Working with my Vistage group this week, we had an exciting discussion about “If you were starting your business today, what would you do differently?” This discussion made me think of sunk costs and how they limit us. I have discussed how to make better decisions before, but sunk costs deal with our assumptions.

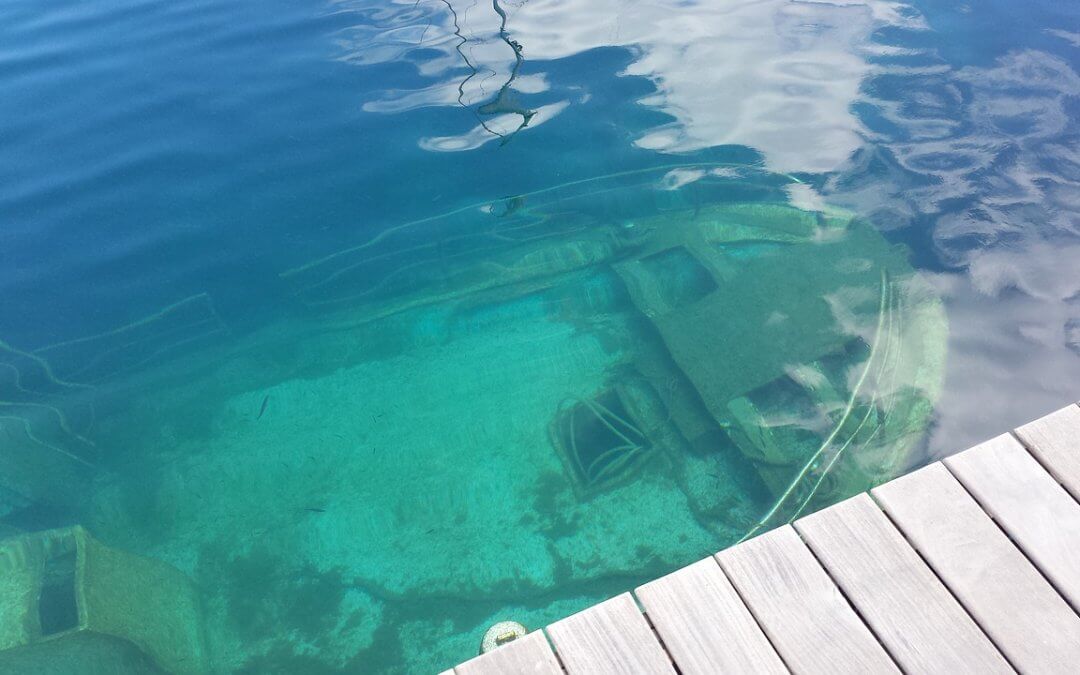

What are sunk costs? A sunk cost is a payment or investment that has already been made, and it is sunk because it is unrecoverable no matter what. So, it should not be a factor in any decisions from now on.

The Sunk Cost Fallacy

The sunk cost fallacy is when an action is continued because of past decisions (time, money, resources) rather than a rational choice of what will maximize the returns at this present time. The fallacy is that behavior is driven by an expenditure that is not recoupable regardless of future actions.

For example, a company that decides to build a new software platform. They have done their analyses and determined that the future benefit they will receive from the software will outweigh its development cost. They pay for the software and expect to save a specific cash flow level from the software’s production each year. But after a few years, the platform is underperforming, and cash flows are less than expected.

A decision has to be made: should the platform be abandoned or not? At this point, the software’s initial cost is a sunk cost and cannot be recovered. The decision should only be based on the future cash flows—or the future expected benefit—of the platform compared to the value of replacing it today, not the original cost of the software.

However, businesses, organizations, and people often have difficulty abandoning strategies because of the time spent developing them, even if they aren’t the right choice for the company or individual. Therefore, recognizing what a sunk cost is will result in better decisions.

How sunk costs sabotage us

Here are a few ways, but this list is not exhaustive.

At Work

Bad Pricing

Companies often justify pricing based on their costs. Most commonly, the R&D expenditure to develop the product. Whatever the R&D costs were, they are irrelevant to the pricing. The market will only pay what the product is worth, not what was invested in it. A pharmaceutical company’s attempt to justify high prices because of the need to recoup R&D expenses is fallacious. The company will charge market prices whether R&D had cost one dollar or one million dollars.

Similarly, many businesses price their services on the hours it took to deliver a service. However, the costs of providing the service are sunk, and you cannot recoup them. The market will only pay you what they deem the value of the product or service to be, so using pricing to recoup costs is “backward.” Instead, one should determine the price and then figure out how to deliver the product or service at the profit margin desired.

Consider if a company invested $100,000 to produce a product and planned to sell them at $100 each. However, the day after the product launch, a competitor announces a better competing product at $50. Will anyone pay $100 for an inferior product when the best one is available for $50?

Bad Investments

Sunk costs are why so many investors tend to remain committed or even invest additional capital into a bad investment to make their initial decision seem worthwhile. How many times has an investor tell you, “As soon as X gets back to what I paid, I am selling.” Why?

What they paid is paid. The investor cannot change that; it is a sunk cost. The real question is, “Does X offer higher returns in the future than Y, some other asset I am considering, after transaction costs?” If yes, then stick with it. If no, switch out X for Y.

Assume you spend $4,000 on a wine tour of Napa. Later on, you find a better wine tour to Bordeau that costs $2,500, and you purchase that trip as well. Later, you realize that the two dates clash and the tickets are non-refundable. Would you attend the $4,000 good wine trip or the $2,500 great wine trip? The $2,500 trip. The $4,000 trip is irrelevant in consideration because it is inferior, and the money is gone.

Bad processes

Returning to my initial question, “If you were starting your business again today, what would you do differently?” Many people will give outstanding examples of what they would do differently but never consider making the change because of the investment they have in their current process. As with assets, if your current process generates a cash flow of $X per year, and switching would generate some cash flow greater than $X after the costs of switching, you should switch.

Misaligned employees

Many companies have employees whom they know are subpar. However, they cannot fire them because they have been employed for a long time or the company has invested some amount in them. This situation is most often seen with those employees who have been with the organization since the beginning. However, the organization has outgrown them.

Again, the time invested by the company and the employee are sunk costs. The decision is what is the best investment going forward. If a more significant return is achievable with a new employee, then the change is required.

Sunk Costs Exist in Our Personal Lives Too

Feel free not to ski in bad weather.

You may be considered a fair-weather skier, but the cost became sunk when you purchased your ticket. You might feel obligated to stay and stick it out if the ticket was expensive or you have a limited holiday window, but if not skiing in a freezing whiteout makes you happier, do it! Either way, you aren’t getting your money back.

Don’t go to the gym just because you have an annual membership.

While working out may be advantageous to your health, your annual membership shouldn’t dictate whether you go to the gym on any given day. If you have paid up front, then the money is gone. So if you would prefer to take a hike, ride a bike, relax and meditate, you should. However, I am not saying there may be more benefits to working out.

Don’t grow up to be a lawyer.

I chose lawyers because I was this example; however, I decided before I graduated law school that I didn’t want to be a lawyer. Assume you went to law school, passed the bar, started working, and then realized you hate being a lawyer. What should you do? You invested so much time, energy, and money in that degree, so it can’t be worth starting over again with a new career? Unfortunately, time, energy, and money are all sunk costs, so if your end goal is your happiness, you might need to cut your losses and refocus your energies elsewhere.

With the above examples, next time you face a decision, ignore all the sunk costs; you will make better decisions for your organization and yourself.

Copyright (c) 2021, Marc A. Borrelli

Recent Posts

The Downfall of Boeing: A Lesson in Core Values

Boeing’s 737 Max issues highlighted the company’s sacrifice of safety for financial performance, resulting in a tarnished reputation. The prioritization of profit over core values also damaged the FAA’s credibility and revealed a lack of accountability for top executives. This downfall serves as a reminder of the importance of maintaining core values and prioritizing them over short-term financial gains.

Resolutions, Here We Go Again.

In reflecting on 2021 resolutions, the author scored themselves in three categories and sought to improve success in 2022 by addressing friction points. Drawing on advice from social psychologist Wendy Wood, the author identified areas to reduce or increase friction in their failed resolutions. By making these adjustments, the author aims to enhance their goal achievement and encourages others to consider friction when setting resolutions.

You need to take an extended vacation. No, seriously, you do.

COVID has taken a toll on all of us. If you have not taken an extended vacation in a while where you disconnect, you need to now. You and your business will benefit.

Becoming Famous in Your Niche: The Success Story of Linn Products Limited

In a previous discussion, I highlighted the importance of being famous for something. Being well-known in your niche can help you: Concentrate on your strengths Connect with your target audience Communicate your offerings more effectively Receive referrals Identify...

Understanding and Optimizing Your Cash Conversion Cycle

Understanding and optimizing the Cash Conversion Cycle is crucial for business growth, as it impacts cash flow and the ability to access external capital. This cycle consists of four components: Sales, Make/Production & Inventory, Delivery, and Billing and Payments. To improve the Cash Conversion Cycle, companies can eliminate mistakes, shorten cycle times, and revamp their business models.

Discovering Your Niche: Why You Need to Be Famous for Something

As an entrepreneur, it’s crucial to specialize in a specific area and become famous for something, allowing you to generate referrals and build your brand. Understanding the “job” you’re hired for helps you stand out in the marketplace and communicate your value proposition effectively. By providing value to your clients, you can adopt a value-based pricing approach, ensuring your business remains competitive and maintains a strong market presence.

Rethinking Your Pricing Model: Maximizing Margins and Providing Value

Rethink your pricing model by focusing on the value you provide and your customers’ Best Alternative To a Negotiated Agreement (BATNA). This approach can help you maximize margins while delivering better value to your clients. Assess your offerings and brainstorm with your team to identify pricing adjustment opportunities or eliminate commodity products or services.

Do you know your Profit per X to drive dramatic growth?

I recently facilitated a workshop with several CEOs where we worked on the dramatic business growth model components. One of the questions that I had asked them beforehand was, "What is Your Profit/X?" The results showed that there this concept is not clear to many....

The War for Talent: 5 Ways to Attract the Best Employees

In today’s War for Talent, attracting the best employees requires a focus on value creation, core customer, brand promise, and value delivery. Clearly articulate your company’s mission, identify your “core employee” based on shared values, and offer more than just a salary to stand out as an employer. Utilize employee satisfaction metrics and showcase your company’s commitment to its workforce on your website to make a strong impression on potential candidates.

Are you killing your firm’s WFH productivity?

Productivity remained during WFH with COVID. However, further analysis found that hourly productivity fell and was compensated for by employees working more hours. What was the culprit – Meetings. Want to increase productivity, have fewer meetings.

amlodipine drug order norvasc 10mg pill buy norvasc 10mg generic

buy generic rosuvastatin online crestor over the counter ezetimibe where to buy

order lisinopril pill buy cheap lisinopril zestril 10mg usa

domperidone pill purchase sumycin without prescription tetracycline 250mg cost

order omeprazole 10mg pill buy generic prilosec 20mg brand prilosec 10mg

flexeril without prescription purchase ozobax for sale buy cheap generic baclofen

lopressor oral order metoprolol 100mg pill metoprolol medication

toradol 10mg pill toradol 10mg without prescription gloperba cheap

order generic atenolol 50mg atenolol 100mg uk buy atenolol without prescription

methylprednisolone 8 mg online buy depo-medrol tablets methylprednisolone order

inderal medication buy inderal 10mg online cheap buy clopidogrel 150mg generic

mba essay service essay buy online help with thesis

methotrexate price methotrexate canada coumadin 5mg ca

metoclopramide cheap order reglan generic buy losartan without a prescription

buy meloxicam 15mg online cheap celecoxib 100mg usa celecoxib 200mg usa

brand esomeprazole buy cheap generic topamax purchase topiramate sale

I¦ll immediately grab your rss as I can’t find your email subscription hyperlink or newsletter service. Do you have any? Kindly let me understand so that I may just subscribe. Thanks.

generic flomax 0.2mg flomax 0.2mg oral celecoxib us

Your article helped me a lot, is there any more related content? Thanks!

cost sumatriptan 50mg where can i buy sumatriptan brand levofloxacin 500mg

buy generic zofran buy ondansetron 4mg generic order aldactone 25mg generic

Glad to be one of the visitors on this awful internet site : D.

buy cheap generic dutasteride order avodart 0.5mg generic purchase ranitidine without prescription

cheap simvastatin 20mg simvastatin medication valacyclovir where to buy

buy acillin tablets buy generic ampicillin over the counter order amoxicillin online cheap

finasteride 1mg drug proscar pill buy diflucan 200mg pills

cipro 500mg tablet – buy bactrim 480mg generic order augmentin 625mg pills

purchase ciprofloxacin online cheap – order myambutol 1000mg generic augmentin 375mg cost

link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link

link link link link link link

link link link link link link link link link

link link link link link link link link link

link link link link link link link link link

link link link link link link link link link

link link link link link link link link link

link link link link link link link link link

link link link link link link link link link

suhagrat xxx xxx videos xxx hd video xxx videos

indian xxx video hindi alyx star xxx xxx video download xxx videos hd

xxx hd hindi hindi xxx anime xxx xxx (film series) xxx video

hindi mein xxx hot videos xxx bhojpuri anjali arora xxx xxx sex video

xxx video hindi mein alyx star xxx johnny sins xxx xxx वीडियो xxx

desi xxx bhojpuri xxx sexy xxx (film series) xxx bhojpuri xxx video hindi xxx hindi xxx sexy video xxx

hot video xxx full hd xxx gf hindi xxx videos xxx video hd

xxx video download xxx tentacion

xxx hd hindi india xxx xxx sex videos xxx hindi video xxx gf xxx videos in hindi xxx tentacion death

xxx (film series) movies johnny sins xxx

porn xxx nora fatehi xxx bf xxx xxx story xxx tentacion death alyx star xxx xxx hindi video xxx sis xxx video hindi

cartoon xxx your priya xxx xxx v xxx indian video xxx sis

xxx hot video your priya xxx xxx tentacion lyrics johnny sins xxx

xxx com www xxx video xxx tentacion lyrics sunny leone xxx xxx tentacion real

name xxx sex videos xxx video download mia khalifa xxx xxx bhojpuri

xxx (film series) nora fatehi xxx xxx hindi video xxx porn videos www xxx video hindi xxx xxx

story xxx hindi video xxx desi

hindi xxx video xxx hd videos xxx videos indian russian xxx xxx tentacion real name xxx videos hindi xxx

porn video hot xxx videos xxx movie

russian xxx xxx videos indian xxx hot xxx v xxx hot xxx sis xxx in hindi

bhabhi xxx xxx video hindi mein

xxx videos hd xxx video indian russian xxx xxx sis xxx tentacion lyrics xxx

hindi video xxx hd xxx sis xxx videos hindi

gay xxx xxx sis xxx story cartoon xxx xxx (film series) movies xxx tentacion death hot xxx videos cartoon xxx xxx hindi nora fatehi xxx xxx tentacion lyrics hindi xxx

video xxx sexy xxx porn video xxx hot video

xxx xxx hot video xxx tentacion real name xxx bhojpuri xxx videos hindi xxx videos

in hindi xxx videos indian suhagrat xxx xxx video download xxx v anjali arora xxx

xxx best

xxx india xxx (film series) nora fatehi xxx hot xxx gay xxx xxx

porn videos desi xxx xxx tentacion xxx video indian

xxx sexy videos xxx videos hd xxx video download rashmika mandanna xxx xxx

in hindi hot xxx videos xxx sexy videos xxx vedio www xxx video

xxx hot xxx video hindi xxx tentacion xxx videos in hindi xxx

hd hindi your priya xxx xxx वीडियो xxx sex videos xxx tentacion

johnny sins xxx xxx tentacion xxx (film series) xxx india rashmika mandanna xxx

gay xxx xxx sexy videos xxx वीडियो xxx sex

nora fatehi xxx rashmika mandanna xxx bhabhi xxx xxx videos indian xxx tentacion lyrics bf

xxx xxx tentacion real name xxx sex videos hindi xxx videos

xxx in hindi xxx videos in hindi sex xxx xxx

video hd rashmika mandanna xxx indian xxx video hindi xxx video bf xxx

xxx tentacion death

xxx video hindi xxx video xxx hindi video hindi xxx gungun gupta xxx, xxx video hd xxx bhojpuri nora fatehi xxx johnny sins xxx

metronidazole price – order oxytetracycline 250mg purchase azithromycin for sale

ciprofloxacin over the counter – ciprofloxacin 500mg sale erythromycin 250mg uk

cheap valacyclovir 500mg – where can i buy nemasole buy cheap generic zovirax

ivermectin 6mg online – sumycin price tetracycline 250mg drug

I always used to read post in news papers but now as I am a user of internet so from now I am using net for articles, thanks to web.

source source source source source source source source source source source

source source source source source source source source source source source source source source

source source source source source source source source source

source source

source source source source source source source source source

source source source source source source source source source

source source source source source source source source source

source source source source source source source source source

source source source source source source source source source

source source source source source source source source source

source source source source source source source source source

source source source source source source source source source source

source source source source source source source source source source source source source source source source source source source source source source source source

source source

source source source source source source source source source

source source source source source source source source source

source source source source source source source source source

source source source source source source source source source

source source source source source source source source source

source source source source source source source source source

source source source source source source source source source

Wow that was odd. I just wrote an very long comment but after I clicked submit my comment didn’t show up. Grrrr… well I’m not writing all that over again. Anyhow, just wanted to say excellent blog!

you are in point of fact a good webmaster. The website loading

velocity is incredible. It kind of feels that you are doing any unique trick.

In addition, The contents are masterpiece. you’ve performed a fantastic task on this matter!

source, source, source, source, source, source, source, source, source, source, source, source,

source, source, source, source, source, source, source, source,

source, source, source, source, source, source, source, source, source,

source, source, source, source, source, source, source, source, source, source, source, source, source, source, source, source,

source, source, source, source, source, source, source, source, source,

source, source, source, source, source, source,

flagyl 400mg drug – flagyl 400mg uk cost azithromycin 250mg

I do not even know how I ended up here, but I thought this post was great. I don’t know who you are but definitely you’re going to a famous blogger if you aren’t already 😉 Cheers!

ampicillin online order purchase doxycycline pill buy amoxicillin tablets

Greetings from Los angeles! I’m bored to tears at work so

I decided to check out your blog on my iphone during lunch break.

I really like the information you present here and can’t wait to take a look when I get home.

I’m shocked at how fast your blog loaded on my cell phone ..

I’m not even using WIFI, just 3G .. Anyhow,

superb blog!

source, source, source, source, source, source, source, source,

source, source, source, source, source, source, source, source, source, source, source, source, source,

source, source, source, source, source, source, source, source,

source, source, source, source, source, source,

source, source, source, source, source, source, source,

Hiya very cool website!! Man .. Excellent .. Amazing .. I will bookmark your blog and take the feeds also…I am satisfied to find a lot of helpful information here within the publish, we’d like develop more strategies in this regard, thank you for sharing. . . . . .

Восторгаемся возможностью анонсировать новейшее обновление приложения от БК Олимп для Android! Ваше взаимодействие со ставками на спорт станет еще более увлекательным благодаря обновленному интерфейсу и ускоренной работе программы. [url=https://best-olimpbet-apk.ru/]Олимп на андроид[/url] уже сегодня! С последней версией приложения вы получите прямой доступ к разнообразию спортивных событий прямо с вашего мобильного устройства. Ожидайте расширенные возможности для управления счетом, современный дизайн для интуитивного пользования и значительное улучшение скорости приложения. Станьте частью счастливых клиентов БК Олимп и радуйтесь ставкам где угодно и когда угодно. Установите последнюю версию приложения без промедления и начните выигрывать вместе с Олимп!

buy furosemide generic diuretic – buy minipress paypal buy cheap generic captopril

Hey! This is kind of off topic but I need some help from an established

blog. Is it very difficult to set up your own blog?

I’m not very techincal but I can figure things out pretty quick.

I’m thinking about making my own but I’m not sure where

to begin. Do you have any ideas or suggestions? With thanks

source, source, source, source, source, source, source,

source, source, source, source, source, source,

source, source, source, source, source, source, source, source, source, source,

source, source, source, source, source, source, source, source, source, source, source, source,

source, source, source, source, source, source, source,

source, source, source, source, source, source, source, source,

source, source, source, source, source, source, source, source, source,

source,

С огромной радостью разделяем новостью о релизе обновленной версии мобильного приложения от БК Олимп для Android! Это обновление изменит ваш подход к ставкам на спорт, делая процесс более гладким и эффективным. [url=https://olimpbet-apk.ru/]Загрузить файл apk Olimp[/url] и вы получите доступ без труда к огромному выбору спортивных мероприятий, открытых для ставок прямо с вашего мобильного. Расширенные функции управления профилем, интуитивный дизайн для легкости использования и ускорение скорости приложения обещают выдающийся опыт. Становитесь частью сообществу довольных клиентов и наслаждайтесь ставками в любом месте, когда захотите. Скачайте последнюю версию приложения БК Олимп уже сейчас и погрузитесь в мир игры с комфортом и стилем!

Мы коллектив SEO-экспертов, специализирующихся на продвижении сайтов в поисковых системах.

Мы получили заметные достижения и желаем поделиться с вами нашими знаниями и навыками.

Что мы можем вам предложить:

• [url=https://seo-prodvizhenie-ulyanovsk1.ru/]продвижение сайта магазин цена[/url]

• Анализ всех аспектов вашего сайта и разработка уникальной стратегии продвижения.

• Модернизация контента и технических аспектов вашего сайта для оптимальной работы.

• Регулярное отслеживание и анализ результатов, с целью постоянного улучшения вашего онлайн-присутствия.

Подробнее [url=https://seo-prodvizhenie-ulyanovsk1.ru/]https://seo-prodvizhenie-ulyanovsk1.ru/[/url]

Наши клиенты уже видят результаты: повышение посещаемости, улучшение позиций в поисковых запросах и, конечно же, рост бизнеса. Вы можете получить бесплатную консультацию у нас, чтобы обсудить ваши потребности и помочь вам разработать стратегию продвижения, соответствующую вашим целям и бюджету.

Не упустите шанс улучшить свои результаты в интернете. Обратитесь к нам немедленно.

purchase metformin pills – order bactrim 960mg pill cost lincocin 500mg

zidovudine 300mg pill – buy biaxsig generic zyloprim 300mg for sale

I’ve been absent for a while, but now I remember why I used to love this website. Thanks, I will try and check back more frequently. How frequently you update your site?

Hello would you mind letting me know which webhost you’re using?

I’ve loaded your blog in 3 different browsers and I must say this blog

loads a lot quicker then most. Can you suggest a good hosting provider at

a reasonable price? Kudos, I appreciate it!

indian sex, indian porn, indian xxx, indian xxx, indian porn, sex, porn, sex videos, indian porn, sex videos,

indian sex, porn, indian porn, porn videos, indian xxx,

sex videos, xnxx, indian xxx, indian sex, xnxx videos, xnxx

videos, sex videos, porn videos, xnxx videos, sex, porn videos, sex, xnxx videos, indian porn,

porn hd, porn hd, xnxx videos, porn hd, xnxx videos, indian porn, sex videos, porn hd, indian porn, indian xxx, indian xxx, sex videos, xnxx

videos, sex, porn videos, xnxx videos, porn hd, xnxx videos,

xnxx videos, indian porn, indian xxx, indian porn, indian sex,

indian xxx, porn videos, sex, xnxx videos, xnxx videos, sex videos, xnxx videos, sex videos,

Искали где [url=https://el-gusto.ru/]https://el-gusto.ru/[/url]? Качественные беспроводные наушники в Москве. Копия оригинальных AirPods с активным шумоподавлением всего за 2490 рублей. Самые качественные гаджеты по низким ценам. Быстрая доставка по России.

Ищете где [url=https://el-gusto.ru/]купить копию Airpods PRO в Москве[/url]? Наилучшие беспроводные наушники в Москве и РФ. Реплика оригинальных AirPods с активным шумоподавлением по цене 2490 рублей. Проверенные гаджеты по низким ценам. Быстрая доставка по России.

Не могу каждый раз прям дрожь берет когда встречаю это [url=https://globalmsk.ru/firmnews/id/33207/1]обзорник зевс[/url] где-нибудь.

Чем дальше от casinozeus.by тем лучше сплошная реклама мутных контор. [url=https://o-kemerovo.ru/rejting-onlajn-kazino-belarusi-casino-zeus/]http://forum.igromania.ru/member.php?u=630810[/url]

В поисках где [url=https://mdou41orel.ru/]купить реплику Airpods PRO[/url]? Наилучшие беспроводные наушники в Москве и области. Реплика оригинальных AirPods с активным шумоподавлением по цене 2490 рублей. Только качественные гаджеты по приемлимым ценам. Доставка по России.

Искали где [url=https://mdou41orel.ru/]купить реплику наушников Airpods PRO в Москве[/url]? Наилучшие беспроводные наушники в Москве и РФ. Реплика оригинальных AirPods с активным шумоподавлением со скидкой. Надежные гарнитуры по приемлимым ценам. Быстрая доставка по России.

В поисках где [url=https://mdou41orel.ru/]купить копию Аирподс ПРО[/url]? Топовые беспроводные наушники в Москве и области. Копия оригинальных AirPods с шумоподавлением по цене 2490 рублей. Только проверенные гарнитуры по низким ценам. Доставка по России.

Искали где [url=https://mdou41orel.ru/]копия Airpods PRO[/url]? Качественные беспроводные наушники в Москве и области. Реплика оригинальных AirPods с активным шумоподавлением всего за 2490 рублей. Надежные гарнитуры по приемлимым ценам. Быстрая доставка по России.

I am now not certain where you’re getting your information, however good topic. I needs to spend some time studying much more or figuring out more. Thank you for fantastic info I used to be looking for this info for my mission.

Some really great posts on this site, thanks for contribution.

buy clozaril 50mg – order quinapril 10mg without prescription purchase famotidine online

Одни проблемы. [url=https://leon.ru/android/]Леон не работает приложение[/url] и с чем связана данная проблема я не знаю. Но лучше поискать другой источник для скачивания данной программы. Тут тратить свое время не советую.

Одни проблемы. [url=https://leon.ru/android/]Букмекерская контора леон не работает[/url] и с чем связана данная проблема я не знаю. Но лучше поискать другой источник для скачивания данной программы. Тут тратить свое время не советую.

Одни проблемы. [url=https://apps.rustore.ru/app/com.leonru.mobile5]Приложение бк леон вылетает[/url] и с чем связана данная проблема я не знаю. Но лучше поискать другой источник для скачивания данной программы. Тут тратить свое время не советую.

Одни проблемы. [url=https://apps.rustore.ru/app/com.leonru.mobile5]Почему не работает бк леон сегодня[/url] и с чем связана данная проблема я не знаю. Но лучше поискать другой источник для скачивания данной программы. Тут тратить свое время не советую.

Искали где [url=https://el-gusto.ru/]купить реплику Airpods PRO в Москве[/url]? Лучшие беспроводные наушники в Москве и области. Копия оригинальных AirPods с шумоподавлением всего за 2490 рублей. Только качественные гарнитуры по доступным ценам. Быстрая доставка по России.

Ищете где [url=https://el-gusto.ru/]купить реплику Airpods PRO[/url]? Качественные беспроводные наушники в Москве и области. Копия оригинальных AirPods с шумоподавлением со скидкой. Самые надежные гарнитуры по доступным ценам. Быстрая доставка по России.

В поисках где [url=https://mdou41orel.ru/]https://mdou41orel.ru/[/url]? Наилучшие беспроводные наушники в Москве и РФ. Реплика оригинальных AirPods с шумоподавлением по скидке. Только проверенные гаджеты по приемлимым ценам. Доставка по России.

Ищете где [url=https://mdou41orel.ru/]купить копию Аирподс ПРО в Москве[/url]? Наилучшие беспроводные наушники в Москве и области. Копия оригинальных AirPods с шумоподавлением по скидке. Самые надежные гаджеты по приемлимым ценам. Быстро доставим по России.

Искали где [url=https://el-gusto.ru/]купить копию Airpods PRO[/url]? Лучшие беспроводные наушники в Москве. Копия оригинальных AirPods с активным шумоподавлением со скидкой. Проверенные гаджеты по приемлимым ценам. Доставим по России.

В поисках где [url=https://el-gusto.ru/]el-gusto.ru[/url]? Наилучшие беспроводные наушники в Москве и РФ. Реплика оригинальных AirPods с шумоподавлением по скидке. Самые качественные гаджеты по доступным ценам. Быстрая доставка по России.

В поисках где [url=https://mdou41orel.ru/]купить реплику наушников Airpods PRO[/url]? Качественные беспроводные наушники в Москве. Реплика оригинальных AirPods с активным шумоподавлением всего за 2490 рублей. Проверенные гарнитуры по приемлимым ценам. Доставка по России.

Ищете где [url=https://mdou41orel.ru/]реплика Airpods PRO[/url]? Качественные беспроводные наушники в Москве и РФ. Копия оригинальных AirPods с активным шумоподавлением со скидкой. Надежные гарнитуры по доступным ценам. Доставим по России.

Одни проблемы. [url=https://leon.ru/android/]Почему не работает бк леон сегодня[/url] и с чем связана данная проблема я не знаю. Но лучше поискать другой источник для скачивания данной программы. Тут тратить свое время не советую.

Одни проблемы. [url=https://leon.ru/android/]Леон букмекерская не работает[/url] и с чем связана данная проблема я не знаю. Но лучше поискать другой источник для скачивания данной программы. Тут тратить свое время не советую.

seroquel over the counter – order generic seroquel 100mg order eskalith pill

Одни проблемы. [url=https://apps.rustore.ru/app/com.leonru.mobile5]БК леон не работает[/url] и с чем связана данная проблема я не знаю. Но лучше поискать другой источник для скачивания данной программы. Тут тратить свое время не советую.

Одни проблемы. [url=https://apps.rustore.ru/app/com.leonru.mobile5]БК леон не могу войти[/url] и с чем связана данная проблема я не знаю. Но лучше поискать другой источник для скачивания данной программы. Тут тратить свое время не советую.

anafranil cheap – tofranil cheap buy sinequan 25mg pills

order atarax pill – order prozac 20mg online cheap order endep

Thanks for another informative web site. Where else could I get that kind of info written in such an ideal way? I have a project that I am just now working on, and I’ve been on the look out for such info.

Fantastic post however , I was wondering if you could write a litte more on this subject?

I’d be very thankful if you could elaborate a little

bit more. Kudos!

Awesome article.

As I website possessor I think the written content here is really fantastic, regards for your efforts.

What i do not realize is in truth how you’re no longer really much more neatly-appreciated than you might be right now.

You are so intelligent. You already know thus significantly on the subject of

this subject, made me in my view consider it from a lot of

various angles. Its like women and men don’t seem to be involved until it is something to accomplish

with Lady gaga! Your individual stuffs nice. Always handle

it up!

I reckon something really special in this site.

Can I just say what a relief to find someone who actually knows what theyre talking about on the internet. You definitely know how to bring an issue to light and make it important. More people need to read this and understand this side of the story. I cant believe youre not more popular because you definitely have the gift.

My coder is trying to convince me to move to .net from PHP. I have always disliked the idea because of the costs. But he’s tryiong none the less. I’ve been using WordPress on various websites for about a year and am concerned about switching to another platform. I have heard great things about blogengine.net. Is there a way I can import all my wordpress content into it? Any kind of help would be really appreciated!

I¦ll immediately grab your rss as I can not in finding your email subscription link or e-newsletter service. Do you’ve any? Kindly permit me understand in order that I may subscribe. Thanks.

Всем привет! Предлагаем [url=https://do-zarplaty.xyz/]где взять денег в Минске[/url] круглосуточно. Вы можете получить средства без излишних вопросов и документов. Приятные условия заема и быстрое получение в вашем городе. Звоните для уточнения подробной информации, либо оставляйте заявку на сайте.

Привет! Предлагаем [url=https://do-zarplaty.xyz/]где взять деньги в долг[/url] круглосуточно. Вы можете получить деньги без избыточных вопросов и документов. Привлекательные условия займа и моментальное получение рядом с вами. Набирайте нам для уточнения подробной информации, или оставляйте заявку на сайте.

Здравствуйте! Возник вопрос про [url=https://dengizaimy.by/]взять займ срочно[/url]? Предлагаем стабильный источник финансовой помощи. Вы можете получить финансирование в займ без лишних вопросов и документов? Тогда обратитесь к нам! Мы готовы предоставить высокоприбыльные условия кредитования, моментальное решение и обеспечение конфиденциальности. Не откладывайте свои планы и мечты, воспользуйтесь доступным предложением прямо сейчас!

Приветствую! Появился вопрос про [url=https://dengizaimy.by/]займ срочно[/url]? Предоставляем надежный источник финансовой помощи. Вы можете получить средства в долг без лишних вопросов и документов? Тогда обратитесь к нам! Мы предлагаем высокоприбыльные условия займа, оперативное решение и гарантию конфиденциальности. Не откладывайте свои планы и мечты, воспользуйтесь доступным предложением прямо сейчас!

Всем привет! Предлагаю [url=https://do-zarplaty.xyz/]предоставление займа[/url] в любое время. Вы можете получить деньги без излишних вопросов и документов. Доступные условия займа и быстрое получение рядом с вами. Набирайте нам для уточнения подробной информации, либо оставляйте заявку на сайте.

Всем привет! Предлагаю [url=https://do-zarplaty.xyz/]получить деньги в долг в Минске[/url] в любом городе. Вы можете получить средства без избыточных вопросов и документов. Привлекательные условия займа и срочное получение в любом городе. Звоните для получения подробной информации, или оставляйте заявку на сайте.

Здравствуйте! Возник вопрос про [url=https://financedirector.by/]получить денег в долг в интернете[/url]? Предоставляем стабильный источник финансовой помощи. Вы можете получить финансирование в займ без лишних вопросов и документов? Тогда обратитесь к нам! Мы предоставляем выгодные условия кредитования, моментальное решение и обеспечение конфиденциальности. Не откладывайте свои планы и мечты, воспользуйтесь предложенным предложением прямо сейчас!

buy amoxiclav – buy linezolid no prescription order baycip generic

buy amoxil generic – erythromycin 250mg cost baycip oral

For newest information you have to go to see internet and

on internet I found this site as a finest website for hottest updates.

This site was… how do I say it? Relevant!! Finally I’ve found something that helped me.

Kudos!

What’s up colleagues, pleasant paragraph and nice arguments

commented here, I am truly enjoying by these.

buy clindamycin cheap – order monodox online order chloromycetin online

buy azithromycin 500mg without prescription – buy generic ciprofloxacin brand ciprofloxacin

WOW just what I was searching for. Came here by searching for %keyword%

Hello, I log on to your new stuff daily. Your writing style is awesome, keep up the good work!

Fantastic website. Plenty of useful information here. I¦m sending it to several friends ans additionally sharing in delicious. And of course, thanks on your effort!

Heya i’m for the first time here. I came across this board and I find It really useful & it helped me out much. I hope to provide something again and help others like you helped me.

Hi there just wanted to give you a quick heads up. The words in your post seem to be running off the screen in Ie.

I’m not sure if this is a format issue or something to do with internet browser compatibility

but I figured I’d post to let you know. The style and design look

great though! Hope you get the issue solved soon. Cheers

ivermectine online – stromectol canada buy cefaclor sale

albuterol medication – promethazine sale buy theo-24 Cr 400 mg online cheap

В настоящее время наши дни могут содержать внезапные издержки и экономические трудности, и в такие моменты каждый ищет надежную поддержку. На сайте [url=https://brokers-group.ru/]взять деньги в долг[/url] вам помогут без лишних сложностей. В своей роли представителя я стремлюсь поделиться этими сведениями, чтобы помочь тем, кто столкнулся с временными трудностями. Наша система обеспечивает честные условия и эффективное рассмотрение запросов, чтобы каждый мог решить свои денежные проблемы оперативно и без лишних затрат времени.

В настоящее время наши дни могут содержать внезапные издержки и финансовые вызовы, и в такие моменты каждый ищет помощь. На сайте [url=https://brokers-group.ru/]Брокерс Групп[/url] вам помогут без избыточной бюрократии. В своей роли агента я стремлюсь распространить эту информацию, чтобы помочь тем, кто столкнулся с временными трудностями. Наша платформа обеспечивает честные условия и быструю обработку заявок, чтобы каждый мог решить свои денежные проблемы быстро и без лишних хлопот.

В наше время многие из нас сталкиваются с внезапными затратами и экономическими вызовами, и в такие моменты важно иметь доступ к дополнительным средствам. На сайте [url=https://dengizaimy.ru/]деньги в долг в Минске[/url] вам помогут быстро и удобно. В качестве официального представителя Брокерс Групп, я с удовольствием делиться этой важной информацией, чтобы помочь каждому, кто столкнулся с финансовыми трудностями. Наша платформа гарантирует прозрачные условия и быструю обработку заявок, чтобы каждый мог разрешить свои денежные проблемы с минимальными временными затратами.

В наше время многие из нас сталкиваются с внезапными затратами и денежными трудностями, и в такие моменты важно иметь возможность взять кредит. На сайте [url=https://dengizaimy.ru/]dengizaimy.ru[/url] вам помогут с минимальными усилиями. В качестве официального представителя Брокерс Групп, я рад делиться этой важной информацией, чтобы помочь каждому, кто столкнулся с финансовыми трудностями. Наша система гарантирует прозрачные условия и оперативное рассмотрение запросов, чтобы каждый мог разрешить свои денежные проблемы с минимальными временными затратами.

В настоящей эпохе финансовые трудности не редкость, и каждый человек может оказаться в ситуации, когда необходима дополнительная финансовая поддержка. На сайте [url=https://moneybel.ru/]займ денег[/url] помогут решить эти проблемы, предоставляя простой и лёгкий метод займа. Мы понимаем, что времени на решение проблемы не хватает, поэтому наш процесс обработки заявок максимально быстр и эффективен. В роли представителя Манибел, мы нацелены на то, чтобы помочь каждому клиенту преодолеть свои денежные трудности, предложив ясные и выгодные условия займа. Доверьтесь нам, и мы решим ваши финансовые проблемы.

В настоящей эпохе финансовые трудности не редкость, и каждый из нас может оказаться в ситуации, когда потребуется дополнительная финансовая помощь. На сайте [url=https://moneybel.ru/]деньги в долг на карту[/url] помогут преодолеть эти трудности, принося простой и лёгкий метод займа. Мы понимаем, что времени на решение проблемы не хватает, поэтому мы обрабатываем заявки оперативно и эффективно. В роли представителя Манибел, наша цель – помочь каждому клиенту преодолеть финансовые затруднения, предложив ясные и выгодные условия займа. Доверьтесь нашей компании, и мы поможем вам в решении ваших финансовых проблем.

В настоящей экономической обстановке, где неожиданные финансовые обязательства могут возникнуть в любое время, поиск надежного и удобного источника финансовой помощи становится все более критическим. Предложение [url=https://zaim-minsk.ru/]взять деньги в долг в Минске[/url] предлагает возможность рассчитывать на быстрое и беззаботное получение необходимых средств без лишних трудностей. Мы ценим ваше время и обеспечиваем оперативную обработку всех запросов. В качестве вашего финансового партнера, наша главная задача состоит в том, чтобы помочь вам преодолеть текущие финансовые препятствия, предоставляя ясные и выгодные условия кредитования. Доверьтесь нам в вашем финансовом путешествии, и мы обеспечим вас надежной поддержкой на каждом этапе.

В настоящей экономической обстановке, где неожиданные финансовые обязательства могут возникнуть в любое время, поиск надежного и удобного источника финансовой помощи становится все более критическим. Предложение [url=https://zaim-minsk.ru/]zaim-minsk.ru[/url] предлагает возможность рассчитывать на быстрое и беззаботное получение необходимых средств без лишних трудностей. Мы ценим ваше время и обеспечиваем оперативную обработку всех запросов. В качестве вашего финансового партнера, наша главная задача состоит в том, чтобы помочь вам преодолеть текущие финансовые препятствия, предоставляя ясные и выгодные условия кредитования. Доверьтесь нам в вашем финансовом путешествии, и мы обеспечим вас надежной поддержкой на каждом этапе.

В настоящее время наши дни могут содержать внезапные издержки и экономические трудности, и в такие моменты каждый ищет надежную поддержку. На сайте [url=https://brokers-group.ru/]brokers-group.ru[/url] вам помогут без избыточной бюрократии. В своей роли агента я стремлюсь поделиться этими сведениями, чтобы помочь тем, кто столкнулся с временными трудностями. Наша платформа обеспечивает прозрачные условия и быструю обработку заявок, чтобы каждый мог решить свои денежные проблемы быстро и без лишних хлопот.

В настоящее время наши дни могут содержать неожиданные расходы и экономические трудности, и в такие моменты каждый ищет помощь. На сайте [url=https://brokers-group.ru/]займ в Минске[/url] вам помогут без лишних сложностей. В своей роли агента я стремлюсь распространить эту информацию, чтобы помочь людям в сложной ситуации. Наша система обеспечивает прозрачные условия и эффективное рассмотрение запросов, чтобы каждый мог разрешить свои финансовые вопросы оперативно и без лишних затрат времени.

В наше время многие из нас сталкиваются с внезапными затратами и экономическими вызовами, и в такие моменты важно иметь доступ к дополнительным средствам. На сайте [url=https://dengizaimy.ru/]займ в беларуси[/url] вам помогут с минимальными усилиями. В качестве представителя Брокерс Групп, я рад делиться этой важной информацией, чтобы помочь каждому, кто нуждается в финансовой поддержке. Наша система гарантирует прозрачные условия и быструю обработку заявок, чтобы каждый мог решить свои финансовые вопросы с минимальными временными затратами.

В наше время многие из нас сталкиваются с непредвиденными расходами и экономическими вызовами, и в такие моменты важно иметь возможность взять кредит. На сайте [url=https://dengizaimy.ru/]быстрый займ[/url] вам помогут с минимальными усилиями. В качестве представителя Брокерс Групп, я рад делиться этой информацией, чтобы помочь людям, кто столкнулся с финансовыми трудностями. Наша система гарантирует честные условия и оперативное рассмотрение запросов, чтобы каждый мог разрешить свои денежные проблемы быстро и эффективно.

Sweet blog! I found it while browsing on Yahoo News. Do you have any tips on how to get listed in Yahoo News? I’ve been trying for a while but I never seem to get there! Thanks

I¦ve read several excellent stuff here. Definitely worth bookmarking for revisiting. I surprise how a lot attempt you set to create this sort of wonderful informative site.

В настоящей эпохе финансовые трудности встречаются часто, и каждый человек может оказаться в ситуации, когда потребуется дополнительная финансовая помощь. На сайте [url=https://moneybel.ru/]moneybel.ru[/url] помогут решить эти проблемы, принося простой и лёгкий метод займа. Мы осознаём, что времени на решение проблемы не хватает, поэтому мы обрабатываем заявки оперативно и эффективно. В качестве представителя Манибел, наша цель – помочь каждому клиенту преодолеть финансовые затруднения, предложив ясные и выгодные условия займа. Доверьтесь нашей компании, и мы поможем вам в решении ваших финансовых проблем.

В сегодняшнем обществе финансовые сложности не редкость, и каждый из нас может оказаться в ситуации, когда потребуется дополнительная финансовая помощь. На сайте [url=https://moneybel.ru/]взять деньги в долг[/url] помогут преодолеть эти трудности, принося простой и удобный способ займа. Мы осознаём, что время играет ключевую роль, поэтому мы обрабатываем заявки оперативно и эффективно. В качестве представителя Манибел, наша цель – помочь каждому клиенту преодолеть финансовые затруднения, предоставив прозрачные и выгодные условия кредитования. Доверьтесь нам, и мы поможем вам в решении ваших финансовых проблем.

В настоящей экономической обстановке, где неожиданные финансовые обязательства могут возникнуть в любое время, поиск надежного и удобного источника финансовой помощи становится все более критическим. Предложение [url=https://zaim-minsk.ru/]быстрый займ[/url] предлагает возможность рассчитывать на быстрое и беззаботное получение необходимых средств без лишних трудностей. Мы ценим ваше время и обеспечиваем оперативную обработку всех запросов. В качестве вашего финансового партнера, наша главная задача состоит в том, чтобы помочь вам преодолеть текущие финансовые препятствия, предоставляя ясные и выгодные условия кредитования. Доверьтесь нам в вашем финансовом путешествии, и мы обеспечим вас надежной поддержкой на каждом этапе.

В настоящей экономической обстановке, где неожиданные финансовые обязательства могут возникнуть в любое время, поиск надежного и удобного источника финансовой помощи становится все более критическим. Предложение [url=https://zaim-minsk.ru/]получить деньги в долг[/url] предлагает возможность рассчитывать на быстрое и беззаботное получение необходимых средств без лишних трудностей. Мы ценим ваше время и обеспечиваем оперативную обработку всех запросов. В качестве вашего финансового партнера, наша главная задача состоит в том, чтобы помочь вам преодолеть текущие финансовые препятствия, предоставляя ясные и выгодные условия кредитования. Доверьтесь нам в вашем финансовом путешествии, и мы обеспечим вас надежной поддержкой на каждом этапе.

After study a few of the blog posts in your web site now, and I truly like your method of blogging. I bookmarked it to my bookmark website record and shall be checking again soon. Pls try my website as well and let me know what you think.

I will right away take hold of your rss as I can’t in finding your e-mail subscription link or e-newsletter service. Do you have any? Kindly allow me know so that I could subscribe. Thanks.

Внимание, любители ставок! БК Олимп представляет с гордостью последнюю версию своего приложения для Android, которое обещает изменить ваш мир ставок на радость. Мы полностью пересмотрели приложение, чтобы предоставить вам лучший впечатление от ставок на спорт. [url=https://top-olimp-apk.ru/]Олимп бет на андроид[/url] и откройте просмотр разнообразных спортивных событий, который стал удобнее благодаря улучшенному интерфейсу и ускоренной обработке данных. Присоединяйтесь к сообществу БК Олимп и пользуйтесь возможностью делать ставки в любой точке мира, будь то на диване или в отпуске. Получите новую версию приложения без задержек и откройте для себя мир ставок с БК Олимп, где победы становятся реальностью!

Внимание, любители ставок! БК Олимп представляет с гордостью последнюю версию своего приложения для Android, которое обещает перевернуть ваш мир ставок на радость. Мы полностью пересмотрели приложение, чтобы гарантировать лучший опыт от ставок на спорт. [url=https://top-olimp-apk.ru/]Скачать Olimp bet на андроид[/url] и откройте просмотр разнообразных спортивных событий, который стал проще благодаря новому дизайну и ускоренной обработке данных. Присоединяйтесь к сообществу БК Олимп и пользуйтесь возможностью делать ставки где угодно, будь то дома или в путешествии. Получите новую версию приложения без задержек и откройте для себя мир ставок с БК Олимп, где победы становятся реальностью!

order desloratadine 5mg generic – cost ketotifen albuterol 4mg ca

Вот оно, свежее обновление от БК Олимп для всех энтузиастов ставок с Android устройствами! Изменив наше приложение, мы целимся предоставить вам непревзойденный опыт, делая ставки не только простыми, но и захватывающими. [url=https://best-olimpbet-app.ru/]Контора Олимп на андроид[/url] доступное для игроков! С улучшенным интерфейсом и быстрой обработкой данных, доступ к большому разнообразию событий стал проще простого. Ощутите радость от улучшенного управления счетом и интуитивной навигации, которые делают каждую ставку особым событием. Забудьте о пропущенных возможностях – установите последнее обновление сейчас же и вступите в ряды довольных пользователей, празднующих каждой ставке с БК Олимп, где каждый шанс на победу высоко оценивается.

Hello.This post was really motivating, particularly because I was searching for thoughts on this subject last Friday.

Вот оно, свежее веяние от БК Олимп для всех поклонников ставок с Android устройствами! Преобразив наше приложение, мы стремимся предоставить вам непревзойденный опыт, делая ставки не только простыми, но и захватывающими. [url=https://best-olimpbet-app.ru/]Контора Олимп на андроид[/url] доступно для игроков! С улучшенным интерфейсом и ускоренной производительностью, доступ к огромному спектру событий стал легким делом. Ощутите радость от улучшенного управления счетом и простоты использования, которые делают каждую ставку волнующим моментом. Забудьте о пропущенных возможностях – установите последнее обновление немедленно и вступите в ряды довольных пользователей, празднующих каждой ставке с БК Олимп, где каждый шанс на победу высоко оценивается.

methylprednisolone over the counter – medrol 4 mg without a doctor prescription cheap azelastine 10ml

Не пропустите новинку от БК Олимп для Android! [url=https://skachat-olimp-apk.ru/]Olimp для андроид[/url] доступное для игроков. Мы пересмотрели наше приложение, чтобы ваш опыт ставок стал ещё удобнее. С переработанным дизайном и повышенной скоростью, вы получите доступ к широкому ассортименту спортивных событий легко и просто. Оцените простотой управления аккаунтом и лёгкостью использования, делая каждую ставку особым моментом. Загрузите это обновление сегодня и начните выигрывать с БК Олимп, где каждая ставка приносит удовольствие!

Не пропустите обновление от БК Олимп для Android! [url=https://skachat-olimp-apk.ru/]Олимп бет на андроид[/url] доступно для игроков. Мы обновили наше приложение, чтобы ваш опыт ставок стал ещё лучше. С новым интерфейсом и ускоренной обработкой данных, вы получите доступ к многообразию спортивных событий без усилий. Оцените простотой управления аккаунтом и лёгкостью использования, делая каждую ставку особым моментом. Установите это приложение сегодня и стартуйте побеждать с БК Олимп, где каждая ставка приносит удовольствие!

Запуск переделанной версии приложения БК Олимп для Android уже здесь! Переосмыслив функционал, мы сделали процесс ставок невероятно простым. [url=https://skachat-olimpbet.ru/]Контора Олимп на андроид[/url] доступно для ставочников. С обновленным дизайном и ускоренной загрузкой данных, доступ к всему спектру спортивных событий станет игрой. Наслаждайтесь простотой управления счетом и легкой навигацией, превращая каждую ставку в особенный момент. Не теряйте времени, получите последнюю версию без отлагательств и присоединяйтесь к удовлетворенным пользователям с БК Олимп, где ставки приносят наслаждение и победы!

Very nice post and right to the point. I am not sure if this is actually the best place to ask but do you guys have any ideea where to hire some professional writers? Thank you 🙂

Запуск обновленной версии приложения БК Олимп для Android уже здесь! Переосмыслив функционал, мы сделали процесс ставок невероятно простым. [url=https://skachat-olimpbet.ru/]Скачать Olimp bet[/url] доступное для игроков. С обновленным дизайном и ускоренной загрузкой данных, доступ к всему спектру спортивных событий станет игрой. Наслаждайтесь простотой управления счетом и интуитивно понятной навигацией, превращая каждую ставку в важное событие. Не теряйте времени, скачайте последнюю версию без отлагательств и присоединяйтесь к победителям с БК Олимп, где ставки приносят наслаждение и победы!

Откройте для себя новейшие обновления в приложении БК Олимп для Android! [url=https://olimp-apk.ru/]Скачать контору Олимп на андроид[/url] доступное для игроков. Мы совершенствовали наше приложение, чтобы сделать ваше взаимодействие с ставками более приятным. Благодаря усовершенствованному интерфейсу и ускоренной обработке данных, вы теперь имеете легкий доступ к широкому спектру спортивных событий. Научитесь наслаждаться удобство использования своим аккаунтом и интуитивную навигацию, превращая каждую вашу ставку в значимое событие. Загрузите обновление сейчас и начните получать удовольствие от побед вместе с БК Олимп, где каждая ставка несет радость.

Откройте для себя последние новшества в приложении БК Олимп для Android! [url=https://olimp-apk.ru/]Скачать приложение Олимп на андроид[/url] возможно сегодня. Мы совершенствовали наше приложение, чтобы сделать ваше взаимодействие с ставками более приятным. С новым дизайном и быстрой загрузке данных, вы теперь имеете прямой доступ к широкому спектру спортивных событий. Оцените простоту управления своим аккаунтом и интуитивную навигацию, превращая каждую вашу ставку в уникальное приключение. Загрузите обновление прямо сегодня и начните зарабатывать на своих победах вместе с БК Олимп, где каждая ставка несет радость.

Откройте для себя революцию в мире ставок с новейшей версией приложения БК Олимп для Android! [url=https://free-apk-olimp.ru/]Приложение букмекера Олимп[/url] прямо сейчас. Мы полностью переработали приложение, обеспечивая беспрецедентный уровень удобства и быстроту загрузки. Теперь выбор соревнований находится у вас под рукой с новым дизайном и интуитивной навигацией. Испытайте на себе легкость управления счетом и сделайте каждую ставку значительным событием. Загрузите это обновление немедленно и поднимайте свой опыт ставок с БК Олимп, где каждый выбор может принести успех!

Откройте для себя революцию в мире ставок с последним обновлением приложения БК Олимп для Android! [url=https://free-apk-olimp.ru/]Скачать апк файл Олимп Бет[/url] уже сейчас. Мы освежили приложение, обеспечивая беспрецедентный уровень удобства и быстроту загрузки. Теперь выбор соревнований находится у вас под рукой с новым дизайном и легкой навигацией. Испытайте на себе легкость управления счетом и сделайте каждую ставку значительным событием. Установите это приложение сегодня и выходите на новый уровень ставок с БК Олимп, где каждый выбор может принести победу!

Познакомьтесь с новейшим обновлением приложения БК Олимп для Android, преобразующим ваш опыт в мире ставок! [url=https://olimp-bet-app.ru/]Скачать приложение Olimp[/url] доступны для всех игроков. Инновационный дизайн и быстрая загрузка данных гарантируют легкий доступ к множеству спортивных событий. Кастомизируйте свой аккаунт с уникальной простотой и навигацией, превращая каждую ставку в захватывающий опыт. Загрузите сейчас и начните наслаждаться от ставок на новом уровне с БК Олимп, где каждое событие – это шанс на успех!

Undeniably believe that that you said. Your favorite justification appeared to be on the net the easiest factor to be mindful of. I say to you, I definitely get annoyed even as other folks think about issues that they just don’t realize about. You managed to hit the nail upon the top and also defined out the whole thing with no need side effect , folks can take a signal. Will probably be again to get more. Thank you

Познакомьтесь с свежим обновлением приложения БК Олимп для Android, преобразующим ваш опыт в мире ставок! [url=https://olimp-bet-app.ru/]Приложение букмекерской конторы Олимп[/url] доступны для всех ставочников. Передовой дизайн и быстрая загрузка данных гарантируют легкий доступ к широкому ассортименту спортивных событий. Настройте свой аккаунт с уникальной простотой и навигацией, превращая каждую ставку в волнующее приключение. Скачайте сейчас и начните получать удовольствие от ставок на новом уровне с БК Олимп, где каждое событие – это шанс на выигрыш!

Встречайте обновление от БК Олимп для Android, которое полностью преобразит ваш подход к ставкам! С переделанным интерфейсом и ускоренной работой, вы обретете доступ к бесконечному множеству спортивных мероприятий буквально в несколько касаний. [url=https://olimp-bet-apk.ru/]Букмекерская контора Олимп для андроид[/url] доступны для желающих. Простое управление аккаунтом и понятная навигация сделают процесс ставок удовольствием. Не упустите возможность обновиться уже сегодня и разгадайте секреты успешных ставок с БК Олимп, где каждый ваш выбор может привести к успеху!

Встречайте обновление от БК Олимп для Android, которое кардинально изменит ваш подход к ставкам! С усовершенствованным интерфейсом и оптимизированной работой, вы обретете доступ к огромному количеству спортивных мероприятий буквально в несколько касаний. [url=https://olimp-bet-apk.ru/]Приложение БК Олимп[/url] доступны для желающих. Легкое управление аккаунтом и понятная навигация сделают процесс ставок удовольствием. Не упустите возможность перейти на новый уровень уже сегодня и откройте секреты успешных ставок с БК Олимп, где каждый ваш выбор может привести к победе!

Hey, you used to write wonderful, but the last few posts have been kinda boring… I miss your tremendous writings. Past several posts are just a little bit out of track! come on!

Рады представить запуск новой версии мобильного приложения БК Лига Ставок для Android! Этот выпуск существенно улучшает ваш досуг с ставками, делая его ещё удобнее и эффективным. [url=https://ligastavok-android.ru/]Скачать бесплатно лига ставок на андроид[/url] для всех пользователей! В обновлении вы найдете свободу доступа к огромному ассортименту спортивных мероприятий прямо с вашего смартфона. Усовершенствованное управление профилем, инновационная концепция дизайна для простой навигации и увеличенная скорость работы приложения – всё это создано для вас. Станьте частью довольных пользователей и получайте удовольствие от ставок где только захотите и в любое время. Скачайте обновление приложения БК Лига Ставок прямо сейчас и переходите к новому этапу игры!

Рады представить запуск обновленной мобильного приложения БК Лига Ставок для Android! Этот выпуск полностью преобразует ваш пользовательский опыт, делая его ещё удобнее и динамичным. [url=https://ligastavok-android.ru/]Бк лига ставок скачать бесплатно телефон[/url] для всех сейчас! В обновлении вы найдете прямой доступ к огромному ассортименту спортивных мероприятий из любой точки с помощью вашего устройства. Усовершенствованное управление профилем, передовая концепция дизайна для удобной навигации и увеличенная скорость работы приложения – всё это создано для вас. Станьте частью довольных пользователей и получайте удовольствие от ставок в любой точке планеты и в любое время. Скачайте обновление приложения БК Лига Ставок уже сегодня и переходите к новому этапу ставок!

Hey there just wanted to give you a quick heads up and let you know a few of the pictures aren’t loading correctly. I’m not sure why but I think its a linking issue. I’ve tried it in two different web browsers and both show the same results.

Вашему вниманию предлагается эксклюзивное предложение от БК Лига Ставок – фрибет для новых игроков! Это бесплатная ставка позволяет вам сделать ставку без риска потери собственных средств, открывая новые горизонты для получения призов с первых же шагов в мире ставок. [url=https://ligastavok-freebet.ru/]Лига ставок фрибет условия[/url] новым пользователям после регистрации! С фрибетом от БК Лига Ставок, вы получаете шанс испытать все преимущества ставок без каких-либо финансовых обязательств. Это отличный способ начать для тех, кто хочет стать частью мира спортивных ставок с минимальными рисками. Воспользуйтесь этим предложением и сделайте первый шаг к большим выигрышам в БК Лига Ставок с нашим фрибетом. Заберите свой фрибет сейчас же и стартуйте к выигрышам!

Вашему вниманию предлагается эксклюзивное предложение от БК Лига Ставок – фрибет для новых игроков! Это бесплатная ставка позволяет вам сделать ставку без риска потери собственных средств, предоставляя новые горизонты для выигрыша с первых же шагов в мире ставок. [url=https://ligastavok-freebet.ru/]Лига ставок фрибет новым игрокам[/url] для всех новичков после регистрации! С фрибетом от БК Лига Ставок, вы имеете возможность ознакомиться с платформой без каких-либо финансовых обязательств. Это идеальный старт для тех, кто хочет стать частью мира спортивных ставок с минимальными рисками. Не упускайте свой шанс и сделайте первый шаг к большим выигрышам в БК Лига Ставок с нашим фрибетом. Активируйте ваш фрибет уже сегодня и откройте для себя мир ставок без рисков!

Представляем выпуске эксклюзивного промокода для БК Лига Ставок! Этот специальный промокод предоставляет доступ к эксклюзивным привилегиям и повышает ваш опыт ставок, делая его ещё более выгодным и волнующим. [url=https://ligastavok-promocode.ru/]Промокод при регистрации лига ставок[/url] для активации сегодня! С данным промокодом, игроки получают доступ к дополнительным бонусам на ставки, привилегиям при регистрации и эксклюзивным акциям. Воспользуйтесь этой возможностью стать частью элитного клуба пользователей БК Лига Ставок и увеличьте свои шансы на успех с нашим промокодом. Активируйте промокод уже сегодня и начните выигрывать еще до первой ставки!

buy generic micronase 5mg – glipizide sale purchase dapagliflozin pills

Самый ожидаемый футбольный поединок сезона – Манчестер Сити против Реала Мадрид! Страсть, волнение, и адреналин ждут нас на поле. Но этот день может быть еще более захватывающим благодаря промокоду PLAYDAY от 1win! Ставьте на своего героя с уверенностью и растите свои шансы на победу! Не упустите шанс – забирайте [url=https://www.pinterest.com/pin/916693699143021366/]Манчестер Сити Реал Мадрид промокод на депозит[/url] уже сегодня!

Самый ожидаемый футбольный поединок сезона – Манчестер Сити против Реала Мадрид! Энтузиазм, волнение, и адреналин ждут нас на поле. Но этот день может быть еще более захватывающим благодаря промокоду PLAYDAY от 1win! Ставьте на своего героя с уверенностью и повысьте свои шансы на победу! Не упустите возможность – забирайте [url=https://www.pinterest.com/pin/916693699143021366/]Манчестер Сити Реал 500 за депозит[/url] уже сегодня!

Битва гигантов на поле – Бавария против Арсенала! Адреналин, азарт и невероятные моменты ждут нас в этом поединке. Но почему бы не добавить еще больше интриги с помощью промокода PLAYDAY от 1win? Сделайте ставку на победный исход и повысьте свои шансы на победу! Не упустите этот возможность – воспользуйтесь [url=https://www.pinterest.com/pin/916693699143021391]Бавария Арсенал 500 за депозит[/url] уже сегодня и получайте удовольствие от игры в полную силу!

Встречайте игру на новом уровне с промокодом PLAYDAY от 1win! Независимо от того, на какой событие вы ставите – будь то спортивное противостояние – этот промокод приносит вам дополнительные возможности для победы. Повысьте свои выигрышные шансы, активируя промокод PLAYDAY при размещении ставок. Не упустите возможность на увлекательный опыт и дополнительные призы – воспользуйтесь [url=https://www.pinterest.com/pin/916693699143021313/]промокод на пополнение 1win[/url] прямо сейчас на 1win!

Встречайте игру на пике с промокодом PLAYDAY от 1win! Независимо от того, на какой матч вы ставите – будь то футбольная битва – этот промокод приносит вам дополнительные возможности для победы. Повысьте свои вероятность победы, активируя промокод PLAYDAY при размещении ставок. Не упустите шанс на увлекательный опыт и бонусные выигрыши – активируйте [url=https://www.pinterest.com/pin/916693699143021313/]1вин промокоды[/url] прямо сейчас на 1win!

В настоящее время наши дни могут содержать неожиданные расходы и экономические трудности, и в такие моменты каждый ищет надежную поддержку. На сайте [url=https://brokers-group.ru/]деньги в долг в Минске срочно[/url] вам помогут без лишних сложностей. В своей роли агента я стремлюсь распространить эту информацию, чтобы помочь тем, кто столкнулся с временными трудностями. Наша система обеспечивает прозрачные условия и быструю обработку заявок, чтобы каждый мог разрешить свои финансовые вопросы оперативно и без лишних затрат времени.

В настоящее время наши дни могут содержать внезапные издержки и финансовые вызовы, и в такие моменты каждый ищет надежную поддержку. На сайте [url=https://brokers-group.ru/]займ в Минске[/url] вам помогут без лишних сложностей. В своей роли агента я стремлюсь поделиться этими сведениями, чтобы помочь тем, кто столкнулся с временными трудностями. Наша система обеспечивает честные условия и быструю обработку заявок, чтобы каждый мог разрешить свои финансовые вопросы быстро и без лишних хлопот.

В наше время многие из нас сталкиваются с внезапными затратами и денежными трудностями, и в такие моменты важно иметь доступ к дополнительным средствам. На сайте [url=https://dengizaimy.ru/]деньги в долг в Минске срочно[/url] вам помогут с минимальными усилиями. В качестве представителя Брокерс Групп, я с удовольствием делиться этой важной информацией, чтобы помочь людям, кто столкнулся с финансовыми трудностями. Наша система гарантирует честные условия и оперативное рассмотрение запросов, чтобы каждый мог решить свои финансовые вопросы быстро и эффективно.

В наше время многие из нас сталкиваются с внезапными затратами и экономическими вызовами, и в такие моменты важно иметь доступ к дополнительным средствам. На сайте [url=https://dengizaimy.ru/]займ денег[/url] вам помогут с минимальными усилиями. В качестве представителя Брокерс Групп, я рад делиться этой информацией, чтобы помочь каждому, кто нуждается в финансовой поддержке. Наша платформа гарантирует прозрачные условия и быструю обработку заявок, чтобы каждый мог разрешить свои денежные проблемы быстро и эффективно.

В настоящей эпохе финансовые сложности не редкость, и каждый человек может оказаться в ситуации, когда потребуется дополнительная финансовая помощь. На сайте [url=https://moneybel.ru/]деньги в долг онлайн[/url] помогут решить эти проблемы, принося простой и лёгкий метод займа. Мы осознаём, что время играет ключевую роль, поэтому наш процесс обработки заявок максимально быстр и эффективен. В роли представителя Манибел, наша цель – помочь каждому клиенту преодолеть финансовые затруднения, предложив ясные и выгодные условия займа. Доверьтесь нам, и мы решим ваши финансовые проблемы.

В сегодняшнем обществе финансовые трудности встречаются часто, и каждый из нас может оказаться в ситуации, когда необходима дополнительная финансовая поддержка. На сайте [url=https://moneybel.ru/]займ на карту[/url] помогут решить эти проблемы, предоставляя простой и лёгкий метод получения кредита. Мы осознаём, что времени на решение проблемы не хватает, поэтому мы обрабатываем заявки оперативно и эффективно. В роли представителя Манибел, мы нацелены на то, чтобы помочь каждому клиенту преодолеть свои денежные трудности, предоставив прозрачные и выгодные условия кредитования. Доверьтесь нашей компании, и мы решим ваши финансовые проблемы.

Bellenty – ваш надёжный союзник в области конвейерных решений. Для вас [url=http://bellenty.by/]купить ленту конвейерную в Минске[/url] помогут консультанты магазина. Благодаря нашему практике и компетентности мы гарантируем, что каждая лента, предлагаемая нами, соответствует высочайшим стандартам качества и эффективности. Мы разрабатываем индивидуальные решения, учитывая особые потребности наших заказчиков. Независимо от размера, материала или спецификаций, Bellenty обеспечивает идеальное решение для вашего конвейерного оборудования, даря вашему бизнесу надёжность и эффективность.

Bellenty – ваш надёжный союзник в области конвейерных решений. Для вас [url=http://bellenty.by/]купить ленты транспортерные на Bellenty[/url] помогут консультанты магазина. Благодаря нашему опыту и профессионализму мы гарантируем, что каждая лента, предлагаемая нами, соответствует высочайшим стандартам стандартам качества и эффективности. Мы разрабатываем индивидуальные решения, учитывая особые потребности наших клиентов. Независимо от размера, материала или спецификаций, Bellenty обеспечивает идеальное решение для вашего конвейерного оборудования, даря вашему бизнесу надёжность и эффективность.

Merely wanna say that this is very beneficial, Thanks for taking your time to write this.

prandin 1mg drug – cheap repaglinide 2mg buy empagliflozin 25mg without prescription

What Is Exactly ZenCortex? ZenCortex is an optimal hearing function support

You made some decent points there. I did a search on the issue and found most guys will approve with your site.

buy glycomet 1000mg pill – order glycomet 500mg generic acarbose generic

В настоящей эпохе финансовые трудности не редкость, и каждый из нас может оказаться в ситуации, когда необходима дополнительная финансовая поддержка. На сайте МаниБел помогут решить эти проблемы, предоставляя простой и лёгкий метод займа. Мы понимаем, что время играет ключевую роль, поэтому мы обрабатываем заявки оперативно и эффективно. В качестве представителя Манибел, мы нацелены на то, чтобы помочь каждому клиенту преодолеть свои денежные трудности, предложив ясные и выгодные условия займа. Доверьтесь нам, и мы решим ваши финансовые проблемы.

В сегодняшнем обществе финансовые трудности встречаются часто, и каждый из нас может оказаться в ситуации, когда необходима дополнительная финансовая поддержка. На сайте [url=https://moneybel.ru/]взять деньги в долг[/url] помогут преодолеть эти трудности, предоставляя простой и удобный способ получения кредита. Мы понимаем, что время играет ключевую роль, поэтому мы обрабатываем заявки оперативно и эффективно. В качестве представителя Манибел, мы нацелены на то, чтобы помочь каждому клиенту преодолеть свои денежные трудности, предоставив прозрачные и выгодные условия кредитования. Доверьтесь нашей компании, и мы решим ваши финансовые проблемы.

В настоящей экономической обстановке, где неожиданные финансовые обязательства могут возникнуть в любое время, поиск надежного и удобного источника финансовой помощи становится все более критическим. Предложение [url=https://zaim-minsk.ru/]деньги в кредит[/url] предлагает возможность рассчитывать на быстрое и беззаботное получение необходимых средств без лишних трудностей. Мы ценим ваше время и обеспечиваем оперативную обработку всех запросов. В качестве вашего финансового партнера, наша главная задача состоит в том, чтобы помочь вам преодолеть текущие финансовые препятствия, предоставляя ясные и выгодные условия кредитования. Доверьтесь нам в вашем финансовом путешествии, и мы обеспечим вас надежной поддержкой на каждом этапе.

В настоящей экономической обстановке, где неожиданные финансовые обязательства могут возникнуть в любое время, поиск надежного и удобного источника финансовой помощи становится все более критическим. Предложение [url=https://zaim-minsk.ru/]zaim-minsk.ru[/url] предлагает возможность рассчитывать на быстрое и беззаботное получение необходимых средств без лишних трудностей. Мы ценим ваше время и обеспечиваем оперативную обработку всех запросов. В качестве вашего финансового партнера, наша главная задача состоит в том, чтобы помочь вам преодолеть текущие финансовые препятствия, предоставляя ясные и выгодные условия кредитования. Доверьтесь нам в вашем финансовом путешествии, и мы обеспечим вас надежной поддержкой на каждом этапе.

It?¦s actually a cool and helpful piece of information. I?¦m satisfied that you shared this helpful info with us. Please keep us up to date like this. Thank you for sharing.

Bellenty – ваш надёжный союзник в области конвейерных решений. Для вас [url=http://bellenty.by/]заказать ленты транспортерные на Bellenty.by[/url] помогут консультанты интернет-магазина. Благодаря нашему практике и профессионализму мы гарантируем, что каждая лента, предлагаемая нами, соответствует высочайшим стандартам стандартам качества и эффективности. Мы производим индивидуальные решения, учитывая особые потребности наших клиентов. Независимо от размера, материала или спецификаций, Bellenty обеспечивает идеальное решение для вашего конвейерного оборудования, даря вашему бизнесу надёжность и эффективность.

Bellenty – ваш надёжный союзник в области конвейерных решений. Для вас [url=http://bellenty.by/]оформить конвейерную ленту на Bellenty.by[/url] помогут консультанты магазина. Благодаря нашему практике и профессионализму мы гарантируем, что каждая лента, предлагаемая нами, соответствует высочайшим стандартам стандартам качества и эффективности. Мы производим индивидуальные решения, учитывая особые потребности наших клиентов. Независимо от величины, материала или технических характеристик, Bellenty обеспечивает идеальное решение для вашего конвейерного оборудования, даря вашему бизнесу надёжность и эффективность.

В настоящее время наши дни могут содержать внезапные издержки и экономические трудности, и в такие моменты каждый ищет надежную поддержку. На сайте [url=https://brokers-group.ru/]получить займ[/url] вам помогут без лишних сложностей. В своей роли представителя я стремлюсь поделиться этими сведениями, чтобы помочь людям в сложной ситуации. Наша платформа обеспечивает прозрачные условия и быструю обработку заявок, чтобы каждый мог решить свои денежные проблемы быстро и без лишних хлопот.

В настоящее время наши дни могут содержать неожиданные расходы и экономические трудности, и в такие моменты каждый ищет надежную поддержку. На сайте [url=https://brokers-group.ru/]brokers-group.ru[/url] вам помогут без избыточной бюрократии. В своей роли представителя я стремлюсь распространить эту информацию, чтобы помочь тем, кто столкнулся с временными трудностями. Наша система обеспечивает прозрачные условия и эффективное рассмотрение запросов, чтобы каждый мог разрешить свои финансовые вопросы быстро и без лишних хлопот.

В наше время многие из нас сталкиваются с внезапными затратами и экономическими вызовами, и в такие моменты важно иметь доступ к дополнительным средствам. На сайте [url=https://dengizaimy.ru/]займ денег[/url] вам помогут с минимальными усилиями. В качестве официального представителя Брокерс Групп, я рад делиться этой информацией, чтобы помочь людям, кто столкнулся с финансовыми трудностями. Наша система гарантирует честные условия и быструю обработку заявок, чтобы каждый мог разрешить свои денежные проблемы быстро и эффективно.

В наше время многие из нас сталкиваются с внезапными затратами и денежными трудностями, и в такие моменты важно иметь возможность взять кредит. На сайте [url=https://dengizaimy.ru/]получить деньги[/url] вам помогут быстро и удобно. В качестве представителя Брокерс Групп, я с удовольствием делиться этой информацией, чтобы помочь каждому, кто нуждается в финансовой поддержке. Наша платформа гарантирует прозрачные условия и быструю обработку заявок, чтобы каждый мог решить свои финансовые вопросы быстро и эффективно.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

В наше время многие из нас сталкиваются с внезапными затратами и денежными трудностями, и в такие моменты важно иметь возможность взять кредит. На сайте [url=https://dengizaimy.ru/]ДеньгиЗаймы[/url] вам помогут с минимальными усилиями. В качестве представителя Брокерс Групп, я рад делиться этой важной информацией, чтобы помочь людям, кто нуждается в финансовой поддержке. Наша платформа гарантирует прозрачные условия и быструю обработку заявок, чтобы каждый мог решить свои финансовые вопросы с минимальными временными затратами.

В наше время многие из нас сталкиваются с непредвиденными расходами и экономическими вызовами, и в такие моменты важно иметь возможность взять кредит. На сайте [url=https://dengizaimy.ru/]деньги в долг в Минске срочно[/url] вам помогут быстро и удобно. В качестве представителя Брокерс Групп, я с удовольствием делиться этой информацией, чтобы помочь каждому, кто нуждается в финансовой поддержке. Наша система гарантирует честные условия и быструю обработку заявок, чтобы каждый мог разрешить свои денежные проблемы быстро и эффективно.