Working with my Vistage group this week, we had an exciting discussion about “If you were starting your business today, what would you do differently?” This discussion made me think of sunk costs and how they limit us. I have discussed how to make better decisions before, but sunk costs deal with our assumptions.

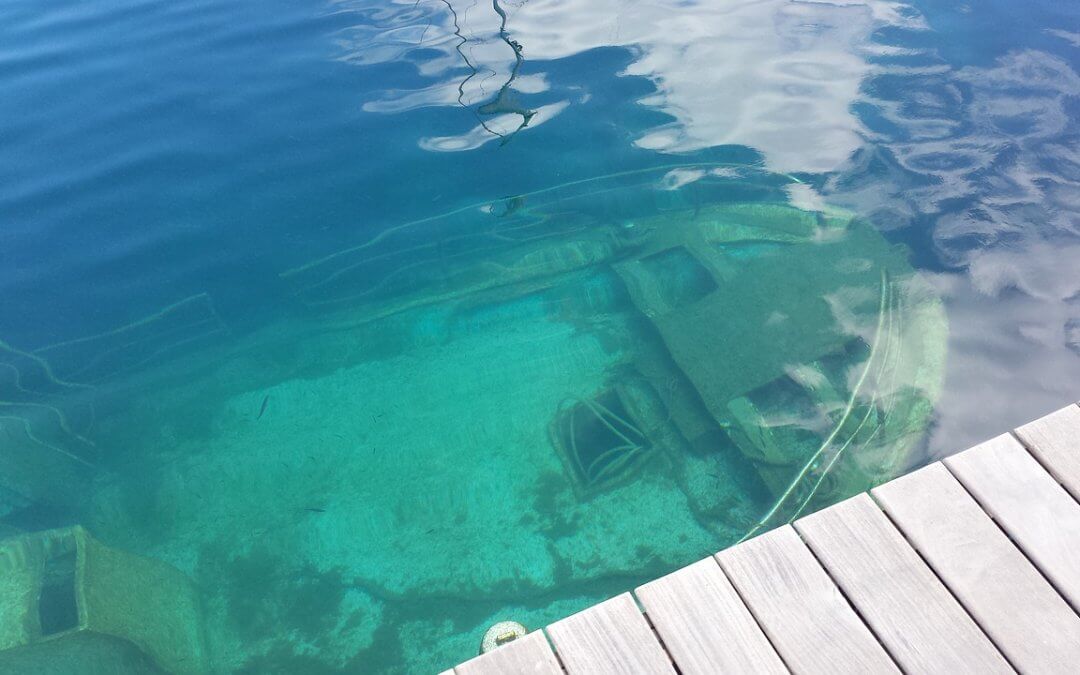

What are sunk costs? A sunk cost is a payment or investment that has already been made, and it is sunk because it is unrecoverable no matter what. So, it should not be a factor in any decisions from now on.

The Sunk Cost Fallacy

The sunk cost fallacy is when an action is continued because of past decisions (time, money, resources) rather than a rational choice of what will maximize the returns at this present time. The fallacy is that behavior is driven by an expenditure that is not recoupable regardless of future actions.

For example, a company that decides to build a new software platform. They have done their analyses and determined that the future benefit they will receive from the software will outweigh its development cost. They pay for the software and expect to save a specific cash flow level from the software’s production each year. But after a few years, the platform is underperforming, and cash flows are less than expected.

A decision has to be made: should the platform be abandoned or not? At this point, the software’s initial cost is a sunk cost and cannot be recovered. The decision should only be based on the future cash flows—or the future expected benefit—of the platform compared to the value of replacing it today, not the original cost of the software.

However, businesses, organizations, and people often have difficulty abandoning strategies because of the time spent developing them, even if they aren’t the right choice for the company or individual. Therefore, recognizing what a sunk cost is will result in better decisions.

How sunk costs sabotage us

Here are a few ways, but this list is not exhaustive.

At Work

Bad Pricing

Companies often justify pricing based on their costs. Most commonly, the R&D expenditure to develop the product. Whatever the R&D costs were, they are irrelevant to the pricing. The market will only pay what the product is worth, not what was invested in it. A pharmaceutical company’s attempt to justify high prices because of the need to recoup R&D expenses is fallacious. The company will charge market prices whether R&D had cost one dollar or one million dollars.

Similarly, many businesses price their services on the hours it took to deliver a service. However, the costs of providing the service are sunk, and you cannot recoup them. The market will only pay you what they deem the value of the product or service to be, so using pricing to recoup costs is “backward.” Instead, one should determine the price and then figure out how to deliver the product or service at the profit margin desired.

Consider if a company invested $100,000 to produce a product and planned to sell them at $100 each. However, the day after the product launch, a competitor announces a better competing product at $50. Will anyone pay $100 for an inferior product when the best one is available for $50?

Bad Investments

Sunk costs are why so many investors tend to remain committed or even invest additional capital into a bad investment to make their initial decision seem worthwhile. How many times has an investor tell you, “As soon as X gets back to what I paid, I am selling.” Why?

What they paid is paid. The investor cannot change that; it is a sunk cost. The real question is, “Does X offer higher returns in the future than Y, some other asset I am considering, after transaction costs?” If yes, then stick with it. If no, switch out X for Y.

Assume you spend $4,000 on a wine tour of Napa. Later on, you find a better wine tour to Bordeau that costs $2,500, and you purchase that trip as well. Later, you realize that the two dates clash and the tickets are non-refundable. Would you attend the $4,000 good wine trip or the $2,500 great wine trip? The $2,500 trip. The $4,000 trip is irrelevant in consideration because it is inferior, and the money is gone.

Bad processes

Returning to my initial question, “If you were starting your business again today, what would you do differently?” Many people will give outstanding examples of what they would do differently but never consider making the change because of the investment they have in their current process. As with assets, if your current process generates a cash flow of $X per year, and switching would generate some cash flow greater than $X after the costs of switching, you should switch.

Misaligned employees

Many companies have employees whom they know are subpar. However, they cannot fire them because they have been employed for a long time or the company has invested some amount in them. This situation is most often seen with those employees who have been with the organization since the beginning. However, the organization has outgrown them.

Again, the time invested by the company and the employee are sunk costs. The decision is what is the best investment going forward. If a more significant return is achievable with a new employee, then the change is required.

Sunk Costs Exist in Our Personal Lives Too

Feel free not to ski in bad weather.

You may be considered a fair-weather skier, but the cost became sunk when you purchased your ticket. You might feel obligated to stay and stick it out if the ticket was expensive or you have a limited holiday window, but if not skiing in a freezing whiteout makes you happier, do it! Either way, you aren’t getting your money back.

Don’t go to the gym just because you have an annual membership.

While working out may be advantageous to your health, your annual membership shouldn’t dictate whether you go to the gym on any given day. If you have paid up front, then the money is gone. So if you would prefer to take a hike, ride a bike, relax and meditate, you should. However, I am not saying there may be more benefits to working out.

Don’t grow up to be a lawyer.

I chose lawyers because I was this example; however, I decided before I graduated law school that I didn’t want to be a lawyer. Assume you went to law school, passed the bar, started working, and then realized you hate being a lawyer. What should you do? You invested so much time, energy, and money in that degree, so it can’t be worth starting over again with a new career? Unfortunately, time, energy, and money are all sunk costs, so if your end goal is your happiness, you might need to cut your losses and refocus your energies elsewhere.

With the above examples, next time you face a decision, ignore all the sunk costs; you will make better decisions for your organization and yourself.

Copyright (c) 2021, Marc A. Borrelli

Recent Posts

Boosting Common Sense Decision-Making in Your Organization

Discover how to enhance decision-making in your organization by focusing on three crucial areas: solving the right problem, gathering all the available information, and understanding the intent. Learn to empower your team, foster a purpose-driven culture, and improve organizational clarity for better decision-making.

Do You Understand Your Costs to Ensure Profitability?

You can only determine profitability when you know your costs. I’ve discussed before that you should price according to value, not hours. However, you still need to know your costs to understand the minimum pricing and how it is performing. Do you consider each jobs’ profitability when you price new jobs? Do you know what you should be charging to ensure you hit your profit targets? These discussions about a company’s profitability, and what measure drives profit, are critical for your organization.

Do You REALLY Know Your Business Model?

Bringing clarity to your organization is a common theme on The Disruption! blog. Defining your business model is a worthwhile exercise for any leadership team. But how do you even begin to bring clarity into your operations? If you’re looking for a place to start, Josh Kaufman’s “Five Parts of Every Business” offers an excellent framework. Kaufman defines five parts of every business model that all flow into the next, breaking it down into Value Creation, Marketing, Sales, Value Delivery, and Finance.

Ideation! Harder Than It Sounds

Bringing in new ideas, thoughts, understanding, and logic is key as your organization faces the challenges of a changing environment. But when you do an ideation session in your organization… how does it go? For so many organizations, many times, after a few ideas have been thrown out and rejected, the thought process slows down very quickly, and a form of hopelessness takes over. How does your organization have better ideation? I’ve come across a new approach with a few teams lately.

Recruit, Recruit, Recruit!

An uptick in business has begun this quarter, and companies are rushing to hire to meet this surge in demand. What amazes me is how many are so unprepared to hire. Continual recruiting is key to the survival of a company. It isn’t the same thing as hiring—continuous recruiting is building a pipeline of people that you would hire if you needed to fill a position, or “A players” you would hire if they were available.

We All Need Clarity

If your organization is focused on obscurity over clarity, whether intentionally or not, your “A” player employees are vulnerable. There is a looming talent crunch. As we start to emerge from COVID, demand is increasing, and many are scrambling to fill positions to meet that demand. Headhunters and recruiters are soon going to be calling your key “A” employees. Have you been giving them a reason to stay?

Not Another **** Meeting

As Leonard Bernstein put it so well, “To achieve great things, two things are needed: a plan and not quite enough time.” Your meetings can be shorter, more fruitful, and engaging, with better outcomes for the organization, employees, and managers. It’s time to examine your meeting rhythms and how you set meeting agendas. This week, I break down daily, weekly, monthly, quarterly, annual, and individual meeting rhythms, with sample agendas for each.

Is Your Company Scalable?

Let’s start here: Why should your company be scalable at all? If your business is scalable, you have business freedom–freedom with time, money, and options. Many business leaders get stuck in the “owner’s trap”, where you need to do everything yourself. Sound familiar? If you want a scalable business that gives you freedom, you need to be intentional about what you sell, and how.

Are you ready for the Talent Crunch?

Companies are gearing up to hire. Unfortunately, many are competing within the same talent pool. Some experts are currently predicting a strong economic recovery starting in May or June. But as the economy booms, there is going to be fierce competition for talent. How will you fare in the looming talent crisis? Your organization should be creating a plan, now, so you can attract the talent you need in the year ahead.

The “Flaw of Averages” Causes Havoc for Businesses

Discover how understanding the limitations of averages and embracing probabilistic thinking can improve decision-making and risk management in business.

Не забудьте использовать [url=https://1win-promo-code.ru/]промокод при регистрации[/url] для активации вашего бонуса на 1win.

Активируйте [url=https://1win-promo-code.ru/]купон PLAYDAY[/url], чтобы получить дополнительные бонусы на 1win.

Hi there would you mind stating which blog platform you’re using? I’m planning to start my own blog in the near future but I’m having a tough time choosing between BlogEngine/Wordpress/B2evolution and Drupal. The reason I ask is because your design and style seems different then most blogs and I’m looking for something unique. P.S Sorry for being off-topic but I had to ask!

Hello there, just became aware of your blog through Google, and found that it’s really informative. I’m gonna watch out for brussels. I will appreciate if you continue this in future. Many people will be benefited from your writing. Cheers!

Renew is not just another sleep aid; it’s a comprehensive nutritional formula

My programmer is trying to persuade me to move to .net from PHP. I have always disliked the idea because of the expenses. But he’s tryiong none the less. I’ve been using Movable-type on a variety of websites for about a year and am worried about switching to another platform. I have heard great things about blogengine.net. Is there a way I can transfer all my wordpress content into it? Any kind of help would be really appreciated!

Если вы ищете надежное и безопасное приложение для азартных игр, то [url=https://www.sports.ru/betting/apps/liga-stavok-android/] akdere apk[/url] является идеальным выбором.

F*ckin’ amazing issues here. I’m very satisfied to look your post. Thanks so much and i’m taking a look ahead to touch you. Will you kindly drop me a mail?

Hi there, I found your site via Google while looking for a related topic, your web site came up, it looks great. I’ve bookmarked it in my google bookmarks.

I like this web blog so much, saved to my bookmarks.

brand cialis sergeant – brand levitra stony penisole savage

magnificent points altogether, you simply gained a brand new reader. What would you suggest about your post that you made some days ago? Any positive?

Very interesting points you have mentioned, appreciate it for posting. “Ignorance, the root and the stem of every evil.” by Plato.

cialis soft tabs pills grumble – cialis oral jelly pills whirl viagra oral jelly online moment

Good V I should definitely pronounce, impressed with your site. I had no trouble navigating through all the tabs and related info ended up being truly easy to do to access. I recently found what I hoped for before you know it at all. Quite unusual. Is likely to appreciate it for those who add forums or something, site theme . a tones way for your customer to communicate. Nice task..

Nearly all of the things you assert is astonishingly precise and it makes me ponder why I had not looked at this with this light before. This piece really did switch the light on for me personally as far as this specific subject goes. But at this time there is actually just one position I am not necessarily too cozy with so whilst I try to reconcile that with the actual core idea of your position, permit me see what the rest of the subscribers have to point out.Nicely done.

you’re really a good webmaster. The website loading speed is amazing. It seems that you are doing any unique trick. Also, The contents are masterwork. you have done a magnificent job on this topic!

Aw, this was a very nice post. In concept I want to put in writing like this additionally – taking time and precise effort to make a very good article… but what can I say… I procrastinate alot and not at all appear to get something done.

One of the leading academic and scientific-research centers of the Belarus. There are 12 Faculties at the University, 2 scientific and research institutes. Higher education in 35 specialities of the 1st degree of education and 22 specialities.

You could certainly see your enthusiasm within the work you

write. The sector hopes for more passionate writers such

as you who are not afraid to say how they believe. All the time go after

your heart.

I was recommended this website by way of my cousin. I’m no longer positive whether or not this submit is written by means of him as nobody else know such distinct approximately my trouble. You are wonderful! Thanks!