Discover the importance of organizational alignment and agility in this blog post. Learn how establishing a strong CORE and building a strategy around it can lead to sustainable growth and success. Find out how alignment and agility empower your organization to thrive in an ever-changing business landscape.

Big Tech is Getting Bigger

As I said before in this blog, COVID is shifting the power towards big business. For a while, many commentators said that when the next bear market hit, the FAAMNG companies would fall. However, that is not the case. It appears that COVID is exactly what they are built for and is prompting a dramatic reversal of fortune for the tech giants. Amazon and Facebook are viewed as essential services during a public in lockdown, and Google and Apple are building tools that will enable state health departments to trace the course of potential new COVID-19 infections.

-

Facebook. During a shutdown is providing connections between communities and people whether through Facebook or Whatsapp;

-

Amazon. Where would we be without Amazon? The company whose logistics is saving us.

-

Apple. Apple iPhones and iPads for communication and schooling. Apple TV for entertainment.

-

Microsoft. TEAMS and Office 365 for the displaced employees.

-

Netflix. When you are stuck at home, nothing better than to get caught up in Tiger Kings or Ozark.

-

Google. Well, Alphabet. With all of Alphabet’s portfolio of products from Hangouts, to Gmail, Google Docs, and search we have more options to work remotely.

Many of these companies are saying employees can work from home for a while, and maybe like Twitter indefinitely. However, they are still hiring like crazy, Facebook is seeking to hire 10,000 high-skilled workers this year. Amazon, leading the hiring spree of the tech giants, announcing more than 175,000 new, mostly low-wage jobs in warehouses and delivery. However, it is openly recruiting workers who have been laid off from other industries.

Over 400 start-ups have shed over 50,000 jobs since March 11. A recent survey by NFX of 400 investors and founders found over 50 percent of start-ups had initiated a hiring freeze or had lowered their value in the hopes of attracting new investment. Roy Bahat, head of Bloomberg Beta, said, “We’re telling the start-ups we invest in that the safest assumption is that the next time you can raise money again is never.”

With many start-ups collapsing due to lack of funds, the tech giants are expanding, hiring great displaced talent, buying or copying rivals, and eroding traditional industries. As many traditional companies disappear due to financial difficulties, tech companies will seek to take over their space. Eric Schmidt, Google’s former CEO recently said that the most powerful companies are able to bounce back far quicker than others. “When you have an industry leader, and something collapses, the industry leader, if it’s well-managed, tends to emerge stronger a year later,” he said. As a result, big tech is grabbing market share and with their large cash balances can outspend the competition.

According to Scott Galloway, “There are really two Americas right now. There is Big Tech and there is everyone else. They can do what very few companies can do, which is play offense in the middle of a pandemic.”

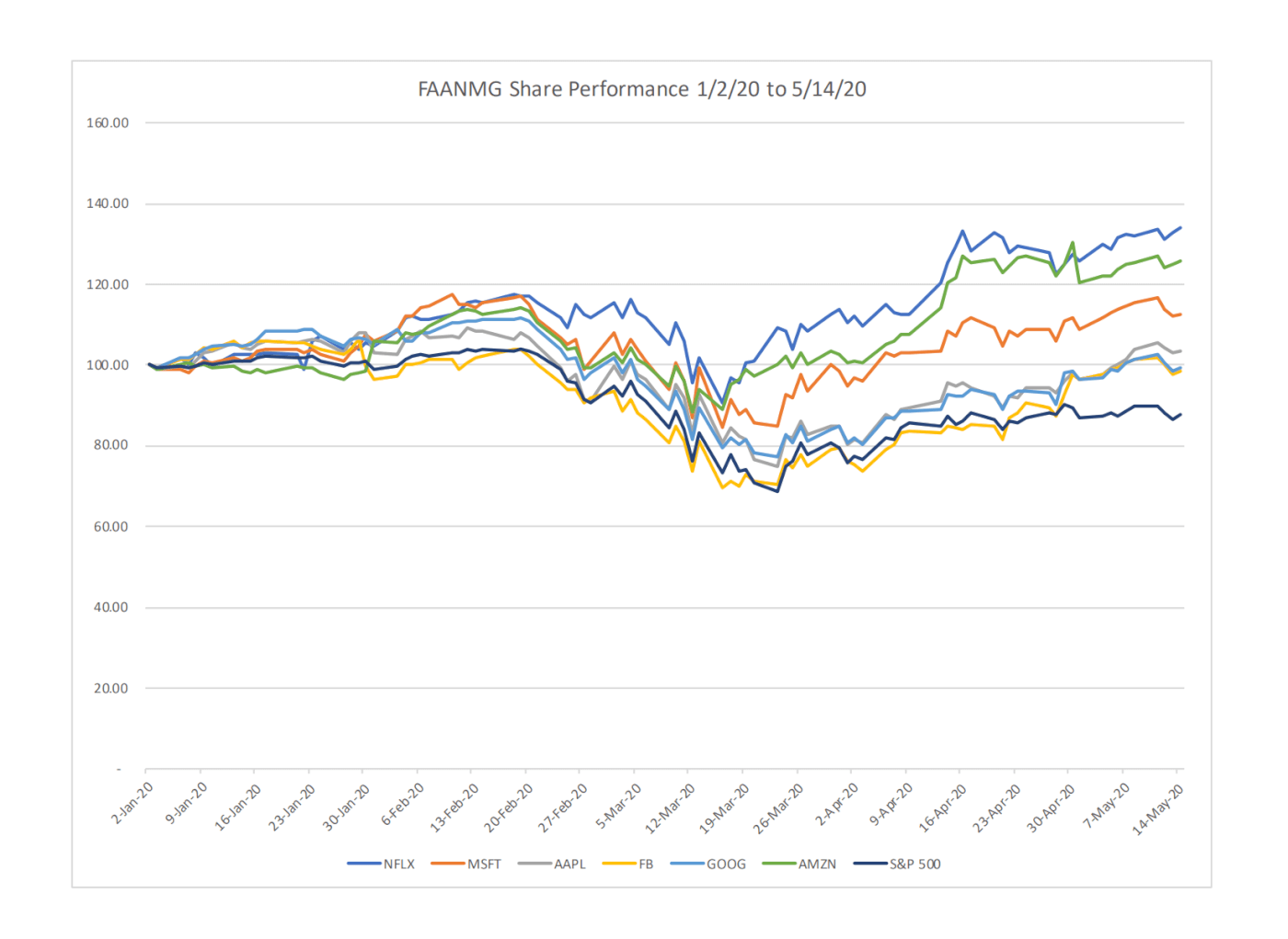

Since COVID all of these companies have outperformed the S&P 500 and considering they account for a large portion of the S&P 500 the performance is even greater.

Source: Yahoo Finance

As can be seen, only Facebook is below the beginning of the year share price.

Furthermore, COVID, to quote Isoroku Yamamoto, “has awoken a sleeping giant.” Jeff Bezos is back and energized! At the outset of his earnings call, Bezos warned shareholders they “may want to take a seat.” He has repeatedly snatched profits from the jaws of shareholders to reinvest in the firm. The investment had a theme: Covid-19. Specifically, Bezos outlined a vision for at-home COVID tests, plasma donors, PPE equipment, distancing, additional compensation, and protocols to adapt to a new world. Jeff Bezos is developing the earth’s first “vaccinated” supply chain. This effort builds on what he said in his letter to shareholders on April 27, 2020, where he warned of the size of failed experiments that are coming, which means Amazon is resting on its laurels, but pushing ahead into new markets and ventures.

Many small and medium-sized businesses are going to be roadkill as the FAAMNG companies expand through this time. Also, as I and others have noted before, the growing power of the FAAMNG companies is limiting the growth of, and investment in, many startups as investors will not bet on companies taking seeking to compete against them.

Copyright (c) 2020, Marc A. Borrelli

Recent Posts

Align and Thrive: The Importance of Organizational Alignment and Agility

How to Achieve Smart Time Management: 10 Tips for Busy Professionals

When you are a busy professional running your own business, it can often feel like there aren’t enough hours in the day to accomplish everything. Being strategic with your time is the best (and possibly the only) way to achieve all of your daily tasks. If you are...

5 Strategic Leadership Skills Every Manager Needs

So often, people view leadership as a talent: you’re either born with this quality or you’re not. However, this is not always the case! In reality, good leadership is made up of skills, and anyone can learn how to improve. Some people may pick up leadership attributes...

How the Sellability Score is Calculated: The Ultimate Guide

Do you have questions about how to calculate your business’s sellability score? Whether you’re looking to sell your business in the near future or years from now, understanding your sellability score will help you thrive. The sellability score identifies the...

The Top 5 Benefits of the Entrepreneurial Operating System

As an entrepreneur running your own business, you know there are bumps in the road and struggles that both you and your business will face over time. However, with the right people and tools at your disposal, you can anticipate what’s coming, plan for it, and continue...

5 Ways to Use Email Automation to Boost Traffic

Every single business in the world wants to evolve and grow. This will happen using a variety of techniques and strategies. In 2022, digital marketing is more than a household name, and most companies will adopt at least a few ideas when long-term planning and coming...

6 Questions To Ask A Potential Business Coach Before Hiring Them

Many entrepreneurs consider executive business coaching when they start struggling on their professional path. A small business coach is an experienced professional mentor who educates, supports, and motivates entrepreneurs. They will listen to your concerns, assess...

3 Ways Proper Long Term Strategic Planning Helps Your Business

Dreams turn into goals when they have a foundation of long-term strategic planning supporting them. They become reality when the ensuing strategic implementation plan is executed properly. With Kaizen Solutions as their strategic planning consultant, small and...

What is a Peer Group, and How Can it Improve Your Career?

If you are a CEO or key executive who has come to a crossroads or crisis in your career, you'll gain valuable insights and solutions from a peer group connection more than anywhere else. But what is a peer group, and how can that statement be made with so much...

Profit and Revenue are Lousy Core Values

As I mentioned last week, I am down with COVID and tired, so spending more time reading rather than working. I read Bill Browder's Freezing Order this weekend, and I highly recommend it. However, at the end of the book, Browder says that oligarchs, autocrats, and...