Discover how to enhance decision-making in your organization by focusing on three crucial areas: solving the right problem, gathering all the available information, and understanding the intent. Learn to empower your team, foster a purpose-driven culture, and improve organizational clarity for better decision-making.

Professional US Sports Teams for Sale – Should You Consider It?

Entry into the professional sports franchise, i.e., a Major League Baseball (MLB) or National Basketball Association (NBA) team ownership club, is limited to the very wealthy. Especially in the U.S. with the franchise system, it is a way for the richer to get even richer. Now there’s a growing movement to help non-billionaires buy into a league.

Bloomberg recently reported that MLB has formally opted to allow investment funds to purchase a minority stake in multiple teams. The rationale behind the move is to help minority team owners find potential buyers for their shares, given the rising valuations of clubs. Forbes estimates that the average MLB team is worth $1.78 billion, up over 8% compared to 2018, and the top teams in the league have seen their values rise much more. The top clubs are estimated to be worth:

New York Yankees: $4.6 billion

Los Angeles Dodgers: $3.3 billion

Boston Red Sox: $3.2 billion

Chicago Cubs: $3.1 billion

Even the last-place Miami Marlins are reported to be worth $1 billion.

Although no investment vehicle has officially begun taking stakes in any clubs, it would, in theory, serve as a sort of fund-of-funds. A secondary market would eventually emerge, allowing investors to make equity trades that increase team valuations or earn a payout in the rare case when the majority owner sells. The opportunity to do this would be especially appealing for investors, given that the pro sports teams’ valuation has no correlation to the stock market in the event of a recession.

Meanwhile, in March, it is reported that the NBA told team owners it was discussing also establishing a similar plan for an investment fund, thanks again to surging valuations. According to the latest Forbes estimates, the average NBA team is valued at $1.9 billion, marking a 13% YoY jump. The New York Knicks topped the list with a $4 billion valuation, followed by the Los Angeles Lakers ($3.7 billion) and Golden State Warriors ($3.5 billion).

Some Considerations

However, before you go rushing off to acquire your share of your favorite sports team, consider the following. Technology is allowing fans to watch any game at any time from anywhere, with the result that sports audiences are more extensive than ever. However, revenue growth has slowed as attention spans are shrinking, and the “stickiness” of viewers is dwindling. A 3% decline in the number of minutes watched per game is typical, and sports that drag on for hours (football and baseball), if not days (cricket), are most vulnerable. Those that fail to attract an audience will lose revenue as advertisers flee. Thus, there is increasingly intense competition between sport for fans’ money and attention. However, today, the sports market is a global business that generates about $90 bn in revenue a year, so the stakes are high and competition global.

How to Reverse the Decline

Soccer (or football as it is known worldwide) is the world’s favorite sport, and since 2000, its overall market share has grown, according to Futures Sport. The reasons are:

-

It is simple to play and easy for fans around the world to follow.

-

FIFA, the sport’s governing body, has invested vast sums of money in emerging markets.

-

The women’s game has galvanized the sport still further attracting a broader and younger audience. More than a billion viewers watched the 2020 women’s World Cup.

-

Football’s popularity has soared in China and America, especially among young people.

Football is unlikely to be dislodged in the foreseeable future; however, all sports can look at four main lessons from its success to improve their standings.

1. Adapt to Modern Viewing Habits

According to a McKinsey report, “In a world with so many sports options across so many screens, sports fans of all ages are clicking away from low-stakes or lopsided games.” While fans may still care about the outcome of a boring game, they are less likely to watch it. Viewers impatiently resort to alternative entertainment on whatever device they are watching, including clips of the highlights. Viewers are increasingly seeking out videos of top game moments, according to Google, with an 80% increase in sports “highlights” video views on YouTube. Cricket is now selling its match highlights separately from the coverage of the entire game, as they appeal to different markets and worth more independently than in a single package. Also, more fans are engaging with sports across a multitude of platforms. In America, major sports leagues are still extremely valuable to advertisers and pay-tv providers because while viewership has declined, almost every other type of television entertainment has suffered worse declines in viewership.

In a time-poor age, no game has reinvented itself as successfully as cricket. In 2003, dwindling stickiness led to the launch of professional Twenty20 (t20) cricket. Games last just three and a half hours versus eight hours for “one-day” cricket and as long as five days for Test matches. t20 matches are now as long as an American Football game. However, due to the nature of t20, as every ball counts, the batters are more aggressive, resulting in far more action during the match than an American Football game. t20 now is the most-watched version of cricket worldwide, especially among the younger fan base. Cricket’s reinvention has paid off and that over the past decade, its revenues have grown faster than those of any other big sport, primarily due to India, where the Indian Premier League is the fastest-growing major league of any sport.

Taking a page from cricket’s success, Rugby Sevens, in which matches consist of two halves lasting seven minutes, compared with the usual 40 minutes, were first featured in 2016 at the Olympic games. Next year at the Olympics, three-a-side basketball will make its debut. In three-a-side basketball, the games last ten minutes versus 48 minutes for National NBA matches.

2. Break into New Markets.

Sports can increase their revenues either by gaining new fans or by relying on existing fans becoming wealthier. Cricket is betting on the latter as India has a fast-growing middle class and is expected to overtake China as the most populous nation in the world sometime in the 2020s. However, most other sports must look farther afield for new fans. By opening international tournaments to new players, viewership and supporters have increased. Basketball has i

ncreased the number of teams in the men’s World Cup to 32 since 2002, a 100% increase. Rugby is considering boosting the number of teams in its world cup from 20 countries to 24. The rationale: viewership in countries is higher when they are competing in a world cup.

“The more inclusive you make sports, the wider the market is going to be,” says Dave Berri, a sports economist from Southern Utah University. Again football is the world leader in this regard. FIFA recently expanded its World Cup to allow 48 teams to compete. The next women’s cup will include 32 countries, a 50% increase from the last one. Holding such competitions in new markets also helps. Rugby intends to hold either the 2027 or 2031 tournament in America, after the success of having Japan host the 2019 World Cup, the first time the event was outside the sport’s traditional strongholds. Japan, Indonesia, and the Philippines are hosting basketball’s next World Cup. Even without a world cup, sports can venture abroad. Major American league football, baseball, and basketball all played regular-season matches in London in 2019. They are already attracting more massive crowds beyond ex-pat Americans, but will the new fans stick or be attracted to more of games?

3. Home Grown Talent

However, to attract foreign fans involves more than merely staging matches in new countries, it requires finding home-grown stars from these markets. Thus, sports have start spotting star players in the markets they are eyeing up. Foreign athletes are a powerful recruitment tool in these new markets and keeping new fans watching. The success of basketball in China, which hosted this year’s World Cup, is partly down to one man, Yao Ming. While finding a star always involves luck, the NBA developed a grassroots network in China in 1992. Since 2004 it has been playing exhibition games in China, long before any other professional American sports league.

The NBA has capitalized on Mr. Yao’s popularity, expand basketball’s reach still further. In China, the NBA has three academies, as well as others in Australia, Mexico, India, and Senegal. The NBA hopes that if the organization can nurture outstanding players in such markets, it will dramatically increase interest in basketball. The extent of the NBA’s investment in China and reliance on China as a future revenue source was reflected in its response to the Chinese boycott over comments by Daryl Morey, the Houston Rocket’s General Manager. China’s reaction was swift and damaging, but the NBA and key players gave in quickly, saying Mr. Morey didn’t speak for the league or other teams. The NBA was accused of being willing to sell its integrity and legacy for the future of its business. While the NBA sought to increase the attraction of the game with international expansion, especially in China, this is risky. Any future market comprising such are large share is critical, but one that is likely to suppress human rights is risky and should be a warning to other teams seeking to follow the NBA’s lead.

Basketball Africa League, including teams from nine African countries, is a collaboration between the NBA and FIBA, the global basketball governing body, and is expected to launch next year.

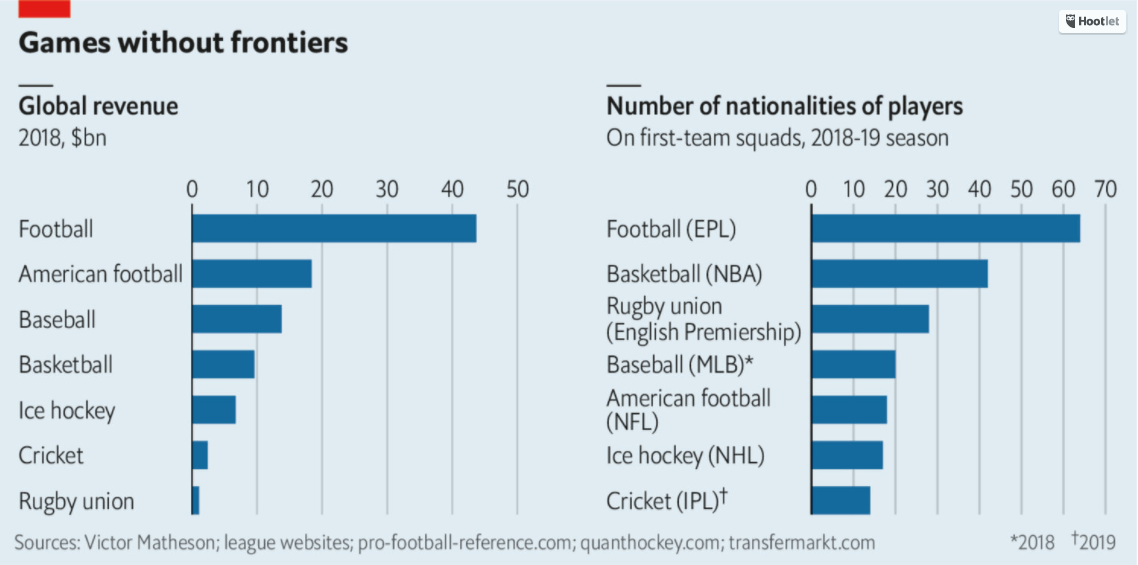

Source: The Economist

The result of this investment helps explain why basketball players have become more internationally diverse. Today the league has 108 international payers, from 42 countries, a substantial increase from the four players from four countries in 1980. While this figure is well short England’s football Premier League which has players from 64 countries last year, it comfortably outstrips similar leagues in other sports.

According to NBA research, particular sports participates are 68 times more likely to be committed fans. China now has 600,000 basketball courts, giving players plenty of places to dream of becoming the next Mr. Yao and developing more fans. In the U.S., football participation among the young has increased fan numbers.

Developing audiences in new markets requires commitment, time, and money. Any sports that put on one-off matches and hopes to gain devoted followers, as a result, will be disappointed. In 2015 a set of t20 matches between teams captained by two cricket legends were staged in America. However, once the tickets had sold, little serious investment went into developing American interest in the sport, and cricket still has a small following, a sad decline from a game that was one of the most popular in America 150 years ago.

Basketball has done better than its competitors at following football’s recipe for success. According to PwC, among the big sports other than football, basketball will see the highest increase in revenues in the coming years. The world seems to have settled on its second-favorite game.

4. The Excitement of the Match

While cricket, rugby, and basketball have changed formats to appeal to new viewers and declining attention span, the traditional game still has to be interesting to retain viewers. However, that is dependent upon the actual action within a game.

| Sport | Clock Duration | Amt of Action | Amt of Commerical Time | No of Commericals/Hour |

|---|---|---|---|---|

| Football (Soccer) | 1 hr 55 mins | 57.6 mins | 19 | 20 |

| Hockey | 2 hrs 20 mins | 60 mins | 30 | 26 |

| Basketball | 2 hrs 18 mins | 48 mins | 45 | 39 |

| Baseball | 2 hrs 56 mins | 18 mins | 75 | 47 |

| American Football | 3 hrs 10 mins | 11 mins | 43 | 29 |

Second, and only applicable to the U.S. leagues, there is that time in the season when teams struggling at the bottom of the standings start to play their reserves and rest their stars. Tanking, as it is known, is done to secure their chances of receiving a high draft pick. While Tanking is a management strategy, not a player strategy, that makes sense, it is annoying for fans who start to tune out. Meanwhile, in the Premier League, the matches are just as exciting at the bottom as at the top, as bottom-dwelling teams fight desperately to avoid relegation. Sadly, in many cases, it’s not only the team’s status that’s at stake but that of the whole town. As the Netflix documentary, Sunderland or Bust, noted, Sunderland’s relegation from the Premier League resulted in a 60% fall in revenue dropped from $100 million to $40 million. The fight for survival retains fans’ attention and interest, making it less likely that they will lose value.

However, relegation will not come to the U.S., as all U.S. leagues are franchises, and the franchisors seek to maximize revenue for its franchisees, not the quality of the overall product. So, the majority of U.S. major sports fans are stuck with a mediocre product in which the franchise owners continue to make steady profits, as opposed to superior products overseas where some franchises make tremendous profits. (In 2018, Manchester United reported revenue of £613 million, and teams like Sunderland get relegated and struggle. The opposite of Sunderland are teams like Leicester City, which was in the second division in 2008/09 and acquired by a Thai consortium in 2010 for £39 mm. In 2015/16, Leicester City won the Premier League, and today Forbes estimates it to be worth £500mm.)

Interestingly, American billionaires are not necessarily averse to taking a risk and investing in teams within promotion and relegation systems as Americans own Arsenal, Liverpool, and Manchester United. Sunderland and Aston Villa were also owned by Americans who later sold them at a loss, after relegation. However, they had to accept those systems which winners and losers, but for the U.S. leagues, no such luck. It is all about protecting their money over product quality. Some, including Martin Luther King and Noam Chomsky, have said that the U.S. is socialism for the rich and capitalism for everyone else. If so, then U.S. sports reflects American society at large.

But, whether or not the U.S. sports leagues are socialist, going back to the initial point of this article, do you want to invest in a team in a U.S. Sports Franchise? Overall it is a mediocre product with declining revenue growth.

An investment vehicle would make sense for the NBA, given that one-fourth of the league’s majority owners made their fortunes in Private Equity. While there may be an opportunity to invest at a bargain rate after the league alienated China, a $4 billion market for the league, having such a large customer who is so fickle may pose too much risk.

If you are a real cynic, you may consider this is another system to get the majority to bail out the rich from their bad mistakes. If you follow Jim Collins’ ideas in Good to Great and Built to Last, it would appear that the U.S. teams are not excellent investments, as I would consider a good investment, one that has the most significant opportunity to grow in value. However, if you are looking for a utility or dividend stock, then maybe it is worth another look.

© 2019 Marc Borrelli All Rights Reserved

Recent Posts

Boosting Common Sense Decision-Making in Your Organization

Do You Understand Your Costs to Ensure Profitability?

You can only determine profitability when you know your costs. I’ve discussed before that you should price according to value, not hours. However, you still need to know your costs to understand the minimum pricing and how it is performing. Do you consider each jobs’ profitability when you price new jobs? Do you know what you should be charging to ensure you hit your profit targets? These discussions about a company’s profitability, and what measure drives profit, are critical for your organization.

Sunk Costs Are Just That, Sunk!

If you were starting your business today, what would you do differently? This thought-provoking question is a valuable exercise, especially when it brings up the idea of “sunk costs” and how they limit us. A sunk cost is a payment or investment that has already been made. Since it is unrecoverable no matter what, a sunk cost shouldn’t be factored into any future decisions. However, we’re all familiar with the sunk cost fallacy: behavior driven by a past expenditure that isn’t recoupable, regardless of future actions.

Do You REALLY Know Your Business Model?

Bringing clarity to your organization is a common theme on The Disruption! blog. Defining your business model is a worthwhile exercise for any leadership team. But how do you even begin to bring clarity into your operations? If you’re looking for a place to start, Josh Kaufman’s “Five Parts of Every Business” offers an excellent framework. Kaufman defines five parts of every business model that all flow into the next, breaking it down into Value Creation, Marketing, Sales, Value Delivery, and Finance.

Ideation! Harder Than It Sounds

Bringing in new ideas, thoughts, understanding, and logic is key as your organization faces the challenges of a changing environment. But when you do an ideation session in your organization… how does it go? For so many organizations, many times, after a few ideas have been thrown out and rejected, the thought process slows down very quickly, and a form of hopelessness takes over. How does your organization have better ideation? I’ve come across a new approach with a few teams lately.

Recruit, Recruit, Recruit!

An uptick in business has begun this quarter, and companies are rushing to hire to meet this surge in demand. What amazes me is how many are so unprepared to hire. Continual recruiting is key to the survival of a company. It isn’t the same thing as hiring—continuous recruiting is building a pipeline of people that you would hire if you needed to fill a position, or “A players” you would hire if they were available.

We All Need Clarity

If your organization is focused on obscurity over clarity, whether intentionally or not, your “A” player employees are vulnerable. There is a looming talent crunch. As we start to emerge from COVID, demand is increasing, and many are scrambling to fill positions to meet that demand. Headhunters and recruiters are soon going to be calling your key “A” employees. Have you been giving them a reason to stay?

Not Another **** Meeting

As Leonard Bernstein put it so well, “To achieve great things, two things are needed: a plan and not quite enough time.” Your meetings can be shorter, more fruitful, and engaging, with better outcomes for the organization, employees, and managers. It’s time to examine your meeting rhythms and how you set meeting agendas. This week, I break down daily, weekly, monthly, quarterly, annual, and individual meeting rhythms, with sample agendas for each.

Is Your Company Scalable?

Let’s start here: Why should your company be scalable at all? If your business is scalable, you have business freedom–freedom with time, money, and options. Many business leaders get stuck in the “owner’s trap”, where you need to do everything yourself. Sound familiar? If you want a scalable business that gives you freedom, you need to be intentional about what you sell, and how.

Are you ready for the Talent Crunch?

Companies are gearing up to hire. Unfortunately, many are competing within the same talent pool. Some experts are currently predicting a strong economic recovery starting in May or June. But as the economy booms, there is going to be fierce competition for talent. How will you fare in the looming talent crisis? Your organization should be creating a plan, now, so you can attract the talent you need in the year ahead.