Discover the importance of organizational alignment and agility in this blog post. Learn how establishing a strong CORE and building a strategy around it can lead to sustainable growth and success. Find out how alignment and agility empower your organization to thrive in an ever-changing business landscape.

When Should I Sell My Business?

Every business owner I have ever known, has sought to sell their business at the top of the market. I think this is part of the movement where many are in a constant quest to outdo others. While conceptually I understand this desire, these owners should heed the voices of some sages.

Daniel Kahneman’, “The average investor’s return is significantly lower than the market indices due primarily to market timing.”

Warren Buffett, “Trying to time the market is a fool’s game.”

Baron Rothschild, “You can have the top 20% and the bottom 20%; I will take the 80% in the middle.”

What it takes to Sell at the Top of the Market

If you are determined to sell at the top and are ready to step aside at any time, the only concern is timing. However, if you have other timing considerations, e.g., retire when my business is worth $X, step aside when I am 65, then things are far more complicated.

For the market to be at the top when you reach some predetermine criteria, you need to ensure that the entire economy collaborates with you. To do this, I expect you would need to have the ear of:

- the President,

- the majority of Congress,

- the Chair of the Federal Reserve, the Secretary of the Treasury,

- the President of the European Central Bank,

- the German Chancellor,

- the President of France,

- the President of Russia,

- the President of the People’s Republic of China,

- the heads of the People’s Bank of China, and

- the leaders of all the leading investment banks and hedge funds worldwide, to name a few.

Not only would you need their ear, but you would have to persuade them that collaborating with you is in their best interests as well. Furthermore, many of these people would want something in return for a favor, and most of the people I have spoken with would be able to afford the price Vladimir Putin would expect. Finally, I have found any scheme where only one person knows of it but requires many people to ensure its success is bound to fail.

As a result, I would say that trying to sell at the top is a fool’s errand and one that should be abandoned.

A Contrarian View

Some have argued that selling at the bottom of the market makes more sense. The rationale is that the business owner will reinvest those assets into other assets whenever they sell their company. Thus if you want to ensure continued wealth accumulation, one should do it at the bottom of the market rather than the top.

To examine this theory, I did a simple analysis. I reviewed four dates and the market conditions. I looked at the Russell 2000 Price Earnings Ratio for those dates and indexed them with the 2000 Price Earnings Ration as the base = 100. Assuming that enterprise value (EV) to EBITDA ratios followed the Russell 2000’s PER, the EV/EBITDA ratio in 2000 was 5x, and the company had an EBITDA of $1 million in each year before the sale, the results are as follows:

| Date | Market Conditions | Russell 2000 PER (Indexed) | EV / EBITDA Multiple | Proceeds ($k) |

| 12/31/2000 | After the Top of the market | 100.0 | 5.0 | $5,000 |

| 12/31/2005 | Near the top of the market | 58.6 | 2.9 | $2,929 |

| 12/31/2010 | Emerging from a recession | 52.6 | 2.6 | $2,631 |

| 12/31/2015 | Middle of a bull market | 74.7 | 3.7 | $3,734 |

I then made a few more simple assumptions:

- Transaction costs to be 30% comprising intermediary and legal fees of 10% and taxes of 20%.

- The proceeds are invested in two funds, VFIAX – Vanguard 500 Index Fund Admiral Shares and VBMFX – Vanguard Total Bond Market Index Fund Investor Shares as proxies for a general stock and bond market investment.

- The allocation is 70% into VFIAX and 30% into VBMFX.

- Any funds withdrawn and any distributions are ignored as they would be the same for both funds.

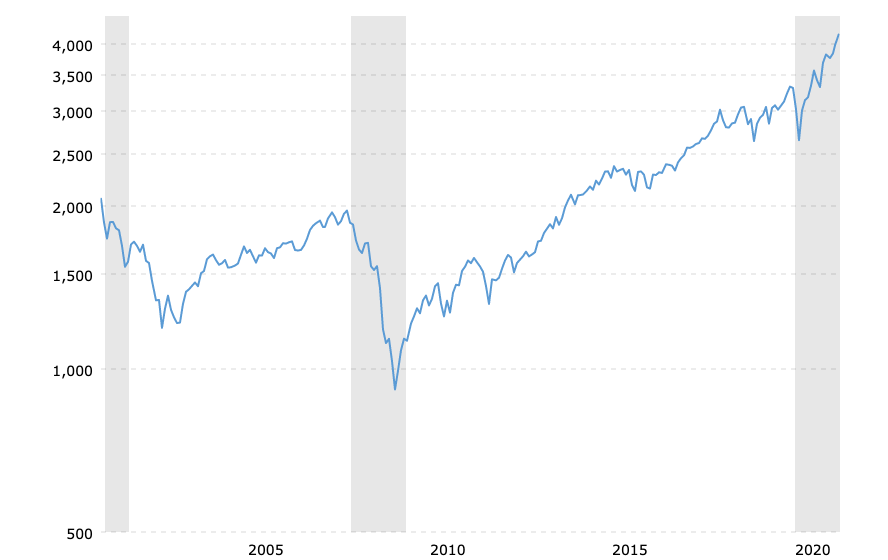

Below is a chart of the S&P 500 from December 31, 2000, to December 31, 2020 to show the market’s performance over the period.

Source: Yahoo Finance

Following the investments as described above after five, ten and fifteen years the returns were:

| Date | Initial Value ($k) | After 5 yrs ($k) | Return (%) | After 10 yrs ($k) | Return (%) | After 15 years ($k) | Return (%) |

| 12/31/2000 | 5,000 | 4,822 | -3.6 | 4,930 | -1.4 | 7,027 | 40.5 |

| 12/31/2005 | 2,929 | 2,993 | 2.2 | 4,292 | 46.5 | 5,414 | 84.8 |

| 12/31/2010 | 2,631 | 3,790 | 44.0 | 4,786 | 81.9 | ||

| 12/31/2015 | 3,734 | 4,643 | 24.3 |

So as it can be seen, while selling at the top, provided the greatest wealth after fifteen years, interesting the difference over 10 years was less than 3% between selling at the top and selling just after the bottom. The other points are somewhere in between. Therefore, selling at the top is not the conclusive answer we expected.

So what to do?

What I have always advised clients is to build a business that is attractive to buyers and can be sold. The key is to create your own redundancy, so that you can sell it, stay in a non-executive capacity and effectively “coupon clip,” or pass it on to your children or employees. You have many options and if someone comes along and offers you “silly” money, take it. But don’t worry about the “Top of the Market.”

If you want to know if your business is sellable, complete this questionnaire, and if you want help building a sellable business, contact me.

Copyright (c) 2021, Marc A. Borrelli

Recent Posts

Align and Thrive: The Importance of Organizational Alignment and Agility

How to Achieve Smart Time Management: 10 Tips for Busy Professionals

When you are a busy professional running your own business, it can often feel like there aren’t enough hours in the day to accomplish everything. Being strategic with your time is the best (and possibly the only) way to achieve all of your daily tasks. If you are...

5 Strategic Leadership Skills Every Manager Needs

So often, people view leadership as a talent: you’re either born with this quality or you’re not. However, this is not always the case! In reality, good leadership is made up of skills, and anyone can learn how to improve. Some people may pick up leadership attributes...

How the Sellability Score is Calculated: The Ultimate Guide

Do you have questions about how to calculate your business’s sellability score? Whether you’re looking to sell your business in the near future or years from now, understanding your sellability score will help you thrive. The sellability score identifies the...

The Top 5 Benefits of the Entrepreneurial Operating System

As an entrepreneur running your own business, you know there are bumps in the road and struggles that both you and your business will face over time. However, with the right people and tools at your disposal, you can anticipate what’s coming, plan for it, and continue...

5 Ways to Use Email Automation to Boost Traffic

Every single business in the world wants to evolve and grow. This will happen using a variety of techniques and strategies. In 2022, digital marketing is more than a household name, and most companies will adopt at least a few ideas when long-term planning and coming...

6 Questions To Ask A Potential Business Coach Before Hiring Them

Many entrepreneurs consider executive business coaching when they start struggling on their professional path. A small business coach is an experienced professional mentor who educates, supports, and motivates entrepreneurs. They will listen to your concerns, assess...

3 Ways Proper Long Term Strategic Planning Helps Your Business

Dreams turn into goals when they have a foundation of long-term strategic planning supporting them. They become reality when the ensuing strategic implementation plan is executed properly. With Kaizen Solutions as their strategic planning consultant, small and...

What is a Peer Group, and How Can it Improve Your Career?

If you are a CEO or key executive who has come to a crossroads or crisis in your career, you'll gain valuable insights and solutions from a peer group connection more than anywhere else. But what is a peer group, and how can that statement be made with so much...

Profit and Revenue are Lousy Core Values

As I mentioned last week, I am down with COVID and tired, so spending more time reading rather than working. I read Bill Browder's Freezing Order this weekend, and I highly recommend it. However, at the end of the book, Browder says that oligarchs, autocrats, and...