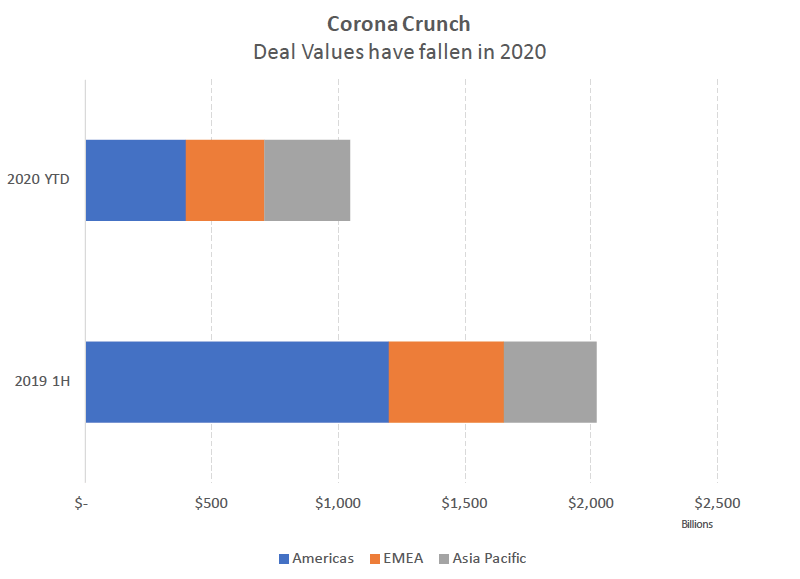

COVID, as I predicted many months ago, is taking a toll on M&A. In the first half of 2020, the value of mergers and acquisitions fell 50% from the year-earlier period to the lowest level since the depths of the euro-zone debt crisis.

Source: Bloomberg

Data shows the value of pending and completed M&A applied to targets in each region. 2020 figures are through June 28.

The Americas have realized the sharpest fall with deals value down 67% in the first half. Every major industry has been hurt. However, the financial sector fared better than most because of Aon Plc’s $30 billion offer for Willis Towers Watson Plc and Morgan Stanley’s proposed $13 billion acquisition of E*Trade Financial Corp.

EMEA was down 31% and Asia Pacific was down 7%.

As has been said before, the COVID situation is a public health crisis. Until we deal with the public health issue, everything else will suffer. The M&A numbers reflect this with Asia Pacific currently leading with the best response. EMEA suffered initially but is recovering, while the Americas, with the U.S. and Brazil failing in their response, has fallen the most.

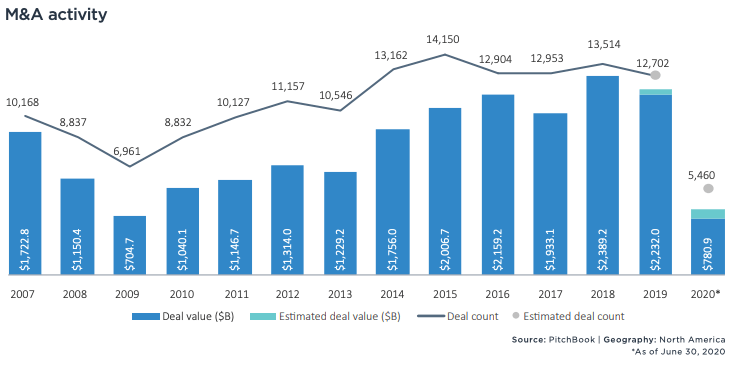

U.S M&A activity in Q2 2020 continued to decline as COVID remained an unrelenting problem in North America, especially in the US. North American M&A activity during this period was $336.8 billion across 2,025 transactions. Currently, the US recovery is more of a “W” than a “V”, which threatens to further drag down M&A activity.

Nevertheless, certain sectors, namely tech, and healthcare continue to have a stable deal volume, as many companies in these sectors have benefited from COVID and are opportunistically seeking M&A transactions. However, in areas such as oil & gas, many companies are completing deals just to survive.

Due to COVID, buyers and sellers are struggling with a lack of accurate earnings and cash flow forecasts, causing parties to avoid deals. Further, cash is key, and survival is not running out of cash. Thus, unless companies have large cash piles or can use their paper, deals will be further limited.

While both the U.S. and Canada confirmed their economies entered recessions during Q1, Canada has since emerged from its shortest recession on record due to its effective COVID response. The prospects for the U.S. remain bleaker with rising COVID cases negatively impacting the country’s economic outlook. Furthermore, many of the states that opened up too early, e.g., Florida, Texas, Georgia, have seen dramatic increases in cases and are shut back down.

Currently, the International Monetary Fund is forecasting an 8% decline in GDP for the U.S. in 2020. With no end in sight for the pandemic in the U.S., which has the most cases and deaths from the virus globally, that may be optimistic.

The outlook for M&A thus remains dim.

Recent Posts

Align and Thrive: The Importance of Organizational Alignment and Agility

Discover the importance of organizational alignment and agility in this blog post. Learn how establishing a strong CORE and building a strategy around it can lead to sustainable growth and success. Find out how alignment and agility empower your organization to thrive in an ever-changing business landscape.

How to Achieve Smart Time Management: 10 Tips for Busy Professionals

When you are a busy professional running your own business, it can often feel like there aren’t enough hours in the day to accomplish everything. Being strategic with your time is the best (and possibly the only) way to achieve all of your daily tasks. If you are...

5 Strategic Leadership Skills Every Manager Needs

So often, people view leadership as a talent: you’re either born with this quality or you’re not. However, this is not always the case! In reality, good leadership is made up of skills, and anyone can learn how to improve. Some people may pick up leadership attributes...

How the Sellability Score is Calculated: The Ultimate Guide

Do you have questions about how to calculate your business’s sellability score? Whether you’re looking to sell your business in the near future or years from now, understanding your sellability score will help you thrive. The sellability score identifies the...

The Top 5 Benefits of the Entrepreneurial Operating System

As an entrepreneur running your own business, you know there are bumps in the road and struggles that both you and your business will face over time. However, with the right people and tools at your disposal, you can anticipate what’s coming, plan for it, and continue...

5 Ways to Use Email Automation to Boost Traffic

Every single business in the world wants to evolve and grow. This will happen using a variety of techniques and strategies. In 2022, digital marketing is more than a household name, and most companies will adopt at least a few ideas when long-term planning and coming...

6 Questions To Ask A Potential Business Coach Before Hiring Them

Many entrepreneurs consider executive business coaching when they start struggling on their professional path. A small business coach is an experienced professional mentor who educates, supports, and motivates entrepreneurs. They will listen to your concerns, assess...

3 Ways Proper Long Term Strategic Planning Helps Your Business

Dreams turn into goals when they have a foundation of long-term strategic planning supporting them. They become reality when the ensuing strategic implementation plan is executed properly. With Kaizen Solutions as their strategic planning consultant, small and...

What is a Peer Group, and How Can it Improve Your Career?

If you are a CEO or key executive who has come to a crossroads or crisis in your career, you'll gain valuable insights and solutions from a peer group connection more than anywhere else. But what is a peer group, and how can that statement be made with so much...

Profit and Revenue are Lousy Core Values

As I mentioned last week, I am down with COVID and tired, so spending more time reading rather than working. I read Bill Browder's Freezing Order this weekend, and I highly recommend it. However, at the end of the book, Browder says that oligarchs, autocrats, and...