Discover how to enhance decision-making in your organization by focusing on three crucial areas: solving the right problem, gathering all the available information, and understanding the intent. Learn to empower your team, foster a purpose-driven culture, and improve organizational clarity for better decision-making.

Do You Understand Your Costs to Ensure Profitability?

During a recent call with a CEO, we discussed the company’s profitability and what measure they used to drive profit – basically Profit/X. It became apparent that they didn’t have a handle on their costs and what they should be charging to ensure they hit their profit targets. I have addressed this a bit before to ensure that your margins were where you wanted and rejecting low-profit jobs. However, this time the issue is to understand the jobs’ profitability and price new jobs effectively.

The Costs

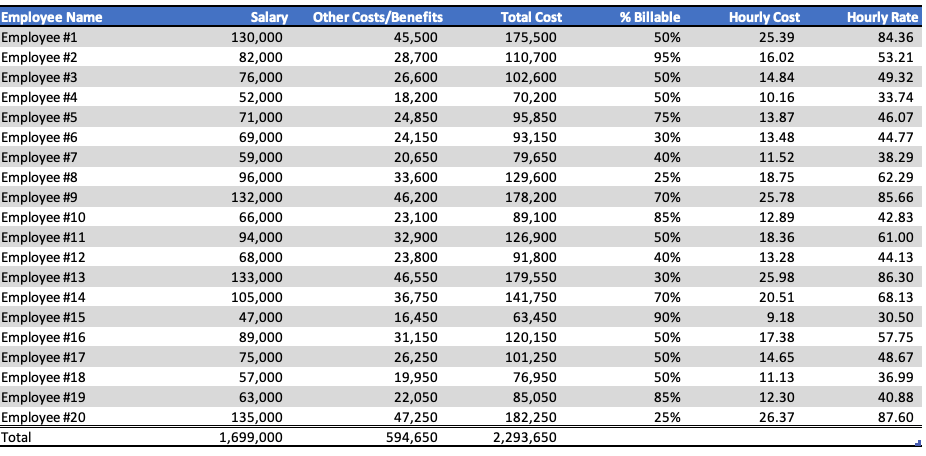

To determine profitability, we need to know our costs. Thus, we built a table listing every employee, the salary, additional expenses, e.g., health insurance, 401k, etc. (estimated at 35% of wages), and the amount of billable time. As a result, we had a table that looked like the one below.

Calculate Hourly Costs

From this Table, we could determine the hourly cost of an employee. To calculate actual costs per hour, we took the number of billable hours, which for 2021 is 8,760, and subtracted 96 hours, the allowable PTO. However, most employees don’t work their total billable hours for various reasons, so we included a “slack” factor of 10%. For multiple reasons, most projects have “re-work” or errors that cannot be billed and estimated at 10% and included. As a result, the total “Billable Hours” was 7,800 rather than 8,760. These adjustments allowed us to produce the hourly cost for each employee.

Calculate Overall Costs

Taking that data, we then divided the hourly costs into billable and non-billable. We added fixed overhead, which was not related to billable expenses, e.g., CEO’s pay, office rent, etc. Thus, we now had a cost structure for the firm that looked as follows.

| Billable Costs | $1,099,150 |

| Non-billable Costs | 1,194,500 |

| Overhead | 750,000 |

| Total Costs | $3,043,650 |

Calculate Revenue

With the company’s cost structure defined, we could determine how much to markup hourly costs to make a 25% profit. Doing this analysis is easy in Excel; however, ensure you don’t make easy Excel mistakes. , and the result was that marking up hourly costs by 232% would enable the company to meet its profit goal. This analysis is shown below.

| Revenue | $4,056,895 |

| Total Costs | 3,043,650 |

| Profit | $1,013,245 |

| Profit Margin | 25% |

Pricing of new projects

While I am a strong proponent of selling value, not time, if the company wants to know the minimum price to charge to realize its minimum profit, it can use this data. Identifying which employees will work on the project and for how long. For example, they would be able to cost it as follows:

| Employee | Hours | Hourly Billable Rate | Total Billable Charge |

| #3 | 25 | $49.32 | $1,233 |

| #6 | 5 | 44.77 | 224 |

| #10 | 20 | 43.83 | 857 |

| #15 | 15 | 30.50 | 457 |

| #17 | 10 | 48.67 | 487 |

| Total | $3,258 |

With this data, we can now estimate jobs more effectively since we know the employees who will work on the jobs and how many hours they will commit. We have to build some waste into that model, but we have a good idea of how to price jobs.

Performance Table

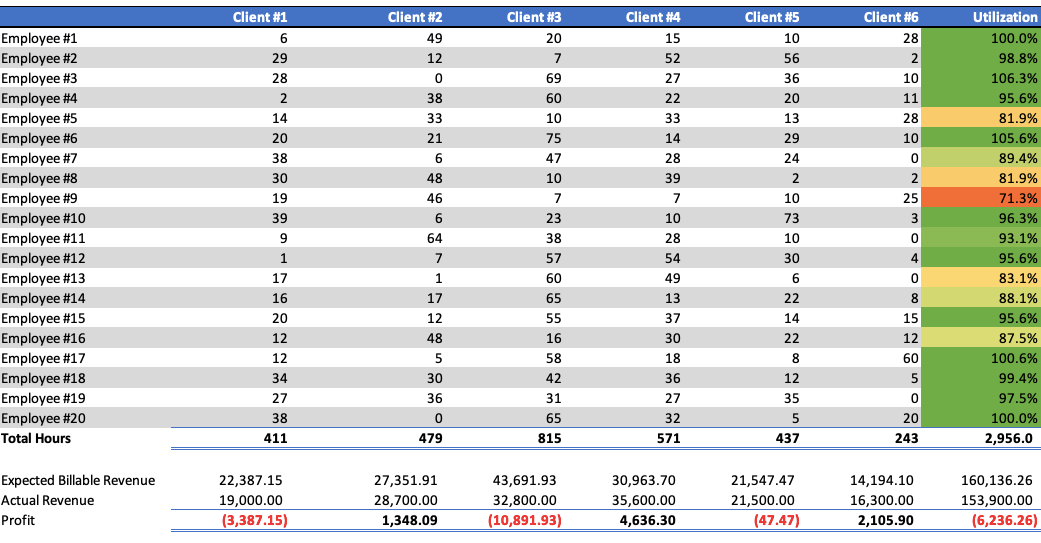

Also, we can see either weekly, monthly, or quarterly how the company is performing. If we produce a table of the employees and clients and hours worked for a month, we can see the utilization of each employee and profit per client as follows.

This table provides a good insight into the company’s and employees’ performance. As can be seen, Employees #3 and #6 are working more than their billable hours with utilization rates above 100%. While this may be good, one would need to ensure that whatever they were supposed to be doing with their non-billable time was being done. Also, Employee #9 is utilized 71.3% of the time, resulting in lost efficiency. Further analysis is required into why this is the case, but it identifies potential issues. Finally, it would appear that nearly half of the employees are working at less than 95% utilization. Given that the company’s utilization is already adjusted for “Slack” and “Rework,” analysis to understand why utilization is low is required.

We cannot only analyze employee performance, but we can see how we are doing with our various contracts. Clients #1 and #3 are losing money, while Client #4 is profitable. The data doesn’t tell us why, but again that would be work investigating as the company is performing below its goal of 25% profit.

Conclusion

As I stated at the beginning, concerning pricing, I strongly believe in pricing according to value and not hours; however, this analysis and methodology are helpful to understand what an organization’s minimum pricing should be and how it is performing. While several issues are highlighted and require more work, this provides a great way of knowing what to examine to improve performance.

If you would like to do this analysis, call me. I would be happy to help you.

Copyright © 2021, Marc A. Borrelli

Recent Posts

Boosting Common Sense Decision-Making in Your Organization

Do You Understand Your Costs to Ensure Profitability?

You can only determine profitability when you know your costs. I’ve discussed before that you should price according to value, not hours. However, you still need to know your costs to understand the minimum pricing and how it is performing. Do you consider each jobs’ profitability when you price new jobs? Do you know what you should be charging to ensure you hit your profit targets? These discussions about a company’s profitability, and what measure drives profit, are critical for your organization.

Sunk Costs Are Just That, Sunk!

If you were starting your business today, what would you do differently? This thought-provoking question is a valuable exercise, especially when it brings up the idea of “sunk costs” and how they limit us. A sunk cost is a payment or investment that has already been made. Since it is unrecoverable no matter what, a sunk cost shouldn’t be factored into any future decisions. However, we’re all familiar with the sunk cost fallacy: behavior driven by a past expenditure that isn’t recoupable, regardless of future actions.

Do You REALLY Know Your Business Model?

Bringing clarity to your organization is a common theme on The Disruption! blog. Defining your business model is a worthwhile exercise for any leadership team. But how do you even begin to bring clarity into your operations? If you’re looking for a place to start, Josh Kaufman’s “Five Parts of Every Business” offers an excellent framework. Kaufman defines five parts of every business model that all flow into the next, breaking it down into Value Creation, Marketing, Sales, Value Delivery, and Finance.

Ideation! Harder Than It Sounds

Bringing in new ideas, thoughts, understanding, and logic is key as your organization faces the challenges of a changing environment. But when you do an ideation session in your organization… how does it go? For so many organizations, many times, after a few ideas have been thrown out and rejected, the thought process slows down very quickly, and a form of hopelessness takes over. How does your organization have better ideation? I’ve come across a new approach with a few teams lately.

Recruit, Recruit, Recruit!

An uptick in business has begun this quarter, and companies are rushing to hire to meet this surge in demand. What amazes me is how many are so unprepared to hire. Continual recruiting is key to the survival of a company. It isn’t the same thing as hiring—continuous recruiting is building a pipeline of people that you would hire if you needed to fill a position, or “A players” you would hire if they were available.

We All Need Clarity

If your organization is focused on obscurity over clarity, whether intentionally or not, your “A” player employees are vulnerable. There is a looming talent crunch. As we start to emerge from COVID, demand is increasing, and many are scrambling to fill positions to meet that demand. Headhunters and recruiters are soon going to be calling your key “A” employees. Have you been giving them a reason to stay?

Not Another **** Meeting

As Leonard Bernstein put it so well, “To achieve great things, two things are needed: a plan and not quite enough time.” Your meetings can be shorter, more fruitful, and engaging, with better outcomes for the organization, employees, and managers. It’s time to examine your meeting rhythms and how you set meeting agendas. This week, I break down daily, weekly, monthly, quarterly, annual, and individual meeting rhythms, with sample agendas for each.

Is Your Company Scalable?

Let’s start here: Why should your company be scalable at all? If your business is scalable, you have business freedom–freedom with time, money, and options. Many business leaders get stuck in the “owner’s trap”, where you need to do everything yourself. Sound familiar? If you want a scalable business that gives you freedom, you need to be intentional about what you sell, and how.

Are you ready for the Talent Crunch?

Companies are gearing up to hire. Unfortunately, many are competing within the same talent pool. Some experts are currently predicting a strong economic recovery starting in May or June. But as the economy booms, there is going to be fierce competition for talent. How will you fare in the looming talent crisis? Your organization should be creating a plan, now, so you can attract the talent you need in the year ahead.