As we progress through the recession, many commentators are saying that recessions are a great time to start a business. To validate their argument, they point to some of the great companies that got their start during a recession, e.g.

- Netflix, 1997

- Airbnb, 2008

- Trader Joe’s, 1958

- Microsoft, 1975

- Sports Illustrated, 1954

- MTV, 1981

- GE, 1890

- IBM, 1896

- Warby Parker, 2010

- Revlon, 1932

- Disney, 1929

Many arguments are justifying why starting a business during a recession is a great time. A summary is:

- Surviving = Winning. During a recession, just surviving is hard. If you survive during such times with limited capital and profits, you will be well-positioned to survive during good times. Companies that survive during times of scarce resources are more efficient.

- Learning from Mistakes. We rarely learn from successes, only from failures. During a recession, things are harder, and there are chances there will be more setbacks. This environment will improve an organization’s problem-solving skills and agility.

- Builds a Tribe with Folklore. Surviving during times of great adversity builds excellent team cohesion. That is why groups have initiation rituals, to bond the members. Those hardships become the folklore of the organization, enabling it to share its culture with newcomers post-recession better.

- Considerable amount of available talent. In recessions, swelling unemployment provides a talent pool is brimming with great potential that one can get for lower prices than during good times.

- Get noticed. During good times, everyone is succeeding, so gaining attention is hard. However, in a recession, marketing and advertising fall, and success stories are rare. Thus it provides a chance to get noticed and get a leadership position.

- People are more interested in “Life-Saving Products.” During good times, selling a product or service that will save a few points of cost, or grow a few points or revenue is not always easy. Margins are good, and management is too distracted to pay attention. However, in a recession, things are tough, and management will look to any lifeline to survive. Thus if you can save costs or boost revenue, customers are more likely to buy.

- Investors Have Shut Up Shop. During a recession, finding VC or institutional capital is hard, so companies must fund expansion from their resources. As a result, they are more focused on generating cash and being resilient, which ensures survival. Those companies that cannot make money in good times, e.g., WeWork, will never survive in a downturn.

- Better able to capture gains when the market returns. Due to the focus on cash generation and resistance, when markets return, these organizations are well suited to achieve the growth and more ahead of others.

- War Time CEOs. As Ben Horowitz points out, at times like this, you are “War Time” CEO. Thus survival is paramount, and you cannot run out of cash. Therefore CEOs will be more thoughtful to avoid costly mistakes, e.g., such as bad hires, pursuing multiple, disparate markets simultaneously, crafting one-sided partnerships to gain media exposure, and making inefficient marketing commitments.

- Everything is on Sale. Not only talent, but everything is on sale. Rents are down, and used equipment is available. The costs of everything are low, enabling higher margins than competitors.

While all the above reasons make logical sense, and there are those companies that launched during recessions that emerge as market leaders, overall do companies that begin during recessions have a higher chance of survival than those that start during regular times?

I don’t know and cannot find research on the matter. However, I am often concerned with being given a single data point and told that it proves a point or trend. A classic example is that anyone can be the next Jeff Bezos, Mark Zuckerberg, or Bill Gates. Yes, anyone can be; however, the probability of someone being like them is incredibly small, probably less than one in a million.

- VC funding continues to hit all-time highs;

- Private Equity buyouts hit all-time highs;

- The availability of gig workers, SaaS products, and Cloud servers should increase the ease of starting companies; and

- over 300 colleges offer entrepreneurship courses

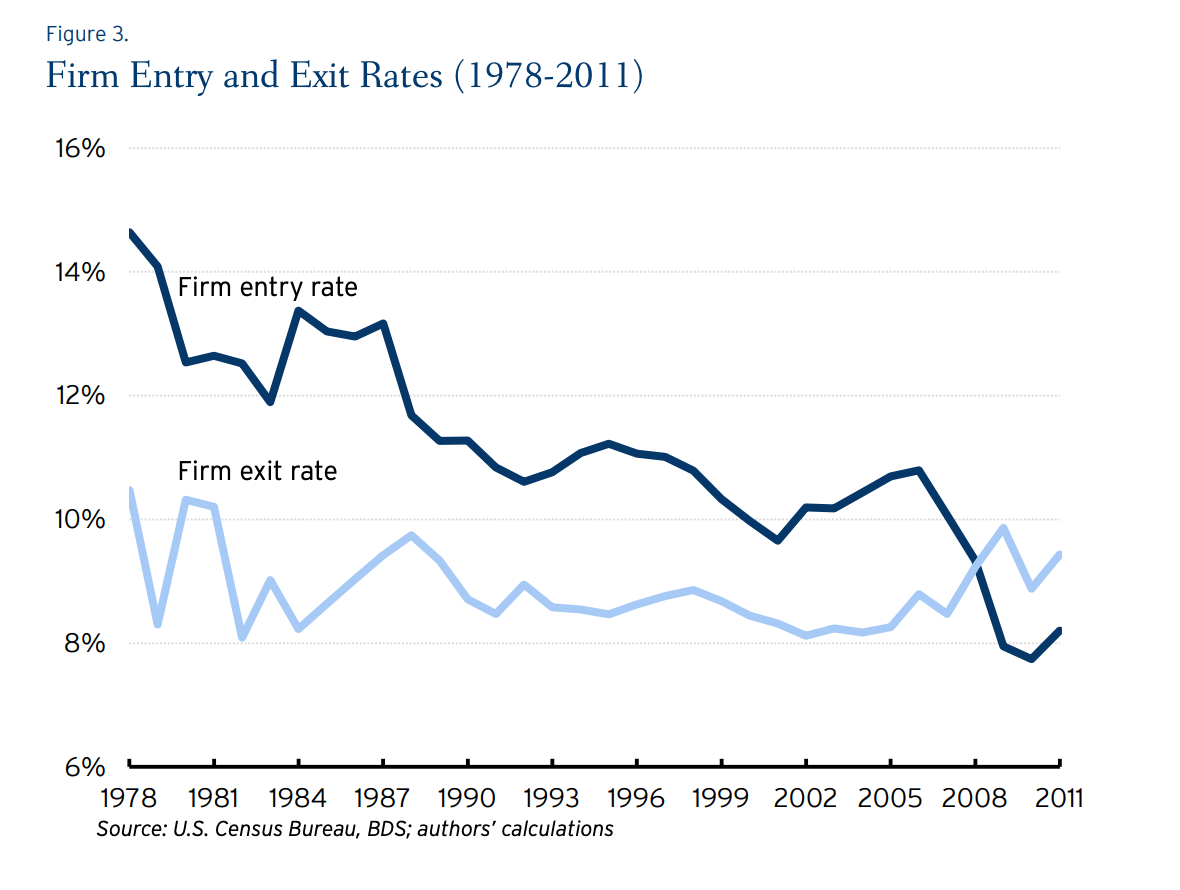

New corporate formation continues to fall and is below its level during the Carter Presidency. While the chart below only goes through 2011, the trends have not improved.

Recent Posts

Boosting Common Sense Decision-Making in Your Organization

Discover how to enhance decision-making in your organization by focusing on three crucial areas: solving the right problem, gathering all the available information, and understanding the intent. Learn to empower your team, foster a purpose-driven culture, and improve organizational clarity for better decision-making.

Do You Understand Your Costs to Ensure Profitability?

You can only determine profitability when you know your costs. I’ve discussed before that you should price according to value, not hours. However, you still need to know your costs to understand the minimum pricing and how it is performing. Do you consider each jobs’ profitability when you price new jobs? Do you know what you should be charging to ensure you hit your profit targets? These discussions about a company’s profitability, and what measure drives profit, are critical for your organization.

Sunk Costs Are Just That, Sunk!

If you were starting your business today, what would you do differently? This thought-provoking question is a valuable exercise, especially when it brings up the idea of “sunk costs” and how they limit us. A sunk cost is a payment or investment that has already been made. Since it is unrecoverable no matter what, a sunk cost shouldn’t be factored into any future decisions. However, we’re all familiar with the sunk cost fallacy: behavior driven by a past expenditure that isn’t recoupable, regardless of future actions.

Do You REALLY Know Your Business Model?

Bringing clarity to your organization is a common theme on The Disruption! blog. Defining your business model is a worthwhile exercise for any leadership team. But how do you even begin to bring clarity into your operations? If you’re looking for a place to start, Josh Kaufman’s “Five Parts of Every Business” offers an excellent framework. Kaufman defines five parts of every business model that all flow into the next, breaking it down into Value Creation, Marketing, Sales, Value Delivery, and Finance.

Ideation! Harder Than It Sounds

Bringing in new ideas, thoughts, understanding, and logic is key as your organization faces the challenges of a changing environment. But when you do an ideation session in your organization… how does it go? For so many organizations, many times, after a few ideas have been thrown out and rejected, the thought process slows down very quickly, and a form of hopelessness takes over. How does your organization have better ideation? I’ve come across a new approach with a few teams lately.

Recruit, Recruit, Recruit!

An uptick in business has begun this quarter, and companies are rushing to hire to meet this surge in demand. What amazes me is how many are so unprepared to hire. Continual recruiting is key to the survival of a company. It isn’t the same thing as hiring—continuous recruiting is building a pipeline of people that you would hire if you needed to fill a position, or “A players” you would hire if they were available.

We All Need Clarity

If your organization is focused on obscurity over clarity, whether intentionally or not, your “A” player employees are vulnerable. There is a looming talent crunch. As we start to emerge from COVID, demand is increasing, and many are scrambling to fill positions to meet that demand. Headhunters and recruiters are soon going to be calling your key “A” employees. Have you been giving them a reason to stay?

Not Another **** Meeting

As Leonard Bernstein put it so well, “To achieve great things, two things are needed: a plan and not quite enough time.” Your meetings can be shorter, more fruitful, and engaging, with better outcomes for the organization, employees, and managers. It’s time to examine your meeting rhythms and how you set meeting agendas. This week, I break down daily, weekly, monthly, quarterly, annual, and individual meeting rhythms, with sample agendas for each.

Is Your Company Scalable?

Let’s start here: Why should your company be scalable at all? If your business is scalable, you have business freedom–freedom with time, money, and options. Many business leaders get stuck in the “owner’s trap”, where you need to do everything yourself. Sound familiar? If you want a scalable business that gives you freedom, you need to be intentional about what you sell, and how.

Are you ready for the Talent Crunch?

Companies are gearing up to hire. Unfortunately, many are competing within the same talent pool. Some experts are currently predicting a strong economic recovery starting in May or June. But as the economy booms, there is going to be fierce competition for talent. How will you fare in the looming talent crisis? Your organization should be creating a plan, now, so you can attract the talent you need in the year ahead.