As we progress through the recession, many commentators are saying that recessions are a great time to start a business. To validate their argument, they point to some of the great companies that got their start during a recession, e.g.

- Netflix, 1997

- Airbnb, 2008

- Trader Joe’s, 1958

- Microsoft, 1975

- Sports Illustrated, 1954

- MTV, 1981

- GE, 1890

- IBM, 1896

- Warby Parker, 2010

- Revlon, 1932

- Disney, 1929

Many arguments are justifying why starting a business during a recession is a great time. A summary is:

- Surviving = Winning. During a recession, just surviving is hard. If you survive during such times with limited capital and profits, you will be well-positioned to survive during good times. Companies that survive during times of scarce resources are more efficient.

- Learning from Mistakes. We rarely learn from successes, only from failures. During a recession, things are harder, and there are chances there will be more setbacks. This environment will improve an organization’s problem-solving skills and agility.

- Builds a Tribe with Folklore. Surviving during times of great adversity builds excellent team cohesion. That is why groups have initiation rituals, to bond the members. Those hardships become the folklore of the organization, enabling it to share its culture with newcomers post-recession better.

- Considerable amount of available talent. In recessions, swelling unemployment provides a talent pool is brimming with great potential that one can get for lower prices than during good times.

- Get noticed. During good times, everyone is succeeding, so gaining attention is hard. However, in a recession, marketing and advertising fall, and success stories are rare. Thus it provides a chance to get noticed and get a leadership position.

- People are more interested in “Life-Saving Products.” During good times, selling a product or service that will save a few points of cost, or grow a few points or revenue is not always easy. Margins are good, and management is too distracted to pay attention. However, in a recession, things are tough, and management will look to any lifeline to survive. Thus if you can save costs or boost revenue, customers are more likely to buy.

- Investors Have Shut Up Shop. During a recession, finding VC or institutional capital is hard, so companies must fund expansion from their resources. As a result, they are more focused on generating cash and being resilient, which ensures survival. Those companies that cannot make money in good times, e.g., WeWork, will never survive in a downturn.

- Better able to capture gains when the market returns. Due to the focus on cash generation and resistance, when markets return, these organizations are well suited to achieve the growth and more ahead of others.

- War Time CEOs. As Ben Horowitz points out, at times like this, you are “War Time” CEO. Thus survival is paramount, and you cannot run out of cash. Therefore CEOs will be more thoughtful to avoid costly mistakes, e.g., such as bad hires, pursuing multiple, disparate markets simultaneously, crafting one-sided partnerships to gain media exposure, and making inefficient marketing commitments.

- Everything is on Sale. Not only talent, but everything is on sale. Rents are down, and used equipment is available. The costs of everything are low, enabling higher margins than competitors.

While all the above reasons make logical sense, and there are those companies that launched during recessions that emerge as market leaders, overall do companies that begin during recessions have a higher chance of survival than those that start during regular times?

I don’t know and cannot find research on the matter. However, I am often concerned with being given a single data point and told that it proves a point or trend. A classic example is that anyone can be the next Jeff Bezos, Mark Zuckerberg, or Bill Gates. Yes, anyone can be; however, the probability of someone being like them is incredibly small, probably less than one in a million.

- VC funding continues to hit all-time highs;

- Private Equity buyouts hit all-time highs;

- The availability of gig workers, SaaS products, and Cloud servers should increase the ease of starting companies; and

- over 300 colleges offer entrepreneurship courses

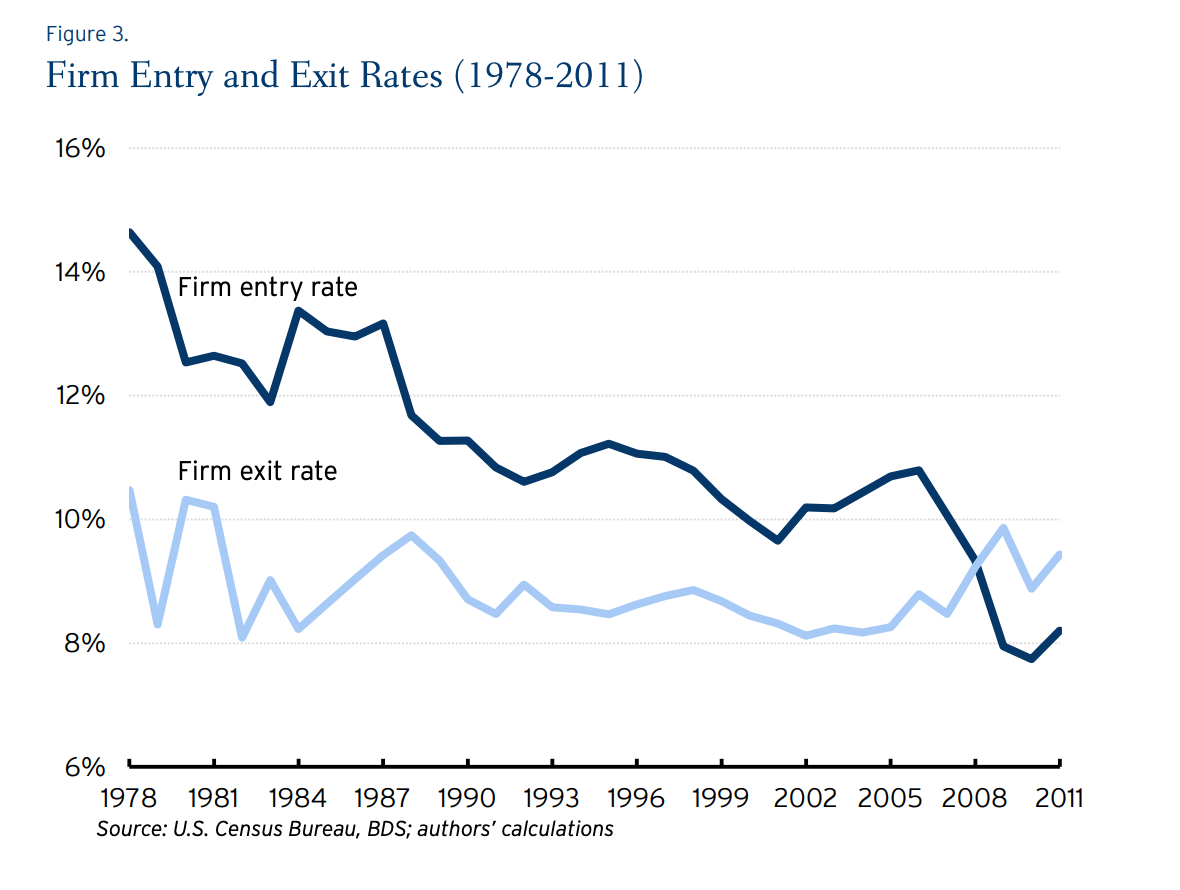

New corporate formation continues to fall and is below its level during the Carter Presidency. While the chart below only goes through 2011, the trends have not improved.

Recent Posts

The Downfall of Boeing: A Lesson in Core Values

Boeing’s 737 Max issues highlighted the company’s sacrifice of safety for financial performance, resulting in a tarnished reputation. The prioritization of profit over core values also damaged the FAA’s credibility and revealed a lack of accountability for top executives. This downfall serves as a reminder of the importance of maintaining core values and prioritizing them over short-term financial gains.

Resolutions, Here We Go Again.

In reflecting on 2021 resolutions, the author scored themselves in three categories and sought to improve success in 2022 by addressing friction points. Drawing on advice from social psychologist Wendy Wood, the author identified areas to reduce or increase friction in their failed resolutions. By making these adjustments, the author aims to enhance their goal achievement and encourages others to consider friction when setting resolutions.

You need to take an extended vacation. No, seriously, you do.

COVID has taken a toll on all of us. If you have not taken an extended vacation in a while where you disconnect, you need to now. You and your business will benefit.

Becoming Famous in Your Niche: The Success Story of Linn Products Limited

In a previous discussion, I highlighted the importance of being famous for something. Being well-known in your niche can help you: Concentrate on your strengths Connect with your target audience Communicate your offerings more effectively Receive referrals Identify...

Understanding and Optimizing Your Cash Conversion Cycle

Understanding and optimizing the Cash Conversion Cycle is crucial for business growth, as it impacts cash flow and the ability to access external capital. This cycle consists of four components: Sales, Make/Production & Inventory, Delivery, and Billing and Payments. To improve the Cash Conversion Cycle, companies can eliminate mistakes, shorten cycle times, and revamp their business models.

Discovering Your Niche: Why You Need to Be Famous for Something

As an entrepreneur, it’s crucial to specialize in a specific area and become famous for something, allowing you to generate referrals and build your brand. Understanding the “job” you’re hired for helps you stand out in the marketplace and communicate your value proposition effectively. By providing value to your clients, you can adopt a value-based pricing approach, ensuring your business remains competitive and maintains a strong market presence.

Rethinking Your Pricing Model: Maximizing Margins and Providing Value

Rethink your pricing model by focusing on the value you provide and your customers’ Best Alternative To a Negotiated Agreement (BATNA). This approach can help you maximize margins while delivering better value to your clients. Assess your offerings and brainstorm with your team to identify pricing adjustment opportunities or eliminate commodity products or services.

Do you know your Profit per X to drive dramatic growth?

I recently facilitated a workshop with several CEOs where we worked on the dramatic business growth model components. One of the questions that I had asked them beforehand was, "What is Your Profit/X?" The results showed that there this concept is not clear to many....

The War for Talent: 5 Ways to Attract the Best Employees

In today’s War for Talent, attracting the best employees requires a focus on value creation, core customer, brand promise, and value delivery. Clearly articulate your company’s mission, identify your “core employee” based on shared values, and offer more than just a salary to stand out as an employer. Utilize employee satisfaction metrics and showcase your company’s commitment to its workforce on your website to make a strong impression on potential candidates.

Are you killing your firm’s WFH productivity?

Productivity remained during WFH with COVID. However, further analysis found that hourly productivity fell and was compensated for by employees working more hours. What was the culprit – Meetings. Want to increase productivity, have fewer meetings.