Boeing’s 737 Max issues highlighted the company’s sacrifice of safety for financial performance, resulting in a tarnished reputation. The prioritization of profit over core values also damaged the FAA’s credibility and revealed a lack of accountability for top executives. This downfall serves as a reminder of the importance of maintaining core values and prioritizing them over short-term financial gains.

Do You Truly Know Your Core Customer?

Who is your Core Customer?

In working with many clients on improving their business and developing a growth model, we soon get into the issue of their “Core Customer.” I have realized that many have not given this much thought and cannot easily define their “Core Customer.” Your Core Customer is the customer you are targeting, the customer that is preferred, and the one that your marketing and sales efforts are focused on. A Core Customer has the following attributes:

- A real person with wants, needs, and fears.

- Will buy for optimal profit.

- Has an unique online identity and behavior.

- Pays on time, loyal, and refers others.

- Exists today among your customers

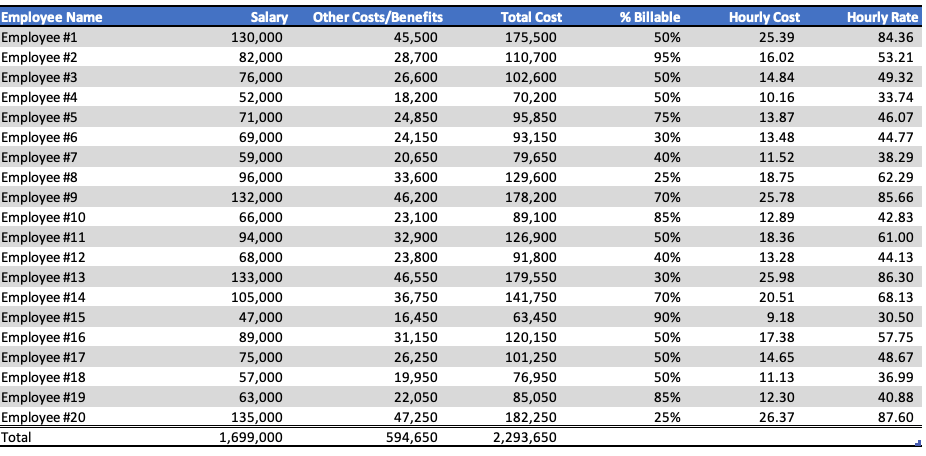

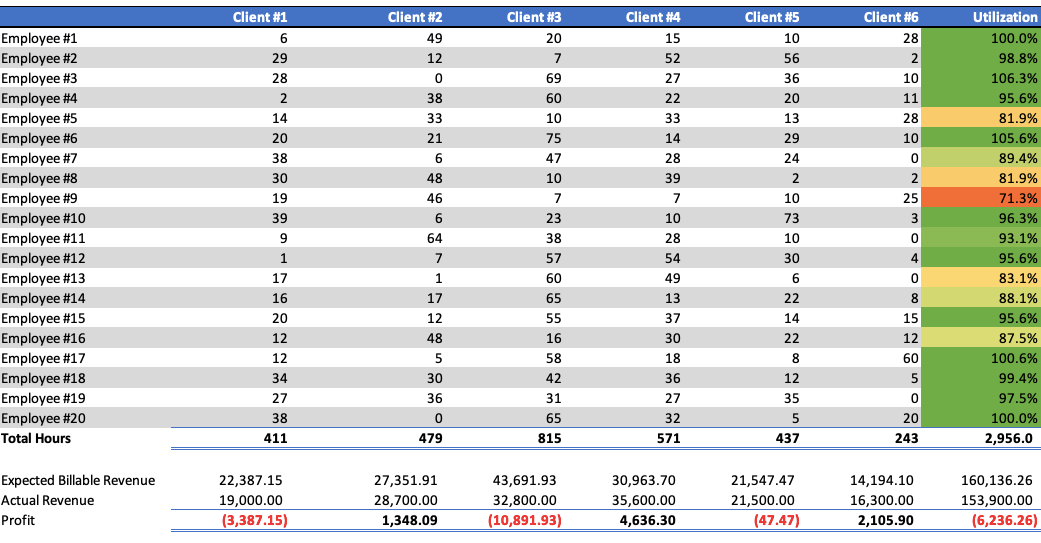

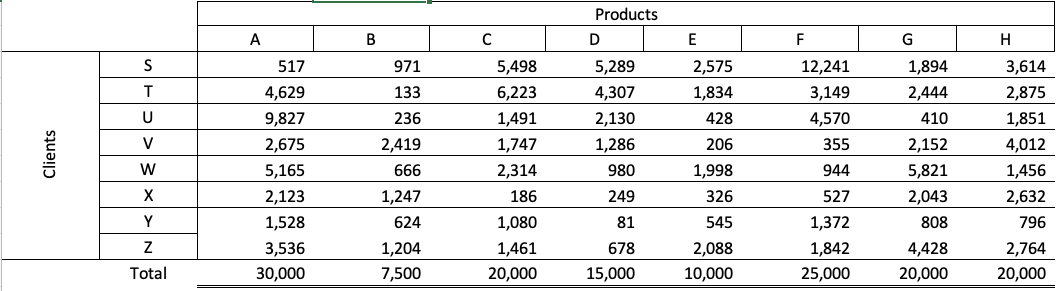

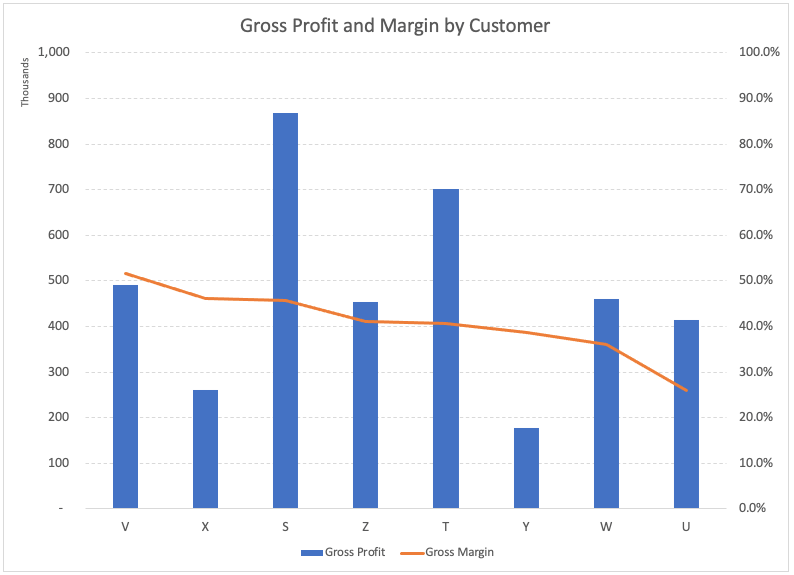

Not knowing your Core Customer is not a terrible problem, as we can quickly work through a session to put a definition in place. However, a more complicated issue is knowing their Core Customer but unable to define their “Economic Engine,” or profitability per customer. Lack of good data is always a severe problem! If you can’t measure something, then your performance is purely an assumption, and down that road is chaos.

Profit per Customer

If you don’t know your profit per customer, the customer you consider your “Core Customer” may generate sub-par profits pulling down the company’s performance. During a recent conversation, a CEO told me their metric was revenue per employee. While that would generate top-line revenue, it does nothing for profit, efficient customer targeting and marketing, or market differentiation. The business adage, “We are losing money on each item, but will make it up on volume,” seems to be the driving force.

Many companies I have worked with cannot tell me the profitability per customer and so work on the assumption that they are performing well, but cannot understand why they cannot scale and have profit and cashflow issues. Also, often their data is corrupted by the “Flaw of Averages.” So to paraphrase the proverb, “First get your data.” Sometimes getting good data on project costs is difficult, but without there cannot be:

- Knowledge of performance;

- Plans for improvement;

- Measurement of improvement.

And “Hope is not a strategy.”

Select the Right Core Customer

Once we have data showing your Core Customer’s profitability, we can determine if they generate optimal profit. Since a requirement of a Core Customer, as mentioned above, if your Core Customer is not generating optimal profit, then there are one of two choices:

- Change your economic model so that they do, or

- Change your Core Customer.

When examining the data, many companies have found that the companies they were targeting as their “Core Customers” were their less profitable customers and ones that everyone in the market was fighting over. Targeting a different segment of customers that generated optimal profit could increase its profitability and differentiate itself from its competition, a great “Blue Ocean” strategy.

Lake Truck Lines, a Gravitas client, was focused on large customers. However, when analyzing its data, Lake Truck Lines realized that everyone was targeting those customers so there was pricing pressure and low margins. By make mid-sized customers its Core Customer, the company was able to operate with less competition and generate the optimal profit per customer. Similarly with Build Direct, focusing on young women seeking to do DIY, it was able to realize a much higher margin and operate in “Blue Ocean” waters compared to when it was focused on supplying general contractors.

The time spent analyzing your clients, their profitability, and your Blue Ocean possibilities can result in you operating at higher margins with less competition.

Profit / X

I have discussed the “Economic Engine” before, but it is the concept of “Profit/X,” Profit/X is the crucial part of your strategy, and it must:

- Tightly aligns with your BHAG®

- Be the fundamental economic engine of your business

- Be a single overarching KPI to scale your business

- It must impact revenue while controlling cost.

- More X must be desirable.

- It must be unique within the industry – you have to differentiate yourself from your competition.

What is critical is finding a Profit/X that is unique within your industry. If you choose the same Profit/X as everyone else, you are all competing on the same drivers, and you cannot differentiate yourself from your competition. Having identified our Core Customer, the appropriate Profit/X can be identified. Picking the wrong Profit/X given your Core Customer again will lead to sub-optimal results. These two concepts are interconnected and for you to achieve the best results, you need to determine both and have them connected.

Having the Right Profit/X

If your Profit/X is defined as profit per employee, you have only three ways to achieve this: increase the price, improve employee performance or cut the product’s quality. Since price should be driven by value creation, not employee profitability, raising prices may be difficult. We do not want to cut value delivery, and driving employees harder is no recipe for success. Thus a better metric may be profit per customer.

With customer size, if you are servicing large customers it may require longer larger projects compared to mid-sized companies. If mid-sized companies have more set up and administrative costs then your Profit/X must be different between the two.

There are many examples of Profit/X from Southwest Airlines’ profit per plane to a dry cleaner who measured it by profit per delivery truck. The key is to find the one that drives your business and will also differentiate yourself.

Conclusion

Many CEOs and Business Owners are salespeople and are not interested in digging into the financials and getting to the data I have discussed above. However, the effort is well worth it, as once you have a clear understanding of where you are, you can:

- Target marketing towards your Core Customer;

- Differentiate yourself from your competition;

- Ensure that all projects, services, or products meeting your Profit/X to ensure profitability; and

- Position yourself for growth and profitability.

Get your CFO, your team, and a coach and spend a day or two to determine the ideal results. The payoff will be huge.

Copyright (c) 2021 Marc A. Borrelli