Boeing’s 737 Max issues highlighted the company’s sacrifice of safety for financial performance, resulting in a tarnished reputation. The prioritization of profit over core values also damaged the FAA’s credibility and revealed a lack of accountability for top executives. This downfall serves as a reminder of the importance of maintaining core values and prioritizing them over short-term financial gains.

Is Social Unrest Coming?

The 2008 Recession led to the Tea Party, Occupy Wall Street, and other movements. Of these, the Tea Party had a more enduring effect due to the large amount of funding it received. Now COVID.

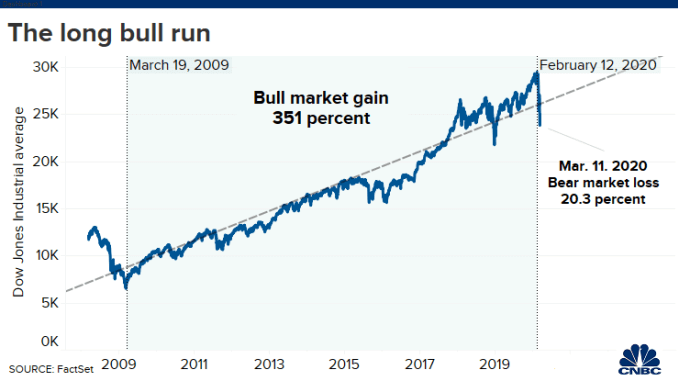

In just over two and a half months, the U.S. has lost more jobs than those gained over 101 months of continuous wage growth since the 2008 Recession. To see how the recovery has primarily benefited the wealthy through higher asset prices, just look at the Dow Jones Industrial Index.

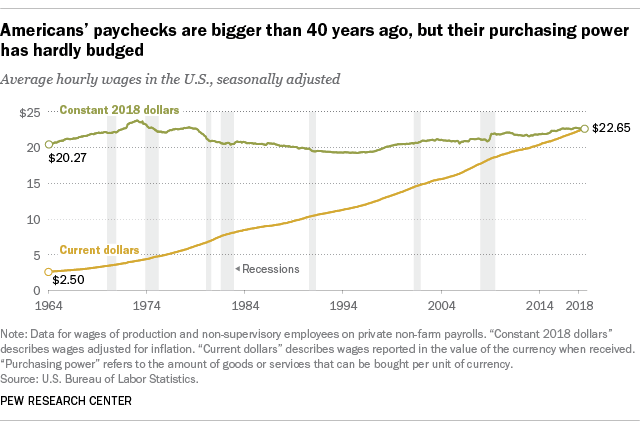

However, workers have not benefited from the largesse of QE and its progeny. According to the Pew Research Center U.S. hour wages have increased about 10% in real terms since 1964!

As Yogi Berra so aptly put it, it is “Déjà vu all over again.” While the Administration is expecting a quick return to normal, most economists do not share that view. Below are areas that I think will cause more economic pain.

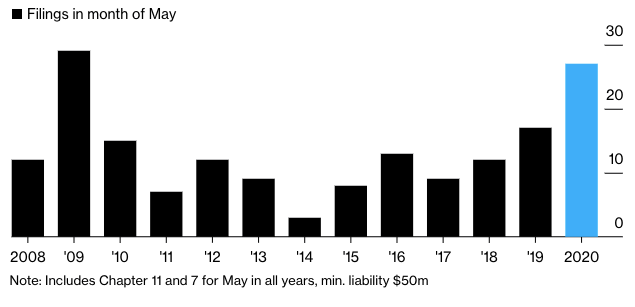

Bankruptcies – Corporate

With all that the Fed and Congress’s stimulus, several significant firms have announced bankruptcies since March, which is likely to make 2020 the worst year since 2009. Recently, firms ranging from Ravn Air, Neiman Marcus, J Crew, Gold’s Gym, and Hertz, have filed bankruptcy, and Chesapeake Energy is considering it. In May, 27 companies reporting at least $50 million in liabilities sought court protection from creditors, the most significant number since 2009.

Source: Bloomberg

While the Fed’s backstop of the corporate debt markets has helped investment-grade borrowing nearly $1 trillion through May, non-investment grade companies are turning to the bankruptcy courts as their revenues have evaporated. According to JP Morgan Chase, in April, corporate borrowers defaulted on $36.7 billion of bonds and loans, the fifth most enormous monthly volume on record. In the last two months, the amount of distressed debt rose 161% to over half a trillion dollars. Industries which are in trouble are:

-

Retail

-

Restaurants,

-

Mining,

-

Transport,

-

Auto,

-

Utilities,

-

Churches, and

-

Higher Education

Of the above, in many cases, the closure of colleges will have huge ripple effects in the local communities, leading to many other businesses closing. New research from economists at three Federal Reserve banks shows coronavirus-related bankruptcies could rise by 200,000 to reach almost 1 million unless government stimulus programs offset the increase.

Finally, many small companies across the country will close for good regardless of their industries.

Bankruptcies – Personal

Along with corporate bankruptcies, many lawyers expect a dramatic rise in personal bankruptcies. American consumers already had a high level of debt before COVID, and with the level of unemployment expected, they will not be able to meet their obligations. Even those with jobs could see reduced hours, wages, or both, which will further strain their finances. Given that foremost, this is a public health crisis, many people who have had COVID and required treatment will be facing substantial medical bills. Many reports show that most Americans cannot face an unexpected $500 charge; however, costs for COVID treatment are about $30,000 with insurance. As COVID has disproportionally affected lower-income minorities, whose jobs do not provide health insurance or who have lost their jobs, many will be unable to meet their medical bills leaving bankruptcy as the only option.

Unemployment

Approximately 41 million Americans have applied for unemployment in just ten weeks, and the unemployment rate is 14.7%, the highest since the Great Depression, according to the Department of Labor. However, even as things open up, unemployment still faces some strong headwinds, including:

-

Corporate bankruptcies leading to significant corporate layoffs;

-

Corporations cutting payroll to reduce costs,e.g., Boeing, IBM, United Airlines, Uber to name a few;

-

Municipalities and State Governments could shed a million jobs to balance their budgets;

-

As PPP funding runs out, many companies are planning to let employees go.

According to Goldman Sachs’ latest estimates, the unemployment rate will peak at 25%, rivaling the worst period of the Great Depression. Further Goldman expects the so-called real jobless rate, the percentage of Americans who want a job but have given up trying to find one, to peak at 35%.

While the Federal Government is providing an additional $600/week in unemployment insurance (“UI”), that will end at the end of July. However, as the states provide most UI and have a maximum duration of 26 weeks in a year, except for Michigan, Missouri, and South Carolina who limit it to 20 weeks, and Florida, Georgia, and North Carolina, which restricts it to 12 weeks. By the end of July, those who let go at the start of the shut down will have been unemployed for 20 weeks. Furthermore, many states only provide about 50 percent or less of weekly earnings.

Evictions

In 2015, approximately 48.5 million people rented their homes in the U.S. Most states put a moratorium on evictions, which is providing some temporary relief. However, there are significant variations from state to state, as the Eviction Lab scorecard shows. According to the Department of Housing and Urban Development, almost half of the rental units are owned by individual investor landlords who depend on rent to meet their expenses. Once the courts open up, I expect a rise in evictions, but for those evicted without jobs, where will they go.

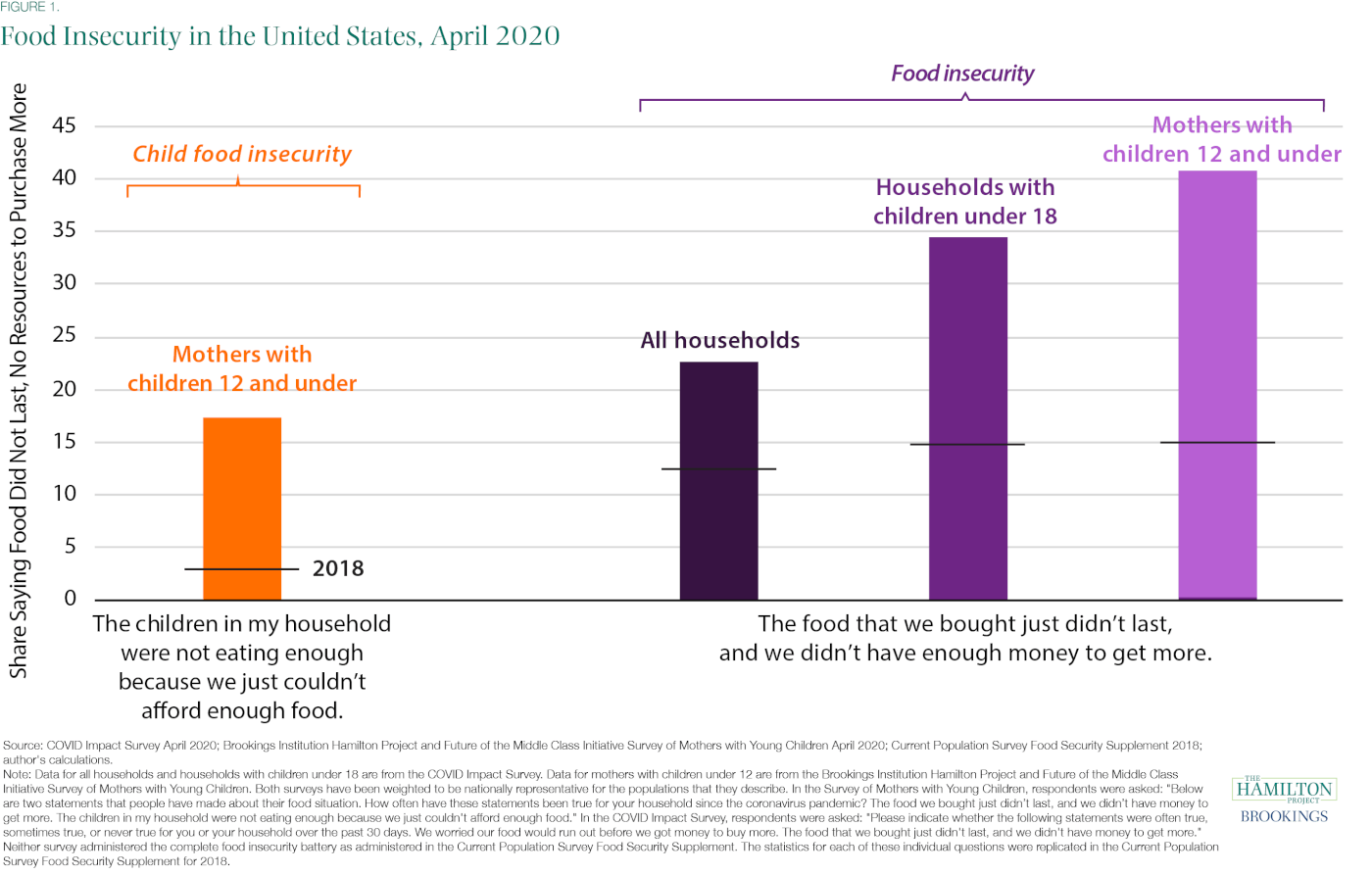

Food Insecurity

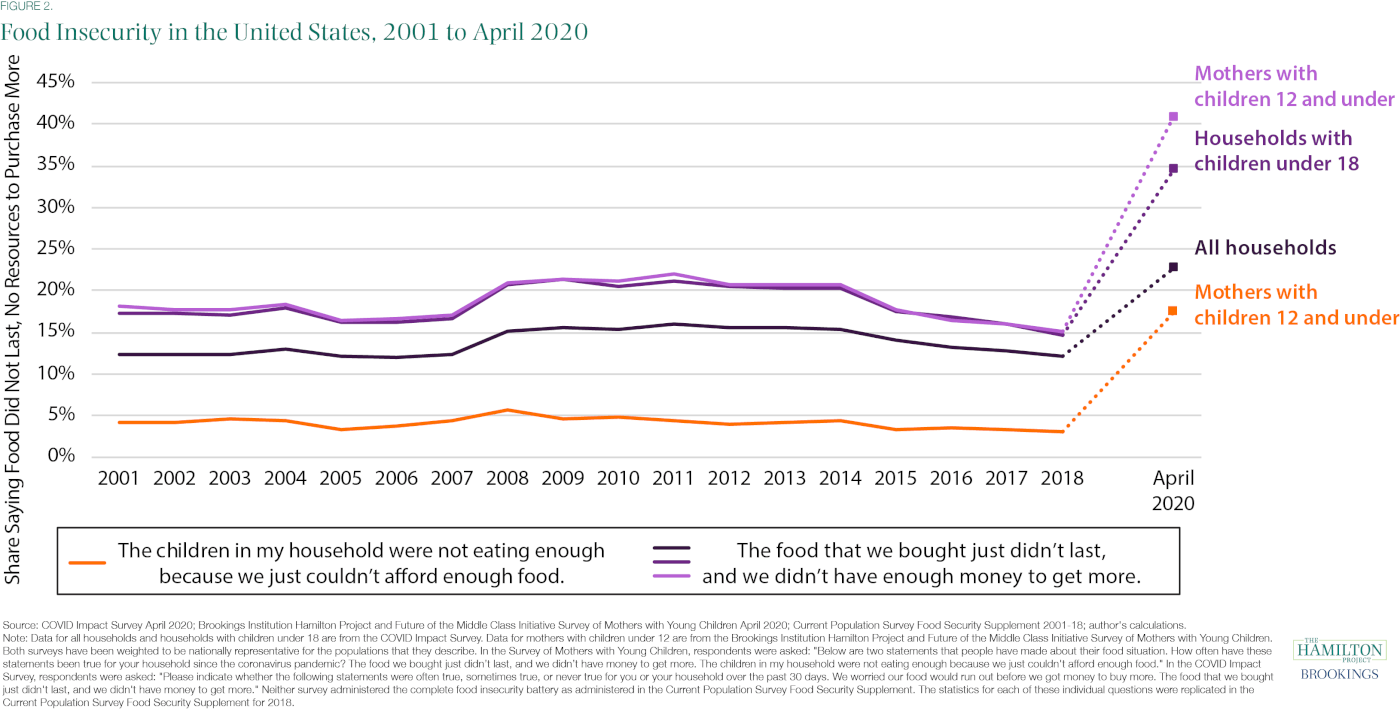

For the wealthiest country in the world, it is a sad fact that many people in the U.S. are food insecure. In 2018, 37.2 million people lived in food-insecure households, meaning they are often forced to skip meals, eat less at meals, buy cheap non-nutritious food and/or feed their children but not themselves. Furthermore, one in six children in the U.S. is food insecure. 5.6 million U.S. households experienced severe food insecurity. Since 2018 things have worsened with food insecurity in households with children under 18 has increased by about 130 percent since 2018.

The Administration’s recent cut to SNAP has reduced food assistance to 700,000 Americans affecting them, their families, and households. With schools closed where many lower-income children receive most of their meals, their food insecurity has grown. The lines at food banks are increasing across the county.

Safety

Regretfully, we have seen the killing of Ahmaud Arbery and George Floyd, which unfortunately shows the different standards minorities face in the U.S.

The “boogaloo” movement, which is seeking a second Civil War against a seemingly tyrannical or left-wing government, minorities, police, and public officials, partially in response to a perceived threat of widespread gun confiscation, is growing. What is concerning is that the use of the term has grown nearly 50 percent on platforms like Reddit and Twitter over the last few months. Also, as the armed protestors, many boogaloo members, take over government buildings supported by wealthy donors, the lack of consequences further shines a light on the difference in treatment between races. These actions will further undermine the feeling of security by many.

What does it all mean?

If you look at Maslow’s Hierarchy of Needs, the two basic needs are:

-

Psychological Needs – food, water, warmth, and rest

-

Safety Needs – security and safety

With evictions and food insecurity, many are not having their Psychological needs met. Nearly all revolutions start in the spring as people are food insecure from the winter, so increased food insecurity is never a good sign. With increased demonstrations, health scares, and no homes, security, and safety are of growing concern. Thus many will be lacking Maslow’s basic needs. In such a situation, many feel a loss of self-worth as they cannot provide basic needs for themselves and their families.

With a loss of self-worth, lack of basic needs, many will feel little stopping them from openly protesting, as we have unfortunately seen across the country, but especially in Minneapolis and other major cities this weekend. Furthermore, there is evidence of out of town people from both sides driving these riots. Solving the crisis will not be easy. While the police and national guard can put down the protests, it does nothing to address the underlying issues, but would further inflame tensions. Many states’ Concealed Carry and Stand Your Ground laws will enable situations to spiral out of hand even quicker. Data shows that Stand Your Ground laws increase firearm homicides, but have no measurable effect on other violent crime. Finally, the President’s Tweet, “When the looting starts, the shooting starts,” does nothing to help the situation.

Social unrest is coming; however, the key questions are how much and how bad? That will depend on whether we are willing to reconsider how our economy works, because as Scott Galloway puts it, “there is evidence of a Hunger Games economy everywhere.” Also, there is evidence that America’s failing safety net is primarily racially driven, something that needs change. We need empathy, more effective government policies, and to retrain workers whose industries have gone.

Recent Posts

The Downfall of Boeing: A Lesson in Core Values

Resolutions, Here We Go Again.

In reflecting on 2021 resolutions, the author scored themselves in three categories and sought to improve success in 2022 by addressing friction points. Drawing on advice from social psychologist Wendy Wood, the author identified areas to reduce or increase friction in their failed resolutions. By making these adjustments, the author aims to enhance their goal achievement and encourages others to consider friction when setting resolutions.

You need to take an extended vacation. No, seriously, you do.

COVID has taken a toll on all of us. If you have not taken an extended vacation in a while where you disconnect, you need to now. You and your business will benefit.

Becoming Famous in Your Niche: The Success Story of Linn Products Limited

In a previous discussion, I highlighted the importance of being famous for something. Being well-known in your niche can help you: Concentrate on your strengths Connect with your target audience Communicate your offerings more effectively Receive referrals Identify...

Understanding and Optimizing Your Cash Conversion Cycle

Understanding and optimizing the Cash Conversion Cycle is crucial for business growth, as it impacts cash flow and the ability to access external capital. This cycle consists of four components: Sales, Make/Production & Inventory, Delivery, and Billing and Payments. To improve the Cash Conversion Cycle, companies can eliminate mistakes, shorten cycle times, and revamp their business models.

Discovering Your Niche: Why You Need to Be Famous for Something

As an entrepreneur, it’s crucial to specialize in a specific area and become famous for something, allowing you to generate referrals and build your brand. Understanding the “job” you’re hired for helps you stand out in the marketplace and communicate your value proposition effectively. By providing value to your clients, you can adopt a value-based pricing approach, ensuring your business remains competitive and maintains a strong market presence.

Rethinking Your Pricing Model: Maximizing Margins and Providing Value

Rethink your pricing model by focusing on the value you provide and your customers’ Best Alternative To a Negotiated Agreement (BATNA). This approach can help you maximize margins while delivering better value to your clients. Assess your offerings and brainstorm with your team to identify pricing adjustment opportunities or eliminate commodity products or services.

Do you know your Profit per X to drive dramatic growth?

I recently facilitated a workshop with several CEOs where we worked on the dramatic business growth model components. One of the questions that I had asked them beforehand was, "What is Your Profit/X?" The results showed that there this concept is not clear to many....

The War for Talent: 5 Ways to Attract the Best Employees

In today’s War for Talent, attracting the best employees requires a focus on value creation, core customer, brand promise, and value delivery. Clearly articulate your company’s mission, identify your “core employee” based on shared values, and offer more than just a salary to stand out as an employer. Utilize employee satisfaction metrics and showcase your company’s commitment to its workforce on your website to make a strong impression on potential candidates.

Are you killing your firm’s WFH productivity?

Productivity remained during WFH with COVID. However, further analysis found that hourly productivity fell and was compensated for by employees working more hours. What was the culprit – Meetings. Want to increase productivity, have fewer meetings.