As we progress through the recession, many commentators are saying that recessions are a great time to start a business. To validate their argument, they point to some of the great companies that got their start during a recession, e.g.

- Netflix, 1997

- Airbnb, 2008

- Trader Joe’s, 1958

- Microsoft, 1975

- Sports Illustrated, 1954

- MTV, 1981

- GE, 1890

- IBM, 1896

- Warby Parker, 2010

- Revlon, 1932

- Disney, 1929

Many arguments are justifying why starting a business during a recession is a great time. A summary is:

- Surviving = Winning. During a recession, just surviving is hard. If you survive during such times with limited capital and profits, you will be well-positioned to survive during good times. Companies that survive during times of scarce resources are more efficient.

- Learning from Mistakes. We rarely learn from successes, only from failures. During a recession, things are harder, and there are chances there will be more setbacks. This environment will improve an organization’s problem-solving skills and agility.

- Builds a Tribe with Folklore. Surviving during times of great adversity builds excellent team cohesion. That is why groups have initiation rituals, to bond the members. Those hardships become the folklore of the organization, enabling it to share its culture with newcomers post-recession better.

- Considerable amount of available talent. In recessions, swelling unemployment provides a talent pool is brimming with great potential that one can get for lower prices than during good times.

- Get noticed. During good times, everyone is succeeding, so gaining attention is hard. However, in a recession, marketing and advertising fall, and success stories are rare. Thus it provides a chance to get noticed and get a leadership position.

- People are more interested in “Life-Saving Products.” During good times, selling a product or service that will save a few points of cost, or grow a few points or revenue is not always easy. Margins are good, and management is too distracted to pay attention. However, in a recession, things are tough, and management will look to any lifeline to survive. Thus if you can save costs or boost revenue, customers are more likely to buy.

- Investors Have Shut Up Shop. During a recession, finding VC or institutional capital is hard, so companies must fund expansion from their resources. As a result, they are more focused on generating cash and being resilient, which ensures survival. Those companies that cannot make money in good times, e.g., WeWork, will never survive in a downturn.

- Better able to capture gains when the market returns. Due to the focus on cash generation and resistance, when markets return, these organizations are well suited to achieve the growth and more ahead of others.

- War Time CEOs. As Ben Horowitz points out, at times like this, you are “War Time” CEO. Thus survival is paramount, and you cannot run out of cash. Therefore CEOs will be more thoughtful to avoid costly mistakes, e.g., such as bad hires, pursuing multiple, disparate markets simultaneously, crafting one-sided partnerships to gain media exposure, and making inefficient marketing commitments.

- Everything is on Sale. Not only talent, but everything is on sale. Rents are down, and used equipment is available. The costs of everything are low, enabling higher margins than competitors.

While all the above reasons make logical sense, and there are those companies that launched during recessions that emerge as market leaders, overall do companies that begin during recessions have a higher chance of survival than those that start during regular times?

I don’t know and cannot find research on the matter. However, I am often concerned with being given a single data point and told that it proves a point or trend. A classic example is that anyone can be the next Jeff Bezos, Mark Zuckerberg, or Bill Gates. Yes, anyone can be; however, the probability of someone being like them is incredibly small, probably less than one in a million.

- VC funding continues to hit all-time highs;

- Private Equity buyouts hit all-time highs;

- The availability of gig workers, SaaS products, and Cloud servers should increase the ease of starting companies; and

- over 300 colleges offer entrepreneurship courses

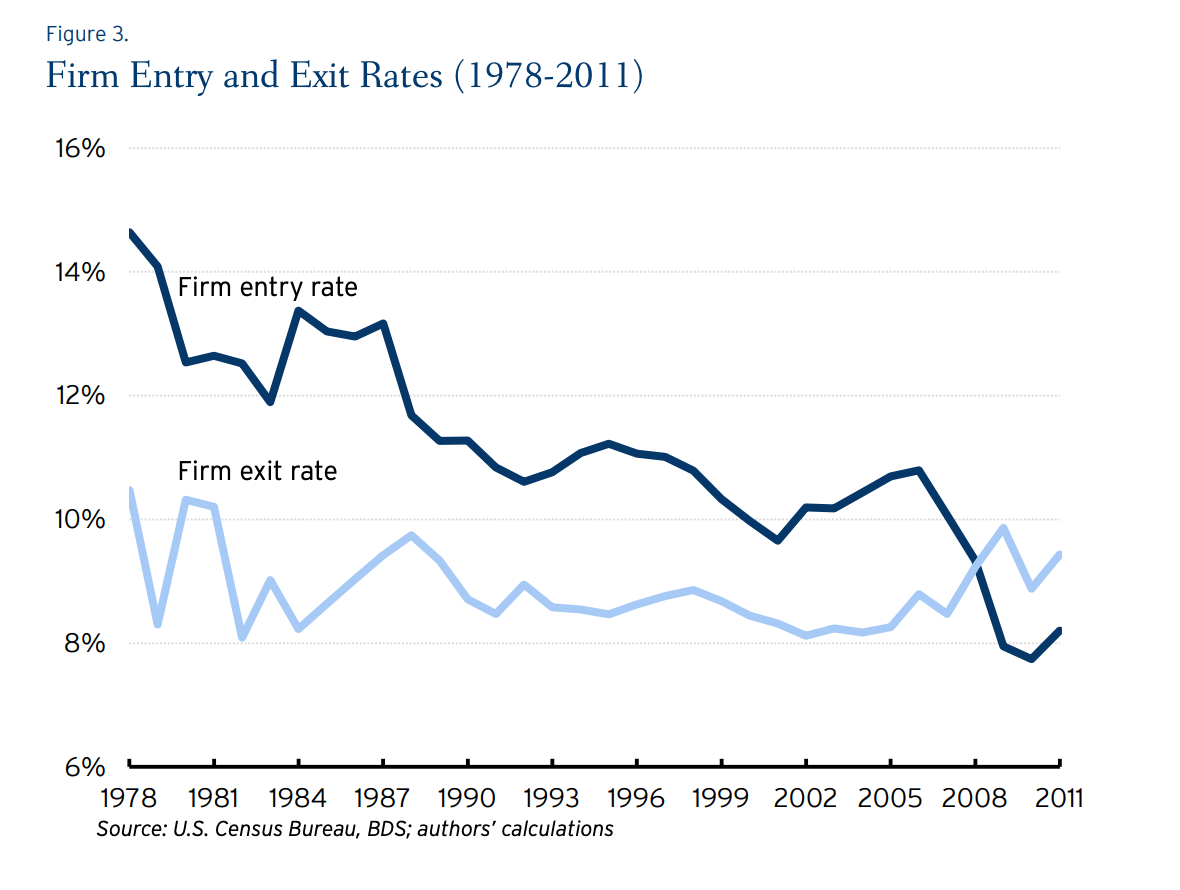

New corporate formation continues to fall and is below its level during the Carter Presidency. While the chart below only goes through 2011, the trends have not improved.

Recent Posts

EOS is just that, an Operating System

The EOS Model® provides a useful foundation for businesses, but it falls short in addressing key aspects of creating an growth. By incorporating additional elements from the Gravitas 7 Attributes of Agile Growth® model, businesses can create a more comprehensive system that promotes growth while maintaining smooth operations. Focusing on Leadership, Strategy, Execution, Customer, Profit, Systems, and Talent, the 7 Attributes of Agile Growth® offer a more encompassing approach to achieving success.

What has COVID done to Company Culture?

COVID has affected everyone. However, companies need to examine if they have lived their core values during COVID, how they are reinforcing them in a WFH environment, and especially with the onboarding of new hires.

Profit ≠ Cash Flow

Knowing how much cash you generate is essential for planning for growth. Too many companies don’t know and when they grow they find they are continually running out of cash. Understand your cash flow generation and how to improve it through improvements in your Cash Conversion Cycle and using the Power of One.

What Are Your Critical and Counter Critical Numbers?

The key to achieving long term goals is to define short term goals that lead you there. Focusing those short term goals around a key metric is essential. However, ensure that the metric will not lead other areas astray by having an appropriate counter critical metric act as a counter balance.

Rethinking ‘Family’ Culture in Business: Fostering Performance and Success

Explore the importance of company culture and the potential pitfalls of adopting a “Family” culture in organizations. Learn how to foster a high-performance culture while maintaining key family values and discover success factors for family businesses. Rethink the “Family” culture concept and create a thriving environment for your organization.

Do You Truly Know Your Core Customer?

Knowing the profit of your core customers is key to building a growth model. Many companies have identified core customers that are generating a sub-optimal profit and so they cannot realize the profits they seek. Identifying the correct core customer allows you to generate profits and often operate in “Blue Ocean.”

The Spectacular Rise and Fall of the European Super League

The European Super League (ESL) collapsed within 48 hours of its announcement due to hubris, a lack of value creation, and fan backlash. The founders’ arrogance led them to disregard European football’s deep-rooted traditions and culture. At the same time, the focus on wealthy club owners instead of merit undermined the essence of the competition. The fierce backlash from fans, who felt betrayed by their clubs, demonstrated the importance of prioritizing supporters’ interests in football.

When Should I Sell My Business?

Many business owners want to sell at the top of the market. However, market timing is tough. Is this the best strategy? Probably not.

Does Your Financial Model Drive Growth?

Working with many companies looking to grow, I am always surprised how many have not built a financial model that drives growth. I have mentioned before a financial model that drives growth? Here I am basing on Jim Collin's Profit/X, which he laid out in Good to...

COVID = Caught Inside

As we emerge from COVID, the current employment environment makes me think of a surfing concept: “Being Caught Inside When a Big Set Comes Through.” Basically, the phrase refers to when you paddle like crazy to escape the crash of one wave, only to find that the next wave in the set is even bigger—and you’re exhausted. 2020 was the first wave, leaving us tired and low. But looking forward, there are major challenges looming on the horizon as business picks up in 2021. You are already asking a lot of your employees, who are working flat out and dealing with stress until you are able to hire more. But everyone is looking for employees right now, and hiring and retention for your organization is growing more difficult.