Discover the importance of organizational alignment and agility in this blog post. Learn how establishing a strong CORE and building a strategy around it can lead to sustainable growth and success. Find out how alignment and agility empower your organization to thrive in an ever-changing business landscape.

The “Flaw of Averages” Causes Havoc for Businesses

Introduction: The Importance of Accurate Data Analysis

The “Flaw of Averages” is a term popularized by Sam Savage, referring to the misleading nature of averages in business decision-making. Averages often misstate the true situation within a company, leading to misallocation of resources and, ultimately, reduced profitability. In this blog post, we will discuss how the flaw of averages can impact businesses, using hypothetical examples to illustrate the consequences and offer suggestions for more accurate data analysis.

- The Flaw of Averages in Product Analysis

Consider a hypothetical business, ABC Inc., which sells a variety of products with different units sold, unit prices, and gross profits per unit.

| Product |

Units Sold |

Price/Unit |

Gross Profit/Unit |

| A |

30,000 |

$ 100.00 |

$ 12.50 |

| B |

7,500 |

$ 90.00 |

$ 75.00 |

| C |

20,000 |

$ 80.00 |

$ 37.50 |

| D |

15,000 |

$ 70.00 |

$ 45.00 |

| E |

10,000 |

$ 60.00 |

$ 25.00 |

| F |

25,000 |

$ 50.00 |

$ 12.50 |

| G |

20,000 |

$ 40.00 |

$ 20.00 |

| H |

20,000 |

$ 30.00 |

$ 25.00 |

When examining the product portfolio, looking beyond the total revenue and gross profit margin is essential. Focusing solely on averages can lead to misconceptions about the importance of certain products to the company’s profitability.

a. Rethinking Product Prioritization

For example, if ABC Inc. were to stop selling its largest revenue-generating product, its gross profit margin would increase substantially. By looking at average margins, the full impact of this product on the business is not apparent. A more detailed analysis may reveal additional costs associated with the production of this product, such as factory space, warehouse storage, staff, and shipping costs.

b. Bundling and Pricing Strategies

With a better understanding of the true profitability of each product, ABC Inc. can explore more effective pricing strategies, such as increasing the price of lower-margin products or bundling them with more profitable ones.

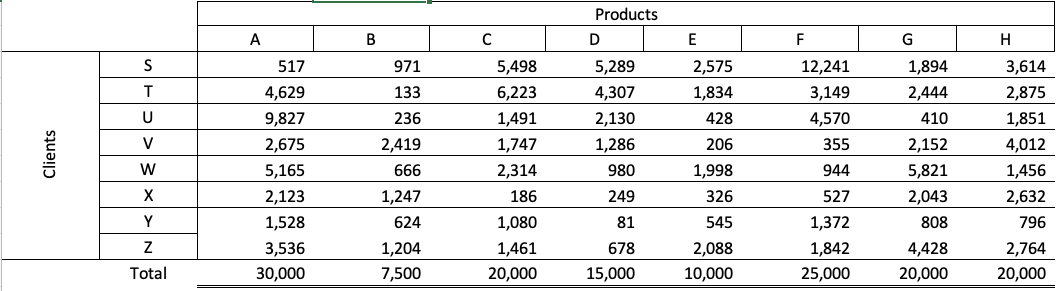

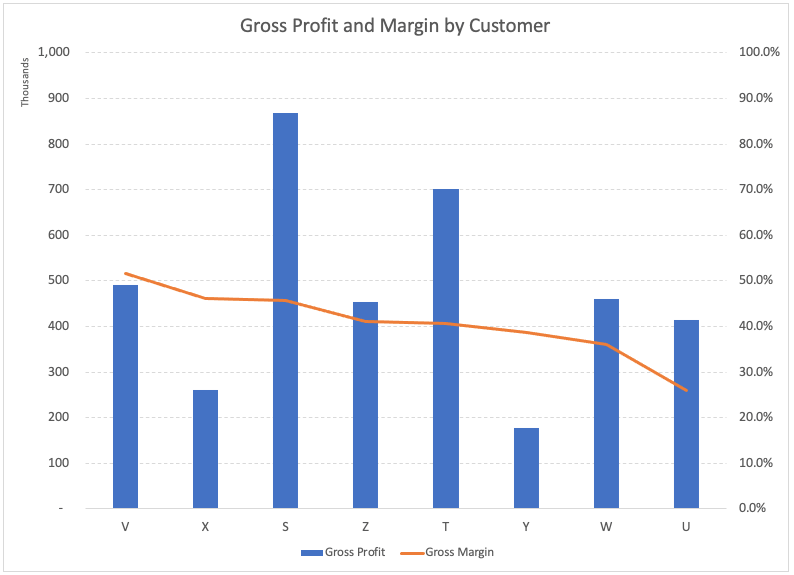

- The Flaw of Averages in Customer Analysis

Examining customers’ revenue and gross profit contributions can also reveal valuable insights. By ranking customers according to their gross margin contributions, businesses can identify the most profitable clients and those that may be dragging down overall profitability.

Now, if we examine the purchase and gross profits of each customer, we get:

| Customer |

Revenue |

Gross Profit |

|

S |

1,899,890 |

869,085 |

|

T |

1,725,700 |

700,983 |

|

U |

1,598,430 |

414,600 |

|

V |

951,540 |

491,173 |

|

W |

1,273,760 |

459,958 |

|

X |

563,430 |

259,640 |

|

Y |

458,530 |

176,880 |

|

Z |

1,103,720 |

452,683 |

|

Total |

9,575,000 |

3,825,000 |

Sorting that into the order of gross margin, we can see the following:

a. Identifying High-Value Customers

For example, if ABC Inc. were to lose its most profitable customer, its gross margin would decrease significantly. By contrast, losing a less profitable customer would lead to an increase in the overall gross margin. Understanding the value of each customer allows the company to focus its resources on retaining and attracting high-value clients.

b. Analyzing Customer Purchase Patterns

In addition to evaluating each customer’s profitability, examining their purchase patterns is essential. Businesses can better target their marketing and sales efforts by identifying clients with higher-margin purchase combinations.

- Improving Business Performance Through Better Data Analysis

To overcome the flaw of averages and make more informed decisions, businesses should:

a. Regularly analyze product and customer data. Examine each product’s and customer’s profitability to identify improvement areas and make better resource allocation decisions.

b. Focus on profitability, not just revenue. While revenue is essential, focusing solely on it can lead to misconceptions about the true value of products and customers. Prioritize profitability to drive sustainable growth.

c. Use data to inform pricing and bundling strategies. Identify opportunities to increase the price of lower-margin products or bundle them with more profitable ones to improve overall profitability.

d. Monitor and adapt to changes in the market. Regularly review product and customer data to stay up-to-date with market trends and adjust strategies accordingly.

Conclusion: The Power of Proper Data Analysis

The flaw of averages can lead businesses to make misguided decisions based on misleading data. By delving deeper into product and customer data, businesses can better understand their true profitability, allocate resources more effectively, and ultimately drive sustainable growth. Don’t let the flaw of averages hold your business back – embrace the power of accurate data analysis to improve your decision-making and achieve success.

Recommended Reading:

-

The Flaw of Averages: Why We Underestimate Risk in the Face of Uncertainty, by Sam Savage This book provides an in-depth look at the limitations of averages and how they can lead to misguided decisions in various fields, including business, finance, and engineering. It also offers practical techniques for better understanding and managing risk through probabilistic thinking.

-

Why Can’t You Just Give Me The Number?: An Executive’s Guide to Using Probabilistic Thinking to Manage Risk and to Make Better Decisions, by Patrick Leach. This guide is designed for executives and decision-makers who want to improve their understanding of risk and uncertainty. It introduces the concept of probabilistic thinking, demonstrating how it can lead to better decision-making and risk management in a variety of business scenarios.

Recent Posts

Align and Thrive: The Importance of Organizational Alignment and Agility

How to Achieve Smart Time Management: 10 Tips for Busy Professionals

When you are a busy professional running your own business, it can often feel like there aren’t enough hours in the day to accomplish everything. Being strategic with your time is the best (and possibly the only) way to achieve all of your daily tasks. If you are...

5 Strategic Leadership Skills Every Manager Needs

So often, people view leadership as a talent: you’re either born with this quality or you’re not. However, this is not always the case! In reality, good leadership is made up of skills, and anyone can learn how to improve. Some people may pick up leadership attributes...

How the Sellability Score is Calculated: The Ultimate Guide

Do you have questions about how to calculate your business’s sellability score? Whether you’re looking to sell your business in the near future or years from now, understanding your sellability score will help you thrive. The sellability score identifies the...

The Top 5 Benefits of the Entrepreneurial Operating System

As an entrepreneur running your own business, you know there are bumps in the road and struggles that both you and your business will face over time. However, with the right people and tools at your disposal, you can anticipate what’s coming, plan for it, and continue...

5 Ways to Use Email Automation to Boost Traffic

Every single business in the world wants to evolve and grow. This will happen using a variety of techniques and strategies. In 2022, digital marketing is more than a household name, and most companies will adopt at least a few ideas when long-term planning and coming...

6 Questions To Ask A Potential Business Coach Before Hiring Them

Many entrepreneurs consider executive business coaching when they start struggling on their professional path. A small business coach is an experienced professional mentor who educates, supports, and motivates entrepreneurs. They will listen to your concerns, assess...

3 Ways Proper Long Term Strategic Planning Helps Your Business

Dreams turn into goals when they have a foundation of long-term strategic planning supporting them. They become reality when the ensuing strategic implementation plan is executed properly. With Kaizen Solutions as their strategic planning consultant, small and...

What is a Peer Group, and How Can it Improve Your Career?

If you are a CEO or key executive who has come to a crossroads or crisis in your career, you'll gain valuable insights and solutions from a peer group connection more than anywhere else. But what is a peer group, and how can that statement be made with so much...

Profit and Revenue are Lousy Core Values

As I mentioned last week, I am down with COVID and tired, so spending more time reading rather than working. I read Bill Browder's Freezing Order this weekend, and I highly recommend it. However, at the end of the book, Browder says that oligarchs, autocrats, and...