Discover the importance of organizational alignment and agility in this blog post. Learn how establishing a strong CORE and building a strategy around it can lead to sustainable growth and success. Find out how alignment and agility empower your organization to thrive in an ever-changing business landscape.

To Buyback or Not Buyback, That is the Question?

As part of The CARES Act, Congress imposed restrictions on stock buybacks. There was bipartisan support for this idea. Billionaire Mark Cuban argued that the rule for any company that receives federal assistance is, “No buybacks. Not now. Not a year from now. Not 20 years from now. Not ever.” Senate Minority Leader Chuck Schumer declared on-air: “Our motto in this is ‘workers first.’ …. These buybacks, they infuriate me. We should not be allowing them to do buybacks, raise corporate salaries.” Sen. Elizabeth Warren said that any corporate recipient of government assistance should be “permanently prohibited from engaging in share repurchases.” President Trump joined the chorus arguing, “I am strongly recommending a buyback exclusion. You can’t take a billion dollars of the money and just buy back your stock and increase the value.” However, others have argued that this policy is “The Worst Coronavirus Idea.”

How it Happened

The airline industry was the poster child for arguments against buybacks. Airlines for America, which represents major U.S. passenger and cargo air carrier companies, requested government assistance because of (i) the coronavirus crisis, and (ii) several of the largest carriers had used the majority of their free cash flow on share buybacks over the last decade. Given that airlines have a propensity for going bankrupt with over 60 since 1991, and being unprepared for hard times including the Sept. 11, 2001, attacks and the volcanic eruption in Iceland in 2010 that disrupted air travel, building up cash for a rainy day hasn’t been part of their plan.

| Airline | Free Cash Flow ($MM) | Share Buybacks ($MM) | Buybacks/FCF |

|---|---|---|---|

| Southwest Airlines Co. | 15,103 | 10,650 | 71% |

| Alaska Air Group, Inc. | 4,948 | 1,590 | 32 |

| Delta Air Lines, Inc. | 23,186 | 11,430 | 49% |

| United Airlines Holdings, Inc. | 11,526 | 8,883 | 77% |

| American Airlines Group, Inc. | (7,935) | 12,957 | N/A |

| JetBlue Airways Corporation | 2,347 | 1,771 | 75% |

Source: FactSet

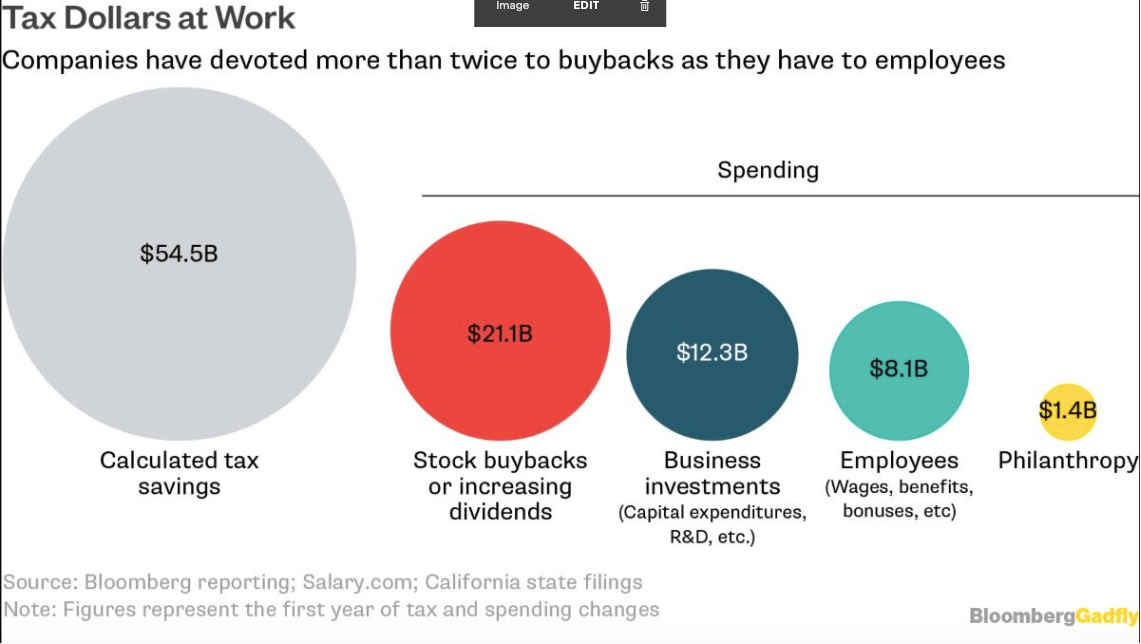

However, airlines weren’t the only ones spending free cash flow on share buybacks. As can be seen below, nearly 50% of the saving from the 2017 Tax Cut and Jobs Act went to share buybacks.

Arguments For Buybacks

Share buybacks are very popular. According to Federal Reserve data compiled by Goldman Sachs, over the past nine years, corporations have acquired more of their stocks – $3.8 trillion—than every other type of investor (individuals, mutual funds, pension funds, foreign investors) combined. So why do they do it?

-

An efficient way to return money to shareholders. By reducing the number of shares outstanding in the market, a buyback lifts the price of each remaining shares.

-

A Valuable source of cash. Donald L. Luskin and Chris Hynes made this argument in a Wall Street Opinion Editorial. It has to be the worst reason I have heard. If people need cash, they can sell their shares on the market; they don’t need the company to repurchase them.

-

More tax-efficient than dividends. If the shareholder has held the shares long enough to qualify for long term capital gains treatment, this is true. Dividends are taxed at 22% while the tax rate for capital gains is 0%,15%, or 20% depending on the taxpayers’ level of income.

-

Management captures the share bump. An analysis by the SEC revealed that executives, on average, sold five times as much stock in the eight days following a buyback announcement as they had on an ordinary day. According to SEC Commissioner Robert Jackson Jr., “Thus, executives personally capture the benefit of the short-term stock-price pop created by the buyback announcement.”

-

Boost management’s compensation. Following the adoption of Milton Friedman’s idea of “creating shareholder value,” more and more companies granted CEOs large blocks of company stock and stock options to align management with the corporate goal. However, with large portfolios of their own company’s stock, the desire to manipulate the share price with share buybacks was a temptation few CEOs could resist. As a recent article noted, “Today, the abuse of stock buybacks is so widespread that naming abusers is a bit like singling out snowflakes for ruining the driveway.”

Arguments Against Buybacks

-

Deprives companies of liquidity. As a recent Harvard Business Review article noted, when companies undertake buybacks, they deprive themselves of the cash that might help them cope when sales and profits decline in an economic downturn.

-

The share price boost is short-lived. A study by the research firm Fortuna Advisors found that five years out, the stocks of companies that engaged in substantial buybacks performed worse for shareholders than the shares of companies that didn’t.

-

The propensity to buy when the price is high and not when it’s low. Companies tend to overpay for their shares, diluting return to shareholders. The is overwhelming evidence that substantial buyback companies usually create less value for shareholders over time.

-

Lack of investment in things that grow shareholder value. Those companies that reinvested a higher percentage of their cash generation into capital expenditures, research and development, cash acquisitions, and working capital delivered substantially higher total shareholder return than those that reinvested less.

-

Lack of Imagination by Management. If the best use of the company’s money is share buybacks, then unless the shares are undervalued (20%+), management has effectively given up on planning to grow the company in new markets or products, through acquisition or investment. Such a strategy is a reflection of failed management.

Conclusion

From the above, it is apparent that there are few good reasons for share buybacks other than to boost management’s earnings. Hopefully, the current environment will cause management to reflect and do their jobs more efficiently so that there is real shareholder growth. As the Atlantic article pointed out.

“Craig Menear, the chairman and CEO of Home Depot mentioned on a conference call with investors in February 2018, their “plan to repurchase approximately $4 billion of outstanding shares during the year.” The next day, he sold 113,687 shares, netting $18 million. The following day, he was granted 38,689 new shares and promptly sold 24,286 shares for a profit of $4.5 million. Though Menear’s stated compensation in SEC filings was $11.4 million for 2018, stock sales helped him earn an additional $30 million for the year.

By contrast, the median worker pay at Home Depot is $23,000 a year. If the money spent on buybacks had been used to boost salaries, the Roosevelt Institute and the National Employment Law Project calculated, each worker would have made an additional $18,000 a year. But buybacks are more than just unfair. They’re myopic. Amazon (which hasn’t repurchased a share in seven years) is presently making the sort of investments in people, technology, and products that could eventually make Home Depot irrelevant. When that happens, Home Depot will probably wish it hadn’t spent all those billions on buying back 35 percent of its shares. “When you’ve got a mature company when everything seems to be going smoothly, that’s the exact moment you need to start worrying Jeff Bezos is going to start eating your lunch,” said the shareholder activist Nell Minow.”

Copyright (c) 2020, Marc A. Borrelli

Recent Posts

Align and Thrive: The Importance of Organizational Alignment and Agility

How to Achieve Smart Time Management: 10 Tips for Busy Professionals

When you are a busy professional running your own business, it can often feel like there aren’t enough hours in the day to accomplish everything. Being strategic with your time is the best (and possibly the only) way to achieve all of your daily tasks. If you are...

5 Strategic Leadership Skills Every Manager Needs

So often, people view leadership as a talent: you’re either born with this quality or you’re not. However, this is not always the case! In reality, good leadership is made up of skills, and anyone can learn how to improve. Some people may pick up leadership attributes...

How the Sellability Score is Calculated: The Ultimate Guide

Do you have questions about how to calculate your business’s sellability score? Whether you’re looking to sell your business in the near future or years from now, understanding your sellability score will help you thrive. The sellability score identifies the...

The Top 5 Benefits of the Entrepreneurial Operating System

As an entrepreneur running your own business, you know there are bumps in the road and struggles that both you and your business will face over time. However, with the right people and tools at your disposal, you can anticipate what’s coming, plan for it, and continue...

5 Ways to Use Email Automation to Boost Traffic

Every single business in the world wants to evolve and grow. This will happen using a variety of techniques and strategies. In 2022, digital marketing is more than a household name, and most companies will adopt at least a few ideas when long-term planning and coming...

6 Questions To Ask A Potential Business Coach Before Hiring Them

Many entrepreneurs consider executive business coaching when they start struggling on their professional path. A small business coach is an experienced professional mentor who educates, supports, and motivates entrepreneurs. They will listen to your concerns, assess...

3 Ways Proper Long Term Strategic Planning Helps Your Business

Dreams turn into goals when they have a foundation of long-term strategic planning supporting them. They become reality when the ensuing strategic implementation plan is executed properly. With Kaizen Solutions as their strategic planning consultant, small and...

What is a Peer Group, and How Can it Improve Your Career?

If you are a CEO or key executive who has come to a crossroads or crisis in your career, you'll gain valuable insights and solutions from a peer group connection more than anywhere else. But what is a peer group, and how can that statement be made with so much...

Profit and Revenue are Lousy Core Values

As I mentioned last week, I am down with COVID and tired, so spending more time reading rather than working. I read Bill Browder's Freezing Order this weekend, and I highly recommend it. However, at the end of the book, Browder says that oligarchs, autocrats, and...