In 2007 the recession hit, and at the time, a partner and I owned a mergers and acquisition boutique that we had built up over three years. In December 2006 we closed our biggest deal yet and had a full pipeline as we moved into 2007. Then things started drying up, and by Q4, there was nothing. Looking into 2008, we figured a few deals would come back to life, but that was not to be the case.

As my partner and I talked through options to save the company and keep us moving forward, we exhibited some of the five dysfunctions of a team. We discussed some hair-brained ideas, including doing what we had done before, but just with more considerable effort. None of the ideas worked, and looking back; we weren’t thinking things through, looking at new markets, and holding each other accountable. Then we did what most of us do when stressed; we fell back doing the things with which we are most comfortable. My partner distracted himself with an executive Ph.D., and I, who was already distracted with the recent death of my mother, my divorce, and my children’s custody, reverted to doing financial analysis and modeling. These distractions enabled us to convince ourselves that we were swamped, which we were, but were not moving the company forward.

I did manage to get us some consulting work, but It was not until 2011, after joining a Vistage group, that we were back on track. However, looking back at that time, I would have given anything to be in a Vistage group from 2006. I needed a group of Peers to:

-

Challenge my thinking and assumptions;

-

Force me to accept what was happening and look for new opportunities;

-

Push me and hold me accountable for commitments;

-

Make me realize what I was doing was ineffective;

-

Challenge me about my concepts of the future and the status quo; and

-

Make me express my vision and strategy.

Not only that, but a Vistage group through its great speakers provides education on so many fronts that there is always something to learn.

As I reflect on this, it reminds me of a moment in 2004 when a Vistage Chair came to see me and tell me about Vistage. I was an overconfident, arrogant, young business owner who believed he didn’t need “no stinking help!” As I said, fast forward several years, and when a second chair proposed joining Vistage, it was like “Throw me a lifeline, I am drowning.”

Few business owners and CEO invest in themselves because they are successful, don’t realize they have stopped learning, don’t think anyone can understand their business, and don’t have time. Over my career, I have worked across many industries, and with many companies and never found a business model I can’t understand. The most significant issue is the confusion is over the myriad of TLAs ( three-letter acronyms) that a unique to a company and industry.” However, remember, as Marshall Goldsmith said, “What Got You to Here, Won’t Get You to There.” Regarding the lack of time, we all find time for what we deem essential. If learning and improving yourself and your business are a priority, then you can find the time. Furthermore, if your business cannot survive for a day without, you are failing as a leader.

Today we are experiencing a variation of 2008’s crisis. Our success as a leader is determined by how we emerge from the disaster. Many will emerge batted and beaten, some will appear as they went in, on a form of autopilot, and then some will develop more robust and resilient, and in a market leadership position.

To make sure you are among the latter, you need to be a member of a Peers Group, i.e., a Vistage Group:

-

where the members’ only price for helping you succeed, is helping them achieve their success;

-

to challenge your assumptions and prevent hubris;

-

to hold you accountable for your commitments;

-

to provide resources to help you and your organization succeed.

My groups are currently meeting weekly to:

-

Provide Emotional Support and Mental Health – We take time to discuss how we are all doing What is happening in our lives, with our families. This discussion occurs before we get to business.

-

Provide Information and Support – The members are helping each other with finding community banks that will provide PPP funds. Helping refer new business to each other. Advising in the areas that are the key competency to the others.

-

Charting the route forward – questioning each other about what the future holds and how they will be successful in the future. Who to keep and let go to ensure they have the right resources in the future. What clients need attention or cultivation and which need to be “fired” as they are too expensive to keep.

-

Employee Care – How to deal with employee issues from hiring in a virtual world to firing. We are discussing how to bring the workforce back safely and avoid litigation. Other topics are how to compensate them for extra efforts, promote those that have risen to the occasion, and what to do with those in leadership positions who didn’t.

Bart Garvin, Owner, and President of Garvin Industries expressed the benefit of such groups, “Because we’re all human, every business owner or CEO has multiple blind spots. Those blind spots often give us a distorted perception of truth inside our company, and it’s all based on our past experiences. [The group] forces me to step outside my business and be intellectually honest about my blind spots so I can change them.”

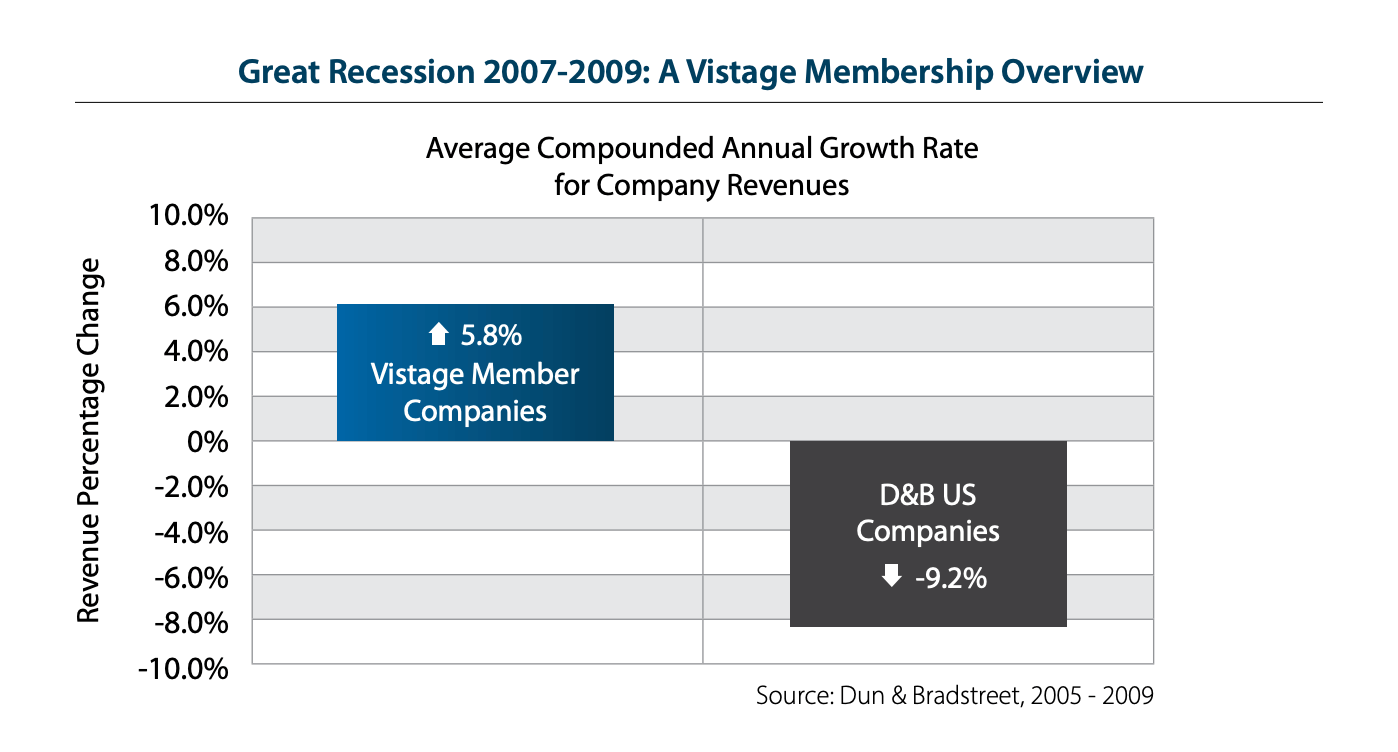

Looking back at the Great Recession, Vistage Member Companies outperformed their peers, as shown below. Vistage members grew revenue by 5.8%, while non-Vistage members saw a 9.2% decline. Many ask, “Is it the Chair, the peer advisory, the insight, the outside perspectives, the tools, the resources, the research, the speakers, the decision model……?” No, it is all of them in a group like Vistage.

A peer group is not an expense, but an investment and one, similar to a gym, if you go and use correctly, will pay huge dividends. Do you want to be a company represented on the left or the right of the above graph? Now is the time to get involved and push to make you and your organization stronger. Leave it too long, and those who do will have leapfrogged over you. If you want to learn more, contact me.

Copyright (c) 2020, Marc A. Borrelli

Recent Posts

Align and Thrive: The Importance of Organizational Alignment and Agility

Discover the importance of organizational alignment and agility in this blog post. Learn how establishing a strong CORE and building a strategy around it can lead to sustainable growth and success. Find out how alignment and agility empower your organization to thrive in an ever-changing business landscape.

How to Achieve Smart Time Management: 10 Tips for Busy Professionals

When you are a busy professional running your own business, it can often feel like there aren’t enough hours in the day to accomplish everything. Being strategic with your time is the best (and possibly the only) way to achieve all of your daily tasks. If you are...

5 Strategic Leadership Skills Every Manager Needs

So often, people view leadership as a talent: you’re either born with this quality or you’re not. However, this is not always the case! In reality, good leadership is made up of skills, and anyone can learn how to improve. Some people may pick up leadership attributes...

How the Sellability Score is Calculated: The Ultimate Guide

Do you have questions about how to calculate your business’s sellability score? Whether you’re looking to sell your business in the near future or years from now, understanding your sellability score will help you thrive. The sellability score identifies the...

The Top 5 Benefits of the Entrepreneurial Operating System

As an entrepreneur running your own business, you know there are bumps in the road and struggles that both you and your business will face over time. However, with the right people and tools at your disposal, you can anticipate what’s coming, plan for it, and continue...

5 Ways to Use Email Automation to Boost Traffic

Every single business in the world wants to evolve and grow. This will happen using a variety of techniques and strategies. In 2022, digital marketing is more than a household name, and most companies will adopt at least a few ideas when long-term planning and coming...

6 Questions To Ask A Potential Business Coach Before Hiring Them

Many entrepreneurs consider executive business coaching when they start struggling on their professional path. A small business coach is an experienced professional mentor who educates, supports, and motivates entrepreneurs. They will listen to your concerns, assess...

3 Ways Proper Long Term Strategic Planning Helps Your Business

Dreams turn into goals when they have a foundation of long-term strategic planning supporting them. They become reality when the ensuing strategic implementation plan is executed properly. With Kaizen Solutions as their strategic planning consultant, small and...

What is a Peer Group, and How Can it Improve Your Career?

If you are a CEO or key executive who has come to a crossroads or crisis in your career, you'll gain valuable insights and solutions from a peer group connection more than anywhere else. But what is a peer group, and how can that statement be made with so much...

Profit and Revenue are Lousy Core Values

As I mentioned last week, I am down with COVID and tired, so spending more time reading rather than working. I read Bill Browder's Freezing Order this weekend, and I highly recommend it. However, at the end of the book, Browder says that oligarchs, autocrats, and...