Discover how to enhance decision-making in your organization by focusing on three crucial areas: solving the right problem, gathering all the available information, and understanding the intent. Learn to empower your team, foster a purpose-driven culture, and improve organizational clarity for better decision-making.

The “Flaw of Averages” Causes Havoc for Businesses

Introduction: The Importance of Accurate Data Analysis

The “Flaw of Averages” is a term popularized by Sam Savage, referring to the misleading nature of averages in business decision-making. Averages often misstate the true situation within a company, leading to misallocation of resources and, ultimately, reduced profitability. In this blog post, we will discuss how the flaw of averages can impact businesses, using hypothetical examples to illustrate the consequences and offer suggestions for more accurate data analysis.

- The Flaw of Averages in Product Analysis

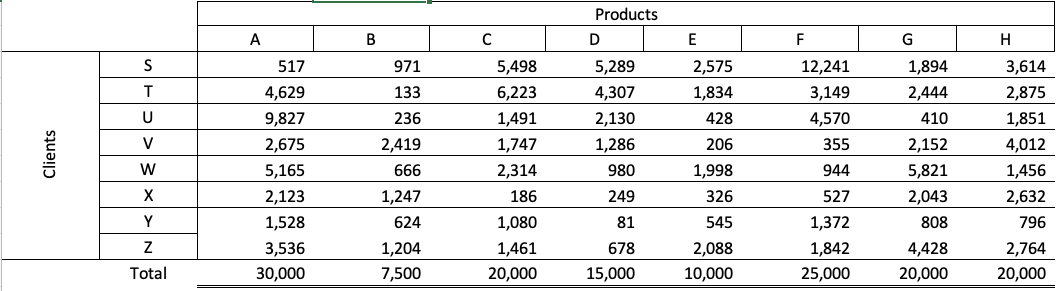

Consider a hypothetical business, ABC Inc., which sells a variety of products with different units sold, unit prices, and gross profits per unit.

| Product |

Units Sold |

Price/Unit |

Gross Profit/Unit |

| A |

30,000 |

$ 100.00 |

$ 12.50 |

| B |

7,500 |

$ 90.00 |

$ 75.00 |

| C |

20,000 |

$ 80.00 |

$ 37.50 |

| D |

15,000 |

$ 70.00 |

$ 45.00 |

| E |

10,000 |

$ 60.00 |

$ 25.00 |

| F |

25,000 |

$ 50.00 |

$ 12.50 |

| G |

20,000 |

$ 40.00 |

$ 20.00 |

| H |

20,000 |

$ 30.00 |

$ 25.00 |

When examining the product portfolio, looking beyond the total revenue and gross profit margin is essential. Focusing solely on averages can lead to misconceptions about the importance of certain products to the company’s profitability.

a. Rethinking Product Prioritization

For example, if ABC Inc. were to stop selling its largest revenue-generating product, its gross profit margin would increase substantially. By looking at average margins, the full impact of this product on the business is not apparent. A more detailed analysis may reveal additional costs associated with the production of this product, such as factory space, warehouse storage, staff, and shipping costs.

b. Bundling and Pricing Strategies

With a better understanding of the true profitability of each product, ABC Inc. can explore more effective pricing strategies, such as increasing the price of lower-margin products or bundling them with more profitable ones.

- The Flaw of Averages in Customer Analysis

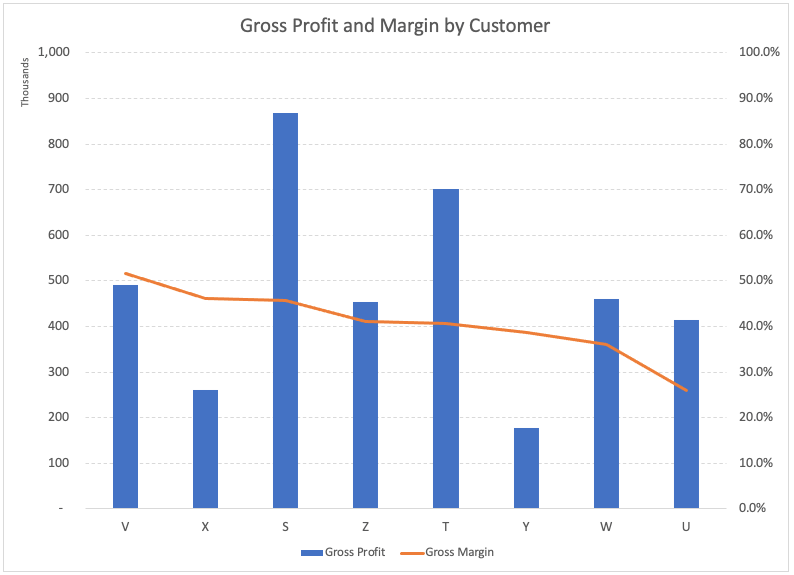

Examining customers’ revenue and gross profit contributions can also reveal valuable insights. By ranking customers according to their gross margin contributions, businesses can identify the most profitable clients and those that may be dragging down overall profitability.

Now, if we examine the purchase and gross profits of each customer, we get:

| Customer |

Revenue |

Gross Profit |

|

S |

1,899,890 |

869,085 |

|

T |

1,725,700 |

700,983 |

|

U |

1,598,430 |

414,600 |

|

V |

951,540 |

491,173 |

|

W |

1,273,760 |

459,958 |

|

X |

563,430 |

259,640 |

|

Y |

458,530 |

176,880 |

|

Z |

1,103,720 |

452,683 |

|

Total |

9,575,000 |

3,825,000 |

Sorting that into the order of gross margin, we can see the following:

a. Identifying High-Value Customers

For example, if ABC Inc. were to lose its most profitable customer, its gross margin would decrease significantly. By contrast, losing a less profitable customer would lead to an increase in the overall gross margin. Understanding the value of each customer allows the company to focus its resources on retaining and attracting high-value clients.

b. Analyzing Customer Purchase Patterns

In addition to evaluating each customer’s profitability, examining their purchase patterns is essential. Businesses can better target their marketing and sales efforts by identifying clients with higher-margin purchase combinations.

- Improving Business Performance Through Better Data Analysis

To overcome the flaw of averages and make more informed decisions, businesses should:

a. Regularly analyze product and customer data. Examine each product’s and customer’s profitability to identify improvement areas and make better resource allocation decisions.

b. Focus on profitability, not just revenue. While revenue is essential, focusing solely on it can lead to misconceptions about the true value of products and customers. Prioritize profitability to drive sustainable growth.

c. Use data to inform pricing and bundling strategies. Identify opportunities to increase the price of lower-margin products or bundle them with more profitable ones to improve overall profitability.

d. Monitor and adapt to changes in the market. Regularly review product and customer data to stay up-to-date with market trends and adjust strategies accordingly.

Conclusion: The Power of Proper Data Analysis

The flaw of averages can lead businesses to make misguided decisions based on misleading data. By delving deeper into product and customer data, businesses can better understand their true profitability, allocate resources more effectively, and ultimately drive sustainable growth. Don’t let the flaw of averages hold your business back – embrace the power of accurate data analysis to improve your decision-making and achieve success.

Recommended Reading:

-

The Flaw of Averages: Why We Underestimate Risk in the Face of Uncertainty, by Sam Savage This book provides an in-depth look at the limitations of averages and how they can lead to misguided decisions in various fields, including business, finance, and engineering. It also offers practical techniques for better understanding and managing risk through probabilistic thinking.

-

Why Can’t You Just Give Me The Number?: An Executive’s Guide to Using Probabilistic Thinking to Manage Risk and to Make Better Decisions, by Patrick Leach. This guide is designed for executives and decision-makers who want to improve their understanding of risk and uncertainty. It introduces the concept of probabilistic thinking, demonstrating how it can lead to better decision-making and risk management in a variety of business scenarios.

Recent Posts

Boosting Common Sense Decision-Making in Your Organization

Do You Understand Your Costs to Ensure Profitability?

You can only determine profitability when you know your costs. I’ve discussed before that you should price according to value, not hours. However, you still need to know your costs to understand the minimum pricing and how it is performing. Do you consider each jobs’ profitability when you price new jobs? Do you know what you should be charging to ensure you hit your profit targets? These discussions about a company’s profitability, and what measure drives profit, are critical for your organization.

Sunk Costs Are Just That, Sunk!

If you were starting your business today, what would you do differently? This thought-provoking question is a valuable exercise, especially when it brings up the idea of “sunk costs” and how they limit us. A sunk cost is a payment or investment that has already been made. Since it is unrecoverable no matter what, a sunk cost shouldn’t be factored into any future decisions. However, we’re all familiar with the sunk cost fallacy: behavior driven by a past expenditure that isn’t recoupable, regardless of future actions.

Do You REALLY Know Your Business Model?

Bringing clarity to your organization is a common theme on The Disruption! blog. Defining your business model is a worthwhile exercise for any leadership team. But how do you even begin to bring clarity into your operations? If you’re looking for a place to start, Josh Kaufman’s “Five Parts of Every Business” offers an excellent framework. Kaufman defines five parts of every business model that all flow into the next, breaking it down into Value Creation, Marketing, Sales, Value Delivery, and Finance.

Ideation! Harder Than It Sounds

Bringing in new ideas, thoughts, understanding, and logic is key as your organization faces the challenges of a changing environment. But when you do an ideation session in your organization… how does it go? For so many organizations, many times, after a few ideas have been thrown out and rejected, the thought process slows down very quickly, and a form of hopelessness takes over. How does your organization have better ideation? I’ve come across a new approach with a few teams lately.

Recruit, Recruit, Recruit!

An uptick in business has begun this quarter, and companies are rushing to hire to meet this surge in demand. What amazes me is how many are so unprepared to hire. Continual recruiting is key to the survival of a company. It isn’t the same thing as hiring—continuous recruiting is building a pipeline of people that you would hire if you needed to fill a position, or “A players” you would hire if they were available.

We All Need Clarity

If your organization is focused on obscurity over clarity, whether intentionally or not, your “A” player employees are vulnerable. There is a looming talent crunch. As we start to emerge from COVID, demand is increasing, and many are scrambling to fill positions to meet that demand. Headhunters and recruiters are soon going to be calling your key “A” employees. Have you been giving them a reason to stay?

Not Another **** Meeting

As Leonard Bernstein put it so well, “To achieve great things, two things are needed: a plan and not quite enough time.” Your meetings can be shorter, more fruitful, and engaging, with better outcomes for the organization, employees, and managers. It’s time to examine your meeting rhythms and how you set meeting agendas. This week, I break down daily, weekly, monthly, quarterly, annual, and individual meeting rhythms, with sample agendas for each.

Is Your Company Scalable?

Let’s start here: Why should your company be scalable at all? If your business is scalable, you have business freedom–freedom with time, money, and options. Many business leaders get stuck in the “owner’s trap”, where you need to do everything yourself. Sound familiar? If you want a scalable business that gives you freedom, you need to be intentional about what you sell, and how.

Are you ready for the Talent Crunch?

Companies are gearing up to hire. Unfortunately, many are competing within the same talent pool. Some experts are currently predicting a strong economic recovery starting in May or June. But as the economy booms, there is going to be fierce competition for talent. How will you fare in the looming talent crisis? Your organization should be creating a plan, now, so you can attract the talent you need in the year ahead.