The EOS Model® provides a useful foundation for businesses, but it falls short in addressing key aspects of creating an growth. By incorporating additional elements from the Gravitas 7 Attributes of Agile Growth® model, businesses can create a more comprehensive system that promotes growth while maintaining smooth operations. Focusing on Leadership, Strategy, Execution, Customer, Profit, Systems, and Talent, the 7 Attributes of Agile Growth® offer a more encompassing approach to achieving success.

Are We Driving (the best) Half of Our Workforce Away?

Last week was the Vice Presidential debate, and I didn’t watch it. Honestly, I am on a diet, forbidding alcohol, so it was not an option. However, looking at Social Media, my understanding of the debate’s outcome was:

- It was a traditional debate; both sides avoided questions, had their talking points, and remained calm.

- The Fly Won

- Senator Kamala Harris made all sorts of unpleasant faces and was a “b****.”

- Vice President Mike Pence talked over Kamela and the female moderator, demonstrating male sexism.

As I didn’t watch it, I have no idea who won; however, many women saw Vice President Pence’s interruptions of Senator Harris sexist norms. Simultaneously, various news outlets reported that Vice President Pence did a great job among many of the President’s supporters. This data ties in with a fascinating paper just released, “Status threat, not economic hardship, explains the 2016 presidential vote,” by Diana C. Mutz, at the University of Pennsylvania. According to Professor Mutz, “Candidate preferences in 2016 reflected increasing anxiety among high-status groups rather than complaints about past treatment among low-status groups.” Thus white males continue to be threatened by other groups diminishing their privilege and claiming to suffer discrimination.

To those who are up in arms so far claiming there is no sexism in the U.S., I would recommend looking at the “Am I the Asshole?” forum on Reddit. The AITA forum provides a thorough look at gender inequality and the degree of sexism in our society. Once you have read this, reflect on what it means for your wife, daughter, and mother. We need to face it and remove it. Adopting the Administration’s stance with its executive order’s stated goal is “to combat offensive, and anti-American race and sex stereotyping and scapegoating,” is just doing more damage and denying reality.

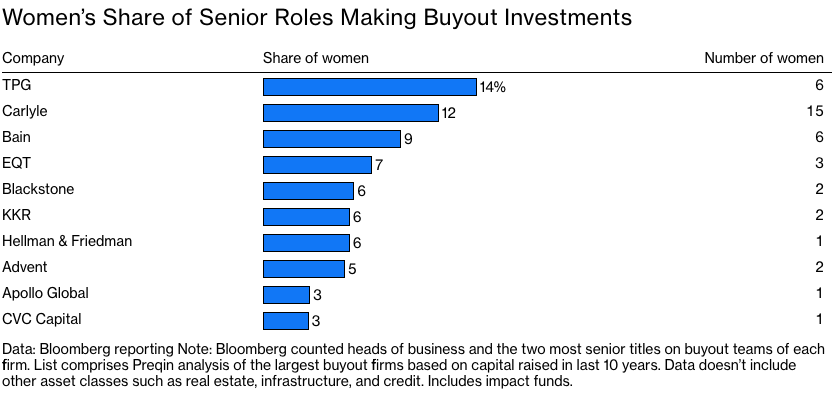

However, being sexist in business and creating an unwelcoming environment for women will not attract more women into the business world. As I discussed in a prior blog post, we need them in business, and we need women more at higher levels of the organization. The data shows that:

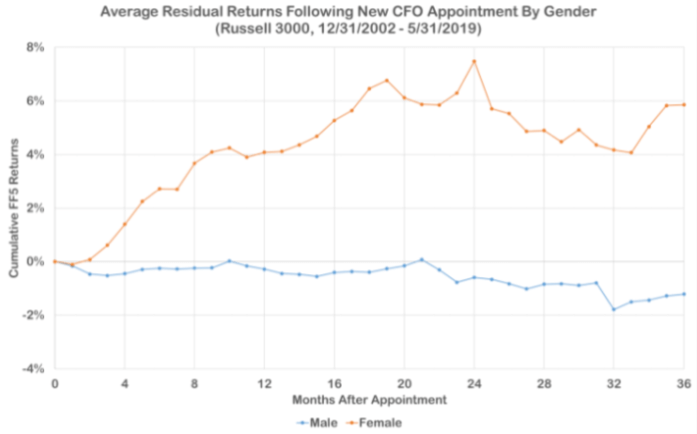

- Companies with female CFOs improved their earnings;

- Companies with female CIOs improved their investment returns; and

- Companies with women on their boards performed better.

Furthermore, some claim that countries with women leaders have performed better during COVID, but there is more to that discussion. While this may be a correlation and not causality, it is worth noting. Women also are better at today’s’ leadership requirements, e.g., working in groups and showing empathy. As I said last week, most of our graduates from undergraduate, law, and medical schools are women; to drive them away is just putting us at a global disadvantage.

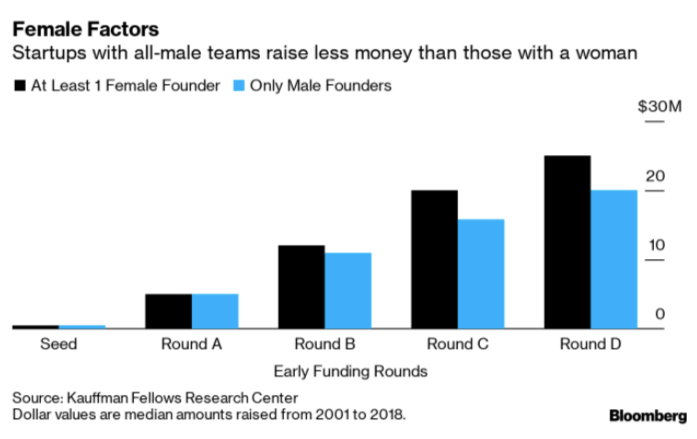

So, given the above, having more high performing women should put you at a competitive advantage. It is time for what I call the “Moneyball” approach. There is a market of high performing employees who are not valued as highly by your competition. The key is to provide an attractive work environment for them, design compensation to meet their needs, e.g., flexible time, and seek out to recruit them. Building an organization that attracts and retains high performing women at all levels will also attract other women and will provide you with a competitive advantage. We all need one of those in these times.

Copyright (c) 2020, Marc A. Borrelli

Recent Posts

EOS is just that, an Operating System

What has COVID done to Company Culture?

COVID has affected everyone. However, companies need to examine if they have lived their core values during COVID, how they are reinforcing them in a WFH environment, and especially with the onboarding of new hires.

Profit ≠ Cash Flow

Knowing how much cash you generate is essential for planning for growth. Too many companies don’t know and when they grow they find they are continually running out of cash. Understand your cash flow generation and how to improve it through improvements in your Cash Conversion Cycle and using the Power of One.

What Are Your Critical and Counter Critical Numbers?

The key to achieving long term goals is to define short term goals that lead you there. Focusing those short term goals around a key metric is essential. However, ensure that the metric will not lead other areas astray by having an appropriate counter critical metric act as a counter balance.

Rethinking ‘Family’ Culture in Business: Fostering Performance and Success

Explore the importance of company culture and the potential pitfalls of adopting a “Family” culture in organizations. Learn how to foster a high-performance culture while maintaining key family values and discover success factors for family businesses. Rethink the “Family” culture concept and create a thriving environment for your organization.

Do You Truly Know Your Core Customer?

Knowing the profit of your core customers is key to building a growth model. Many companies have identified core customers that are generating a sub-optimal profit and so they cannot realize the profits they seek. Identifying the correct core customer allows you to generate profits and often operate in “Blue Ocean.”

The Spectacular Rise and Fall of the European Super League

The European Super League (ESL) collapsed within 48 hours of its announcement due to hubris, a lack of value creation, and fan backlash. The founders’ arrogance led them to disregard European football’s deep-rooted traditions and culture. At the same time, the focus on wealthy club owners instead of merit undermined the essence of the competition. The fierce backlash from fans, who felt betrayed by their clubs, demonstrated the importance of prioritizing supporters’ interests in football.

When Should I Sell My Business?

Many business owners want to sell at the top of the market. However, market timing is tough. Is this the best strategy? Probably not.

Does Your Financial Model Drive Growth?

Working with many companies looking to grow, I am always surprised how many have not built a financial model that drives growth. I have mentioned before a financial model that drives growth? Here I am basing on Jim Collin's Profit/X, which he laid out in Good to...

COVID = Caught Inside

As we emerge from COVID, the current employment environment makes me think of a surfing concept: “Being Caught Inside When a Big Set Comes Through.” Basically, the phrase refers to when you paddle like crazy to escape the crash of one wave, only to find that the next wave in the set is even bigger—and you’re exhausted. 2020 was the first wave, leaving us tired and low. But looking forward, there are major challenges looming on the horizon as business picks up in 2021. You are already asking a lot of your employees, who are working flat out and dealing with stress until you are able to hire more. But everyone is looking for employees right now, and hiring and retention for your organization is growing more difficult.