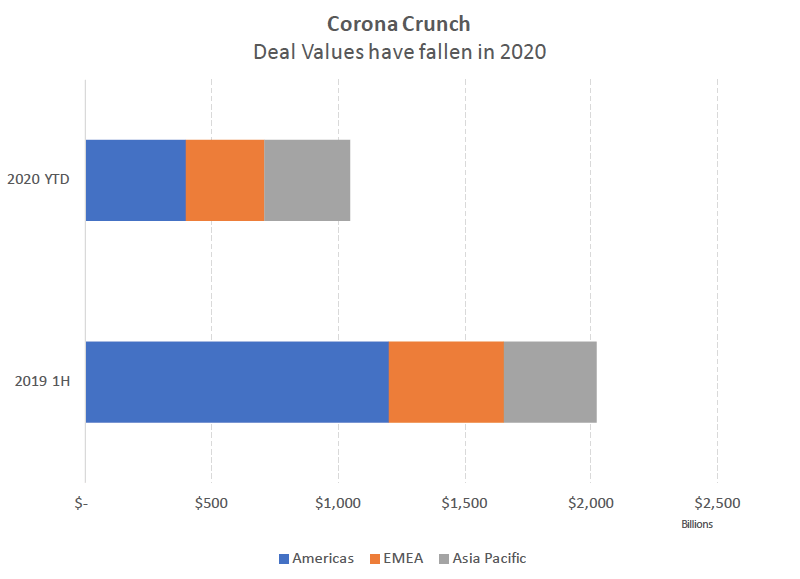

COVID, as I predicted many months ago, is taking a toll on M&A. In the first half of 2020, the value of mergers and acquisitions fell 50% from the year-earlier period to the lowest level since the depths of the euro-zone debt crisis.

Source: Bloomberg

Data shows the value of pending and completed M&A applied to targets in each region. 2020 figures are through June 28.

The Americas have realized the sharpest fall with deals value down 67% in the first half. Every major industry has been hurt. However, the financial sector fared better than most because of Aon Plc’s $30 billion offer for Willis Towers Watson Plc and Morgan Stanley’s proposed $13 billion acquisition of E*Trade Financial Corp.

EMEA was down 31% and Asia Pacific was down 7%.

As has been said before, the COVID situation is a public health crisis. Until we deal with the public health issue, everything else will suffer. The M&A numbers reflect this with Asia Pacific currently leading with the best response. EMEA suffered initially but is recovering, while the Americas, with the U.S. and Brazil failing in their response, has fallen the most.

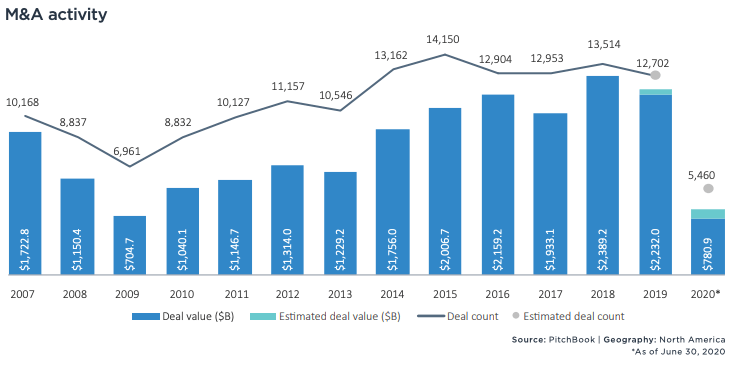

U.S M&A activity in Q2 2020 continued to decline as COVID remained an unrelenting problem in North America, especially in the US. North American M&A activity during this period was $336.8 billion across 2,025 transactions. Currently, the US recovery is more of a “W” than a “V”, which threatens to further drag down M&A activity.

Nevertheless, certain sectors, namely tech, and healthcare continue to have a stable deal volume, as many companies in these sectors have benefited from COVID and are opportunistically seeking M&A transactions. However, in areas such as oil & gas, many companies are completing deals just to survive.

Due to COVID, buyers and sellers are struggling with a lack of accurate earnings and cash flow forecasts, causing parties to avoid deals. Further, cash is key, and survival is not running out of cash. Thus, unless companies have large cash piles or can use their paper, deals will be further limited.

While both the U.S. and Canada confirmed their economies entered recessions during Q1, Canada has since emerged from its shortest recession on record due to its effective COVID response. The prospects for the U.S. remain bleaker with rising COVID cases negatively impacting the country’s economic outlook. Furthermore, many of the states that opened up too early, e.g., Florida, Texas, Georgia, have seen dramatic increases in cases and are shut back down.

Currently, the International Monetary Fund is forecasting an 8% decline in GDP for the U.S. in 2020. With no end in sight for the pandemic in the U.S., which has the most cases and deaths from the virus globally, that may be optimistic.

The outlook for M&A thus remains dim.

Recent Posts

The Downfall of Boeing: A Lesson in Core Values

Boeing’s 737 Max issues highlighted the company’s sacrifice of safety for financial performance, resulting in a tarnished reputation. The prioritization of profit over core values also damaged the FAA’s credibility and revealed a lack of accountability for top executives. This downfall serves as a reminder of the importance of maintaining core values and prioritizing them over short-term financial gains.

Resolutions, Here We Go Again.

In reflecting on 2021 resolutions, the author scored themselves in three categories and sought to improve success in 2022 by addressing friction points. Drawing on advice from social psychologist Wendy Wood, the author identified areas to reduce or increase friction in their failed resolutions. By making these adjustments, the author aims to enhance their goal achievement and encourages others to consider friction when setting resolutions.

You need to take an extended vacation. No, seriously, you do.

COVID has taken a toll on all of us. If you have not taken an extended vacation in a while where you disconnect, you need to now. You and your business will benefit.

Becoming Famous in Your Niche: The Success Story of Linn Products Limited

In a previous discussion, I highlighted the importance of being famous for something. Being well-known in your niche can help you: Concentrate on your strengths Connect with your target audience Communicate your offerings more effectively Receive referrals Identify...

Understanding and Optimizing Your Cash Conversion Cycle

Understanding and optimizing the Cash Conversion Cycle is crucial for business growth, as it impacts cash flow and the ability to access external capital. This cycle consists of four components: Sales, Make/Production & Inventory, Delivery, and Billing and Payments. To improve the Cash Conversion Cycle, companies can eliminate mistakes, shorten cycle times, and revamp their business models.

Discovering Your Niche: Why You Need to Be Famous for Something

As an entrepreneur, it’s crucial to specialize in a specific area and become famous for something, allowing you to generate referrals and build your brand. Understanding the “job” you’re hired for helps you stand out in the marketplace and communicate your value proposition effectively. By providing value to your clients, you can adopt a value-based pricing approach, ensuring your business remains competitive and maintains a strong market presence.

Rethinking Your Pricing Model: Maximizing Margins and Providing Value

Rethink your pricing model by focusing on the value you provide and your customers’ Best Alternative To a Negotiated Agreement (BATNA). This approach can help you maximize margins while delivering better value to your clients. Assess your offerings and brainstorm with your team to identify pricing adjustment opportunities or eliminate commodity products or services.

Do you know your Profit per X to drive dramatic growth?

I recently facilitated a workshop with several CEOs where we worked on the dramatic business growth model components. One of the questions that I had asked them beforehand was, "What is Your Profit/X?" The results showed that there this concept is not clear to many....

The War for Talent: 5 Ways to Attract the Best Employees

In today’s War for Talent, attracting the best employees requires a focus on value creation, core customer, brand promise, and value delivery. Clearly articulate your company’s mission, identify your “core employee” based on shared values, and offer more than just a salary to stand out as an employer. Utilize employee satisfaction metrics and showcase your company’s commitment to its workforce on your website to make a strong impression on potential candidates.

Are you killing your firm’s WFH productivity?

Productivity remained during WFH with COVID. However, further analysis found that hourly productivity fell and was compensated for by employees working more hours. What was the culprit – Meetings. Want to increase productivity, have fewer meetings.