In 2007 the recession hit, and at the time, a partner and I owned a mergers and acquisition boutique that we had built up over three years. In December 2006 we closed our biggest deal yet and had a full pipeline as we moved into 2007. Then things started drying up, and by Q4, there was nothing. Looking into 2008, we figured a few deals would come back to life, but that was not to be the case.

As my partner and I talked through options to save the company and keep us moving forward, we exhibited some of the five dysfunctions of a team. We discussed some hair-brained ideas, including doing what we had done before, but just with more considerable effort. None of the ideas worked, and looking back; we weren’t thinking things through, looking at new markets, and holding each other accountable. Then we did what most of us do when stressed; we fell back doing the things with which we are most comfortable. My partner distracted himself with an executive Ph.D., and I, who was already distracted with the recent death of my mother, my divorce, and my children’s custody, reverted to doing financial analysis and modeling. These distractions enabled us to convince ourselves that we were swamped, which we were, but were not moving the company forward.

I did manage to get us some consulting work, but It was not until 2011, after joining a Vistage group, that we were back on track. However, looking back at that time, I would have given anything to be in a Vistage group from 2006. I needed a group of Peers to:

-

Challenge my thinking and assumptions;

-

Force me to accept what was happening and look for new opportunities;

-

Push me and hold me accountable for commitments;

-

Make me realize what I was doing was ineffective;

-

Challenge me about my concepts of the future and the status quo; and

-

Make me express my vision and strategy.

Not only that, but a Vistage group through its great speakers provides education on so many fronts that there is always something to learn.

As I reflect on this, it reminds me of a moment in 2004 when a Vistage Chair came to see me and tell me about Vistage. I was an overconfident, arrogant, young business owner who believed he didn’t need “no stinking help!” As I said, fast forward several years, and when a second chair proposed joining Vistage, it was like “Throw me a lifeline, I am drowning.”

Few business owners and CEO invest in themselves because they are successful, don’t realize they have stopped learning, don’t think anyone can understand their business, and don’t have time. Over my career, I have worked across many industries, and with many companies and never found a business model I can’t understand. The most significant issue is the confusion is over the myriad of TLAs ( three-letter acronyms) that a unique to a company and industry.” However, remember, as Marshall Goldsmith said, “What Got You to Here, Won’t Get You to There.” Regarding the lack of time, we all find time for what we deem essential. If learning and improving yourself and your business are a priority, then you can find the time. Furthermore, if your business cannot survive for a day without, you are failing as a leader.

Today we are experiencing a variation of 2008’s crisis. Our success as a leader is determined by how we emerge from the disaster. Many will emerge batted and beaten, some will appear as they went in, on a form of autopilot, and then some will develop more robust and resilient, and in a market leadership position.

To make sure you are among the latter, you need to be a member of a Peers Group, i.e., a Vistage Group:

-

where the members’ only price for helping you succeed, is helping them achieve their success;

-

to challenge your assumptions and prevent hubris;

-

to hold you accountable for your commitments;

-

to provide resources to help you and your organization succeed.

My groups are currently meeting weekly to:

-

Provide Emotional Support and Mental Health – We take time to discuss how we are all doing What is happening in our lives, with our families. This discussion occurs before we get to business.

-

Provide Information and Support – The members are helping each other with finding community banks that will provide PPP funds. Helping refer new business to each other. Advising in the areas that are the key competency to the others.

-

Charting the route forward – questioning each other about what the future holds and how they will be successful in the future. Who to keep and let go to ensure they have the right resources in the future. What clients need attention or cultivation and which need to be “fired” as they are too expensive to keep.

-

Employee Care – How to deal with employee issues from hiring in a virtual world to firing. We are discussing how to bring the workforce back safely and avoid litigation. Other topics are how to compensate them for extra efforts, promote those that have risen to the occasion, and what to do with those in leadership positions who didn’t.

Bart Garvin, Owner, and President of Garvin Industries expressed the benefit of such groups, “Because we’re all human, every business owner or CEO has multiple blind spots. Those blind spots often give us a distorted perception of truth inside our company, and it’s all based on our past experiences. [The group] forces me to step outside my business and be intellectually honest about my blind spots so I can change them.”

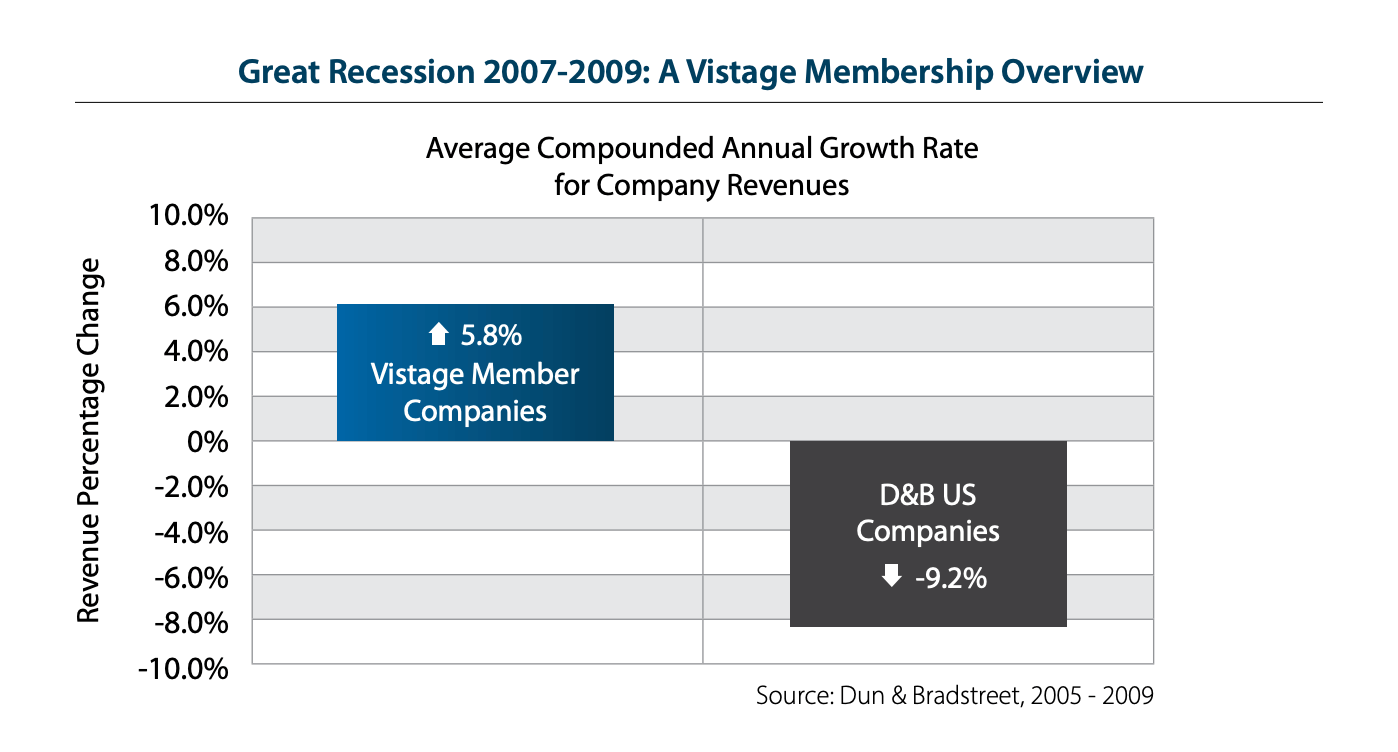

Looking back at the Great Recession, Vistage Member Companies outperformed their peers, as shown below. Vistage members grew revenue by 5.8%, while non-Vistage members saw a 9.2% decline. Many ask, “Is it the Chair, the peer advisory, the insight, the outside perspectives, the tools, the resources, the research, the speakers, the decision model……?” No, it is all of them in a group like Vistage.

A peer group is not an expense, but an investment and one, similar to a gym, if you go and use correctly, will pay huge dividends. Do you want to be a company represented on the left or the right of the above graph? Now is the time to get involved and push to make you and your organization stronger. Leave it too long, and those who do will have leapfrogged over you. If you want to learn more, contact me.

Copyright (c) 2020, Marc A. Borrelli

Recent Posts

Boosting Common Sense Decision-Making in Your Organization

Discover how to enhance decision-making in your organization by focusing on three crucial areas: solving the right problem, gathering all the available information, and understanding the intent. Learn to empower your team, foster a purpose-driven culture, and improve organizational clarity for better decision-making.

Do You Understand Your Costs to Ensure Profitability?

You can only determine profitability when you know your costs. I’ve discussed before that you should price according to value, not hours. However, you still need to know your costs to understand the minimum pricing and how it is performing. Do you consider each jobs’ profitability when you price new jobs? Do you know what you should be charging to ensure you hit your profit targets? These discussions about a company’s profitability, and what measure drives profit, are critical for your organization.

Sunk Costs Are Just That, Sunk!

If you were starting your business today, what would you do differently? This thought-provoking question is a valuable exercise, especially when it brings up the idea of “sunk costs” and how they limit us. A sunk cost is a payment or investment that has already been made. Since it is unrecoverable no matter what, a sunk cost shouldn’t be factored into any future decisions. However, we’re all familiar with the sunk cost fallacy: behavior driven by a past expenditure that isn’t recoupable, regardless of future actions.

Do You REALLY Know Your Business Model?

Bringing clarity to your organization is a common theme on The Disruption! blog. Defining your business model is a worthwhile exercise for any leadership team. But how do you even begin to bring clarity into your operations? If you’re looking for a place to start, Josh Kaufman’s “Five Parts of Every Business” offers an excellent framework. Kaufman defines five parts of every business model that all flow into the next, breaking it down into Value Creation, Marketing, Sales, Value Delivery, and Finance.

Ideation! Harder Than It Sounds

Bringing in new ideas, thoughts, understanding, and logic is key as your organization faces the challenges of a changing environment. But when you do an ideation session in your organization… how does it go? For so many organizations, many times, after a few ideas have been thrown out and rejected, the thought process slows down very quickly, and a form of hopelessness takes over. How does your organization have better ideation? I’ve come across a new approach with a few teams lately.

Recruit, Recruit, Recruit!

An uptick in business has begun this quarter, and companies are rushing to hire to meet this surge in demand. What amazes me is how many are so unprepared to hire. Continual recruiting is key to the survival of a company. It isn’t the same thing as hiring—continuous recruiting is building a pipeline of people that you would hire if you needed to fill a position, or “A players” you would hire if they were available.

We All Need Clarity

If your organization is focused on obscurity over clarity, whether intentionally or not, your “A” player employees are vulnerable. There is a looming talent crunch. As we start to emerge from COVID, demand is increasing, and many are scrambling to fill positions to meet that demand. Headhunters and recruiters are soon going to be calling your key “A” employees. Have you been giving them a reason to stay?

Not Another **** Meeting

As Leonard Bernstein put it so well, “To achieve great things, two things are needed: a plan and not quite enough time.” Your meetings can be shorter, more fruitful, and engaging, with better outcomes for the organization, employees, and managers. It’s time to examine your meeting rhythms and how you set meeting agendas. This week, I break down daily, weekly, monthly, quarterly, annual, and individual meeting rhythms, with sample agendas for each.

Is Your Company Scalable?

Let’s start here: Why should your company be scalable at all? If your business is scalable, you have business freedom–freedom with time, money, and options. Many business leaders get stuck in the “owner’s trap”, where you need to do everything yourself. Sound familiar? If you want a scalable business that gives you freedom, you need to be intentional about what you sell, and how.

Are you ready for the Talent Crunch?

Companies are gearing up to hire. Unfortunately, many are competing within the same talent pool. Some experts are currently predicting a strong economic recovery starting in May or June. But as the economy booms, there is going to be fierce competition for talent. How will you fare in the looming talent crisis? Your organization should be creating a plan, now, so you can attract the talent you need in the year ahead.