заключение

Криптокошельки с балансом могут быть удобным и скорым способом начать пользоваться криптовалютой, но необходимо помнить о безопасности и осторожности при их использовании.Выбор и приобретение криптокошелька с балансом – это серьезный шаг, который требует внимания к деталям и осознанного подхода.”

Сид-фразы, или памятные фразы, представляют собой сумму слов, которая используется для формирования или восстановления кошелька криптовалюты. Эти фразы обеспечивают вход к вашим криптовалютным средствам, поэтому их секурное хранение и использование очень важны для защиты вашего криптоимущества от утери и кражи.

Что такое сид-фразы кошельков криптовалют?

Сид-фразы являются набор случайным образом сгенерированных слов, часто от 12 до 24, которые представляют собой для создания уникального ключа шифрования кошелька. Этот ключ используется для восстановления возможности доступа к вашему кошельку в случае его повреждения или утери. Сид-фразы обладают высокой защиты и шифруются, что делает их секурными для хранения и передачи.

Зачем нужны сид-фразы?

Сид-фразы обязательны для обеспечения безопасности и доступности вашего криптоимущества. Они позволяют восстановить возможность доступа к кошельку в случае утери или повреждения физического устройства, на котором он хранится. Благодаря сид-фразам вы можете легко создавать резервные копии своего кошелька и хранить их в безопасном месте.

Как обеспечить безопасность сид-фраз кошельков?

Никогда не делитесь сид-фразой ни с кем. Сид-фраза является вашим ключом к кошельку, и ее раскрытие может привести к утере вашего криптоимущества.

Храните сид-фразу в надежном месте. Используйте физически секурные места, такие как банковские ячейки или специализированные аппаратные кошельки, для хранения вашей сид-фразы.

Создавайте резервные копии сид-фразы. Регулярно создавайте резервные копии вашей сид-фразы и храните их в разных безопасных местах, чтобы обеспечить вход к вашему кошельку в случае утери или повреждения.

Используйте дополнительные меры безопасности. Включите двухфакторную верификацию и другие методы защиты для своего кошелька криптовалюты, чтобы обеспечить дополнительный уровень безопасности.

Заключение

Сид-фразы кошельков криптовалют являются ключевым элементом секурного хранения криптоимущества. Следуйте рекомендациям по безопасности, чтобы защитить свою сид-фразу и обеспечить безопасность своих криптовалютных средств.

слив сид фраз

Слив мнемонических фраз (seed phrases) является одним из наиболее популярных способов утечки личных информации в мире криптовалют. В этой статье мы разберем, что такое сид фразы, по какой причине они важны и как можно защититься от их утечки.

Что такое сид фразы?

Сид фразы, или мнемонические фразы, являются комбинацию слов, которая используется для создания или восстановления кошелька криптовалюты. Обычно сид фраза состоит из 12 или 24 слов, которые отражают собой ключ к вашему кошельку. Потеря или утечка сид фразы может привести к потере доступа к вашим криптовалютным средствам.

Почему важно защищать сид фразы?

Сид фразы представляют собой ключевым элементом для защищенного хранения криптовалюты. Если злоумышленники получат доступ к вашей сид фразе, они будут в состоянии получить доступ к вашему кошельку и украсть все средства.

Как защититься от утечки сид фраз?

Никогда не передавайте свою сид фразу любому, даже если вам происходит, что это доверенное лицо или сервис.

Храните свою сид фразу в безопасном и защищенном месте. Рекомендуется использовать аппаратные кошельки или специальные программы для хранения сид фразы.

Используйте дополнительные методы защиты, такие как двусторонняя аутентификация, для усиления безопасности вашего кошелька.

Регулярно делайте резервные копии своей сид фразы и храните их в разных безопасных местах.

Заключение

Слив сид фраз является существенной угрозой для безопасности владельцев криптовалют. Понимание важности защиты сид фразы и принятие соответствующих мер безопасности помогут вам избежать потери ваших криптовалютных средств. Будьте бдительны и обеспечивайте надежную защиту своей сид фразы

Структура Backlinks

После того, как многочисленных обновлений поисковой системы G необходимо внедрять разные варианты ранжирования.

Сегодня есть способ привлечь внимание поисковых систем к вашему сайту с помощью бэклинков.

Обратные ссылки представляют собой эффективный инструмент продвижения, но и являются источником органического трафика, хотя прямых продаж с этих ресурсов скорее всего не будет, но переходы будут, и именно органического трафика мы также получаем.

Что в итоге получим на выходе:

Мы демонстрируем сайт поисковым системам с помощью обратных ссылок.

Получают органические переходы на сайт, а это также информация для поисковых систем, что ресурс пользуется спросом у пользователей.

Как мы демонстрируем поисковым системам, что сайт ликвиден:

1 ссылка на главную страницу, где содержится основная информация, создается.

Создаем обратные ссылки с использованием редиректов с доверенных сайтов.

Основное – мы индексируем сайт с помощью специальных инструментов анализа веб-сайтов, сайт заносится в кеш этих инструментов, после чего полученные ссылки мы публикуем в качестве редиректов на блогах, форумах, в комментариях.

Это важное действие показывает поисковым системамКАРТУ САЙТА, так как анализаторы сайтов отображают всю информацию о сайтах со всеми ключевыми словами и заголовками и это очень ХОРОШО

What a stuff of un-ambiguity and preserveness of precious experience regarding unexpected feelings.

grocery store pharmacy

[url=https://lisinoprilgp.com/]prinivil 5 mg[/url]

[url=https://happyfamilymedicalstore.online/]mexican pharmacies online drugs[/url]

Wonderful, what a blog it is! This website provides helpful facts to us, keep it up.

https:/diploman-rossiya.com/

В нашем обществе, где диплом становится началом удачной карьеры в любом направлении, многие стараются найти максимально простой путь получения образования. Наличие документа об образовании переоценить попросту невозможно. Ведь именно он открывает двери перед людьми, желающими начать трудовую деятельность или продолжить обучение в высшем учебном заведении.

В данном контексте мы предлагаем быстро получить этот необходимый документ. Вы имеете возможность купить диплом, и это является удачным решением для человека, который не смог закончить обучение или утратил документ. Любой диплом изготавливается с особой аккуратностью, вниманием к мельчайшим нюансам. В итоге вы сможете получить 100% оригинальный документ.

Превосходство этого решения состоит не только в том, что вы сможете быстро получить свой диплом. Весь процесс организовывается комфортно и легко, с профессиональной поддержкой. От выбора подходящего образца диплома до точного заполнения персональных данных и доставки по России — все будет находиться под полным контролем качественных специалистов.

Для тех, кто хочет найти быстрый и простой способ получить необходимый документ, наша компания предлагает отличное решение. Купить диплом – это значит избежать долгого процесса обучения и сразу переходить к важным целям: к поступлению в ВУЗ или к началу трудовой карьеры.

http://diplomanc-russia24.com

В нашем мире, где диплом является началом удачной карьеры в любом направлении, многие ищут максимально быстрый путь получения качественного образования. Наличие официального документа об образовании переоценить невозможно. Ведь диплом открывает двери перед любым человеком, который желает начать трудовую деятельность или учиться в университете.

В данном контексте мы предлагаем очень быстро получить этот необходимый документ. Вы имеете возможность купить диплом, что будет выгодным решением для человека, который не смог завершить образование, утратил документ или желает исправить плохие оценки. диплом изготавливается с особой тщательностью, вниманием ко всем нюансам. В итоге вы сможете получить полностью оригинальный документ.

Преимущества этого решения заключаются не только в том, что можно оперативно получить диплом. Весь процесс организовывается удобно и легко, с профессиональной поддержкой. От выбора подходящего образца документа до консультации по заполнению персональных данных и доставки по России — все будет находиться под абсолютным контролем качественных мастеров.

Всем, кто ищет оперативный способ получить необходимый документ, наша услуга предлагает выгодное решение. Приобрести диплом – это значит избежать продолжительного обучения и сразу переходить к достижению своих целей: к поступлению в ВУЗ или к началу удачной карьеры.

http://diplomanc-russia24.com

[url=http://tadalafilu.online/]can i buy tadalafil in canada[/url]

I needed to create you one very small remark to be able to thank you very much as before with the awesome secrets you’ve provided on this site. It has been open-handed with you to deliver easily precisely what numerous people would have marketed for an electronic book to get some dough for themselves, most importantly seeing that you might well have tried it if you ever desired. The secrets additionally acted like the great way to realize that the rest have a similar fervor really like my personal own to realize very much more concerning this matter. I know there are several more enjoyable times up front for many who look into your site.

100mg sildenafil

bupropion target pharmacy

В нашем мире, где диплом – это начало удачной карьеры в любой области, многие стараются найти максимально быстрый и простой путь получения качественного образования. Наличие официального документа об образовании переоценить попросту невозможно. Ведь диплом открывает дверь перед всеми, кто собирается вступить в профессиональное сообщество или учиться в высшем учебном заведении.

Мы предлагаем оперативно получить этот важный документ. Вы имеете возможность приобрести диплом нового или старого образца, что является удачным решением для всех, кто не смог завершить образование или потерял документ. Все дипломы производятся аккуратно, с максимальным вниманием к мельчайшим нюансам. В результате вы получите полностью оригинальный документ.

Преимущество этого подхода состоит не только в том, что можно оперативно получить диплом. Весь процесс организован просто и легко, с нашей поддержкой. Начиная от выбора необходимого образца диплома до грамотного заполнения личных данных и доставки в любой регион страны — все под абсолютным контролем качественных мастеров.

Для тех, кто ищет оперативный способ получить необходимый документ, наша компания может предложить выгодное решение. Приобрести диплом – значит избежать длительного процесса обучения и не теряя времени перейти к достижению своих целей: к поступлению в ВУЗ или к началу успешной карьеры.

vuzdiploma

[url=https://tadalafi.online/]cheapest tadalafil cost[/url]

I highly advise steer clear of this platform. My own encounter with it has been only frustration along with concerns regarding deceptive behavior. Exercise extreme caution, or better yet, find a trustworthy platform to meet your needs.

В нашем мире, где диплом – это начало удачной карьеры в любой сфере, многие ищут максимально быстрый путь получения качественного образования. Факт наличия документа об образовании трудно переоценить. Ведь именно диплом открывает дверь перед любым человеком, который желает начать трудовую деятельность или учиться в каком-либо институте.

Мы предлагаем быстро получить этот важный документ. Вы сможете купить диплом нового или старого образца, и это является отличным решением для человека, который не смог закончить образование, потерял документ или желает исправить плохие оценки. диплом изготавливается с особой аккуратностью, вниманием к мельчайшим элементам, чтобы в результате получился продукт, максимально соответствующий оригиналу.

Преимущество подобного подхода состоит не только в том, что можно оперативно получить свой диплом. Весь процесс организовывается удобно, с нашей поддержкой. Начиная от выбора подходящего образца диплома до консультаций по заполнению персональных данных и доставки по России — все под абсолютным контролем наших специалистов.

Всем, кто хочет найти быстрый и простой способ получения требуемого документа, наша компания готова предложить отличное решение. Приобрести диплом – это значит избежать длительного процесса обучения и сразу перейти к личным целям: к поступлению в ВУЗ или к началу трудовой карьеры.

http://www.diplomvam.ru

Pretty! This was an extremely wonderful article. Thanks for supplying these details.

https://cinemarus.ru/

tramadol pharmacy reviews

Player線上娛樂城遊戲指南與評測

台灣最佳線上娛樂城遊戲的終極指南!我們提供專業評測,分析熱門老虎機、百家樂、棋牌及其他賭博遊戲。從遊戲規則、策略到選擇最佳娛樂城,我們全方位覆蓋,協助您更安全的遊玩。

Player如何評測:公正與專業的評分標準

在【Player娛樂城遊戲評測網】我們致力於為玩家提供最公正、最專業的娛樂城評測。我們的評測過程涵蓋多個關鍵領域,旨在確保玩家獲得可靠且全面的信息。以下是我們評測娛樂城的主要步驟:

娛樂城是什麼?

娛樂城是什麼?娛樂城是台灣對於線上賭場的特別稱呼,線上賭場分為幾種:現金版、信用版、手機娛樂城(娛樂城APP),一般來說,台灣人在稱娛樂城時,是指現金版線上賭場。

線上賭場在別的國家也有別的名稱,美國 – Casino, Gambling、中國 – 线上赌场,娱乐城、日本 – オンラインカジノ、越南 – Nhà cái。

娛樂城會被抓嗎?

在台灣,根據刑法第266條,不論是實體或線上賭博,參與賭博的行為可處最高5萬元罰金。而根據刑法第268條,為賭博提供場所並意圖營利的行為,可能面臨3年以下有期徒刑及最高9萬元罰金。一般賭客若被抓到,通常被視為輕微罪行,原則上不會被判處監禁。

信用版娛樂城是什麼?

信用版娛樂城是一種線上賭博平台,其中的賭博活動不是直接以現金進行交易,而是基於信用系統。在這種模式下,玩家在進行賭博時使用虛擬的信用點數或籌碼,這些點數或籌碼代表了一定的貨幣價值,但實際的金錢交易會在賭博活動結束後進行結算。

現金版娛樂城是什麼?

現金版娛樂城是一種線上博弈平台,其中玩家使用實際的金錢進行賭博活動。玩家需要先存入真實貨幣,這些資金轉化為平台上的遊戲籌碼或信用,用於參與各種賭場遊戲。當玩家贏得賭局時,他們可以將這些籌碼或信用兌換回現金。

娛樂城體驗金是什麼?

娛樂城體驗金是娛樂場所為新客戶提供的一種免費遊玩資金,允許玩家在不需要自己投入任何資金的情況下,可以進行各類遊戲的娛樂城試玩。這種體驗金的數額一般介於100元到1,000元之間,且對於如何使用這些體驗金以達到提款條件,各家娛樂城設有不同的規則。

На сегодняшний день, когда диплом – это начало отличной карьеры в любой отрасли, многие пытаются найти максимально простой путь получения образования. Важность наличия документа об образовании трудно переоценить. Ведь именно он открывает дверь перед каждым человеком, который собирается начать профессиональную деятельность или продолжить обучение в любом ВУЗе.

В данном контексте мы предлагаем оперативно получить этот важный документ. Вы сможете приобрести диплом старого или нового образца, и это будет выгодным решением для всех, кто не смог завершить обучение, потерял документ или желает исправить свои оценки. Любой диплом изготавливается аккуратно, с максимальным вниманием ко всем нюансам, чтобы в итоге получился 100% оригинальный документ.

Превосходство такого решения состоит не только в том, что вы сможете оперативно получить диплом. Процесс организован просто и легко, с нашей поддержкой. От выбора необходимого образца документа до точного заполнения личной информации и доставки в любое место России — все будет находиться под абсолютным контролем опытных мастеров.

Для всех, кто хочет найти максимально быстрый способ получить необходимый документ, наша компания предлагает отличное решение. Заказать диплом – значит избежать долгого процесса обучения и не теряя времени переходить к своим целям: к поступлению в ВУЗ или к началу успешной карьеры.

diplomany.ru

[url=http://predniso.online/]canadian online pharmacy prednisone[/url]

Player線上娛樂城遊戲指南與評測

台灣最佳線上娛樂城遊戲的終極指南!我們提供專業評測,分析熱門老虎機、百家樂、棋牌及其他賭博遊戲。從遊戲規則、策略到選擇最佳娛樂城,我們全方位覆蓋,協助您更安全的遊玩。

Player如何評測:公正與專業的評分標準

在【Player娛樂城遊戲評測網】我們致力於為玩家提供最公正、最專業的娛樂城評測。我們的評測過程涵蓋多個關鍵領域,旨在確保玩家獲得可靠且全面的信息。以下是我們評測娛樂城的主要步驟:

娛樂城是什麼?

娛樂城是什麼?娛樂城是台灣對於線上賭場的特別稱呼,線上賭場分為幾種:現金版、信用版、手機娛樂城(娛樂城APP),一般來說,台灣人在稱娛樂城時,是指現金版線上賭場。

線上賭場在別的國家也有別的名稱,美國 – Casino, Gambling、中國 – 线上赌场,娱乐城、日本 – オンラインカジノ、越南 – Nhà cái。

娛樂城會被抓嗎?

在台灣,根據刑法第266條,不論是實體或線上賭博,參與賭博的行為可處最高5萬元罰金。而根據刑法第268條,為賭博提供場所並意圖營利的行為,可能面臨3年以下有期徒刑及最高9萬元罰金。一般賭客若被抓到,通常被視為輕微罪行,原則上不會被判處監禁。

信用版娛樂城是什麼?

信用版娛樂城是一種線上賭博平台,其中的賭博活動不是直接以現金進行交易,而是基於信用系統。在這種模式下,玩家在進行賭博時使用虛擬的信用點數或籌碼,這些點數或籌碼代表了一定的貨幣價值,但實際的金錢交易會在賭博活動結束後進行結算。

現金版娛樂城是什麼?

現金版娛樂城是一種線上博弈平台,其中玩家使用實際的金錢進行賭博活動。玩家需要先存入真實貨幣,這些資金轉化為平台上的遊戲籌碼或信用,用於參與各種賭場遊戲。當玩家贏得賭局時,他們可以將這些籌碼或信用兌換回現金。

娛樂城體驗金是什麼?

娛樂城體驗金是娛樂場所為新客戶提供的一種免費遊玩資金,允許玩家在不需要自己投入任何資金的情況下,可以進行各類遊戲的娛樂城試玩。這種體驗金的數額一般介於100元到1,000元之間,且對於如何使用這些體驗金以達到提款條件,各家娛樂城設有不同的規則。

娛樂城推薦

Player線上娛樂城遊戲指南與評測

台灣最佳線上娛樂城遊戲的終極指南!我們提供專業評測,分析熱門老虎機、百家樂、棋牌及其他賭博遊戲。從遊戲規則、策略到選擇最佳娛樂城,我們全方位覆蓋,協助您更安全的遊玩。

Player如何評測:公正與專業的評分標準

在【Player娛樂城遊戲評測網】我們致力於為玩家提供最公正、最專業的娛樂城評測。我們的評測過程涵蓋多個關鍵領域,旨在確保玩家獲得可靠且全面的信息。以下是我們評測娛樂城的主要步驟:

娛樂城是什麼?

娛樂城是什麼?娛樂城是台灣對於線上賭場的特別稱呼,線上賭場分為幾種:現金版、信用版、手機娛樂城(娛樂城APP),一般來說,台灣人在稱娛樂城時,是指現金版線上賭場。

線上賭場在別的國家也有別的名稱,美國 – Casino, Gambling、中國 – 线上赌场,娱乐城、日本 – オンラインカジノ、越南 – Nhà cái。

娛樂城會被抓嗎?

在台灣,根據刑法第266條,不論是實體或線上賭博,參與賭博的行為可處最高5萬元罰金。而根據刑法第268條,為賭博提供場所並意圖營利的行為,可能面臨3年以下有期徒刑及最高9萬元罰金。一般賭客若被抓到,通常被視為輕微罪行,原則上不會被判處監禁。

信用版娛樂城是什麼?

信用版娛樂城是一種線上賭博平台,其中的賭博活動不是直接以現金進行交易,而是基於信用系統。在這種模式下,玩家在進行賭博時使用虛擬的信用點數或籌碼,這些點數或籌碼代表了一定的貨幣價值,但實際的金錢交易會在賭博活動結束後進行結算。

現金版娛樂城是什麼?

現金版娛樂城是一種線上博弈平台,其中玩家使用實際的金錢進行賭博活動。玩家需要先存入真實貨幣,這些資金轉化為平台上的遊戲籌碼或信用,用於參與各種賭場遊戲。當玩家贏得賭局時,他們可以將這些籌碼或信用兌換回現金。

娛樂城體驗金是什麼?

娛樂城體驗金是娛樂場所為新客戶提供的一種免費遊玩資金,允許玩家在不需要自己投入任何資金的情況下,可以進行各類遊戲的娛樂城試玩。這種體驗金的數額一般介於100元到1,000元之間,且對於如何使用這些體驗金以達到提款條件,各家娛樂城設有不同的規則。

[url=http://lisinoprilgp.com/]lisinopril cost 40 mg[/url]

Как обезопасить свои личные данные: остерегайтесь утечек информации в интернете. Сегодня обеспечение безопасности информации становится более насущной важной задачей. Одним из наиболее распространенных способов утечки личной информации является слив «сит фраз» в интернете. Что такое сит фразы и в каком объеме сберечься от их утечки? Что такое «сит фразы»? «Сит фразы» — это синтезы слов или фраз, которые регулярно используются для доступа к различным онлайн-аккаунтам. Эти фразы могут включать в себя имя пользователя, пароль или другие конфиденциальные данные. Киберпреступники могут пытаться получить доступ к вашим аккаунтам, используя этих сит фраз. Как сохранить свои личные данные? Используйте сложные пароли. Избегайте использования очевидных паролей, которые легко угадать. Лучше всего использовать комбинацию букв, цифр и символов. Используйте уникальные пароли для всего аккаунта. Не пользуйтесь один и тот же пароль для разных сервисов. Используйте двухступенчатую аутентификацию (2FA). Это прибавляет дополнительный уровень безопасности, требуя подтверждение входа на ваш аккаунт путем другое устройство или метод. Будьте осторожны с онлайн-сервисами. Не доверяйте личную информацию ненадежным сайтам и сервисам. Обновляйте программное обеспечение. Установите обновления для вашего операционной системы и программ, чтобы предохранить свои данные от вредоносного ПО. Вывод Слив сит фраз в интернете может спровоцировать серьезным последствиям, таким как кража личной информации и финансовых потерь. Чтобы сохранить себя, следует принимать меры предосторожности и использовать надежные методы для хранения и управления своими личными данными в сети

sildenafil dose

даркнет сливы тг

Даркнет и сливы в Телеграме

Даркнет – это сегмент интернета, которая не индексируется обычными поисковыми системами и требует особых программных средств для доступа. В даркнете существует масса скрытых сайтов, где можно найти различные товары и услуги, в том числе и нелегальные.

Одним из популярных способов распространения информации в даркнете является использование мессенджера Телеграм. Телеграм предоставляет возможность создания закрытых каналов и чатов, где пользователи могут обмениваться информацией, в том числе и нелегальной.

Сливы информации в Телеграме – это метод распространения конфиденциальной информации, такой как украденные данные, базы данных, персональные сведения и другие материалы. Эти сливы могут включать в себя информацию о кредитных картах, паролях, персональных сообщениях и даже фотографиях.

Сливы в Телеграме могут быть опасными, так как они могут привести к утечке конфиденциальной информации и нанести ущерб репутации и финансовым интересам людей. Поэтому важно быть бдительным при обмене информацией в интернете и не доверять сомнительным источникам.

Вот кошельки с балансом у бота

кошелек с балансом купить

Криптокошельки с балансом: зачем их покупают и как использовать

В мире криптовалют все расширяющуюся популярность приобретают криптокошельки с предустановленным балансом. Это специальные кошельки, которые уже содержат определенное количество криптовалюты на момент покупки. Но зачем люди приобретают такие кошельки, и как правильно использовать их?

Почему покупают криптокошельки с балансом?

Удобство: Криптокошельки с предустановленным балансом предлагаются как готовое к работе решение для тех, кто хочет быстро начать пользоваться криптовалютой без необходимости покупки или обмена на бирже.

Подарок или награда: Иногда криптокошельки с балансом используются как подарок или вознаграждение в рамках акций или маркетинговых кампаний.

Анонимность: При покупке криптокошелька с балансом нет необходимости предоставлять личные данные, что может быть важно для тех, кто ценит анонимность.

Как использовать криптокошелек с балансом?

Проверьте безопасность: Убедитесь, что кошелек безопасен и не подвержен взлому. Проверьте репутацию продавца и источник приобретения кошелька.

Переведите средства на другой кошелек: Если вы хотите долгосрочно хранить криптовалюту, рекомендуется перевести средства на более безопасный или комфортный для вас кошелек.

Не храните все средства на одном кошельке: Для обеспечения безопасности рекомендуется распределить средства между несколькими кошельками.

Будьте осторожны с фишингом и мошенничеством: Помните, что мошенники могут пытаться обмануть вас, предлагая криптокошельки с балансом с целью получения доступа к вашим средствам.

Заключение

Криптокошельки с балансом могут быть удобным и скорым способом начать пользоваться криптовалютой, но необходимо помнить о безопасности и осторожности при их использовании.Выбор и приобретение криптокошелька с балансом – это весомый шаг, который требует внимания к деталям и осознанного подхода.”

Слив мнемонических фраз (seed phrases) является одной из наиболее популярных способов утечки личных информации в мире криптовалют. В этой статье мы разберем, что такое сид фразы, по какой причине они важны и как можно защититься от их утечки.

Что такое сид фразы?

Сид фразы, или мнемонические фразы, формируют комбинацию слов, которая используется для создания или восстановления кошелька криптовалюты. Обычно сид фраза состоит из 12 или 24 слов, которые являются собой ключ к вашему кошельку. Потеря или утечка сид фразы может привести к потере доступа к вашим криптовалютным средствам.

Почему важно защищать сид фразы?

Сид фразы являются ключевым элементом для защищенного хранения криптовалюты. Если злоумышленники получат доступ к вашей сид фразе, они смогут получить доступ к вашему кошельку и украсть все средства.

Как защититься от утечки сид фраз?

Никогда не передавайте свою сид фразу ничьему, даже если вам кажется, что это проверенное лицо или сервис.

Храните свою сид фразу в безопасном и секурном месте. Рекомендуется использовать аппаратные кошельки или специальные программы для хранения сид фразы.

Используйте дополнительные методы защиты, такие как двухфакторная аутентификация (2FA), для усиления безопасности вашего кошелька.

Регулярно делайте резервные копии своей сид фразы и храните их в разнообразных безопасных местах.

Заключение

Слив сид фраз является существенной угрозой для безопасности владельцев криптовалют. Понимание важности защиты сид фразы и принятие соответствующих мер безопасности помогут вам избежать потери ваших криптовалютных средств. Будьте бдительны и обеспечивайте надежную защиту своей сид фразы

В современном мире, где диплом – это начало успешной карьеры в любой области, многие ищут максимально быстрый и простой путь получения образования. Наличие официального документа об образовании трудно переоценить. Ведь именно он открывает двери перед всеми, кто желает начать профессиональную деятельность или продолжить обучение в высшем учебном заведении.

В данном контексте наша компания предлагает очень быстро получить этот важный документ. Вы имеете возможность приобрести диплом нового или старого образца, и это будет удачным решением для всех, кто не смог закончить образование, потерял документ или хочет исправить плохие оценки. Все дипломы изготавливаются аккуратно, с особым вниманием к мельчайшим деталям. В итоге вы сможете получить продукт, полностью соответствующий оригиналу.

Преимущества подобного решения заключаются не только в том, что вы сможете оперативно получить диплом. Процесс организован удобно, с нашей поддержкой. Начиная от выбора подходящего образца документа до правильного заполнения личной информации и доставки в любой регион России — все будет находиться под абсолютным контролем качественных мастеров.

Для всех, кто пытается найти быстрый способ получить необходимый документ, наша компания может предложить выгодное решение. Купить диплом – значит избежать долгого обучения и не теряя времени переходить к достижению своих целей, будь то поступление в университет или начало карьеры.

vsediplomu.ru

[url=https://olisinopril.com/]lisinopril 40 mg mexico[/url]

[url=http://happyfamilymedicalstore.online/]capsule online pharmacy[/url]

[url=http://bestmedsx.com/]canadianpharmacymeds com[/url]

[url=https://tadalafi.online/]cheap tadalafil 20mg[/url]

На сегодняшний день, когда диплом является началом отличной карьеры в любой сфере, многие ищут максимально быстрый путь получения качественного образования. Наличие официального документа об образовании переоценить невозможно. Ведь именно он открывает дверь перед любым человеком, который стремится вступить в профессиональное сообщество или учиться в университете.

В данном контексте наша компания предлагает оперативно получить любой необходимый документ. Вы сможете приобрести диплом нового или старого образца, что становится отличным решением для человека, который не смог закончить обучение или потерял документ. дипломы выпускаются с особой тщательностью, вниманием ко всем деталям, чтобы в итоге получился полностью оригинальный документ.

Плюсы подобного решения состоят не только в том, что вы сможете быстро получить свой диплом. Весь процесс организован удобно и легко, с профессиональной поддержкой. Начав от выбора нужного образца до консультации по заполнению личной информации и доставки по стране — все будет находиться под полным контролем квалифицированных мастеров.

Для всех, кто ищет оперативный способ получения необходимого документа, наша компания предлагает отличное решение. Приобрести диплом – это значит избежать длительного процесса обучения и сразу перейти к достижению своих целей: к поступлению в ВУЗ или к началу трудовой карьеры.

http://www.ab-diplom.ru

Thank you for sharing your info. I really appreciate your efforts and I will be waiting for your further post thanks once again.

https://animemedia.me/

I think that everything said made a ton of sense. However, what about this? what if you wrote a catchier title? I ain’t suggesting your information isn’t solid., however suppose you added a headline that makes people desire more? I mean %BLOG_TITLE% is kinda vanilla. You should peek at Yahoo’s front page and see how they create article headlines to get people interested. You might add a video or a related pic or two to grab readers interested about what you’ve written. Just my opinion, it might make your posts a little bit more interesting.

https://cinemarus.ru/

هنا النص مع استخدام السبينتاكس:

“بناء الروابط الخلفية

بعد التحديثات العديدة لمحرك البحث G، تحتاج إلى تطويق خيارات ترتيب مختلفة.

هناك أسلوب لجذب انتباه محركات البحث إلى موقعك على الويب باستخدام الروابط الخلفية.

الروابط الخلفية ليست فقط أداة فعالة للترويج، ولكن تتضمن أيضًا حركة مرور عضوية، والمبيعات المباشرة من هذه الموارد على الأرجح ستكون كذلك، ولكن الانتقالات ستكون، وهي حركة المرور التي نحصل عليها أيضًا.

ما سوف نحصل عليه في النهاية في النهاية في الإخراج:

نعرض الموقع لمحركات البحث من خلال الروابط الخلفية.

2- نحصل على تبديلات عضوية إلى الموقع، وهي أيضًا إشارة لمحركات البحث أن المورد يستخدمه الناس.

كيف نظهر لمحركات البحث أن الموقع سائل:

1 يتم عمل صلة خلفي للصفحة الرئيسية حيث المعلومات الرئيسية

نقوم بعمل صلات خلفية من خلال عمليات توجيه المواقع الموثوقة

الأهم من ذلك أننا نضع الموقع على أداة منفصلة من أدوات تحليل المواقع، ويدخل الموقع في ذاكرة التخزين المؤقت لهذه المحللات، ثم الروابط المستلمة التي نضعها كتوجيه مرة أخرى على المدونات والمنتديات والتعليقات.

هذا التدبير المهم يبين لمحركات البحث خريطة الموقع، حيث تعرض أدوات تحليل المواقع جميع المعلومات عن المواقع مع جميع الكلمات الرئيسية والعناوين وهو شيء جيد جداً

جميع المعلومات عن خدماتنا على الموقع!

[url=https://bestprednisone.online/]prednisone order online uk[/url]

Kantorbola adalah situs slot gacor terbaik di indonesia , kunjungi situs RTP kantor bola untuk mendapatkan informasi akurat slot dengan rtp diatas 95% . Kunjungi juga link alternatif kami di kantorbola77 dan kantorbola99 .

В нашем обществе, где диплом – это начало удачной карьеры в любом направлении, многие пытаются найти максимально быстрый и простой путь получения качественного образования. Факт наличия официального документа переоценить попросту невозможно. Ведь диплом открывает дверь перед всеми, кто стремится вступить в профессиональное сообщество или продолжить обучение в ВУЗе.

В данном контексте мы предлагаем быстро получить этот важный документ. Вы сможете купить диплом, что является удачным решением для всех, кто не смог закончить обучение или утратил документ. дипломы выпускаются с особой тщательностью, вниманием к мельчайшим деталям, чтобы в результате получился полностью оригинальный документ.

Преимущества такого решения заключаются не только в том, что можно оперативно получить свой диплом. Весь процесс организовывается комфортно, с нашей поддержкой. От выбора подходящего образца документа до консультаций по заполнению личных данных и доставки в любой регион страны — все будет находиться под абсолютным контролем качественных специалистов.

Для тех, кто хочет найти оперативный способ получения требуемого документа, наша компания предлагает выгодное решение. Заказать диплом – это значит избежать долгого обучения и не теряя времени перейти к личным целям, будь то поступление в ВУЗ или начало карьеры.

http://www.diplomexpress.ru

I strongly recommend steer clear of this site. The experience I had with it has been nothing but dismay along with concerns regarding scamming practices. Proceed with extreme caution, or better yet, look for an honest site to meet your needs.

В нашем мире, где диплом становится началом отличной карьеры в любом направлении, многие пытаются найти максимально быстрый и простой путь получения качественного образования. Важность наличия официального документа сложно переоценить. Ведь именно диплом открывает двери перед каждым человеком, желающим вступить в профессиональное сообщество или продолжить обучение в университете.

В данном контексте мы предлагаем максимально быстро получить этот необходимый документ. Вы сможете заказать диплом нового или старого образца, и это является отличным решением для всех, кто не смог закончить обучение или потерял документ. дипломы производятся с особой аккуратностью, вниманием ко всем элементам. В результате вы получите документ, 100% соответствующий оригиналу.

Преимущество данного подхода заключается не только в том, что можно максимально быстро получить диплом. Весь процесс организован комфортно, с профессиональной поддержкой. От выбора необходимого образца документа до консультаций по заполнению личной информации и доставки по стране — все под полным контролем наших специалистов.

В результате, для всех, кто пытается найти быстрый способ получить требуемый документ, наша компания предлагает выгодное решение. Заказать диплом – это значит избежать продолжительного процесса обучения и сразу перейти к достижению собственных целей, будь то поступление в ВУЗ или старт карьеры.

http://www.99diplomov.ru

В нашем мире, где диплом – это начало успешной карьеры в любом направлении, многие ищут максимально быстрый путь получения образования. Наличие официального документа переоценить попросту невозможно. Ведь диплом открывает дверь перед каждым человеком, желающим вступить в профессиональное сообщество или учиться в университете.

Мы предлагаем очень быстро получить любой необходимый документ. Вы можете приобрести диплом нового или старого образца, и это будет отличным решением для человека, который не смог завершить образование или потерял документ. дипломы изготавливаются с особой тщательностью, вниманием ко всем элементам. В результате вы получите документ, 100% соответствующий оригиналу.

Плюсы такого решения состоят не только в том, что вы сможете оперативно получить свой диплом. Весь процесс организован удобно, с нашей поддержкой. От выбора необходимого образца до точного заполнения персональной информации и доставки в любой регион России — все под абсолютным контролем опытных специалистов.

Всем, кто ищет быстрый способ получения необходимого документа, наша компания готова предложить отличное решение. Купить диплом – это значит избежать долгого процесса обучения и не теряя времени перейти к личным целям, будь то поступление в ВУЗ или начало карьеры.

ab-diplom.ru

[url=https://valtrexmedication.com/]valtrex for sale[/url]

[url=https://bestmedsx.com/]mexican pharmacy what to buy[/url]

[url=http://happyfamilystorerx.online/]online pharmacy delivery[/url]

В современном мире, где диплом – это начало отличной карьеры в любой отрасли, многие стараются найти максимально быстрый путь получения качественного образования. Необходимость наличия официального документа сложно переоценить. Ведь именно диплом открывает дверь перед любым человеком, желающим вступить в сообщество профессионалов или учиться в университете.

В данном контексте мы предлагаем оперативно получить этот необходимый документ. Вы имеете возможность купить диплом нового или старого образца, что становится отличным решением для человека, который не смог завершить обучение, потерял документ или желает исправить плохие оценки. диплом изготавливается с особой тщательностью, вниманием ко всем элементам, чтобы в результате получился продукт, 100% соответствующий оригиналу.

Преимущества подобного подхода состоят не только в том, что вы быстро получите диплом. Весь процесс организован комфортно, с нашей поддержкой. Начиная от выбора требуемого образца до консультации по заполнению персональной информации и доставки по России — все будет находиться под полным контролем опытных специалистов.

В итоге, для всех, кто ищет быстрый и простой способ получить необходимый документ, наша компания предлагает отличное решение. Заказать диплом – это значит избежать долгого процесса обучения и не теряя времени переходить к достижению своих целей: к поступлению в университет или к началу успешной карьеры.

https://diplom-msk.ru/

В современном мире, где диплом становится началом успешной карьеры в любой отрасли, многие стараются найти максимально быстрый путь получения образования. Важность наличия официального документа сложно переоценить. Ведь именно он открывает двери перед любым человеком, желающим начать профессиональную деятельность или учиться в каком-либо университете.

Мы предлагаем оперативно получить любой необходимый документ. Вы можете приобрести диплом нового или старого образца, и это является выгодным решением для всех, кто не смог завершить обучение, утратил документ или хочет исправить плохие оценки. диплом изготавливается с особой тщательностью, вниманием к мельчайшим элементам. На выходе вы получите документ, максимально соответствующий оригиналу.

Преимущества данного решения состоят не только в том, что вы сможете максимально быстро получить свой диплом. Процесс организован комфортно, с нашей поддержкой. От выбора необходимого образца до грамотного заполнения персональных данных и доставки в любое место страны — все под абсолютным контролем качественных мастеров.

Всем, кто ищет оперативный способ получения необходимого документа, наша компания предлагает отличное решение. Купить диплом – это значит избежать длительного процесса обучения и не теряя времени переходить к достижению своих целей, будь то поступление в ВУЗ или начало успешной карьеры.

http://www.diplom-gotovie.ru

[url=https://synthroidam.online/]synthroid 25 mcg tablet[/url]

[url=http://happyfamilystorerx.online/]best no prescription pharmacy[/url]

[url=https://happyfamilystorerx.online/]safe reliable canadian pharmacy[/url]

[url=https://synthroidsl.online/]synthroid brand cost[/url]

That is very attention-grabbing, You’re an excessively skilled blogger. I’ve joined your feed and look ahead to looking for extra of your excellent post. Additionally, I have shared your site in my social networks

http://www.diplom07.ru

[url=https://happyfamilystorerx.online/]happy family medicine[/url]

[url=http://bmtadalafil.online/]tadalafil brand name in india[/url]

[url=https://bmtadalafil.online/]tadalafil india 5mg[/url]

[url=http://synthroidotp.online/]cost of synthroid generic[/url]

В современном мире, где диплом – это начало удачной карьеры в любом направлении, многие пытаются найти максимально простой путь получения качественного образования. Факт наличия официального документа об образовании трудно переоценить. Ведь именно он открывает двери перед людьми, стремящимися вступить в сообщество профессиональных специалистов или продолжить обучение в высшем учебном заведении.

В данном контексте наша компания предлагает быстро получить этот важный документ. Вы можете приобрести диплом, и это будет удачным решением для человека, который не смог завершить обучение, утратил документ или желает исправить плохие оценки. Любой диплом изготавливается с особой аккуратностью, вниманием ко всем нюансам, чтобы в итоге получился продукт, 100% соответствующий оригиналу.

Превосходство этого решения заключается не только в том, что вы быстро получите свой диплом. Процесс организовывается комфортно, с нашей поддержкой. Начав от выбора нужного образца документа до консультаций по заполнению личных данных и доставки по стране — все под полным контролем качественных специалистов.

В итоге, для тех, кто ищет оперативный способ получить необходимый документ, наша компания готова предложить выгодное решение. Купить диплом – значит избежать длительного процесса обучения и сразу переходить к своим целям: к поступлению в университет или к началу успешной карьеры.

russa24-attestats.com

В наше время, когда диплом – это начало удачной карьеры в любой сфере, многие стараются найти максимально простой путь получения образования. Наличие официального документа об образовании трудно переоценить. Ведь диплом открывает дверь перед любым человеком, желающим начать трудовую деятельность или учиться в высшем учебном заведении.

В данном контексте наша компания предлагает быстро получить этот необходимый документ. Вы можете купить диплом нового или старого образца, что является удачным решением для человека, который не смог завершить образование или потерял документ. Все дипломы выпускаются с особой тщательностью, вниманием к мельчайшим нюансам, чтобы на выходе получился продукт, максимально соответствующий оригиналу.

Преимущество этого решения состоит не только в том, что можно оперативно получить свой диплом. Процесс организован комфортно, с профессиональной поддержкой. От выбора подходящего образца до консультации по заполнению персональной информации и доставки по России — все под полным контролем опытных мастеров.

Всем, кто пытается найти оперативный способ получить требуемый документ, наша компания предлагает выгодное решение. Приобрести диплом – значит избежать долгого обучения и сразу перейти к личным целям, будь то поступление в ВУЗ или начало карьеры.

http://saksx-attestats.ru

[url=https://azithromycinps.online/]can you purchase zithromax[/url]

[url=http://bestmedsx.com/]canadian pharmacy world coupon[/url]

[url=https://tadalafilstd.com/]tadalafil 30mg tablet[/url]

[url=http://tadalafilgf.com/]tadalafil 2.5 mg price[/url]

I highly advise to avoid this site. My personal experience with it was purely frustration and concerns regarding scamming practices. Exercise extreme caution, or better yet, seek out a more reputable service for your needs.

[url=http://drugstorepp.online/]canada cloud pharmacy[/url]

[url=https://synthroidx.online/]synthroid prices[/url]

Hello there! This is kind of off topic but I need some help from an established blog. Is it hard to set up your own blog? I’m not very techincal but I can figure things out pretty quick. I’m thinking about setting up my own but I’m not sure where to begin. Do you have any points or suggestions? Thank you

arusak-attestats.ru

[url=http://bmtadalafil.online/]buy tadalafil cheap[/url]

[url=https://bestprednisone.online/]prednisolone prednisone[/url]

[url=http://olisinopril.online/]zestril coupon[/url]

[url=https://happyfamilymedicalstore.online/]top 10 pharmacies in india[/url]

[url=http://ametformin.com/]glucophage 1000 price[/url]

[url=http://oazithromycin.com/]how much is azithromycin 1g[/url]