Boeing’s 737 Max issues highlighted the company’s sacrifice of safety for financial performance, resulting in a tarnished reputation. The prioritization of profit over core values also damaged the FAA’s credibility and revealed a lack of accountability for top executives. This downfall serves as a reminder of the importance of maintaining core values and prioritizing them over short-term financial gains.

Want to Improve, Put Women in the C-Suite

At the end of last year, there was a male-to-female ratio of 19:1 for CEOs and 6.5:1 for CFOs, which exposes a persisting underrepresentation of females in key executive positions. Within my Vistage groups, I am pleased to say that the male-to-female ratio is 11:3 for CEOs. However, that aside, some recent articles have shown the superior performance of companies that have women in C-Suite positions that are typically not reserved for females.

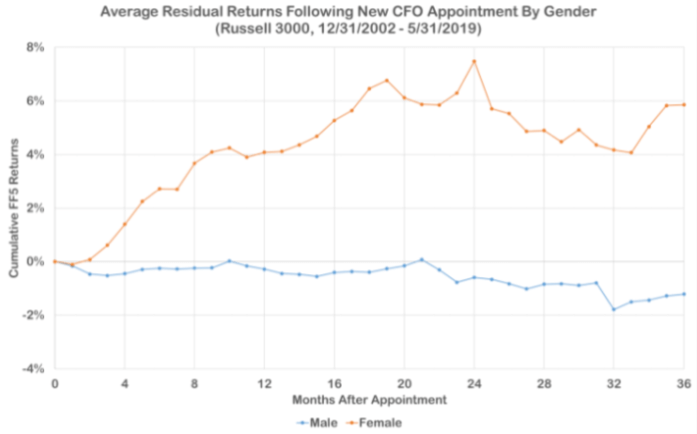

According to a study by S&P Global Market Intelligence, if you are looking for better returns, hire a female CFO! Companies that hired female CFOs saw, on average, a 6% increase in profits and an 8% better stock returns compared with the performance under male predecessors. The 6% increase in profits accounted for an additional $1.8 trillion in additional cumulative profits across 6,000 companies.

Thus, female CEOs drove more value appreciation, improved stock price momentum, better-defended profitability moats, and delivered excess risk-adjusted returns for their firms.

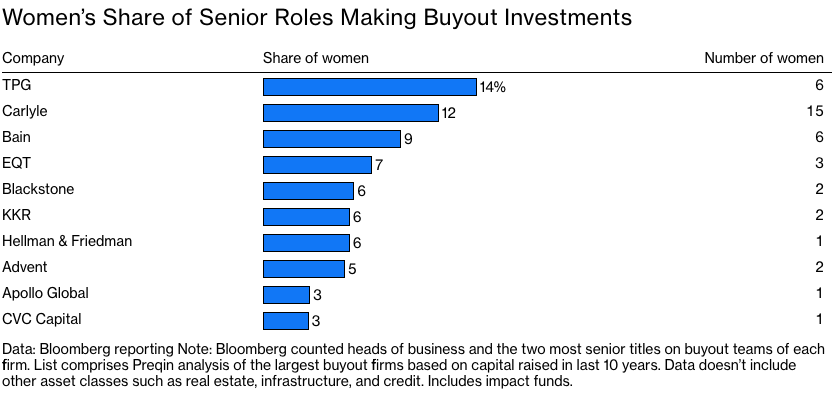

However, a new study by HEC Paris Business School and MVision Private Equity Advisers found that investment committees of private equity fund managers comprising both males and females have experienced comparatively higher returns compared to their male-only peers. Therefore, if PE firms want to outperform their peers, they should appoint more women to their investment committees. The diverse investment committees well outperformed their male-only counterparts! Professor Oliver Gottschalg found that on average, companies in the top quartile for gender diversity on executive teams were 21% more likely to outperform their peers, and 27% more likely to exhibit substantial value creation. Specifically, his research found that gender-diverse investment committees outperformed all-male committees in alpha, TVPI, and IRR by 7%, 0.52%, and 12%, respectively. The level outperformance is due to a broader base of perspectives and the subsequent avoidance of more blind spots!

So what is of interest is that while women’s participation in Investment Committees results in outperformance, Private Equity never received the memo. As can be seen from the chart below, women are very under-represented in the major Private Equity Groups

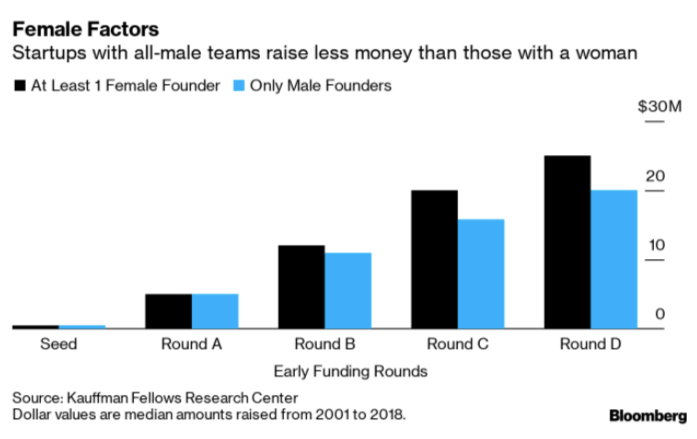

Not only that, Bloomberg has found that startups with all-male teams raise less money than those with a woman. Therefore, you would think all startups would be looking for female teammates. Unfortunately, many are run by men who “know best.”

Thus, while I am the first to say that correlation does not necessarily mean causality, there undoubtedly enough data to say, “If you want to realize above-average performance, put women in your C-Suite!”

This has to be one of the easiest things to improve your performance and make better decisions. If you say, “We just can’t find them,” you are not looking in the right place.

Copyright (c) 2019, Marc A. Borrelli

Recent Posts

The Downfall of Boeing: A Lesson in Core Values

Resolutions, Here We Go Again.

In reflecting on 2021 resolutions, the author scored themselves in three categories and sought to improve success in 2022 by addressing friction points. Drawing on advice from social psychologist Wendy Wood, the author identified areas to reduce or increase friction in their failed resolutions. By making these adjustments, the author aims to enhance their goal achievement and encourages others to consider friction when setting resolutions.

You need to take an extended vacation. No, seriously, you do.

COVID has taken a toll on all of us. If you have not taken an extended vacation in a while where you disconnect, you need to now. You and your business will benefit.

Becoming Famous in Your Niche: The Success Story of Linn Products Limited

In a previous discussion, I highlighted the importance of being famous for something. Being well-known in your niche can help you: Concentrate on your strengths Connect with your target audience Communicate your offerings more effectively Receive referrals Identify...

Understanding and Optimizing Your Cash Conversion Cycle

Understanding and optimizing the Cash Conversion Cycle is crucial for business growth, as it impacts cash flow and the ability to access external capital. This cycle consists of four components: Sales, Make/Production & Inventory, Delivery, and Billing and Payments. To improve the Cash Conversion Cycle, companies can eliminate mistakes, shorten cycle times, and revamp their business models.

Discovering Your Niche: Why You Need to Be Famous for Something

As an entrepreneur, it’s crucial to specialize in a specific area and become famous for something, allowing you to generate referrals and build your brand. Understanding the “job” you’re hired for helps you stand out in the marketplace and communicate your value proposition effectively. By providing value to your clients, you can adopt a value-based pricing approach, ensuring your business remains competitive and maintains a strong market presence.

Rethinking Your Pricing Model: Maximizing Margins and Providing Value

Rethink your pricing model by focusing on the value you provide and your customers’ Best Alternative To a Negotiated Agreement (BATNA). This approach can help you maximize margins while delivering better value to your clients. Assess your offerings and brainstorm with your team to identify pricing adjustment opportunities or eliminate commodity products or services.

Do you know your Profit per X to drive dramatic growth?

I recently facilitated a workshop with several CEOs where we worked on the dramatic business growth model components. One of the questions that I had asked them beforehand was, "What is Your Profit/X?" The results showed that there this concept is not clear to many....

The War for Talent: 5 Ways to Attract the Best Employees

In today’s War for Talent, attracting the best employees requires a focus on value creation, core customer, brand promise, and value delivery. Clearly articulate your company’s mission, identify your “core employee” based on shared values, and offer more than just a salary to stand out as an employer. Utilize employee satisfaction metrics and showcase your company’s commitment to its workforce on your website to make a strong impression on potential candidates.

Are you killing your firm’s WFH productivity?

Productivity remained during WFH with COVID. However, further analysis found that hourly productivity fell and was compensated for by employees working more hours. What was the culprit – Meetings. Want to increase productivity, have fewer meetings.