Discover how to enhance decision-making in your organization by focusing on three crucial areas: solving the right problem, gathering all the available information, and understanding the intent. Learn to empower your team, foster a purpose-driven culture, and improve organizational clarity for better decision-making.

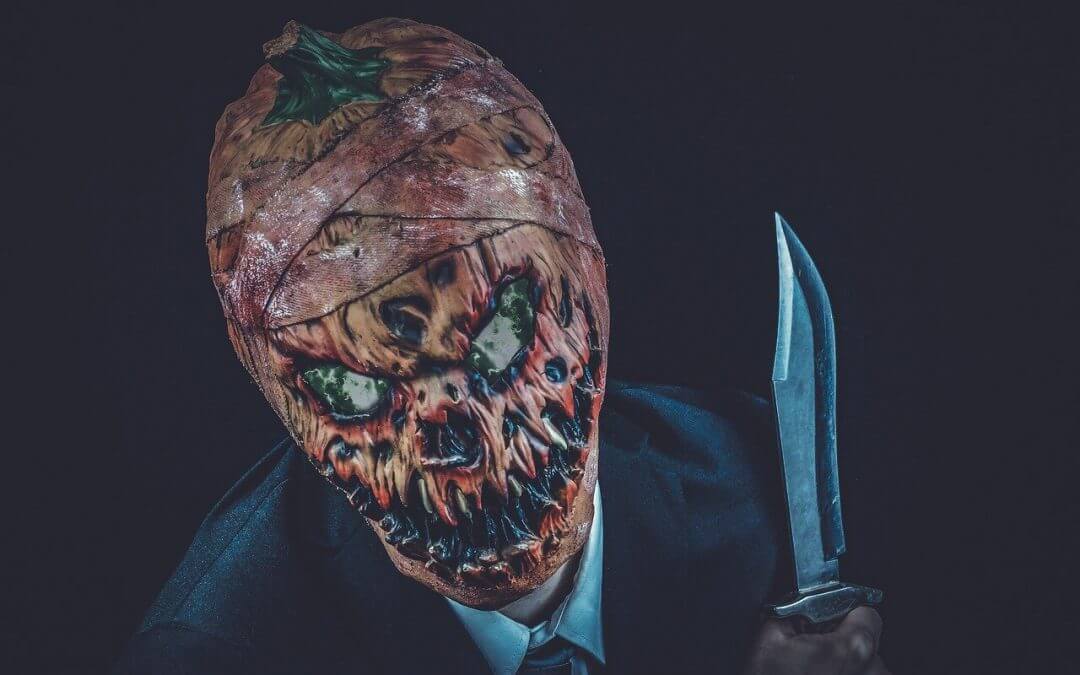

Arthur Laffer, The Horror Sequel Maybe Coming

Say it isn’t so! Sean Hannity is promoting the idea of putting Arthur Laffer in charge of getting American back to work, and Laffer has been advising the President. Laffer is the mastermind behind the Reagan-era tax cuts and a pioneer behind the notion that slashing taxes unleashes economic growth. While Reagan cut taxes, he had to raise them later as the economic growth Laffer promised never materialized to prevent huge deficits. George H. W. Bush had to increase taxes further as growth still wasn’t enough to overcome the deficits from the tax cuts. However, never one to let facts get in the way of a theory, in his 2018 book, Trumponomics, which he co-authored with conservative economic commentator Stephen Moore, Laffer argued that the Trump administration’s 2017 tax plan would raise growth rates to as much as 6% and not increase budget deficits. Wrong on both counts – 10pts. Of course, after Laffer’s great theory hit the proverbial iceberg in Kansas, one would think he would be more circumspect, but alas no. As I look at it, he is at least 0 for 4.

According to Reuters and Business Insider, Laffer is calling for three actions:

-

Impose taxes on non-profit organizations that encourage the arts and education, among others.

-

A 15% pay cut to the taxpayer-funded salaries of government officials and professors.

-

Enact a payroll tax cut holiday for employees and businesses until the end of the year.

Also, Laffer was against the current stimulus because he argues it would serve to discourage people from working and inflict more pain on the economy.

Let’s look at each of his proposals, in reverse order.

Against the current stimulus

The country is closed. With unemployment soaring, 16.6 million as of the latest count, many cannot afford the basics, like rent and mortgage payments. Their inability to work is not due to laziness; they were just laid off. If they don’t pay those bills, landlords and banks will suffer. Besides, without some form of help, they cannot afford car payments, groceries, or medical bills, to name a few things. The U.S. is a consumer economy, and consumer spending in the U.S. was about 71% in 2013. A reduction in consumer spending hurts companies that supply consumers who, in turn, lay off more workers as revenues fall. Thus, we get into a negative feedback loop, increasing the damage at each turn. When this is over, which it will be, those hurt through this negative feedback loop will be unable to quickly return to spend as they would have had their wealth decimated and will look to keep expenditures low while they rebuild their savings or come out of bankruptcy.

Enact a payroll tax cut holiday for employees and businesses until the end of the year.

The President has touted this many times, but as has is noted, it only helps that are working. With nearly 17 million now unemployed, this does nothing to help them. Those that have jobs are unlikely to rush out to spend the little extra they have as everyone is hunkering down financially due to the uncertainty. There is an expected tsunami of bankruptcies coming and possibly worse than in 2008. His proposal will do nothing to alleviate that issue, further depressing the economy.

A 15% pay cut to the taxpayer-funded salaries of government officials and professors.

Such a policy would harm those federal workers as such a significant reduction in their income will reduce the level of their spending as well since the federal government employs about two million people and pays about $136.3 billion a year in wages and salaries. Thus a 15% cut would reduce the wage bill by $20 billion. Economists estimate that the marginal propensity to consume in the U.S. is about 5%, so that the reduction would reduce U.S. spending by $270 billion a year. In effect, this would wipe out the stimulus and decimate the economy further.

Since Ronald Reagan’s statement that the worst thing was the government, those on the right have been seeking to cut the size of the government. However, as we think of cutting “worthless,” government employees consider that (i) if you pay peanuts, you get monkeys, and (ii) surely in relevant agencies we want the best people, not those that have no choice. Among government employees, there are:

-

The military – probably a “No-No.”

-

The FBI – what we need, more problems with law enforcement, and increase the probability of corruption.

-

The Justice Department and Federal Prosecutors – See FBI

-

Medical researchers and specialists who are working on COVID and other diseases. These people sacrifice a considerable amount for relatively little pay because they believe in what they are doing, unlike many in business who are just in it for the money. They work to keep us safe from COVID, Ebola, and other diseases. However, discouraging competent medical professionals and scientists is an excellent start to protect us from other pathogens.

-

The scientists are Los Alamos, N.W., and Oak Ridge, TN. We don’t need to take care of our nuclear facilities and weapons because hey look at Chernobyl.

-

International relations. Of course, we don’t need relationships with others now that we are going it alone. We may need someone to help us get essential medical products from a foreign county. I am sure Mike Pompeo or Jared Kushner can squeeze it in.

-

Air traffic controllers. We don’t need them, ask any pilot that has flown into Cairo.

-

Professors. Hopefully, the government hires excellent professors at its educational institutes. I am sure a pay cut will improve the quality of teaching and graduates.

I am sure, he didn’t mean any of these groups, so really what he is proposing is a non-event financially and just a personal vendetta against those he believes add no value.

Impose taxes on non-profit organizations that encourage the arts and education, among others.

I am sure that doing so would be a massive tax revenue booster. While false, the famous story of Churchill’s response, “What are we fighting for,” when asked to consider cutting funding for art programs to support the war effort, does strike a point. However, Churchill did say, “The arts are essential to any complete national life. The State owes it to itself to sustain and encourage them….Ill fares the race which fails to salute the arts with the reverence and delight which are their due.”

As I and others have noted, that those with a humanities background are better at management than STEM and business graduates. The arts are there to teach us empathy and what it is to be human. If we want to improve as a country, this is not the way to go about it.

As the saying goes, “When all you have is a hammer, everything looks like a nail.” Once more, it appears that Mr. Laffer is proposing his standard solutions without considering the facts. He should look to another economist, with a much better record, Keynes, who supposedly said, “When the Facts Change, I Change My Mind. What Do You Do, Sir?” Laffer has never changed his mind regardless of how the facts judge him. As someone whose views on many things have changed over the years, be it down to persuasion by others, more information and data, or just Bayesian logic, I find his position enough to disqualify him and his suggestions from any serious economic consideration.

Copyright (c) 2020, Marc A. Borrelli

Recent Posts

Boosting Common Sense Decision-Making in Your Organization

Do You Understand Your Costs to Ensure Profitability?

You can only determine profitability when you know your costs. I’ve discussed before that you should price according to value, not hours. However, you still need to know your costs to understand the minimum pricing and how it is performing. Do you consider each jobs’ profitability when you price new jobs? Do you know what you should be charging to ensure you hit your profit targets? These discussions about a company’s profitability, and what measure drives profit, are critical for your organization.

Sunk Costs Are Just That, Sunk!

If you were starting your business today, what would you do differently? This thought-provoking question is a valuable exercise, especially when it brings up the idea of “sunk costs” and how they limit us. A sunk cost is a payment or investment that has already been made. Since it is unrecoverable no matter what, a sunk cost shouldn’t be factored into any future decisions. However, we’re all familiar with the sunk cost fallacy: behavior driven by a past expenditure that isn’t recoupable, regardless of future actions.

Do You REALLY Know Your Business Model?

Bringing clarity to your organization is a common theme on The Disruption! blog. Defining your business model is a worthwhile exercise for any leadership team. But how do you even begin to bring clarity into your operations? If you’re looking for a place to start, Josh Kaufman’s “Five Parts of Every Business” offers an excellent framework. Kaufman defines five parts of every business model that all flow into the next, breaking it down into Value Creation, Marketing, Sales, Value Delivery, and Finance.

Ideation! Harder Than It Sounds

Bringing in new ideas, thoughts, understanding, and logic is key as your organization faces the challenges of a changing environment. But when you do an ideation session in your organization… how does it go? For so many organizations, many times, after a few ideas have been thrown out and rejected, the thought process slows down very quickly, and a form of hopelessness takes over. How does your organization have better ideation? I’ve come across a new approach with a few teams lately.

Recruit, Recruit, Recruit!

An uptick in business has begun this quarter, and companies are rushing to hire to meet this surge in demand. What amazes me is how many are so unprepared to hire. Continual recruiting is key to the survival of a company. It isn’t the same thing as hiring—continuous recruiting is building a pipeline of people that you would hire if you needed to fill a position, or “A players” you would hire if they were available.

We All Need Clarity

If your organization is focused on obscurity over clarity, whether intentionally or not, your “A” player employees are vulnerable. There is a looming talent crunch. As we start to emerge from COVID, demand is increasing, and many are scrambling to fill positions to meet that demand. Headhunters and recruiters are soon going to be calling your key “A” employees. Have you been giving them a reason to stay?

Not Another **** Meeting

As Leonard Bernstein put it so well, “To achieve great things, two things are needed: a plan and not quite enough time.” Your meetings can be shorter, more fruitful, and engaging, with better outcomes for the organization, employees, and managers. It’s time to examine your meeting rhythms and how you set meeting agendas. This week, I break down daily, weekly, monthly, quarterly, annual, and individual meeting rhythms, with sample agendas for each.

Is Your Company Scalable?

Let’s start here: Why should your company be scalable at all? If your business is scalable, you have business freedom–freedom with time, money, and options. Many business leaders get stuck in the “owner’s trap”, where you need to do everything yourself. Sound familiar? If you want a scalable business that gives you freedom, you need to be intentional about what you sell, and how.

Are you ready for the Talent Crunch?

Companies are gearing up to hire. Unfortunately, many are competing within the same talent pool. Some experts are currently predicting a strong economic recovery starting in May or June. But as the economy booms, there is going to be fierce competition for talent. How will you fare in the looming talent crisis? Your organization should be creating a plan, now, so you can attract the talent you need in the year ahead.