Boeing’s 737 Max issues highlighted the company’s sacrifice of safety for financial performance, resulting in a tarnished reputation. The prioritization of profit over core values also damaged the FAA’s credibility and revealed a lack of accountability for top executives. This downfall serves as a reminder of the importance of maintaining core values and prioritizing them over short-term financial gains.

The “Flaw of Averages” Causes Havoc for Businesses

Introduction: The Importance of Accurate Data Analysis

The “Flaw of Averages” is a term popularized by Sam Savage, referring to the misleading nature of averages in business decision-making. Averages often misstate the true situation within a company, leading to misallocation of resources and, ultimately, reduced profitability. In this blog post, we will discuss how the flaw of averages can impact businesses, using hypothetical examples to illustrate the consequences and offer suggestions for more accurate data analysis.

- The Flaw of Averages in Product Analysis

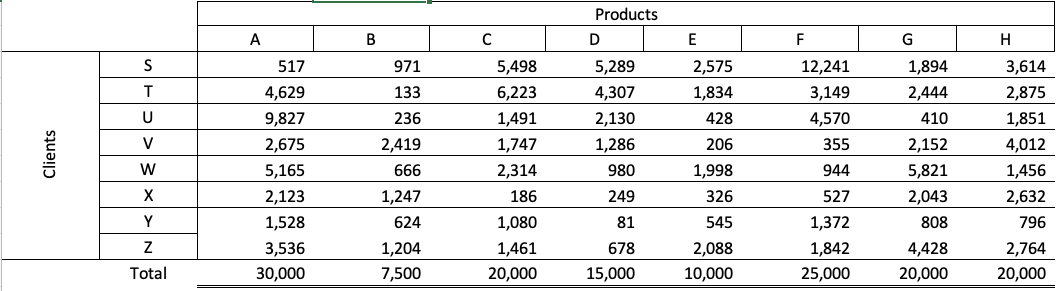

Consider a hypothetical business, ABC Inc., which sells a variety of products with different units sold, unit prices, and gross profits per unit.

| Product |

Units Sold |

Price/Unit |

Gross Profit/Unit |

| A |

30,000 |

$ 100.00 |

$ 12.50 |

| B |

7,500 |

$ 90.00 |

$ 75.00 |

| C |

20,000 |

$ 80.00 |

$ 37.50 |

| D |

15,000 |

$ 70.00 |

$ 45.00 |

| E |

10,000 |

$ 60.00 |

$ 25.00 |

| F |

25,000 |

$ 50.00 |

$ 12.50 |

| G |

20,000 |

$ 40.00 |

$ 20.00 |

| H |

20,000 |

$ 30.00 |

$ 25.00 |

When examining the product portfolio, looking beyond the total revenue and gross profit margin is essential. Focusing solely on averages can lead to misconceptions about the importance of certain products to the company’s profitability.

a. Rethinking Product Prioritization

For example, if ABC Inc. were to stop selling its largest revenue-generating product, its gross profit margin would increase substantially. By looking at average margins, the full impact of this product on the business is not apparent. A more detailed analysis may reveal additional costs associated with the production of this product, such as factory space, warehouse storage, staff, and shipping costs.

b. Bundling and Pricing Strategies

With a better understanding of the true profitability of each product, ABC Inc. can explore more effective pricing strategies, such as increasing the price of lower-margin products or bundling them with more profitable ones.

- The Flaw of Averages in Customer Analysis

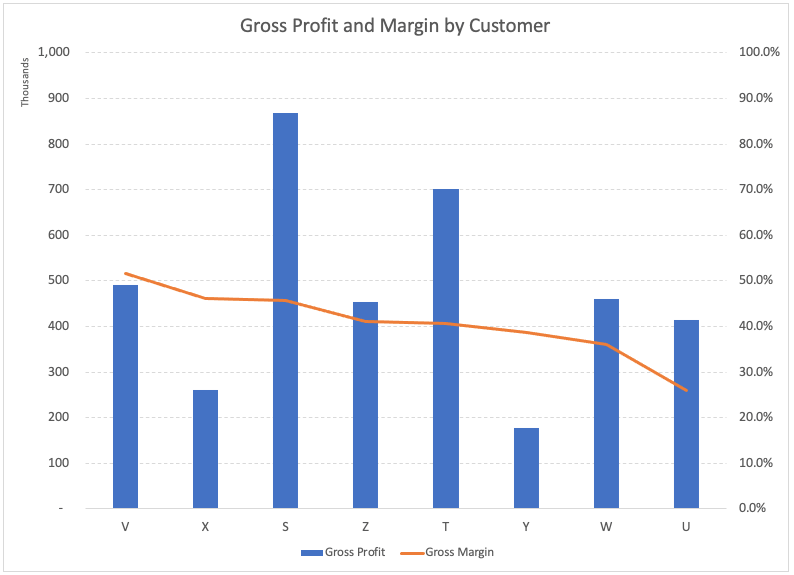

Examining customers’ revenue and gross profit contributions can also reveal valuable insights. By ranking customers according to their gross margin contributions, businesses can identify the most profitable clients and those that may be dragging down overall profitability.

Now, if we examine the purchase and gross profits of each customer, we get:

| Customer |

Revenue |

Gross Profit |

|

S |

1,899,890 |

869,085 |

|

T |

1,725,700 |

700,983 |

|

U |

1,598,430 |

414,600 |

|

V |

951,540 |

491,173 |

|

W |

1,273,760 |

459,958 |

|

X |

563,430 |

259,640 |

|

Y |

458,530 |

176,880 |

|

Z |

1,103,720 |

452,683 |

|

Total |

9,575,000 |

3,825,000 |

Sorting that into the order of gross margin, we can see the following:

a. Identifying High-Value Customers

For example, if ABC Inc. were to lose its most profitable customer, its gross margin would decrease significantly. By contrast, losing a less profitable customer would lead to an increase in the overall gross margin. Understanding the value of each customer allows the company to focus its resources on retaining and attracting high-value clients.

b. Analyzing Customer Purchase Patterns

In addition to evaluating each customer’s profitability, examining their purchase patterns is essential. Businesses can better target their marketing and sales efforts by identifying clients with higher-margin purchase combinations.

- Improving Business Performance Through Better Data Analysis

To overcome the flaw of averages and make more informed decisions, businesses should:

a. Regularly analyze product and customer data. Examine each product’s and customer’s profitability to identify improvement areas and make better resource allocation decisions.

b. Focus on profitability, not just revenue. While revenue is essential, focusing solely on it can lead to misconceptions about the true value of products and customers. Prioritize profitability to drive sustainable growth.

c. Use data to inform pricing and bundling strategies. Identify opportunities to increase the price of lower-margin products or bundle them with more profitable ones to improve overall profitability.

d. Monitor and adapt to changes in the market. Regularly review product and customer data to stay up-to-date with market trends and adjust strategies accordingly.

Conclusion: The Power of Proper Data Analysis

The flaw of averages can lead businesses to make misguided decisions based on misleading data. By delving deeper into product and customer data, businesses can better understand their true profitability, allocate resources more effectively, and ultimately drive sustainable growth. Don’t let the flaw of averages hold your business back – embrace the power of accurate data analysis to improve your decision-making and achieve success.

Recommended Reading:

-

The Flaw of Averages: Why We Underestimate Risk in the Face of Uncertainty, by Sam Savage This book provides an in-depth look at the limitations of averages and how they can lead to misguided decisions in various fields, including business, finance, and engineering. It also offers practical techniques for better understanding and managing risk through probabilistic thinking.

-

Why Can’t You Just Give Me The Number?: An Executive’s Guide to Using Probabilistic Thinking to Manage Risk and to Make Better Decisions, by Patrick Leach. This guide is designed for executives and decision-makers who want to improve their understanding of risk and uncertainty. It introduces the concept of probabilistic thinking, demonstrating how it can lead to better decision-making and risk management in a variety of business scenarios.

Recent Posts

The Downfall of Boeing: A Lesson in Core Values

Resolutions, Here We Go Again.

In reflecting on 2021 resolutions, the author scored themselves in three categories and sought to improve success in 2022 by addressing friction points. Drawing on advice from social psychologist Wendy Wood, the author identified areas to reduce or increase friction in their failed resolutions. By making these adjustments, the author aims to enhance their goal achievement and encourages others to consider friction when setting resolutions.

You need to take an extended vacation. No, seriously, you do.

COVID has taken a toll on all of us. If you have not taken an extended vacation in a while where you disconnect, you need to now. You and your business will benefit.

Becoming Famous in Your Niche: The Success Story of Linn Products Limited

In a previous discussion, I highlighted the importance of being famous for something. Being well-known in your niche can help you: Concentrate on your strengths Connect with your target audience Communicate your offerings more effectively Receive referrals Identify...

Understanding and Optimizing Your Cash Conversion Cycle

Understanding and optimizing the Cash Conversion Cycle is crucial for business growth, as it impacts cash flow and the ability to access external capital. This cycle consists of four components: Sales, Make/Production & Inventory, Delivery, and Billing and Payments. To improve the Cash Conversion Cycle, companies can eliminate mistakes, shorten cycle times, and revamp their business models.

Discovering Your Niche: Why You Need to Be Famous for Something

As an entrepreneur, it’s crucial to specialize in a specific area and become famous for something, allowing you to generate referrals and build your brand. Understanding the “job” you’re hired for helps you stand out in the marketplace and communicate your value proposition effectively. By providing value to your clients, you can adopt a value-based pricing approach, ensuring your business remains competitive and maintains a strong market presence.

Rethinking Your Pricing Model: Maximizing Margins and Providing Value

Rethink your pricing model by focusing on the value you provide and your customers’ Best Alternative To a Negotiated Agreement (BATNA). This approach can help you maximize margins while delivering better value to your clients. Assess your offerings and brainstorm with your team to identify pricing adjustment opportunities or eliminate commodity products or services.

Do you know your Profit per X to drive dramatic growth?

I recently facilitated a workshop with several CEOs where we worked on the dramatic business growth model components. One of the questions that I had asked them beforehand was, "What is Your Profit/X?" The results showed that there this concept is not clear to many....

The War for Talent: 5 Ways to Attract the Best Employees

In today’s War for Talent, attracting the best employees requires a focus on value creation, core customer, brand promise, and value delivery. Clearly articulate your company’s mission, identify your “core employee” based on shared values, and offer more than just a salary to stand out as an employer. Utilize employee satisfaction metrics and showcase your company’s commitment to its workforce on your website to make a strong impression on potential candidates.

Are you killing your firm’s WFH productivity?

Productivity remained during WFH with COVID. However, further analysis found that hourly productivity fell and was compensated for by employees working more hours. What was the culprit – Meetings. Want to increase productivity, have fewer meetings.