Discover the importance of organizational alignment and agility in this blog post. Learn how establishing a strong CORE and building a strategy around it can lead to sustainable growth and success. Find out how alignment and agility empower your organization to thrive in an ever-changing business landscape.

Do You Understand Your Costs to Ensure Profitability?

During a recent call with a CEO, we discussed the company’s profitability and what measure they used to drive profit – basically Profit/X. It became apparent that they didn’t have a handle on their costs and what they should be charging to ensure they hit their profit targets. I have addressed this a bit before to ensure that your margins were where you wanted and rejecting low-profit jobs. However, this time the issue is to understand the jobs’ profitability and price new jobs effectively.

The Costs

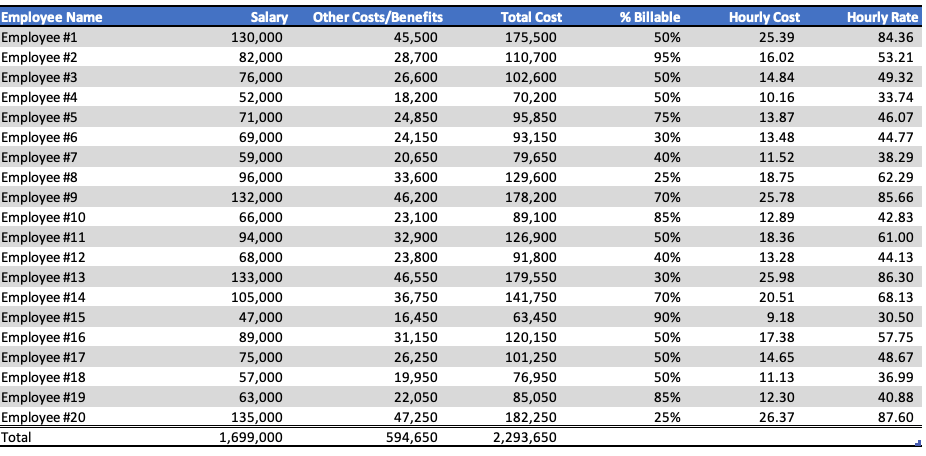

To determine profitability, we need to know our costs. Thus, we built a table listing every employee, the salary, additional expenses, e.g., health insurance, 401k, etc. (estimated at 35% of wages), and the amount of billable time. As a result, we had a table that looked like the one below.

Calculate Hourly Costs

From this Table, we could determine the hourly cost of an employee. To calculate actual costs per hour, we took the number of billable hours, which for 2021 is 8,760, and subtracted 96 hours, the allowable PTO. However, most employees don’t work their total billable hours for various reasons, so we included a “slack” factor of 10%. For multiple reasons, most projects have “re-work” or errors that cannot be billed and estimated at 10% and included. As a result, the total “Billable Hours” was 7,800 rather than 8,760. These adjustments allowed us to produce the hourly cost for each employee.

Calculate Overall Costs

Taking that data, we then divided the hourly costs into billable and non-billable. We added fixed overhead, which was not related to billable expenses, e.g., CEO’s pay, office rent, etc. Thus, we now had a cost structure for the firm that looked as follows.

| Billable Costs | $1,099,150 |

| Non-billable Costs | 1,194,500 |

| Overhead | 750,000 |

| Total Costs | $3,043,650 |

Calculate Revenue

With the company’s cost structure defined, we could determine how much to markup hourly costs to make a 25% profit. Doing this analysis is easy in Excel; however, ensure you don’t make easy Excel mistakes. , and the result was that marking up hourly costs by 232% would enable the company to meet its profit goal. This analysis is shown below.

| Revenue | $4,056,895 |

| Total Costs | 3,043,650 |

| Profit | $1,013,245 |

| Profit Margin | 25% |

Pricing of new projects

While I am a strong proponent of selling value, not time, if the company wants to know the minimum price to charge to realize its minimum profit, it can use this data. Identifying which employees will work on the project and for how long. For example, they would be able to cost it as follows:

| Employee | Hours | Hourly Billable Rate | Total Billable Charge |

| #3 | 25 | $49.32 | $1,233 |

| #6 | 5 | 44.77 | 224 |

| #10 | 20 | 43.83 | 857 |

| #15 | 15 | 30.50 | 457 |

| #17 | 10 | 48.67 | 487 |

| Total | $3,258 |

With this data, we can now estimate jobs more effectively since we know the employees who will work on the jobs and how many hours they will commit. We have to build some waste into that model, but we have a good idea of how to price jobs.

Performance Table

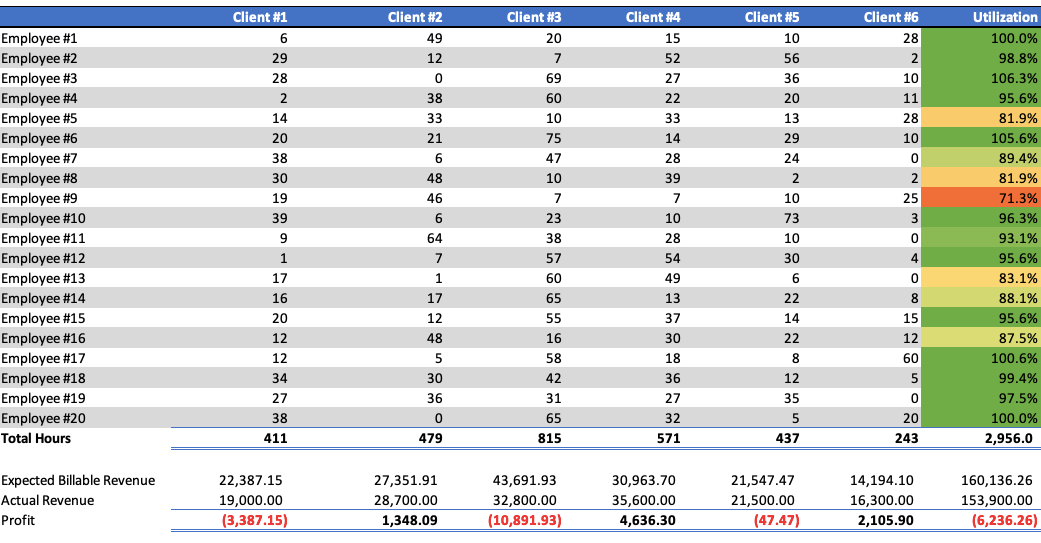

Also, we can see either weekly, monthly, or quarterly how the company is performing. If we produce a table of the employees and clients and hours worked for a month, we can see the utilization of each employee and profit per client as follows.

This table provides a good insight into the company’s and employees’ performance. As can be seen, Employees #3 and #6 are working more than their billable hours with utilization rates above 100%. While this may be good, one would need to ensure that whatever they were supposed to be doing with their non-billable time was being done. Also, Employee #9 is utilized 71.3% of the time, resulting in lost efficiency. Further analysis is required into why this is the case, but it identifies potential issues. Finally, it would appear that nearly half of the employees are working at less than 95% utilization. Given that the company’s utilization is already adjusted for “Slack” and “Rework,” analysis to understand why utilization is low is required.

We cannot only analyze employee performance, but we can see how we are doing with our various contracts. Clients #1 and #3 are losing money, while Client #4 is profitable. The data doesn’t tell us why, but again that would be work investigating as the company is performing below its goal of 25% profit.

Conclusion

As I stated at the beginning, concerning pricing, I strongly believe in pricing according to value and not hours; however, this analysis and methodology are helpful to understand what an organization’s minimum pricing should be and how it is performing. While several issues are highlighted and require more work, this provides a great way of knowing what to examine to improve performance.

If you would like to do this analysis, call me. I would be happy to help you.

Copyright © 2021, Marc A. Borrelli

Recent Posts

Align and Thrive: The Importance of Organizational Alignment and Agility

How to Achieve Smart Time Management: 10 Tips for Busy Professionals

When you are a busy professional running your own business, it can often feel like there aren’t enough hours in the day to accomplish everything. Being strategic with your time is the best (and possibly the only) way to achieve all of your daily tasks. If you are...

5 Strategic Leadership Skills Every Manager Needs

So often, people view leadership as a talent: you’re either born with this quality or you’re not. However, this is not always the case! In reality, good leadership is made up of skills, and anyone can learn how to improve. Some people may pick up leadership attributes...

How the Sellability Score is Calculated: The Ultimate Guide

Do you have questions about how to calculate your business’s sellability score? Whether you’re looking to sell your business in the near future or years from now, understanding your sellability score will help you thrive. The sellability score identifies the...

The Top 5 Benefits of the Entrepreneurial Operating System

As an entrepreneur running your own business, you know there are bumps in the road and struggles that both you and your business will face over time. However, with the right people and tools at your disposal, you can anticipate what’s coming, plan for it, and continue...

5 Ways to Use Email Automation to Boost Traffic

Every single business in the world wants to evolve and grow. This will happen using a variety of techniques and strategies. In 2022, digital marketing is more than a household name, and most companies will adopt at least a few ideas when long-term planning and coming...

6 Questions To Ask A Potential Business Coach Before Hiring Them

Many entrepreneurs consider executive business coaching when they start struggling on their professional path. A small business coach is an experienced professional mentor who educates, supports, and motivates entrepreneurs. They will listen to your concerns, assess...

3 Ways Proper Long Term Strategic Planning Helps Your Business

Dreams turn into goals when they have a foundation of long-term strategic planning supporting them. They become reality when the ensuing strategic implementation plan is executed properly. With Kaizen Solutions as their strategic planning consultant, small and...

What is a Peer Group, and How Can it Improve Your Career?

If you are a CEO or key executive who has come to a crossroads or crisis in your career, you'll gain valuable insights and solutions from a peer group connection more than anywhere else. But what is a peer group, and how can that statement be made with so much...

Profit and Revenue are Lousy Core Values

As I mentioned last week, I am down with COVID and tired, so spending more time reading rather than working. I read Bill Browder's Freezing Order this weekend, and I highly recommend it. However, at the end of the book, Browder says that oligarchs, autocrats, and...