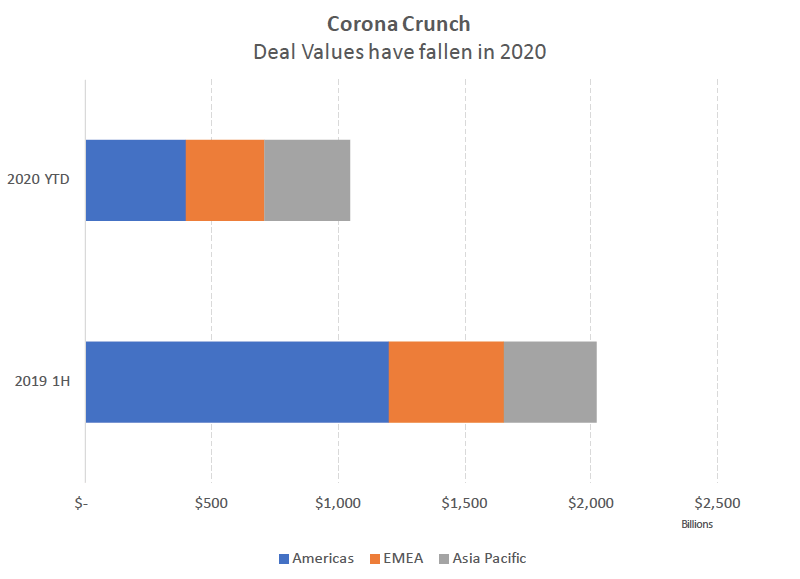

COVID, as I predicted many months ago, is taking a toll on M&A. In the first half of 2020, the value of mergers and acquisitions fell 50% from the year-earlier period to the lowest level since the depths of the euro-zone debt crisis.

Source: Bloomberg

Data shows the value of pending and completed M&A applied to targets in each region. 2020 figures are through June 28.

The Americas have realized the sharpest fall with deals value down 67% in the first half. Every major industry has been hurt. However, the financial sector fared better than most because of Aon Plc’s $30 billion offer for Willis Towers Watson Plc and Morgan Stanley’s proposed $13 billion acquisition of E*Trade Financial Corp.

EMEA was down 31% and Asia Pacific was down 7%.

As has been said before, the COVID situation is a public health crisis. Until we deal with the public health issue, everything else will suffer. The M&A numbers reflect this with Asia Pacific currently leading with the best response. EMEA suffered initially but is recovering, while the Americas, with the U.S. and Brazil failing in their response, has fallen the most.

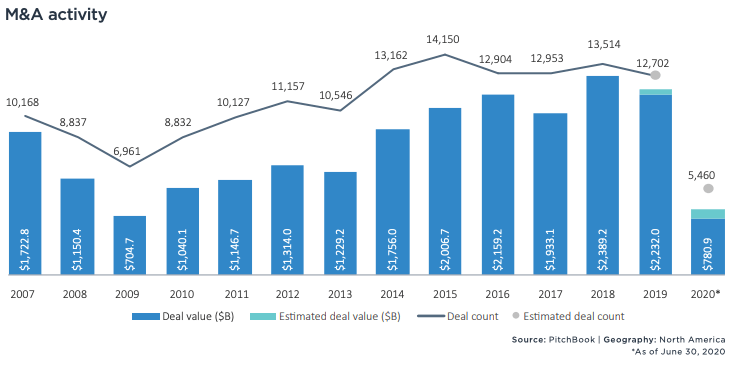

U.S M&A activity in Q2 2020 continued to decline as COVID remained an unrelenting problem in North America, especially in the US. North American M&A activity during this period was $336.8 billion across 2,025 transactions. Currently, the US recovery is more of a “W” than a “V”, which threatens to further drag down M&A activity.

Nevertheless, certain sectors, namely tech, and healthcare continue to have a stable deal volume, as many companies in these sectors have benefited from COVID and are opportunistically seeking M&A transactions. However, in areas such as oil & gas, many companies are completing deals just to survive.

Due to COVID, buyers and sellers are struggling with a lack of accurate earnings and cash flow forecasts, causing parties to avoid deals. Further, cash is key, and survival is not running out of cash. Thus, unless companies have large cash piles or can use their paper, deals will be further limited.

While both the U.S. and Canada confirmed their economies entered recessions during Q1, Canada has since emerged from its shortest recession on record due to its effective COVID response. The prospects for the U.S. remain bleaker with rising COVID cases negatively impacting the country’s economic outlook. Furthermore, many of the states that opened up too early, e.g., Florida, Texas, Georgia, have seen dramatic increases in cases and are shut back down.

Currently, the International Monetary Fund is forecasting an 8% decline in GDP for the U.S. in 2020. With no end in sight for the pandemic in the U.S., which has the most cases and deaths from the virus globally, that may be optimistic.

The outlook for M&A thus remains dim.

Recent Posts

The “Flaw of Averages” Causes Havoc for Businesses

Discover how understanding the limitations of averages and embracing probabilistic thinking can improve decision-making and risk management in business.

What is Your Strategy, In a Sentence?

If you are banking on the vaccine returning us all to “normal” quite quickly, in the famous words of Dr. Akande, “Hope is not a strategy.” Your organization should be preparing a well-defined strategy for 2021 and beyond. Once you have this strategy, the ultimate question: can you clearly articulate it in one sentence? Distilling your strategy into a single sentence is a powerful tool, both for your legacy and your team effectiveness. Not sure where to start? I offer a plug-in formula to set up your strategy sentence.

Character Matters

“It’s easier to hold to your principles 100% of the time than it is to hold to them 98% of the time.” — Clayton Christiansen. I have often written about the importance of a company’s Core Values. That’s because no matter what words you may have chosen as values, your organization’s Core Values are on display in how leadership and employees actually behave. As I’ve said before, how you have acted in the last twelve months will define your career for the next decade. Your character, and your company’s character, matters.

New Year’s Resolutions, Once More Unto the Breach

The holidays have been even quieter than normal, which has given me plenty of time to reflect on my New Year’s resolutions. Looking at 2021, I decided to use a completely new approach to lay out my goals. The result of my new approach? A highly-detailed, accountable, actually achievable plan for the next year (I think). Wondering what this process looks like?

To Vaccinate or Not to Vaccinate, that is the Question

What do your employees, peers, and leadership team think of the COVID-19 vaccine? Will you require the vaccine, or will you let employees make individual decisions? As a leader, you need to steer the discussion about vaccines in your organization with your Core Values in mind. No matter what strategy your organization takes, the most important factor is going to be how you communicate your decision.

3 Ways You Could be Undermining Your Core Values

Can you answer “Why does your organization exist? What are your core values?” Great. Now, would your latest entry-level employee give a similar answer? How about someone who has been at your company for a year? Your core values give your organization a guiding mission. Many organizations pay this idea lip service, but their true commitment to their core values was tested this year. As we close out 2020, there’s no better time to examine how your organization is approaching your core values.

Are You Prepared for 2021 With Enough Cash?

Companies don’t go bankrupt because they lose money; rather, they run out of cash. Where are we, heading into 2021? First, you can expect your cash to get tighter as we weather the current economic slowdown. Then, with a vaccine on the horizon, you will need to be positioned for growth. If you don’t have the cash you need, have you looked at how you can generate the cash internally? More on how to improve your cash conversion cycle…

Tony Hsieh, a Corporate Culture Icon, RIP

In his work as Zappos CEO and elsewhere, Tony Hsieh believed, and proved, that culture is the most important thing in an organization. According to Hsieh, if you get the culture right, the rest will take of itself. How did Zappos do it? You can take a look at everything from the company’s interview questions, to “The Offer” to leave a position as a new hire. Hsieh believed that a company’s brand is just a reflection of the culture, and his legacy is felt across so many industries.

CEO, Try Thy Hiring System

How does your company hire? I’ve seen the good, the bad, and the surprisingly ugly hiring processes in my career. From the HR email mix-ups to the interviewer watching the World Series while I responded to his questions, I’ve learned that you can tell a lot about an organization simply by examining the hiring experience. Are you chasing away the kind of people you need at your company?

What is Leadership?

What is it, exactly, that great leaders do? There are plenty of overused adages about “leadership” in business. It’s worth examining the tropes around leadership, plus the traits of the leaders who actually leave a mark. Great leaders are forged through adversity, and they leave a legacy. What does that look like in your organization?