The EOS Model® provides a useful foundation for businesses, but it falls short in addressing key aspects of creating an growth. By incorporating additional elements from the Gravitas 7 Attributes of Agile Growth® model, businesses can create a more comprehensive system that promotes growth while maintaining smooth operations. Focusing on Leadership, Strategy, Execution, Customer, Profit, Systems, and Talent, the 7 Attributes of Agile Growth® offer a more encompassing approach to achieving success.

Why We Suck at Planning for Catastrophic Events

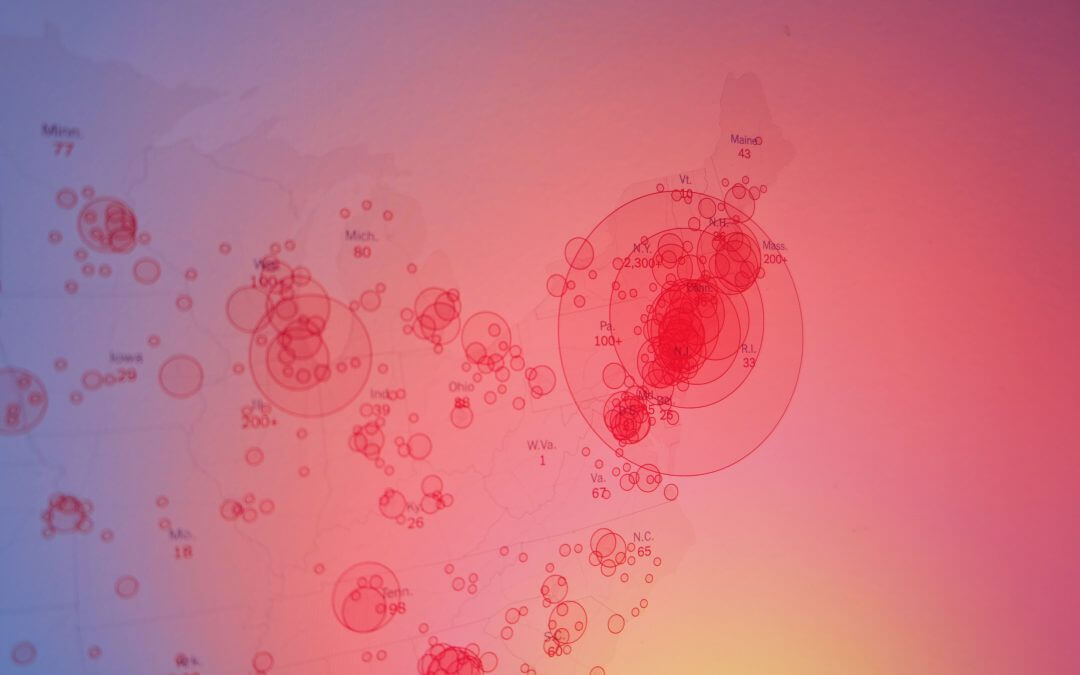

COVID has disrupted everything and is bringing about unprecedented changes. However, while many say that we could not have expected COVID, that is not the case. Many people raised the alarm over or planning for a pandemic, from Bill Gates to George W. Bush and Obama administrations. And this is not the first time.

If we look back at the Financial Recession, that was not entirely unexpected. Several people saw the problem and were either raising the alarm or trying to profit from it. As Nassim Nicholas Taleb has stated on several occasions, these are not actual Black Swan events, they were predictable, and the probability of them happening was far more extensive than we recognized.

Finally, even when these calamities are bearing down on us, we tend to do little to avoid them until it is too late. The Administration’s response was lacking in preparing for COVID, even though we knew about it coming out of China. How many times do we see a hurricane bearing down on the coast, and even though there is a mandatory evacuation, people refuse to leave, often paying for such decisions with their lives?

It seems there are some reasons.

Economic Behavior

Why we prepare so badly is basic economics. In our continual pursuit to improve efficiencies and be either more profitable or less wasteful, it becomes harder to justify spending money on events that we are uncertain will occur. Thus companies moved to just in time systems with no redundancies or excess inventory, which failed them when COVID hit and disrupted shipping. Companies had moved production to lower-cost centers overseas, which caused huge issues when COVID shut down operations in those countries. Finally, I think we have seen the failings of our economic priorities in the U.S. healthcare system, which is not designed for dealing with a public health care crisis, but rather for making a return to investors.

Former Governor Arnold Schwarzenegger invested $200 million in three mobile 200-bed hospitals deployable to the scene of a crisis within 72 hours. Each hospital would be the size of a football field, with a surgery ward, intensive care unit, and X-ray equipment. Medical response teams would also have access to a massive stockpile of emergency supplies: 50 million N95 respirators, 2,400 portable ventilators, and kits to set up 21,000 additional patient beds wherever they were needed. As Schwarzenegger told a news conference, “In light of the pandemic flu risk, it is absolutely a critical investment, I’m not willing to gamble with the people’s safety.” However, in 2011 facing a recession and budget deficit of $26 billion, Former Governor Jerry Brown cut funding for the program.

Thus in our continual drive to be efficient, investments in backup systems and redundancies quickly get cut. For governments, there is always the demand of current situations that take priority over planning. Thus, our economic behavior leaves us vulnerable to the crisis when it arises.

However, once a crisis hits, we are terrible at dealing with it, and that is due to three psychological issues: normalcy bias, optimism bias, and our herd instinct.

Normalcy Bias

Normalcy bias is a cognitive bias that leads people to disbelieve or minimize threat warnings until we are overwhelmed and cannot respond. Thus, individuals underestimate the likelihood of a disaster, when it might affect them, and its potential adverse effects. Normalcy bias causes many people to inadequately prepare for natural disasters, pandemics, war, and calamities caused by human error. During a disaster, about 70% of people reportedly display normalcy bias. Normalcy bias is also called analysis paralysis, the ostrich effect, and by first responders, the negative panic.

Throughout history, there plenty of examples of normalcy bias.

- When Vesuvius erupted, the residents of Pompeii watched for hours without evacuating. Thousands of people refused to leave New Orleans as Hurricane Katrina approached.

- At least 70% of the 9/11 survivors spoke with others before leaving.

- Officials at the White Star Line made insufficient preparations to evacuate passengers on the Titanic.

- Passengers on the Titanic refused evacuation orders because they underestimated the odds of a worst-case scenario and minimized its potential impact.

- Experts at the Fukushima nuclear power plant believed that a multiple reactor meltdown could never occur.

So how do we overcome Normalcy bias? Amanda Ripley, author of The Unthinkable: Who Survives When Disaster Strikes – and Why explains that there are three phases of response:

- Denial. People are likely to deny that a disaster is happening. It takes time for the brain to process information and recognize that a disaster is a threat.

- Deliberation. In this phase, people have to decide what to do. If the individual has no plan, the problem is serious. The effects of life-threatening stress on the body (e.g., tunnel vision, audio exclusion, time dilations, out-of-body experiences, or reduced motor skills) limit an individual’s ability to perceive information and make plans.

- Decisive Moment. Here a person must act quickly and decisively. Failure to do so can result in injury or death.

According to Ripley, the faster we can get through the Denial and Deliberation phases, the quicker we will reach the Decisive Moment and begin to take action.

Optimism Bias

Optimism bias is a cognitive bias that causes someone to believe that even though bad things are happening around me, I will do better than everyone else. It is also known as unrealistic optimism or comparative optimism. Optimism bias is “Even if bad things are happening around me, I will do better than everyone else.” Optimism bias is common and transcends gender, ethnicity, nationality, and age. Four factors cause optimism bias in people:

- their desired end state,

- their cognitive mechanisms,

- the information they have about themselves versus others, and

- overall mood.

A typical example would someone diagnosed with aggressive cancer, and ten specialists tell them they have little chance of survival. However, an eleventh tells them they will be ok, so they believe the 11th. Other examples are:

- smokers feeling that they are less likely to contract lung cancer or disease than other smokers,

- first-time bungee jumpers believing that they are less at risk of an injury than other jumpers, or

- traders who think they are less exposed to potential losses in the markets.

Herd Instinct

We are social animals, and we take our clues from those around us. If we know a tsunami is coming, but no else is leaving, we figure it is safe to stay, even though we understand a tsunami will cause a calamity.

So what to do?

From an economic behavior point of view, we will have to bear additional costs and waste to maintain preparation. I would expect that for a while, at least a decade or more, we will ensure we have back up lines of supply and more inventory than we need. However, once all memory of COVID has passed, and there is another generation making decisions which did not experience it, costs cuts will return with our move to efficiency.

Concerning our biases, we need to understand them and be prepared. With normalcy bias, we need to have plans on what to do in the case of an emergency. Luckily for the economy, the experience of the Great Recession was still fresh enough that governments knew that had to provide financial support in large amount to stop the economy collapsing, which they did. However, for a lot of emergencies, we will not have the benefit of a recent crisis to fall back on as a guiding example.

Unfortunately, like the generals, in planning for crises, we tend to “fight the last war.” However, each situation is different. What will out next problem be, A.I. went amuck, climate change? Who knows, but it may be something we have not experienced yet, or even if it is, e.g., a public health crisis, the disease may be very different, requiring a different response.

A great example of our failure is Climate Change. We know that climate change is coming, and a recent report by the U.S. Commodity Futures Trading Commission (CFTC) starts by saying climate change “poses a major risk to the stability of the U.S. financial system and to its ability to sustain the American economy.” The report, “Managing Climate Risk in the U.S. Financial System,” was written by a group of 35 advisors from major banks such as Morgan Stanley and JPMorgan Chase, environmental groups such as The Nature Conservancy and Ceres, energy firms such as B.P. and ConocoPhillips, several investment firms, and experts from several universities. According to it, regulators “must recognize that climate change poses serious emerging risks to the U.S. financial system, and they should move urgently and decisively to measure, understand, and address these risks.”

However, our economic behavior justifies us doing nothing since the costs of prevention are so high. The vested interests of doing nothing spend an enormous amount to ensure nothing changes. Of course, the price of prevention is high compared to what? We always underestimate the expense of the crisis, as COVID has dramatically shown. The annual costs of climate change continue to grow, as we experience more significant fires, hurricanes, and damage to crops.

Concerning normalcy bias, we have one denial and not enough deliberation. Concerning decisive movement, the Republican chairman of the CFTC, Heath Tarbert, acknowledged the risk of climate change. Still, he said, “The subcommittee’s report acknowledges that ‘transition risks’ of a green economy could be just as disruptive to our financial system as the possible physical manifestations of climate change, and that moving too fast, too soon could be just as disorderly as doing too little, too late.” Basically, we don’t have a plan!

Concerning optimism bias, we have a situation where 97 percent of actively publishing scientists believe human activity is causing global warming and climate change. However, we cling to the three percent who are deniers.

Finally, herd instinct, we don’t want to be the first or do something that we are not sure others will do.

However, if you wish to protect your business, it would be worth investing time in understanding the effects of climate change on it and developing a plan to protect yourself. Start follow Nassim Taleb’s advice and build “antifragility” into your systems, which provide robustness to black swan events. An application of the least fragile risk management approach, according to Taleb, is the “barbell strategy,” which seeks to avoid the middle in favor of a combination of extremes. How that applies to your business will be different, but planning should start now.

Recent Posts

EOS is just that, an Operating System

What has COVID done to Company Culture?

COVID has affected everyone. However, companies need to examine if they have lived their core values during COVID, how they are reinforcing them in a WFH environment, and especially with the onboarding of new hires.

Profit ≠ Cash Flow

Knowing how much cash you generate is essential for planning for growth. Too many companies don’t know and when they grow they find they are continually running out of cash. Understand your cash flow generation and how to improve it through improvements in your Cash Conversion Cycle and using the Power of One.

What Are Your Critical and Counter Critical Numbers?

The key to achieving long term goals is to define short term goals that lead you there. Focusing those short term goals around a key metric is essential. However, ensure that the metric will not lead other areas astray by having an appropriate counter critical metric act as a counter balance.

Rethinking ‘Family’ Culture in Business: Fostering Performance and Success

Explore the importance of company culture and the potential pitfalls of adopting a “Family” culture in organizations. Learn how to foster a high-performance culture while maintaining key family values and discover success factors for family businesses. Rethink the “Family” culture concept and create a thriving environment for your organization.

Do You Truly Know Your Core Customer?

Knowing the profit of your core customers is key to building a growth model. Many companies have identified core customers that are generating a sub-optimal profit and so they cannot realize the profits they seek. Identifying the correct core customer allows you to generate profits and often operate in “Blue Ocean.”

The Spectacular Rise and Fall of the European Super League

The European Super League (ESL) collapsed within 48 hours of its announcement due to hubris, a lack of value creation, and fan backlash. The founders’ arrogance led them to disregard European football’s deep-rooted traditions and culture. At the same time, the focus on wealthy club owners instead of merit undermined the essence of the competition. The fierce backlash from fans, who felt betrayed by their clubs, demonstrated the importance of prioritizing supporters’ interests in football.

When Should I Sell My Business?

Many business owners want to sell at the top of the market. However, market timing is tough. Is this the best strategy? Probably not.

Does Your Financial Model Drive Growth?

Working with many companies looking to grow, I am always surprised how many have not built a financial model that drives growth. I have mentioned before a financial model that drives growth? Here I am basing on Jim Collin's Profit/X, which he laid out in Good to...

COVID = Caught Inside

As we emerge from COVID, the current employment environment makes me think of a surfing concept: “Being Caught Inside When a Big Set Comes Through.” Basically, the phrase refers to when you paddle like crazy to escape the crash of one wave, only to find that the next wave in the set is even bigger—and you’re exhausted. 2020 was the first wave, leaving us tired and low. But looking forward, there are major challenges looming on the horizon as business picks up in 2021. You are already asking a lot of your employees, who are working flat out and dealing with stress until you are able to hire more. But everyone is looking for employees right now, and hiring and retention for your organization is growing more difficult.