As we move towards opening up the country to varying degrees, I see some interesting data points.

Many consumers and businesses are wary.

While I don’t have any specific data, talking with friends, clients, and looking at social media, I see that most people are careful. They are:

-

social distancing,

-

avoiding contact with others,

-

wearing masks and gloves, and

-

not going to restaurants.

Furthermore, I don’t see anyone in a hurry to change this behavior. I look forward to seeing some data on this.

Some businesses are open.

As I move around Atlanta, I see many retail locations are open, from Home Depot to some small local retailers. What I notice is that Home Depot is still busy but at a lower level than pre-shutdown. Many small local retailers are open but empty. From what I have heard, some hotels are operating, but service is limited, and the employees are continuously cleaning after each guest touches the doors, check-in desk, etc.

Online business is operating at full speed and shows little signs of slowing. The biggest issue will be their inventory. B2B remains relatively strong in specific sectors, but as the effect of more bankruptcies and closures ripples through the economy, I think demand could weaken.

Some places are giving up on data and experts.

Many states are opening up before meeting the guidelines set by the Administration, i.e., Georgia, and Texas, and the White House is encouraging this behavior and anti closure protests. Furthermore, Arizona has halted its partnership with experts predicting coronavirus cases would continue to increase. The argument is that we have to open up as the damage to the economy cannot be sustained. To stop the fear, kill the messenger. To quote David Farragut, “Damn the torpedoes… go ahead! … full speed!”

The delicate nature of our supply chain.

An interesting paper argues that the cost of opening up is higher than the price of shutting down, as we are learning daily that our supply chains cannot take the hit from illness, i.e., the meat industry, nasal squabs, fresh produce. Could other sectors be affected? What would happen if the energy, transportation, or pharmaceutical sector failed? We aren’t even sure which industries are critical. As this progresses, will more industries stop working effectively as their supply chains stop working? I expect so, and we will learn what is vital.

Waiting for a return to the old normal.

Many are looking forward to a return to the way things were before COVID-19 hit. I don’t think we are returning to that period. If we look at 9/11, 3,000 people were killed, vs. 76,000+ today of COVID. Also, the economic loss will be much higher. Events like this will change behavior for many forever. Some of the things I see being affected are:

-

Business travel

-

Flying

-

Hotels

-

Rental Cars

-

Ride Share

-

Restaurants

-

Large meetings/events

-

Sports

I am sure I will be proved wrong, but things will be different. An interesting article on how COVID might affect restaurants like Prohibition affected drinks may provide food for thought.

What does this mean for your business?

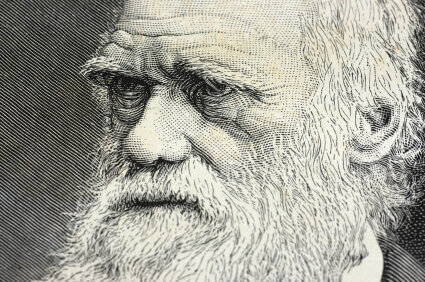

As I have said in this weekly newsletter before, Darwinian evolution holds that those that adapt best to the new environment will survive. Therefore, the questions for all CEOs and business leaders are:

-

How do we continue to perform in this new world?

-

What is our new environment?

Performing in the New World.

There is resistance among many in the U.S. to look abroad for best practices that are implementable here. As a CEO once told me, “There is nothing anyone can teach us.” However, many of our current practices came from abroad, i.e., just in time manufacturing and continuous improvement. So why not.

While experiencing about the same number of diagnosed infections as Italy, Spain, France, and the UK, Germany has registered approximately one-quarter as many deaths. Also, German authorities gave all factories the option to stay open through the pandemic, with the result that over 80% of did so, and only one-quarter have canceled investments. Businesses, to protect workers, implemented strict safety rules early on, and managers involved unions and employees in safety planning. Regional governments were quick to test and trace chains of infection to contain the spread. Finally, many German firms having ties to China had a jump on planning for operations through a shutdown. As a result of its experience in China, Volkswagen implemented a 100 steps affecting many aspects of workers’ routines, including where to change into work clothes, where and how to eat lunch, and how to check for Covid-19 symptoms.

Ebm-papst Group, a family-owned fan and motor manufacturer, has kept its domestic factories running at 80 percent of normal capacity. With three factories in China, management got an early warning of the seriousness of the pandemic, and so they sought to buy masks. Today they a full-time employee whose sole responsibility is to source masks and now have over 100,000 stockpiled. To provide a safe environment, social distancing, ubiquitous face masks, in-house Covid-19 tests, and contact tracing when employees fell ill helped enabled the company to keep its plants open. Ebm-papst, like most German companies, involves employee representatives in management decisions. The head of personnel and a workers’ representative sit on the crisis task force. To date, only 15 of its 6,700 employees in Germany have contracted the virus, and the workers feel safe.

However, the German economy is not immune to COVID and will probably suffer its most significant downturn since WWII. Furthermore, German’s rely heavily on international trade and global supply chains, which could remain under pressure for months or even years. Yet many economists, including those from the International Monetary Fund, thi

nk that the decision by German companies to keep running through the lockdown could allow its economy to recover faster than other nations next year.

What is our new environment?

This question is more complex; however, all CEOs and business leaders need to have a team to look at this. As I have said before, they need to look beyond what is happening today, and consider:

-

How could our supply chains be affected?

-

How could my customers’ supply chain be affected?

-

What will our working capital look like going forward if we have more inventory?

-

Can we source more products locally and reduce reliance on international supply chains?

-

How will our business operations change going forward, great WFH?

-

What costs have we cut that we can live without going forward?

-

What personnel have we cut that we don’t need?

-

What roles have we cut that we don’t need?

-

What roles do we need that we don’t currently have?

-

What employees/skills do we need that we don’t currently have?

-

What do we need to do to keep workers and customers safe?

-

Will any consumer/business behavior or government policy changes affect our business?

-

Will any consumer/business behavior or government policy changes affect our customer’s business?

-

Will any consumer/business behavior or government policy changes affect our supplier’s business?

-

How financially stable are our customers and suppliers?

-

How financially stable are their industries?

-

What new markets are available that were not before?

-

What new clients can we attract with our service/product offerings which we didn’t have before?

-

What happens if revenue falls by 25%, 50%?

-

What happens if revenue grows by 25%, 50%, can we meet standards and delivery schedules?

-

What should we automate?

-

How should we change our investment plans?

This is not a definitive list, but definitely, a place to start. Good luck and if I can help, contact me.

Copyright (c) 2020 Marc A. Borrelli

Recent Posts

Align and Thrive: The Importance of Organizational Alignment and Agility

Discover the importance of organizational alignment and agility in this blog post. Learn how establishing a strong CORE and building a strategy around it can lead to sustainable growth and success. Find out how alignment and agility empower your organization to thrive in an ever-changing business landscape.

How to Achieve Smart Time Management: 10 Tips for Busy Professionals

When you are a busy professional running your own business, it can often feel like there aren’t enough hours in the day to accomplish everything. Being strategic with your time is the best (and possibly the only) way to achieve all of your daily tasks. If you are...

5 Strategic Leadership Skills Every Manager Needs

So often, people view leadership as a talent: you’re either born with this quality or you’re not. However, this is not always the case! In reality, good leadership is made up of skills, and anyone can learn how to improve. Some people may pick up leadership attributes...

How the Sellability Score is Calculated: The Ultimate Guide

Do you have questions about how to calculate your business’s sellability score? Whether you’re looking to sell your business in the near future or years from now, understanding your sellability score will help you thrive. The sellability score identifies the...

The Top 5 Benefits of the Entrepreneurial Operating System

As an entrepreneur running your own business, you know there are bumps in the road and struggles that both you and your business will face over time. However, with the right people and tools at your disposal, you can anticipate what’s coming, plan for it, and continue...

5 Ways to Use Email Automation to Boost Traffic

Every single business in the world wants to evolve and grow. This will happen using a variety of techniques and strategies. In 2022, digital marketing is more than a household name, and most companies will adopt at least a few ideas when long-term planning and coming...

6 Questions To Ask A Potential Business Coach Before Hiring Them

Many entrepreneurs consider executive business coaching when they start struggling on their professional path. A small business coach is an experienced professional mentor who educates, supports, and motivates entrepreneurs. They will listen to your concerns, assess...

3 Ways Proper Long Term Strategic Planning Helps Your Business

Dreams turn into goals when they have a foundation of long-term strategic planning supporting them. They become reality when the ensuing strategic implementation plan is executed properly. With Kaizen Solutions as their strategic planning consultant, small and...

What is a Peer Group, and How Can it Improve Your Career?

If you are a CEO or key executive who has come to a crossroads or crisis in your career, you'll gain valuable insights and solutions from a peer group connection more than anywhere else. But what is a peer group, and how can that statement be made with so much...

Profit and Revenue are Lousy Core Values

As I mentioned last week, I am down with COVID and tired, so spending more time reading rather than working. I read Bill Browder's Freezing Order this weekend, and I highly recommend it. However, at the end of the book, Browder says that oligarchs, autocrats, and...