The EOS Model® provides a useful foundation for businesses, but it falls short in addressing key aspects of creating an growth. By incorporating additional elements from the Gravitas 7 Attributes of Agile Growth® model, businesses can create a more comprehensive system that promotes growth while maintaining smooth operations. Focusing on Leadership, Strategy, Execution, Customer, Profit, Systems, and Talent, the 7 Attributes of Agile Growth® offer a more encompassing approach to achieving success.

When Should I Sell My Business?

Every business owner I have ever known, has sought to sell their business at the top of the market. I think this is part of the movement where many are in a constant quest to outdo others. While conceptually I understand this desire, these owners should heed the voices of some sages.

Daniel Kahneman’, “The average investor’s return is significantly lower than the market indices due primarily to market timing.”

Warren Buffett, “Trying to time the market is a fool’s game.”

Baron Rothschild, “You can have the top 20% and the bottom 20%; I will take the 80% in the middle.”

What it takes to Sell at the Top of the Market

If you are determined to sell at the top and are ready to step aside at any time, the only concern is timing. However, if you have other timing considerations, e.g., retire when my business is worth $X, step aside when I am 65, then things are far more complicated.

For the market to be at the top when you reach some predetermine criteria, you need to ensure that the entire economy collaborates with you. To do this, I expect you would need to have the ear of:

- the President,

- the majority of Congress,

- the Chair of the Federal Reserve, the Secretary of the Treasury,

- the President of the European Central Bank,

- the German Chancellor,

- the President of France,

- the President of Russia,

- the President of the People’s Republic of China,

- the heads of the People’s Bank of China, and

- the leaders of all the leading investment banks and hedge funds worldwide, to name a few.

Not only would you need their ear, but you would have to persuade them that collaborating with you is in their best interests as well. Furthermore, many of these people would want something in return for a favor, and most of the people I have spoken with would be able to afford the price Vladimir Putin would expect. Finally, I have found any scheme where only one person knows of it but requires many people to ensure its success is bound to fail.

As a result, I would say that trying to sell at the top is a fool’s errand and one that should be abandoned.

A Contrarian View

Some have argued that selling at the bottom of the market makes more sense. The rationale is that the business owner will reinvest those assets into other assets whenever they sell their company. Thus if you want to ensure continued wealth accumulation, one should do it at the bottom of the market rather than the top.

To examine this theory, I did a simple analysis. I reviewed four dates and the market conditions. I looked at the Russell 2000 Price Earnings Ratio for those dates and indexed them with the 2000 Price Earnings Ration as the base = 100. Assuming that enterprise value (EV) to EBITDA ratios followed the Russell 2000’s PER, the EV/EBITDA ratio in 2000 was 5x, and the company had an EBITDA of $1 million in each year before the sale, the results are as follows:

| Date | Market Conditions | Russell 2000 PER (Indexed) | EV / EBITDA Multiple | Proceeds ($k) |

| 12/31/2000 | After the Top of the market | 100.0 | 5.0 | $5,000 |

| 12/31/2005 | Near the top of the market | 58.6 | 2.9 | $2,929 |

| 12/31/2010 | Emerging from a recession | 52.6 | 2.6 | $2,631 |

| 12/31/2015 | Middle of a bull market | 74.7 | 3.7 | $3,734 |

I then made a few more simple assumptions:

- Transaction costs to be 30% comprising intermediary and legal fees of 10% and taxes of 20%.

- The proceeds are invested in two funds, VFIAX – Vanguard 500 Index Fund Admiral Shares and VBMFX – Vanguard Total Bond Market Index Fund Investor Shares as proxies for a general stock and bond market investment.

- The allocation is 70% into VFIAX and 30% into VBMFX.

- Any funds withdrawn and any distributions are ignored as they would be the same for both funds.

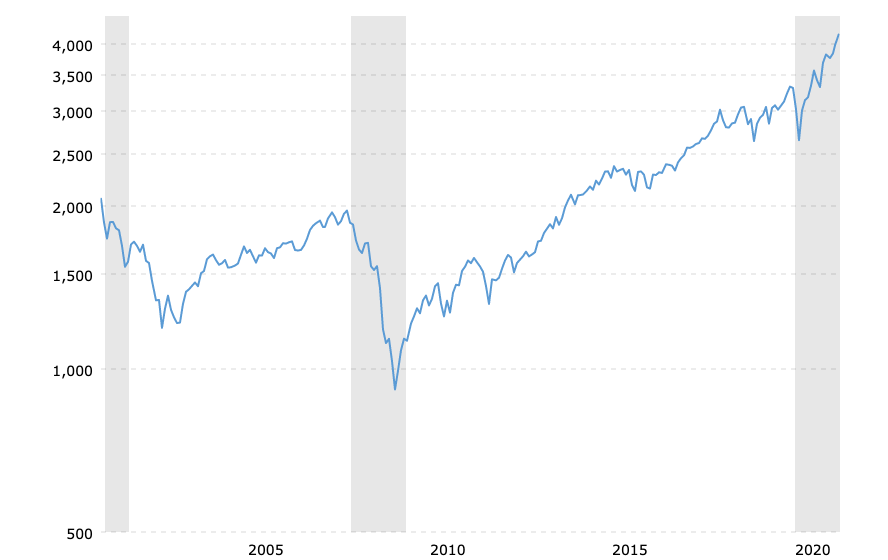

Below is a chart of the S&P 500 from December 31, 2000, to December 31, 2020 to show the market’s performance over the period.

Source: Yahoo Finance

Following the investments as described above after five, ten and fifteen years the returns were:

| Date | Initial Value ($k) | After 5 yrs ($k) | Return (%) | After 10 yrs ($k) | Return (%) | After 15 years ($k) | Return (%) |

| 12/31/2000 | 5,000 | 4,822 | -3.6 | 4,930 | -1.4 | 7,027 | 40.5 |

| 12/31/2005 | 2,929 | 2,993 | 2.2 | 4,292 | 46.5 | 5,414 | 84.8 |

| 12/31/2010 | 2,631 | 3,790 | 44.0 | 4,786 | 81.9 | ||

| 12/31/2015 | 3,734 | 4,643 | 24.3 |

So as it can be seen, while selling at the top, provided the greatest wealth after fifteen years, interesting the difference over 10 years was less than 3% between selling at the top and selling just after the bottom. The other points are somewhere in between. Therefore, selling at the top is not the conclusive answer we expected.

So what to do?

What I have always advised clients is to build a business that is attractive to buyers and can be sold. The key is to create your own redundancy, so that you can sell it, stay in a non-executive capacity and effectively “coupon clip,” or pass it on to your children or employees. You have many options and if someone comes along and offers you “silly” money, take it. But don’t worry about the “Top of the Market.”

If you want to know if your business is sellable, complete this questionnaire, and if you want help building a sellable business, contact me.

Copyright (c) 2021, Marc A. Borrelli

Recent Posts

EOS is just that, an Operating System

What has COVID done to Company Culture?

COVID has affected everyone. However, companies need to examine if they have lived their core values during COVID, how they are reinforcing them in a WFH environment, and especially with the onboarding of new hires.

Profit ≠ Cash Flow

Knowing how much cash you generate is essential for planning for growth. Too many companies don’t know and when they grow they find they are continually running out of cash. Understand your cash flow generation and how to improve it through improvements in your Cash Conversion Cycle and using the Power of One.

What Are Your Critical and Counter Critical Numbers?

The key to achieving long term goals is to define short term goals that lead you there. Focusing those short term goals around a key metric is essential. However, ensure that the metric will not lead other areas astray by having an appropriate counter critical metric act as a counter balance.

Rethinking ‘Family’ Culture in Business: Fostering Performance and Success

Explore the importance of company culture and the potential pitfalls of adopting a “Family” culture in organizations. Learn how to foster a high-performance culture while maintaining key family values and discover success factors for family businesses. Rethink the “Family” culture concept and create a thriving environment for your organization.

Do You Truly Know Your Core Customer?

Knowing the profit of your core customers is key to building a growth model. Many companies have identified core customers that are generating a sub-optimal profit and so they cannot realize the profits they seek. Identifying the correct core customer allows you to generate profits and often operate in “Blue Ocean.”

The Spectacular Rise and Fall of the European Super League

The European Super League (ESL) collapsed within 48 hours of its announcement due to hubris, a lack of value creation, and fan backlash. The founders’ arrogance led them to disregard European football’s deep-rooted traditions and culture. At the same time, the focus on wealthy club owners instead of merit undermined the essence of the competition. The fierce backlash from fans, who felt betrayed by their clubs, demonstrated the importance of prioritizing supporters’ interests in football.

When Should I Sell My Business?

Many business owners want to sell at the top of the market. However, market timing is tough. Is this the best strategy? Probably not.

Does Your Financial Model Drive Growth?

Working with many companies looking to grow, I am always surprised how many have not built a financial model that drives growth. I have mentioned before a financial model that drives growth? Here I am basing on Jim Collin's Profit/X, which he laid out in Good to...

COVID = Caught Inside

As we emerge from COVID, the current employment environment makes me think of a surfing concept: “Being Caught Inside When a Big Set Comes Through.” Basically, the phrase refers to when you paddle like crazy to escape the crash of one wave, only to find that the next wave in the set is even bigger—and you’re exhausted. 2020 was the first wave, leaving us tired and low. But looking forward, there are major challenges looming on the horizon as business picks up in 2021. You are already asking a lot of your employees, who are working flat out and dealing with stress until you are able to hire more. But everyone is looking for employees right now, and hiring and retention for your organization is growing more difficult.