Discover the importance of organizational alignment and agility in this blog post. Learn how establishing a strong CORE and building a strategy around it can lead to sustainable growth and success. Find out how alignment and agility empower your organization to thrive in an ever-changing business landscape.

Want to Improve, Put Women in the C-Suite

At the end of last year, there was a male-to-female ratio of 19:1 for CEOs and 6.5:1 for CFOs, which exposes a persisting underrepresentation of females in key executive positions. Within my Vistage groups, I am pleased to say that the male-to-female ratio is 11:3 for CEOs. However, that aside, some recent articles have shown the superior performance of companies that have women in C-Suite positions that are typically not reserved for females.

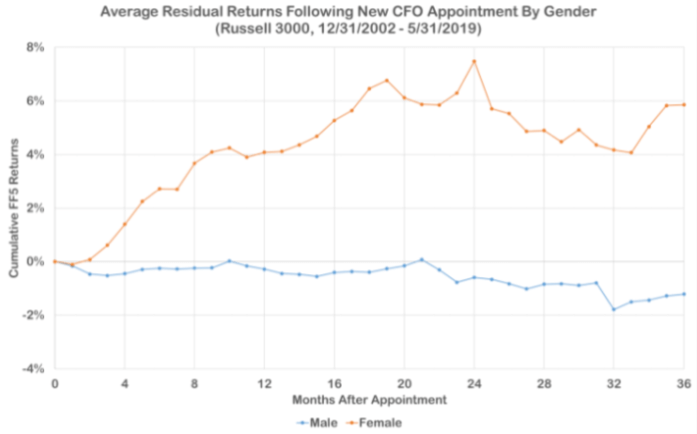

According to a study by S&P Global Market Intelligence, if you are looking for better returns, hire a female CFO! Companies that hired female CFOs saw, on average, a 6% increase in profits and an 8% better stock returns compared with the performance under male predecessors. The 6% increase in profits accounted for an additional $1.8 trillion in additional cumulative profits across 6,000 companies.

Thus, female CEOs drove more value appreciation, improved stock price momentum, better-defended profitability moats, and delivered excess risk-adjusted returns for their firms.

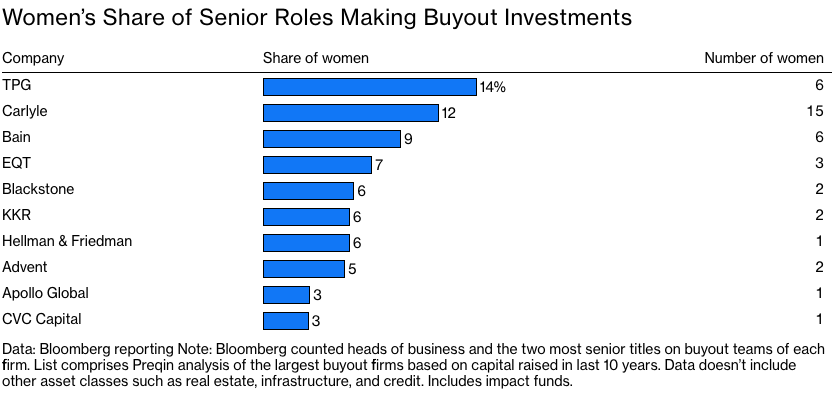

However, a new study by HEC Paris Business School and MVision Private Equity Advisers found that investment committees of private equity fund managers comprising both males and females have experienced comparatively higher returns compared to their male-only peers. Therefore, if PE firms want to outperform their peers, they should appoint more women to their investment committees. The diverse investment committees well outperformed their male-only counterparts! Professor Oliver Gottschalg found that on average, companies in the top quartile for gender diversity on executive teams were 21% more likely to outperform their peers, and 27% more likely to exhibit substantial value creation. Specifically, his research found that gender-diverse investment committees outperformed all-male committees in alpha, TVPI, and IRR by 7%, 0.52%, and 12%, respectively. The level outperformance is due to a broader base of perspectives and the subsequent avoidance of more blind spots!

So what is of interest is that while women’s participation in Investment Committees results in outperformance, Private Equity never received the memo. As can be seen from the chart below, women are very under-represented in the major Private Equity Groups

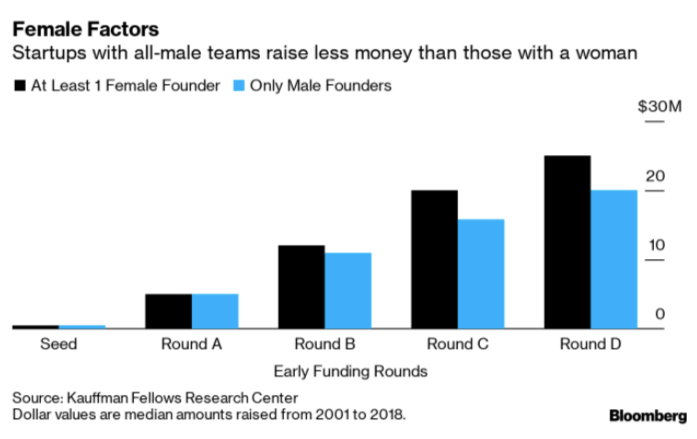

Not only that, Bloomberg has found that startups with all-male teams raise less money than those with a woman. Therefore, you would think all startups would be looking for female teammates. Unfortunately, many are run by men who “know best.”

Thus, while I am the first to say that correlation does not necessarily mean causality, there undoubtedly enough data to say, “If you want to realize above-average performance, put women in your C-Suite!”

This has to be one of the easiest things to improve your performance and make better decisions. If you say, “We just can’t find them,” you are not looking in the right place.

Copyright (c) 2019, Marc A. Borrelli

Recent Posts

Align and Thrive: The Importance of Organizational Alignment and Agility

How to Achieve Smart Time Management: 10 Tips for Busy Professionals

When you are a busy professional running your own business, it can often feel like there aren’t enough hours in the day to accomplish everything. Being strategic with your time is the best (and possibly the only) way to achieve all of your daily tasks. If you are...

5 Strategic Leadership Skills Every Manager Needs

So often, people view leadership as a talent: you’re either born with this quality or you’re not. However, this is not always the case! In reality, good leadership is made up of skills, and anyone can learn how to improve. Some people may pick up leadership attributes...

How the Sellability Score is Calculated: The Ultimate Guide

Do you have questions about how to calculate your business’s sellability score? Whether you’re looking to sell your business in the near future or years from now, understanding your sellability score will help you thrive. The sellability score identifies the...

The Top 5 Benefits of the Entrepreneurial Operating System

As an entrepreneur running your own business, you know there are bumps in the road and struggles that both you and your business will face over time. However, with the right people and tools at your disposal, you can anticipate what’s coming, plan for it, and continue...

5 Ways to Use Email Automation to Boost Traffic

Every single business in the world wants to evolve and grow. This will happen using a variety of techniques and strategies. In 2022, digital marketing is more than a household name, and most companies will adopt at least a few ideas when long-term planning and coming...

6 Questions To Ask A Potential Business Coach Before Hiring Them

Many entrepreneurs consider executive business coaching when they start struggling on their professional path. A small business coach is an experienced professional mentor who educates, supports, and motivates entrepreneurs. They will listen to your concerns, assess...

3 Ways Proper Long Term Strategic Planning Helps Your Business

Dreams turn into goals when they have a foundation of long-term strategic planning supporting them. They become reality when the ensuing strategic implementation plan is executed properly. With Kaizen Solutions as their strategic planning consultant, small and...

What is a Peer Group, and How Can it Improve Your Career?

If you are a CEO or key executive who has come to a crossroads or crisis in your career, you'll gain valuable insights and solutions from a peer group connection more than anywhere else. But what is a peer group, and how can that statement be made with so much...

Profit and Revenue are Lousy Core Values

As I mentioned last week, I am down with COVID and tired, so spending more time reading rather than working. I read Bill Browder's Freezing Order this weekend, and I highly recommend it. However, at the end of the book, Browder says that oligarchs, autocrats, and...