Boeing’s 737 Max issues highlighted the company’s sacrifice of safety for financial performance, resulting in a tarnished reputation. The prioritization of profit over core values also damaged the FAA’s credibility and revealed a lack of accountability for top executives. This downfall serves as a reminder of the importance of maintaining core values and prioritizing them over short-term financial gains.

COVID continues to accelerate changes in business models

As I have said repeatedly, COVID is accelerating change for all businesses, whether or not they recognize it. A recent survey by the IBM Institute of Business Value concluded that “executives must accept that pandemic-induced changes in strategy, management, operations, and budgetary priorities are here to stay.” I see three significant shifts taking place.

- How CEOs Lead

- Changes in priorities

- Changes in business models.

How CEOs Lead

- Unlocking bolder (“10x”) aspirations. COVID caused most CEOs to question their assumptions about the pace and magnitude change attainable. The realization that a change in mindset can dramatically affect goal setting and the operating model, many CEOs are effecting changes in a few months that companies previously assumed would take years. The speed for many of these changes is down to employees working longer and harder; however, many CEOs also recognize that many employees have more time available with the stop in travel.

- Elevating their “to be” list to the same level as “to do” in their operating models. With COVID, leadership has to change. CEOs’ priorities were setting up strategy, culture, and making people decisions at regular times. However, now it about maintaining morale and ensuring employees are prepared for whatever may come in the face of uncertainty. Thus, leaders are changing how they and their senior management team show up. Leaders now need to be empathetic and offer words of encouragement. According to Lance Fritz, CEO of Union Pacific, “[Employees] need to see that their leadership is vulnerable, empathetic, and making decisions in accordance with our values, which I’d better be the living proof of.”

- Fully embracing stakeholder capitalism. While I have also previously discussed embracing stakeholder capitalism; however, COVID has accelerated this trend as it has emphatically affirmed the interconnection and interdependence of businesses with their full range of stakeholders. CEOs are confronting tough decisions with profound human consequences every day. CEOs have realized that their choices are affecting their employees, communities, and suppliers. How they behave will have a long term effect on their business, especially as 87 percent of customers say that they will purchase from companies that support what they care about.

- Harnessing the full power of their CEO peer networks. As a result of COVID, CEOs talk to one another much more and at a much greater rate. The belief is, “Let’s learn from each other. Let’s hold hands. Let’s commiserate.” They are achieving this through informal networks and groups like Vistage. The power of a Peer group where you can be vulnerable and get input into these hard decisions is immense. CEOs don’t have to feel like they are carrying all the weight themselves. During the Great Recession, Vistage member companies outperformed non-Vistage member companies [. ]

Changes in Priorities

Not only are CEOs changing the way they lead, but companies are finding that their priorities have changed dramatically! According to the recent IBM survey, companies will focus more inwardly over the next two years. Their top priorities now are:

| 87% | Cost Management |

| 87% | Enterprise Agility |

| 86% | Cash Flow and Liquidity Management |

| 84% | Customer Experience Management |

| 76% | Cybersecurity |

| 75% | I.T. Resiliency |

| 65% | IoT, Cloud and Mobility |

| 58% | New Product Development |

| 52% | New Market Entry |

As companies move away from just-in-time delivery, 40% of those surveyed identified the need for space capacity in their supply chains. However, about 60% said they were accelerating their organizations’ digital transformation, and three-quarters plan on building more robust I.T. capabilities.

Changes in Business Models

Finally, many companies have also changed their business models to address market changes resulting from COVID, including some clients. Some of the creative pivots are:

- Mandarin Oriental. As mentioned last week, many high-end hotel chains are supplying alternative residences for the wealthy. MO has not only done that; it seeks to deliver the luxury experience where you are rather than at a destination. The company promotes “Staycations at M.O.” at its properties if there is one in your city. These staycations offer early check-in, late check-out, a free bottle of wine, and credits for other purchases. However, if you don’t want to leave you home, MO says, “Just call room service.” They will deliver food, items from the cake shop, supplies from the spa, or other merchandise to your house.

- JD.com. For producers of alcoholic beverages, COVID was a considerable blow. During the Chinese shutdown, its e-commerce giant, JD.com, go D.J.s and performers to stage three hour live show online. During these shows, viewers could purchase alcoholic beverages from Rémy Martin to Budweiser and have it delivered to their doors with a single click. As a result, whiskey sales from “a single partner brand” increased eightfold during a day with the show. As a result, JD.com plans to continue its live music events but to expand the products it offers.

- David Dodge. As auto sales plunged nationwide, according to the Washington Post reports David Dodge in Glen Mills, Pa., the auto dealership sold more cars in July than in any previous month in its 15-year existence. David Kelleher, David Dodge’s owner, pivoted to meet the changing market. The company created a business development center to consolidate online leads and located it prominently just inside the front door. Salespeople now work phones, email, texts, and Zoom. They are using FaceTime to accompany customers on test drives. For those customers who want to stay socially distant, David Dodge allows the whole process online, and they deliver the vehicle to the customer’s home. Kelleher and his top salesperson, Mike McVeigh, doesn’t expect to return to the old ways once COVID is behind them.

- Chipotle Mexican Grill. For a company that had been struggling with several crises over the last few years, when COVID hit, Chipotle new it had to change its business model to survive. The model was for pickup orders to be its lifeline. The company added “digital kitchens,” which handle online orders for pickup, at those restaurants that didn’t already have them, to enable this pivot. In May, Chipotle announced it would add 8,000 new workers to meet the growing demand. In July, it needed to hire 10,000 more. The company has aggressively added “Chipotlanes,” drive-thru lanes exclusively for picking up digital orders. That business model requires more employees than traditional stores—hence all that hiring is much more profitable.

Cause for Concern

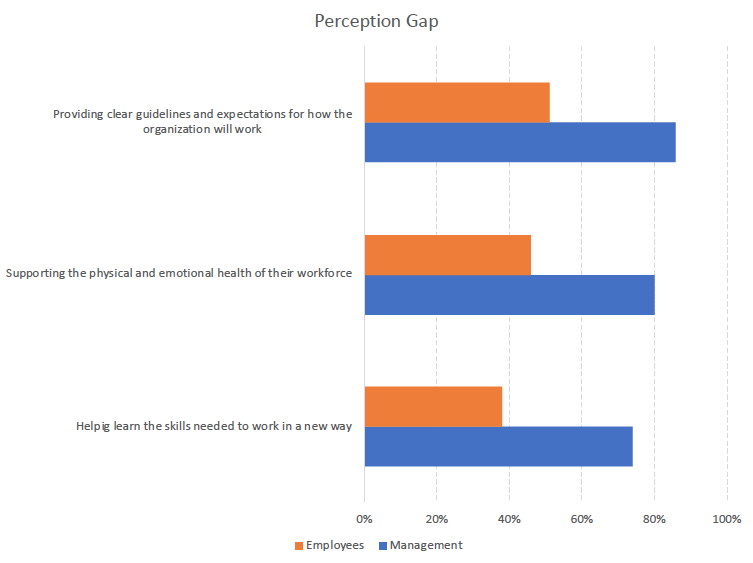

All these changes are requiring more from employees in terms of working longer and harder. As I have noted on numerous occasions, empathy is needed, and burnout is a huge issue. What is worrying is that IBM’s research, drawing from other surveys that included employees, found a disturbing wide gap between “employers significantly overestimating the effectiveness of their support and training efforts” and how employees feel about these measures.

Source: IBM Institute of Business Value

As CEOs and leaders, it is critical that as you face COVID and plan for changes in leadership style, changes in priorities, and pivots in your business model, you need to do more for your employees. They are scared, uncertain, working from with kids doing school virtually, potentially overwhelming debt (see below), and they need management to support them. Those leaders who don’t rise to this challenge will see the good employees leave and create a reputation stain that could last a generation.

Recent Posts

The Downfall of Boeing: A Lesson in Core Values

Resolutions, Here We Go Again.

In reflecting on 2021 resolutions, the author scored themselves in three categories and sought to improve success in 2022 by addressing friction points. Drawing on advice from social psychologist Wendy Wood, the author identified areas to reduce or increase friction in their failed resolutions. By making these adjustments, the author aims to enhance their goal achievement and encourages others to consider friction when setting resolutions.

You need to take an extended vacation. No, seriously, you do.

COVID has taken a toll on all of us. If you have not taken an extended vacation in a while where you disconnect, you need to now. You and your business will benefit.

Becoming Famous in Your Niche: The Success Story of Linn Products Limited

In a previous discussion, I highlighted the importance of being famous for something. Being well-known in your niche can help you: Concentrate on your strengths Connect with your target audience Communicate your offerings more effectively Receive referrals Identify...

Understanding and Optimizing Your Cash Conversion Cycle

Understanding and optimizing the Cash Conversion Cycle is crucial for business growth, as it impacts cash flow and the ability to access external capital. This cycle consists of four components: Sales, Make/Production & Inventory, Delivery, and Billing and Payments. To improve the Cash Conversion Cycle, companies can eliminate mistakes, shorten cycle times, and revamp their business models.

Discovering Your Niche: Why You Need to Be Famous for Something

As an entrepreneur, it’s crucial to specialize in a specific area and become famous for something, allowing you to generate referrals and build your brand. Understanding the “job” you’re hired for helps you stand out in the marketplace and communicate your value proposition effectively. By providing value to your clients, you can adopt a value-based pricing approach, ensuring your business remains competitive and maintains a strong market presence.

Rethinking Your Pricing Model: Maximizing Margins and Providing Value

Rethink your pricing model by focusing on the value you provide and your customers’ Best Alternative To a Negotiated Agreement (BATNA). This approach can help you maximize margins while delivering better value to your clients. Assess your offerings and brainstorm with your team to identify pricing adjustment opportunities or eliminate commodity products or services.

Do you know your Profit per X to drive dramatic growth?

I recently facilitated a workshop with several CEOs where we worked on the dramatic business growth model components. One of the questions that I had asked them beforehand was, "What is Your Profit/X?" The results showed that there this concept is not clear to many....

The War for Talent: 5 Ways to Attract the Best Employees

In today’s War for Talent, attracting the best employees requires a focus on value creation, core customer, brand promise, and value delivery. Clearly articulate your company’s mission, identify your “core employee” based on shared values, and offer more than just a salary to stand out as an employer. Utilize employee satisfaction metrics and showcase your company’s commitment to its workforce on your website to make a strong impression on potential candidates.

Are you killing your firm’s WFH productivity?

Productivity remained during WFH with COVID. However, further analysis found that hourly productivity fell and was compensated for by employees working more hours. What was the culprit – Meetings. Want to increase productivity, have fewer meetings.